Market Brief 14/12/2023

VIETNAM STOCK MARKET

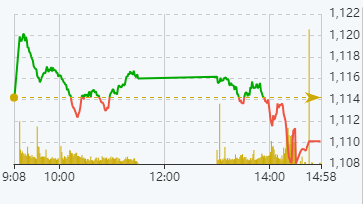

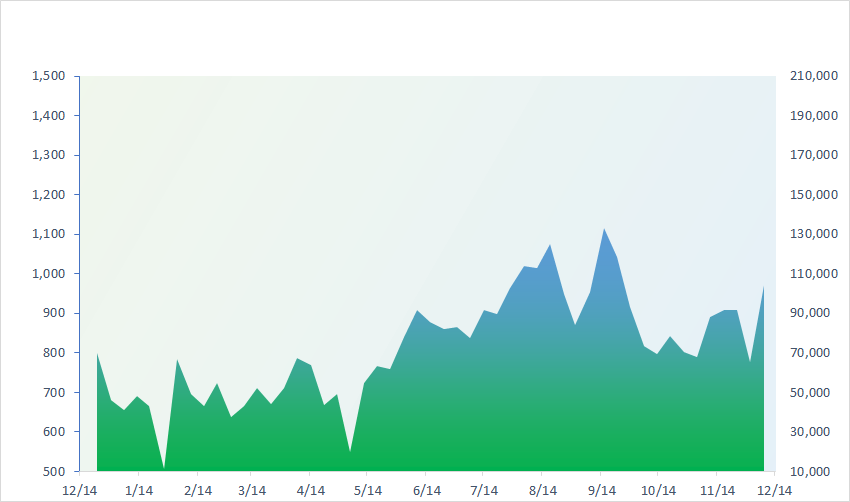

1,110.13

1D -0.37%

YTD 10.23%

227.23

1D -0.52%

YTD 10.68%

1,104.49

1D -0.21%

YTD 9.88%

85.22

1D 0.15%

YTD 18.94%

-328.60

1D 0.00%

YTD 0.00%

16,918.81

1D -20.91%

YTD 96.37%

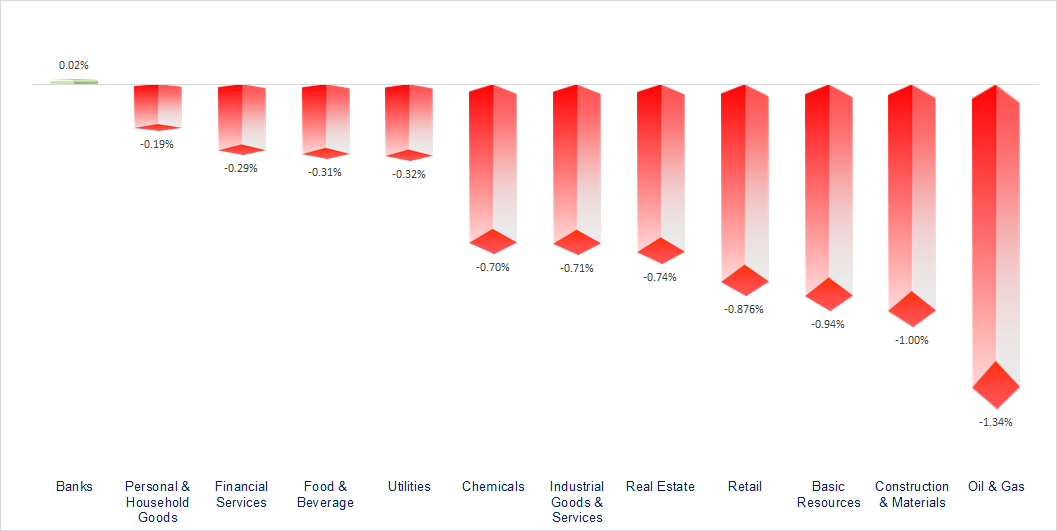

In contrast to the European market, today VnIndex had its second consecutive decline with low liquidity. Banking was a rare industry that closed in the green. In contrast, oil and gas, basic resources were the most negative groups.

ETF & DERIVATIVES

19,080

1D -0.10%

YTD 10.10%

13,100

1D -0.08%

YTD 9.90%

13,670

1D 0.22%

YTD 9.54%

17,090

1D -0.06%

YTD 21.64%

17,990

1D -0.06%

YTD 25.37%

25,290

1D -0.32%

YTD 12.90%

15,000

1D -0.27%

YTD 15.83%

1,104

1D -0.28%

YTD 0.00%

1,105

1D -0.23%

YTD 0.00%

1,102

1D -0.11%

YTD 0.00%

1,103

1D 0.03%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,686.25

1D -0.73%

YTD 25.26%

2,958.99

1D -0.33%

YTD -4.22%

9,417.97

1D -0.62%

YTD -14.51%

16,402.19

1D 1.07%

YTD -17.08%

2,544.18

1D 1.34%

YTD 13.76%

70,547.76

1D 1.38%

YTD 15.95%

3,122.95

1D 0.60%

YTD -3.95%

1,378.94

1D 1.54%

YTD -17.45%

75.51

1D 0.84%

YTD -12.11%

2,036.78

1D 0.26%

YTD 11.53%

Most Asian stocks rallied today after the Fed gave a positive signal on interest rates last night, although the upside was still limited by concerns about an economic slowdown in China. The Nikkei 225 index dropped today as investors took profits after three sessions of strong gains.

VIETNAM ECONOMY

0.15%

1D (bps) -5

YTD (bps) -482

4.80%

YTD (bps) -260

1.91%

1D (bps) -1

YTD (bps) -288

2.33%

1D (bps) -1

YTD (bps) -257

24,428

1D (%) 0.16%

YTD (%) 2.81%

27,179

1D (%) 0.30%

YTD (%) 5.92%

3,469

1D (%) 0.64%

YTD (%) -0.46%

The US dollar dropped to a fresh four-month low on Thursday after the Federal Reserve indicated that its interest-rate hike cycle has ended and that lower borrowing costs are coming in 2024. The DXY index fluctuated around 102.5 (recorded at 5:00 p.m Vietnam), down 1.4% compared to the end of December 13.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Civil Aviation Authority said domestic ticket prices are still low compared to the world;

- Iron ore import turnover in November was twice as high as the same period;

- Seafood exports to China have great potential but fierce competition;

- The US House of Representatives officially authorized an impeachment investigation of President Biden;

- Samsung officially usurped Xiaomi to become top smartphone seller in India;

- Panama Canal drought to disrupt global trade well into 2024.

VN30

BANK

84,400

1D 0.84%

5D -0.94%

Buy Vol. 1,453,088

Sell Vol. 1,796,569

41,600

1D 0.00%

5D 2.46%

Buy Vol. 1,427,746

Sell Vol. 1,442,125

26,750

1D 0.00%

5D -0.56%

Buy Vol. 6,197,401

Sell Vol. 6,964,541

30,550

1D 0.16%

5D -0.97%

Buy Vol. 4,716,325

Sell Vol. 4,260,534

19,000

1D -1.04%

5D -3.31%

Buy Vol. 13,732,934

Sell Vol. 19,083,973

18,050

1D 0.00%

5D -1.10%

Buy Vol. 12,808,551

Sell Vol. 15,701,920

18,900

1D 0.27%

5D 1.07%

Buy Vol. 10,515,705

Sell Vol. 12,562,898

16,900

1D -0.59%

5D -3.70%

Buy Vol. 5,858,240

Sell Vol. 6,560,844

27,100

1D -1.28%

5D -5.08%

Buy Vol. 26,445,681

Sell Vol. 24,413,739

18,900

1D -0.79%

5D -2.07%

Buy Vol. 4,467,553

Sell Vol. 6,808,333

22,500

1D 0.90%

5D 0.45%

Buy Vol. 11,061,211

Sell Vol. 13,315,898

10,800

1D -0.92%

5D -2.26%

Buy Vol. 36,563,788

Sell Vol. 48,734,648

22,600

1D 0.00%

5D -0.44%

Buy Vol. 1,160,737

Sell Vol. 2,383,103

Fitch Ratings has just upgraded the ratings for 8 banks in Vietnam, including: Vietcombank, VietinBank, Agribank, ACB, MBB, HSBC Vietnam, ANZ Vietnam and Standard Chartered Vietnam. With Vietcombank, VietinBank and Agribank, Fitch Ratings has simultaneously upgraded the long-term foreign-currency issuer default rating (IDR) of these banks from 'BB' to 'BB+' and the Government support rating from 'bb' to 'bb+'.

OIL & GAS

76,900

1D 0.00%

5D -1.74%

Buy Vol. 10,092,366

Sell Vol. 8,199,655

11,300

1D -0.88%

5D -2.28%

Buy Vol. 1,392,176

Sell Vol. 1,107,837

34,350

1D -1.01%

5D 2.34%

Buy Vol. 5,095,292

Sell Vol. 6,470,864

From 3:00 p.m on December 14, gasoline prices decreased by 778 - 917 VND/liter depending on type, while diesel prices decreased by 711 VND/liter.

VINGROUP

43,800

1D -0.23%

5D 1.51%

Buy Vol. 8,160,102

Sell Vol. 9,841,383

40,300

1D -1.10%

5D 0.22%

Buy Vol. 7,817,766

Sell Vol. 6,450,758

22,850

1D -0.65%

5D 0.00%

Buy Vol. 3,287,607

Sell Vol. 2,578,844

VHM: According to VinaCapital statistics, Vinhomes' Glory Heights project has sold 80% of the apartments.

FOOD & BEVERAGE

68,400

1D 0.29%

5D 2.36%

Buy Vol. 2,993,601

Sell Vol. 3,129,785

65,000

1D -1.22%

5D -3.96%

Buy Vol. 740,651

Sell Vol. 818,895

63,000

1D -1.56%

5D -1.70%

Buy Vol. 641,276

Sell Vol. 617,982

VNM: Vinamilk won the Human Act Prize and the Persistence Project at the Community Action Awards.

OTHERS

63,700

1D -0.31%

5D 1.39%

Buy Vol. 494,140

Sell Vol. 1,018,254

40,150

1D -0.86%

5D 1.39%

Buy Vol. 494,140

Sell Vol. 1,018,254

105,300

1D 0.29%

5D -0.38%

Buy Vol. 922,256

Sell Vol. 1,060,059

96,200

1D 1.05%

5D 2.01%

Buy Vol. 3,280,961

Sell Vol. 3,503,363

41,600

1D -0.24%

5D 1.84%

Buy Vol. 11,972,970

Sell Vol. 13,695,491

19,850

1D -0.50%

5D -1.73%

Buy Vol. 2,475,769

Sell Vol. 3,092,346

32,000

1D 0.00%

5D -2.59%

Buy Vol. 39,576,505

Sell Vol. 31,485,051

27,050

1D -1.10%

5D -1.99%

Buy Vol. 56,149,439

Sell Vol. 60,128,801

FPT: On December 14, FPT Corporation announced the establishment of FPT Automotive company headquartered in Texas, USA. With a mission to drive the advancement of software-defined vehicles (SDV), shape the new mobility era, and deliver the highest standards of safety and superior experiences to customers, FPT Automotive sets its sights on becoming a billion-dollar world-class automotive services and products provider in 2030.

Market by numbers

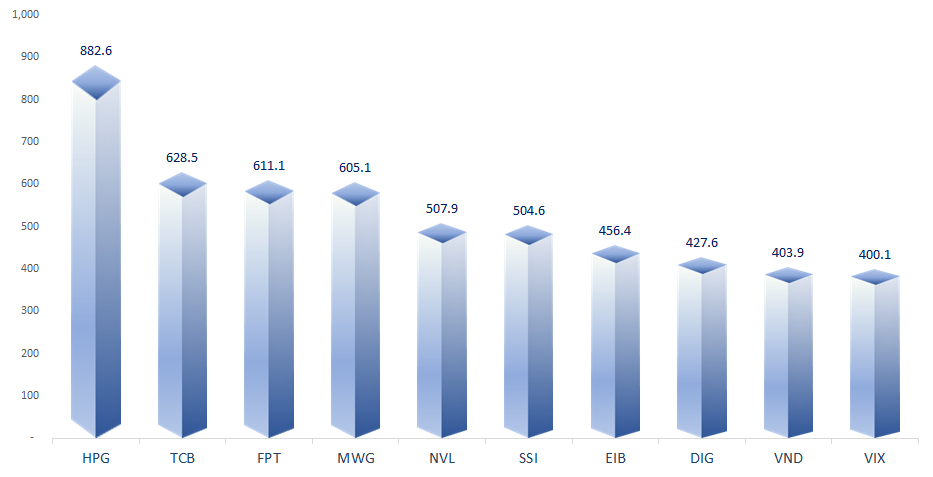

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

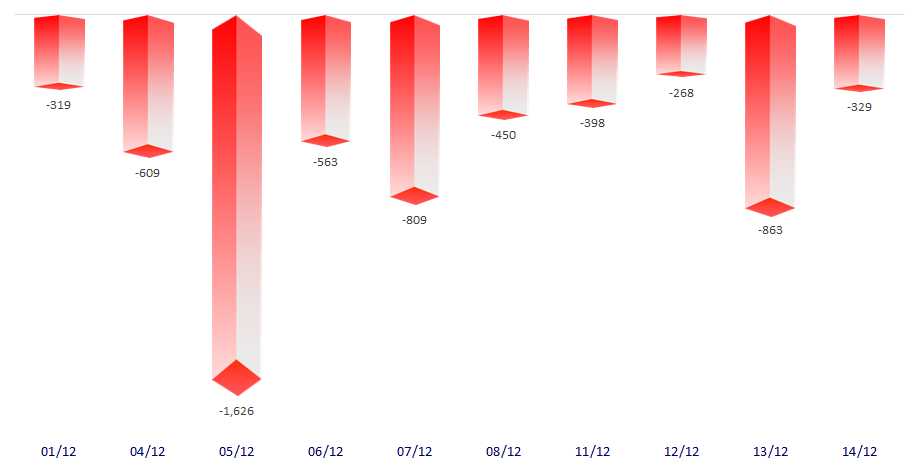

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

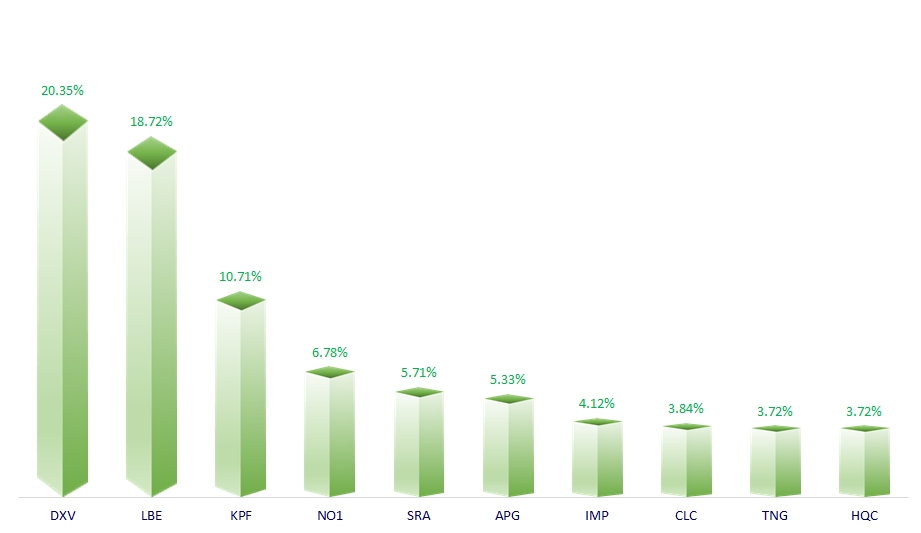

TOP INCREASES 3 CONSECUTIVE SESSIONS

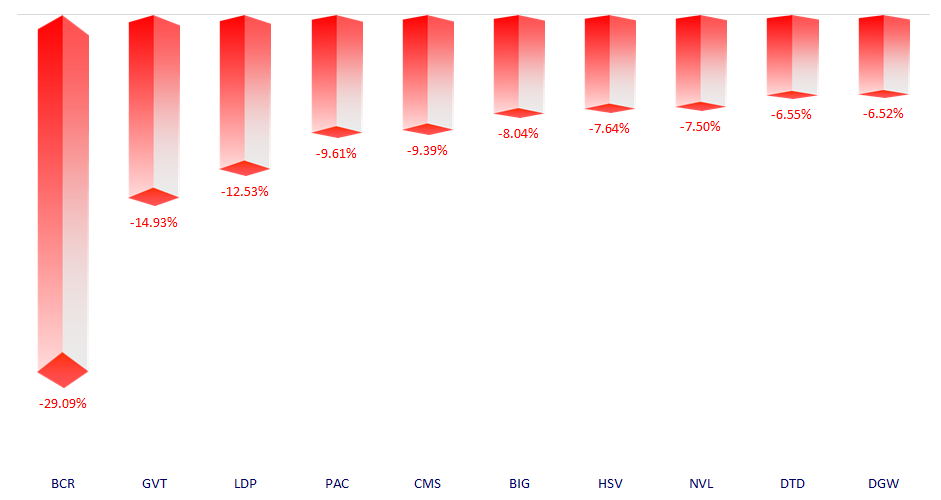

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.