Market Brief 28/12/2023

VIETNAM STOCK MARKET

1,128.93

1D 0.62%

YTD 12.10%

231.35

1D 0.33%

YTD 12.69%

1,128.51

1D 1.13%

YTD 12.27%

86.97

1D 0.59%

YTD 21.38%

333.04

1D 0.00%

YTD 0.00%

17,303.44

1D -19.24%

YTD 100.83%

The market has rebounded since opening. Although there was a time of weakness, the market quickly rebounded and continued to increase until the end of the session. Real estate, food and beverage were most active today. VHM was the most outstanding stock when it increased by 4.3% with unexpectedly high liquidity, contributing nearly 2 points to VNIndex.

ETF & DERIVATIVES

19,430

1D 0.83%

YTD 12.12%

13,390

1D 0.83%

YTD 12.33%

13,810

1D 0.29%

YTD 10.66%

16,600

1D -0.30%

YTD 18.15%

18,240

1D 0.00%

YTD 27.11%

25,880

1D 0.50%

YTD 15.54%

15,290

1D 0.99%

YTD 18.07%

1,133

1D 1.43%

YTD 0.00%

1,131

1D 1.16%

YTD 0.00%

1,133

1D 1.48%

YTD 0.00%

1,134

1D 1.66%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

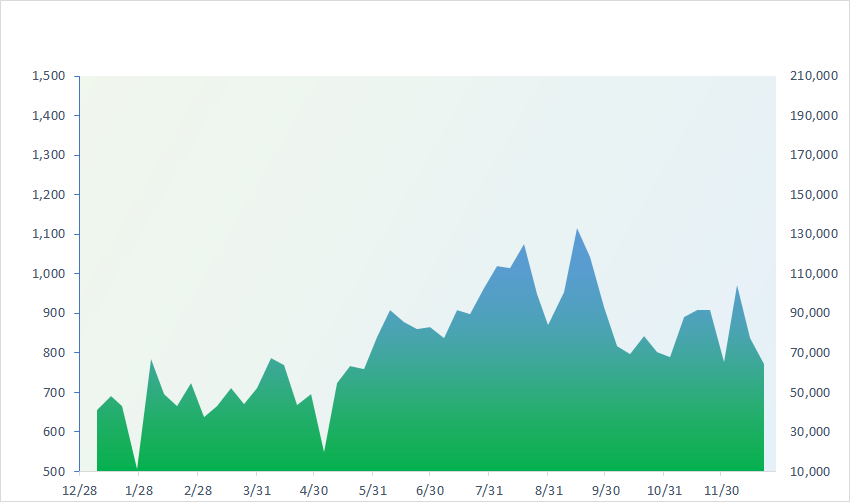

VNINDEX (12M)

GLOBAL MARKET

33,539.62

1D -0.42%

YTD 28.53%

2,954.70

1D 1.38%

YTD -4.36%

17,043.53

1D 2.52%

YTD -13.84%

2,655.28

1D 1.60%

YTD 18.73%

72,410.38

1D 0.52%

YTD 19.02%

3,214.40

1D 1.38%

YTD -1.14%

1,415.85

1D 0.38%

YTD -15.24%

78.54

1D -1.63%

YTD -8.58%

2,076.76

1D -0.35%

YTD 13.72%

Asian stocks mostly increased today. Chinese stocks recovered thanks to gains in online game stocks. Meanwhile, Nikkei 225 decreased by 0.42% today as the market faced profit-taking pressure after many rising sessions.

VIETNAM ECONOMY

0.79%

1D (bps) -23

YTD (bps) -418

4.80%

YTD (bps) -260

1.89%

1D (bps) 1

YTD (bps) -290

2.22%

1D (bps) 2

YTD (bps) -268

24,465

1D (%) -0.10%

YTD (%) 2.97%

27,635

1D (%) -0.45%

YTD (%) 7.70%

3,485

1D (%) 0.29%

YTD (%) 0.00%

Today, SJC gold price decreased by 4 million VND/tael on the selling side to 76 million VND/tael. Recently, the SBV explained the reason why the domestic price of SJC gold bars increased sharply in recent days, mainly due to the continuous increase in international gold prices. The State Bank said it will continue to closely monitor developments in the gold market and be prepared to implement an intervention plan to stabilize the gold market.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Import-export value reached USD650 billion, trade surplus was more than USD25 billion;

- Outstanding Government debt is expected to reach about 37% of GDP by the end of 2023;

- Gasoline prices fluctuated mixed in the final adjustment period of 2023;

- Shipping companies are preparing to return to the Suez Canal;

- Google plans to lay off 30,000 employees;

- US buys 3 million barrels of oil for strategic reserve.

VN30

BANK

82,800

1D 0.12%

5D 2.35%

Buy Vol. 1,257,553

Sell Vol. 1,481,457

42,700

1D -0.70%

5D 2.15%

Buy Vol. 2,514,062

Sell Vol. 1,666,153

27,100

1D 0.93%

5D 2.07%

Buy Vol. 6,269,443

Sell Vol. 8,409,401

31,500

1D 2.11%

5D 2.77%

Buy Vol. 11,829,949

Sell Vol. 8,707,310

18,800

1D 1.62%

5D 3.30%

Buy Vol. 20,174,321

Sell Vol. 17,356,796

18,550

1D 0.82%

5D 2.20%

Buy Vol. 24,757,447

Sell Vol. 18,133,142

19,350

1D 0.26%

5D 3.20%

Buy Vol. 11,958,791

Sell Vol. 17,355,807

17,300

1D -0.29%

5D 2.37%

Buy Vol. 7,342,317

Sell Vol. 9,349,317

27,600

1D 0.73%

5D 3.76%

Buy Vol. 20,383,389

Sell Vol. 23,646,649

19,650

1D 2.34%

5D 4.80%

Buy Vol. 14,070,578

Sell Vol. 7,749,025

23,750

1D 1.93%

5D 2.15%

Buy Vol. 20,565,895

Sell Vol. 19,098,823

10,800

1D 0.47%

5D 1.41%

Buy Vol. 26,297,154

Sell Vol. 28,093,990

23,650

1D 4.42%

5D 4.65%

Buy Vol. 2,052,509

Sell Vol. 2,789,063

VCB: In December, Vietcombank offered to sell many mortgaged assets of customers to recover debt. Some properties have been announced for sale multiple times a month and have continuously reduced prices.

OIL & GAS

76,000

1D -0.39%

5D -0.44%

Buy Vol. 1,661,610

Sell Vol. 8,004,484

11,250

1D 0.90%

5D 1.47%

Buy Vol. 8,866,565

Sell Vol. 1,691,201

34,500

1D 0.15%

5D 2.89%

Buy Vol. 1,908,103

Sell Vol. 8,646,378

POW: PV Power estimates profit in 2023 to reach more than VND1,300 billion.

VINGROUP

44,450

1D 1.95%

5D 8.71%

Buy Vol. 7,790,159

Sell Vol. 20,773,615

43,700

1D 4.30%

5D 2.40%

Buy Vol. 24,074,390

Sell Vol. 10,862,919

23,500

1D 1.08%

5D 1.79%

Buy Vol. 13,097,665

Sell Vol. 4,357,391

VIC: VinFast announced that it would begin selling cars in the Triangle today. Leith Automotive, located in Cary, will be the home of the company’s first non-factory-owned dealership in the US.

FOOD & BEVERAGE

68,500

1D 1.48%

5D 5.18%

Buy Vol. 4,862,147

Sell Vol. 3,781,250

67,000

1D 0.00%

5D 0.32%

Buy Vol. 3,302,436

Sell Vol. 1,374,385

62,200

1D 0.16%

5D 1.46%

Buy Vol. 1,831,062

Sell Vol. 959,861

VNM: Foreign investors returned to net buying VNM with a value of more than VND14 billion today, after 5 consecutive net selling sessions.

OTHERS

62,700

1D 0.16%

5D 0.64%

Buy Vol. 850,725

Sell Vol. 568,329

39,600

1D 0.13%

5D 0.64%

Buy Vol. 371,603

Sell Vol. 568,329

108,000

1D 0.09%

5D 2.56%

Buy Vol. 1,823,067

Sell Vol. 2,158,188

96,600

1D -0.31%

5D 1.58%

Buy Vol. 2,200,966

Sell Vol. 2,520,283

43,050

1D 0.47%

5D 0.94%

Buy Vol. 9,214,327

Sell Vol. 14,143,783

20,300

1D 0.25%

5D 2.01%

Buy Vol. 3,336,821

Sell Vol. 4,210,601

33,000

1D 0.61%

5D 2.48%

Buy Vol. 27,019,372

Sell Vol. 31,853,051

27,950

1D 0.72%

5D 2.76%

Buy Vol. 55,293,784

Sell Vol. 58,750,800

MWG: To achieve the revenue plan in 2023, MWG needs to achieve at least VND27,000 billion in revenue this December. This number is double the peak revenue in October, even nearly 3 times the average monthly revenue.

Market by numbers

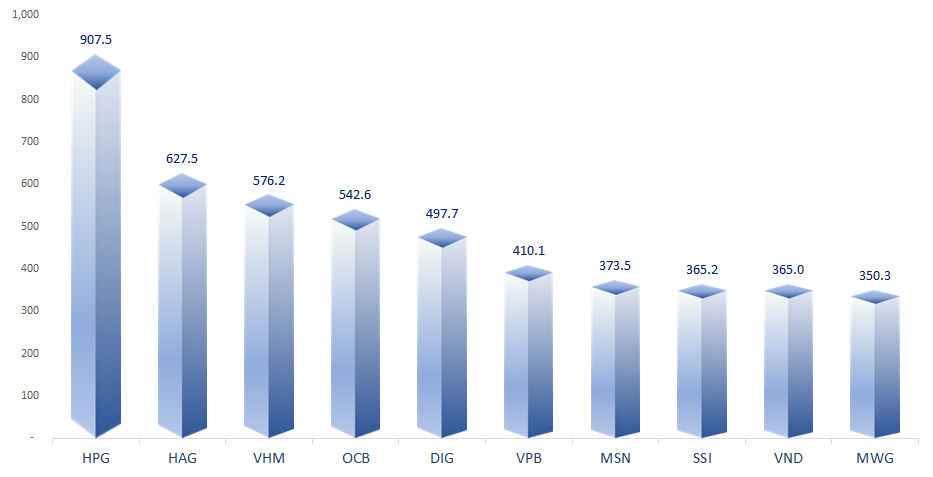

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

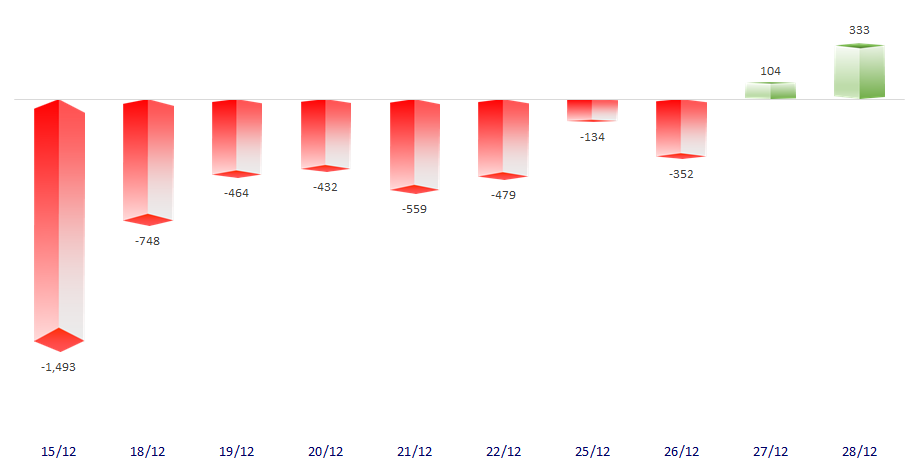

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

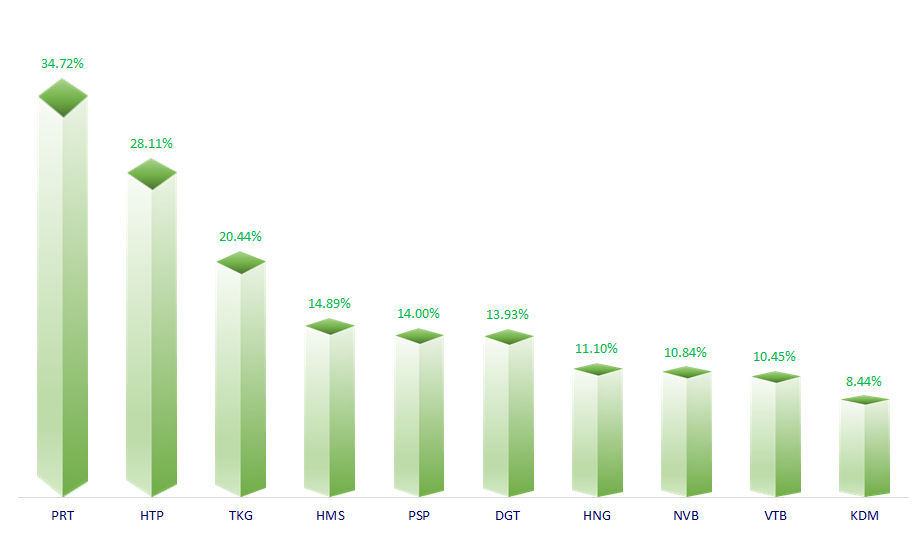

TOP INCREASES 3 CONSECUTIVE SESSIONS

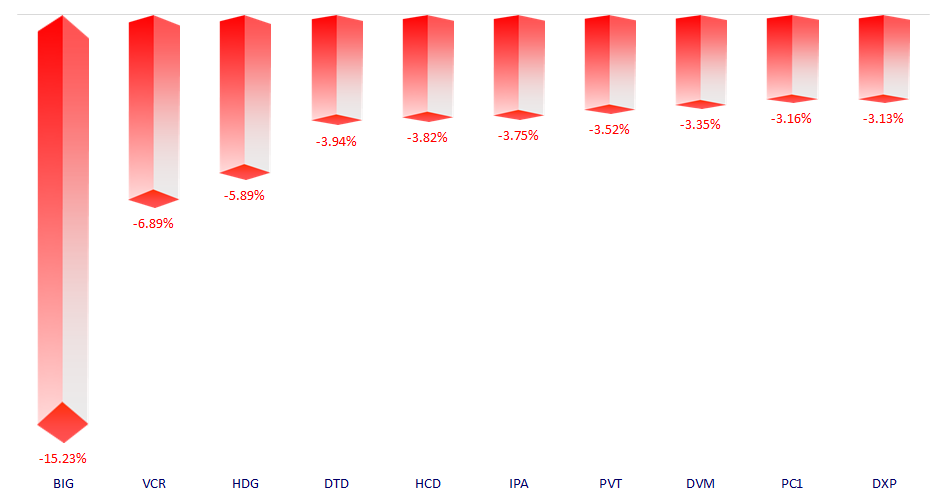

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.