Market brief 01/02/2024

VIETNAM STOCK MARKET

1,173.02

1D 0.75%

YTD 3.65%

230.57

1D 0.61%

YTD 0.25%

1,173.35

1D 0.60%

YTD 3.69%

88.02

1D 0.38%

YTD 0.50%

104.32

1D 0.00%

YTD 0.00%

17,071.95

1D -36.70%

YTD -9.66%

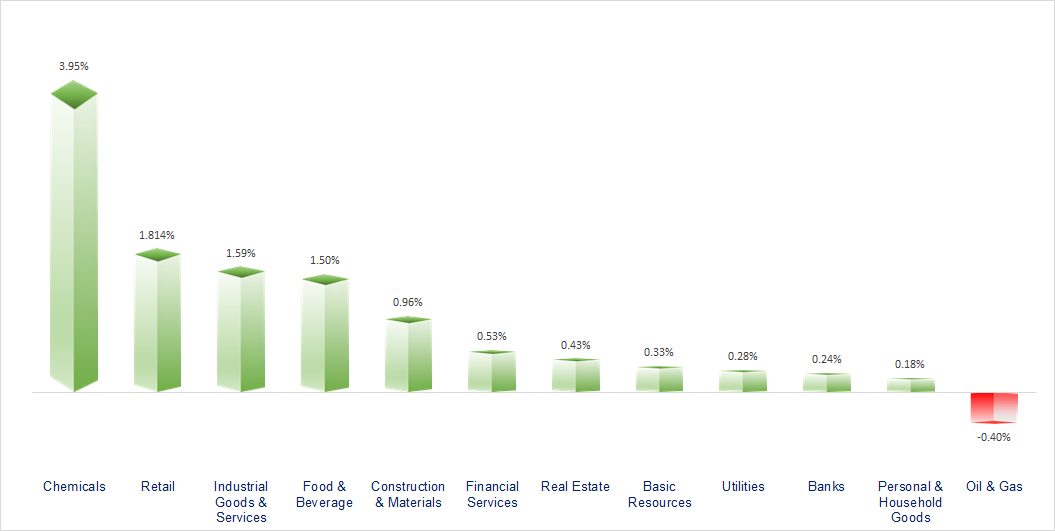

The market has recovered positively after a sharp decline yesterday. Almost industry groups increased today, in which industrial real estate and retail were the two most positive sectors.

ETF & DERIVATIVES

20,290

1D 0.50%

YTD 3.89%

13,950

1D 0.58%

YTD 3.72%

14,400

1D 0.00%

YTD 3.90%

16,920

1D -1.05%

YTD -0.35%

19,460

1D -0.05%

YTD 5.76%

27,300

1D 0.59%

YTD 4.88%

15,790

1D -0.69%

YTD 3.41%

1,177

1D 0.53%

YTD 0.00%

1,179

1D 0.60%

YTD 0.00%

1,176

1D 0.69%

YTD 0.00%

1,176

1D 0.87%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

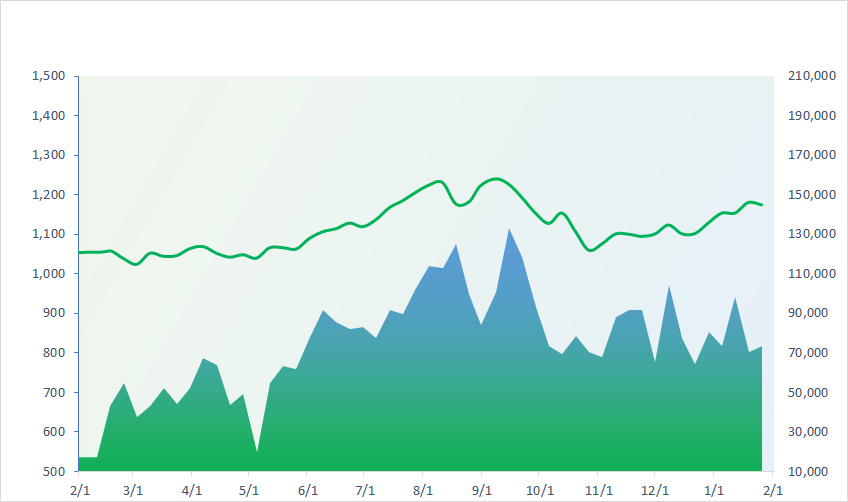

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

36,011.46

1D -0.76%

YTD 7.61%

2,770.74

1D -0.64%

YTD -6.47%

15,566.21

1D 0.52%

YTD -7.28%

2,542.46

1D 1.82%

YTD -4.77%

71,645.30

1D 0.00%

YTD -0.34%

3,143.06

1D -0.37%

YTD -2.69%

1,367.96

1D 0.20%

YTD -4.56%

81.10

1D 0.32%

YTD 2.87%

2,031.73

1D -0.45%

YTD -2.17%

Asian stocks were mixed today. The Kospi index was the most positive after S&P Global announced that Korea's PMI index in January reached 51.2 points, recording a positive increase from 49.9 in December last year.

VIETNAM ECONOMY

1.00%

1D (bps) -6

YTD (bps) -260

4.70%

YTD (bps) -10

1.75%

1D (bps) 2

YTD (bps) -14

2.20%

1D (bps) 3

YTD (bps) 2

24,605

1D (%) 0.04%

YTD (%) 0.39%

26,970

1D (%) -0.59%

YTD (%) -1.48%

3,466

1D (%) -0.32%

YTD (%) -0.29%

The central exchange rate listed by the SBV is at 23,991 VND/USD, down quite sharply compared to yesterday and falling out of the area of 24,000 VND/USD. USD prices at commercial banks have also continuously cooled down in recent days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In the first half of January, Vietnam exported goods earned more than USD15 billion;

- The more than VND18,000 billion road in Binh Duong will have two stops;

- Vietnam's economic overview in the first month of 2024;

- Demand for transporting goods from China to Europe by rail via Russia has skyrocketed due to tensions in the Red Sea;

- IMF: Red Sea container shipping decreased by 30% due to attacks;

- It is forecast that the Eurozone economy will continue to stagnate in the near future.

VN30

BANK

89,800

1D 1.47%

5D -1.32%

Buy Vol. 1,512,331

Sell Vol. 1,741,220

47,250

1D -0.94%

5D -2.38%

Buy Vol. 3,144,691

Sell Vol. 2,505,066

32,050

1D 1.42%

5D 0.00%

Buy Vol. 11,888,839

Sell Vol. 8,722,859

34,150

1D -1.16%

5D -2.43%

Buy Vol. 10,395,487

Sell Vol. 8,545,760

19,150

1D -1.29%

5D -2.54%

Buy Vol. 14,794,757

Sell Vol. 20,412,562

21,900

1D 0.69%

5D 0.00%

Buy Vol. 36,130,036

Sell Vol. 19,479,042

21,800

1D 0.00%

5D 3.56%

Buy Vol. 7,810,415

Sell Vol. 9,789,524

17,850

1D 0.00%

5D -1.65%

Buy Vol. 11,687,169

Sell Vol. 10,669,911

29,800

1D -0.33%

5D -2.30%

Buy Vol. 26,008,643

Sell Vol. 22,711,991

20,650

1D -0.48%

5D 0.24%

Buy Vol. 8,113,110

Sell Vol. 7,832,283

26,000

1D 0.97%

5D 0.78%

Buy Vol. 16,779,008

Sell Vol. 12,525,303

11,600

1D 0.00%

5D -5.31%

Buy Vol. 56,466,074

Sell Vol. 50,597,124

22,750

1D -0.66%

5D -1.52%

Buy Vol. 1,755,270

Sell Vol. 2,384,690

STB: Sacombank has just announced business results for the fourth quarter of 2023. Accordingly, Sacombank has completed key business targets assigned by the General Meeting of Shareholders, pre-tax profit growth reached VND9,595 billion, an increase of 51% compared to 2022, exceeding the plan set at the beginning of the year. In particular, Sacombank has completed 100% provision for unrecovered debt sold from VAMC. It is expected that the Bank will complete the restructuring project in the first half of 2024.

OIL & GAS

75,500

1D 0.13%

5D -0.87%

Buy Vol. 1,068,988

Sell Vol. 7,271,435

11,350

1D 0.00%

5D 0.29%

Buy Vol. 8,012,072

Sell Vol. 898,649

34,600

1D 0.00%

5D -1.05%

Buy Vol. 640,634

Sell Vol. 4,167,568

GAS: PV Gas ended the fourth quarter with revenue of nearly VND22.6 trillion, a slight increase over the same period last year.

VINGROUP

42,350

1D -0.35%

5D -2.14%

Buy Vol. 3,588,854

Sell Vol. 10,460,367

41,200

1D -0.72%

5D -4.83%

Buy Vol. 12,115,524

Sell Vol. 11,675,781

22,650

1D 0.89%

5D 0.90%

Buy Vol. 16,805,836

Sell Vol. 6,372,616

VIC: Vinfast will be the first company of Vingroup to invest in the Philippines in 2024 with the establishment of a business network for cars and electric motorbikes.

FOOD & BEVERAGE

67,500

1D 0.75%

5D -2.54%

Buy Vol. 4,209,639

Sell Vol. 3,166,449

65,100

1D 1.09%

5D -2.21%

Buy Vol. 3,262,333

Sell Vol. 1,100,889

57,500

1D 2.13%

5D 7.14%

Buy Vol. 1,353,777

Sell Vol. 1,801,548

VNM: Foreign markets have a growth rate of 11.7% over the same period, contributing VND2,534 billion in revenue in the fourth quarter of 2023 of Vinamilk.

OTHERS

66,000

1D 1.07%

5D 1.35%

Buy Vol. 1,439,125

Sell Vol. 1,071,222

41,250

1D 1.85%

5D 1.35%

Buy Vol. 822,134

Sell Vol. 1,071,222

105,500

1D 0.86%

5D 0.57%

Buy Vol. 794,647

Sell Vol. 803,168

99,900

1D 4.39%

5D 5.05%

Buy Vol. 13,448,458

Sell Vol. 11,744,623

46,200

1D 2.67%

5D 2.21%

Buy Vol. 18,554,853

Sell Vol. 20,663,627

23,950

1D 6.92%

5D 14.59%

Buy Vol. 19,003,379

Sell Vol. 7,333,068

34,650

1D 0.73%

5D 2.06%

Buy Vol. 22,051,797

Sell Vol. 29,965,089

27,850

1D 0.36%

5D -1.42%

Buy Vol. 22,792,923

Sell Vol. 25,316,746

GVR and FPT are the two stocks in the VN30 basket that increased the most today with suddenly high liquidity.

Market by numbers

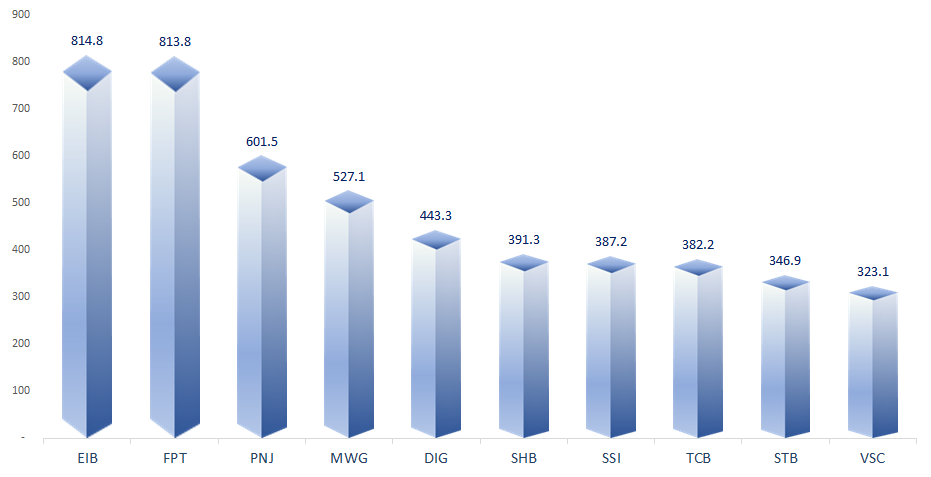

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

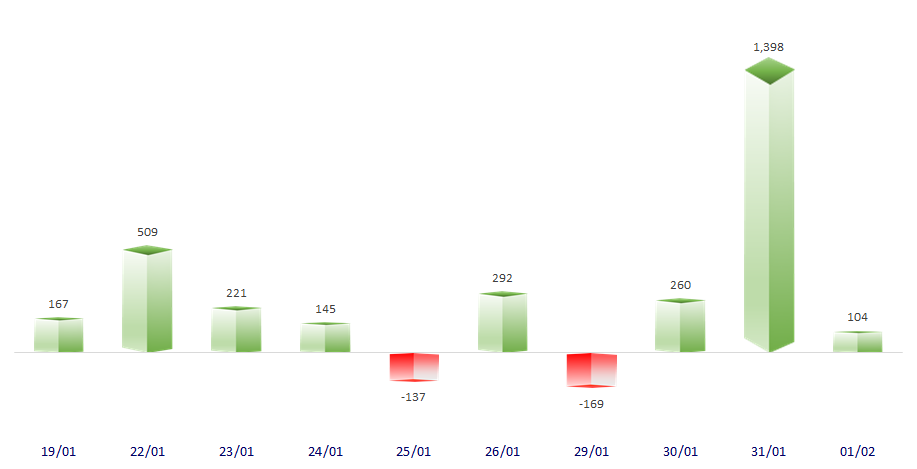

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

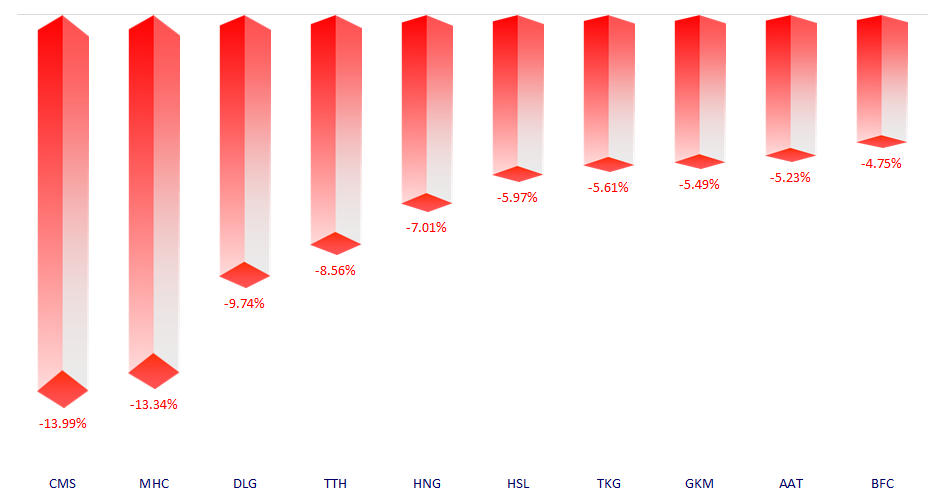

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.