Market Brief 08/01/2024

VIETNAM STOCK MARKET

1,160.19

1D 0.48%

YTD 2.52%

233.33

1D 0.24%

YTD 1.45%

1,163.52

1D 0.20%

YTD 2.82%

87.79

1D -0.16%

YTD 0.24%

-261.64

1D 0.00%

YTD 0.00%

21,601.71

1D 20.74%

YTD 14.32%

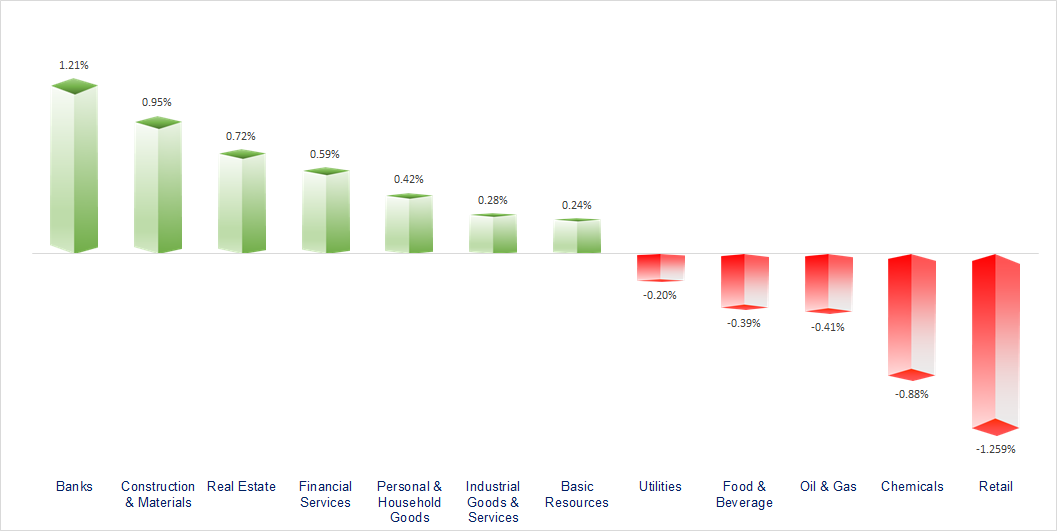

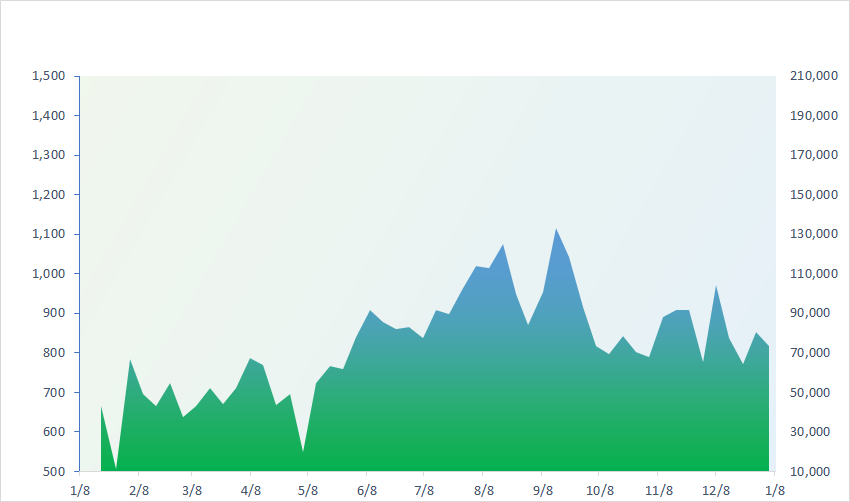

The series of gaining sessions from last weekend continued to be extended in today's session. Since opening, VNIndex has opened a gap and increased by more than 6 points. Banking, real estate were the sectors that increased in today's session.

ETF & DERIVATIVES

20,080

1D 0.25%

YTD 2.82%

13,830

1D 0.44%

YTD 2.83%

14,360

1D 0.35%

YTD 3.61%

17,000

1D 0.00%

YTD 0.12%

19,250

1D 0.89%

YTD 4.62%

26,620

1D 0.08%

YTD 2.27%

15,650

1D 0.32%

YTD 2.49%

1,162

1D -0.34%

YTD 0.00%

1,164

1D -0.03%

YTD 0.00%

1,163

1D -0.10%

YTD 0.00%

1,159

1D -0.32%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

33,377.42

1D 0.00%

YTD -0.26%

2,887.53

1D -1.42%

YTD -2.52%

16,224.45

1D -1.88%

YTD -3.36%

2,567.82

1D -0.40%

YTD -3.82%

71,405.79

1D -0.89%

YTD -0.68%

3,189.00

1D 0.15%

YTD -1.27%

1,418.45

1D -0.67%

YTD -1.04%

77.78

1D -0.45%

YTD -1.34%

2,028.53

1D -0.85%

YTD -2.32%

Asian shares slipped into the red today as Chinese stocks extended their recent retreat, and investors braced for U.S. inflation data. Thailand's stocks fell after the country's prime minister said he would speak with the governor of the central bank about cutting rates. Inflation data from China and Tokyo are also due this week, with analysts looking for deflation to ease a touch in China. Japan's Nikkei 225 Index was closed for a holiday.

VIETNAM ECONOMY

0.23%

1D (bps) -2

YTD (bps) -337

4.80%

1.85%

1D (bps) -5

YTD (bps) -3

2.20%

1D (bps) -4

YTD (bps) 2

24,524

1D (%) -0.09%

YTD (%) 0.06%

27,336

1D (%) -0.31%

YTD (%) -0.15%

3,470

1D (%) -0.26%

YTD (%) -0.17%

Today, Vietcombank adjusted deposit interest rates for many terms. Accordingly, VCB has reduced interest rates by 0.5%/year for terms from 1 to less than 12 months compared to the end of last year and kept interest rates unchanged for other terms.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Construction steel prices will start to increase for the first time in 2024;

- Standard Chartered forecasts that the State Bank of Vietnam may raise interest rates in the fourth quarter;

- SJC gold decreased from 300,000 VND/tael to 500,000 VND/tael at the beginning of the week;

- Goldman Sachs: Oil Prices could double if Houthi attacks continue;

- Thai rice is expected to reduce exports and be less competitive than Vietnamese rice;

- China's electric aircraft makes debut flight.

VN30

BANK

86,800

1D 0.70%

5D 8.09%

Buy Vol. 2,191,376

Sell Vol. 3,083,173

46,400

1D 4.27%

5D 6.91%

Buy Vol. 3,465,091

Sell Vol. 2,994,720

29,550

1D 1.90%

5D 9.04%

Buy Vol. 22,882,234

Sell Vol. 21,097,675

34,100

1D 2.71%

5D 7.23%

Buy Vol. 14,162,056

Sell Vol. 10,797,853

19,250

1D 0.26%

5D 0.26%

Buy Vol. 18,047,631

Sell Vol. 21,992,268

20,700

1D 0.98%

5D 10.99%

Buy Vol. 39,903,566

Sell Vol. 36,996,867

20,550

1D 0.24%

5D 1.23%

Buy Vol. 8,041,053

Sell Vol. 9,596,703

17,950

1D -0.28%

5D 3.16%

Buy Vol. 23,306,293

Sell Vol. 20,166,614

29,200

1D -0.34%

5D 4.47%

Buy Vol. 31,616,795

Sell Vol. 38,052,682

20,900

1D 0.97%

5D 6.63%

Buy Vol. 12,302,211

Sell Vol. 10,502,170

25,350

1D -0.39%

5D 6.07%

Buy Vol. 19,052,107

Sell Vol. 24,693,771

11,700

1D 1.30%

5D 8.33%

Buy Vol. 78,484,916

Sell Vol. 82,966,575

23,300

1D -1.27%

5D -2.51%

Buy Vol. 1,399,861

Sell Vol. 2,017,067

VCB: Vietcombank has just set a new record of profit, with consolidated pre-tax profit estimated to reach more than VND41,000 billion in 2023. Outstanding loan is estimated at VND1.27 quadrillion, an increase of 10.6% compared to the end of 2022.

OIL & GAS

76,800

1D -0.52%

5D 1.33%

Buy Vol. 1,577,487

Sell Vol. 14,562,016

11,400

1D 0.88%

5D 2.32%

Buy Vol. 16,693,589

Sell Vol. 2,593,083

35,300

1D 0.28%

5D -0.56%

Buy Vol. 2,212,098

Sell Vol. 6,083,607

PVN's gas exploitation output in 2023 has reached 7.47 billion m3, exceeding 25.7% of the plan, equal to 92% of the group's exploitation capacity.

VINGROUP

44,350

1D 0.57%

5D 0.35%

Buy Vol. 4,033,059

Sell Vol. 11,601,070

43,350

1D 0.58%

5D 1.72%

Buy Vol. 10,203,635

Sell Vol. 13,445,857

23,700

1D 1.50%

5D 0.89%

Buy Vol. 13,858,287

Sell Vol. 4,998,573

January 06, 2024, VinFast and the Tamil Nadu State Government announce a landmark partnership in a MoU to charge the development of green transportation in India.

FOOD & BEVERAGE

68,200

1D -0.87%

5D -0.60%

Buy Vol. 4,259,390

Sell Vol. 4,463,845

66,600

1D -1.91%

5D 0.95%

Buy Vol. 4,635,516

Sell Vol. 1,323,257

62,100

1D 0.32%

5D -4.13%

Buy Vol. 1,449,051

Sell Vol. 884,047

VNM: According to Brand Finance, Vinamilk has ranked in the Top 5 most sustainable milk brands globally and Top 6 most valuable milk brands globally.

OTHERS

60,300

1D -0.33%

5D 1.27%

Buy Vol. 1,252,645

Sell Vol. 784,657

40,000

1D 0.00%

5D 1.27%

Buy Vol. 623,840

Sell Vol. 784,657

106,600

1D -0.93%

5D -1.30%

Buy Vol. 792,396

Sell Vol. 980,467

97,300

1D -0.10%

5D 1.25%

Buy Vol. 2,511,423

Sell Vol. 3,959,294

43,200

1D -1.48%

5D 0.93%

Buy Vol. 9,020,487

Sell Vol. 12,894,156

21,500

1D -1.38%

5D 1.42%

Buy Vol. 3,355,442

Sell Vol. 3,967,892

34,100

1D -0.15%

5D 3.96%

Buy Vol. 39,563,626

Sell Vol. 41,863,748

27,850

1D 0.18%

5D -0.36%

Buy Vol. 61,723,183

Sell Vol. 61,644,172

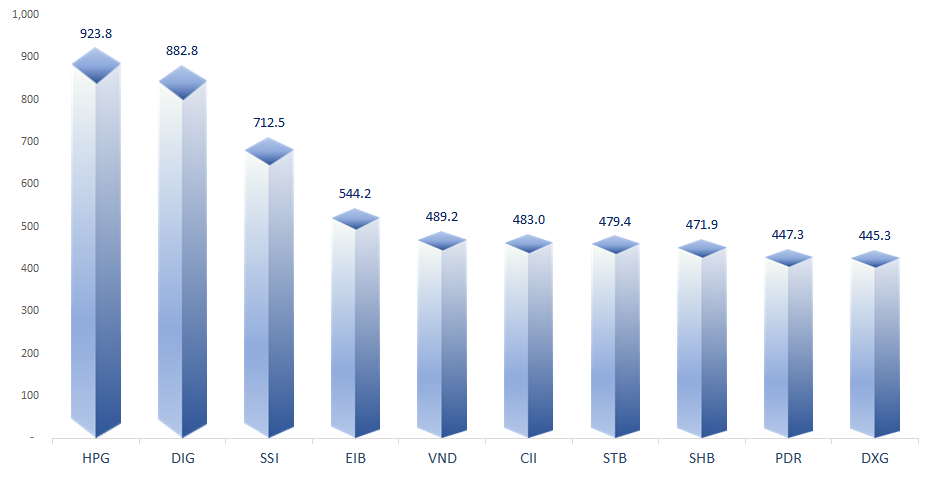

HPG: In December 2023, Hoa Phat Group produced 648,000 tons of crude steel, an increase of 4% compared to the previous month. Consumption of HRC steel products, construction steel and steel billets reached 760,000 tons, an increase of 7%. Of which, construction steel and high quality steel were 462,000 tons, an increase of 13% compared to last November.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

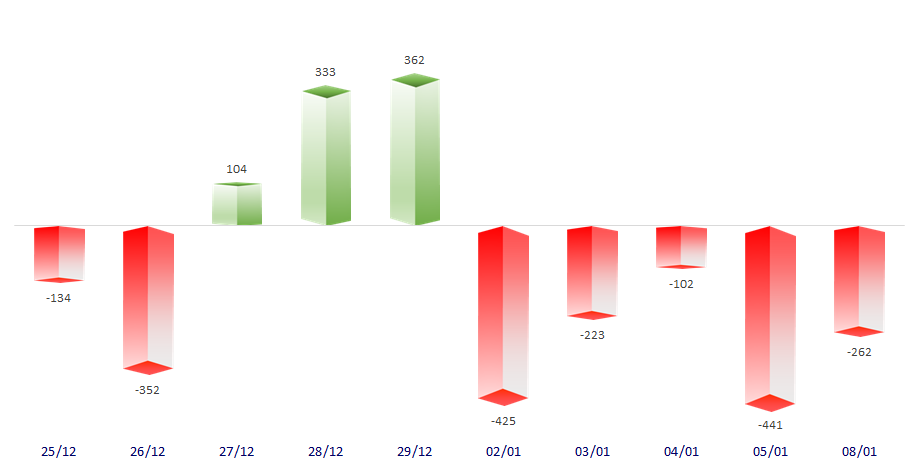

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

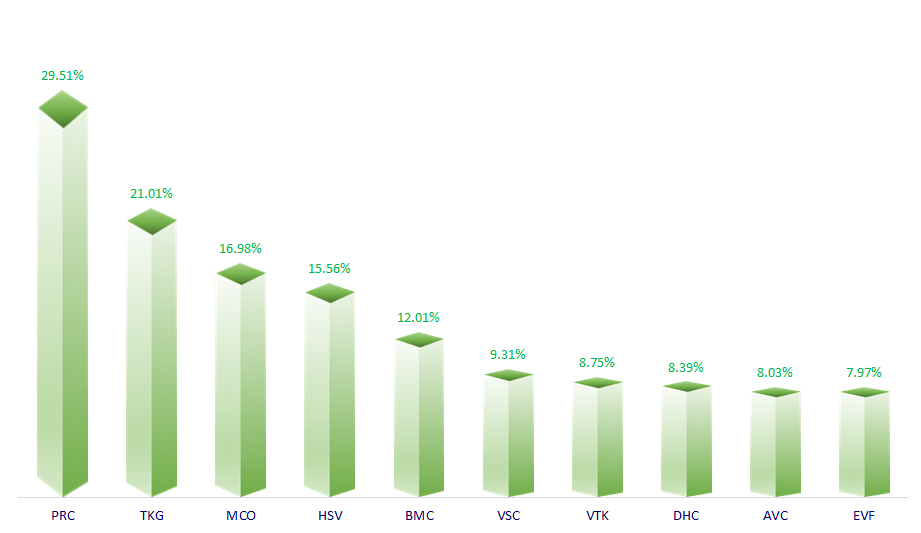

TOP INCREASES 3 CONSECUTIVE SESSIONS

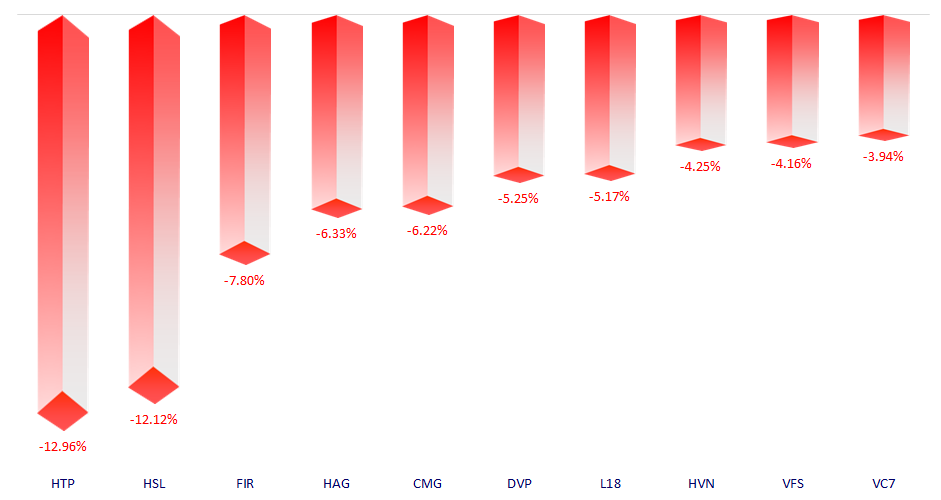

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.