Market brief 12/03/2024

VIETNAM STOCK MARKET

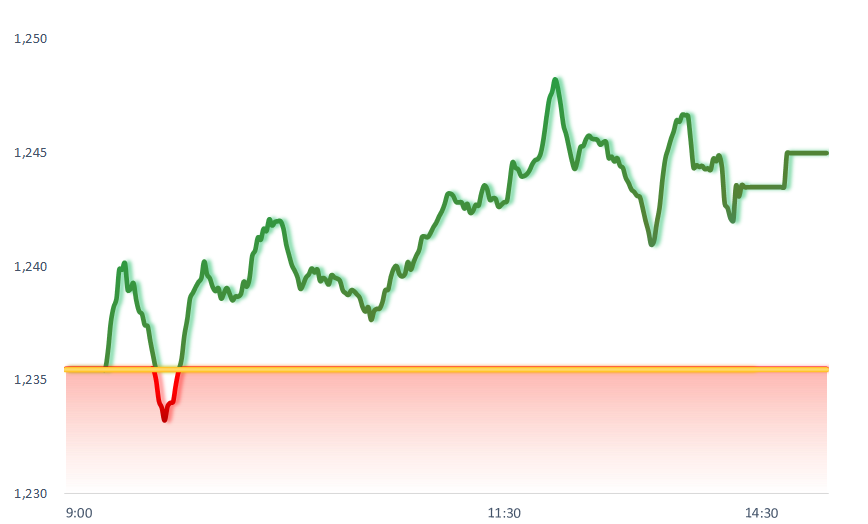

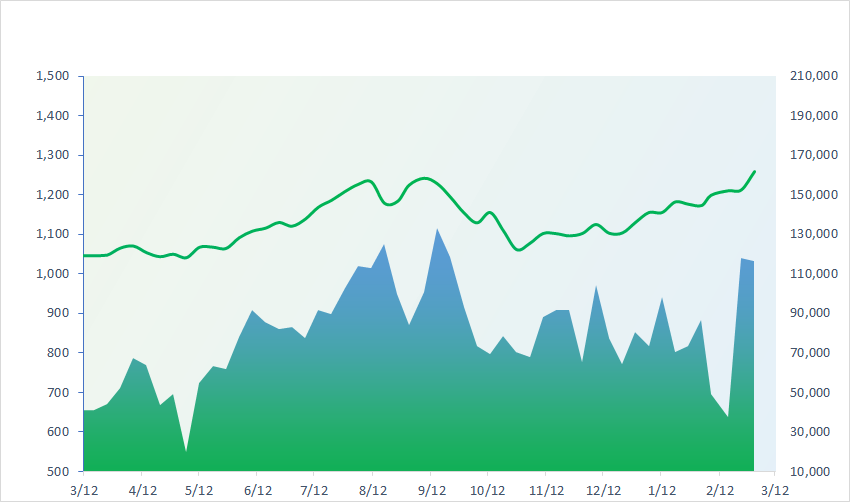

1,245.00

1D 0.77%

YTD 10.01%

234.03

1D 0.08%

YTD 1.76%

1,242.23

1D 0.58%

YTD 9.77%

90.77

1D 0.12%

YTD 3.64%

-211.36

1D 0.00%

YTD 0.00%

22,982.37

1D -13.20%

YTD 21.62%

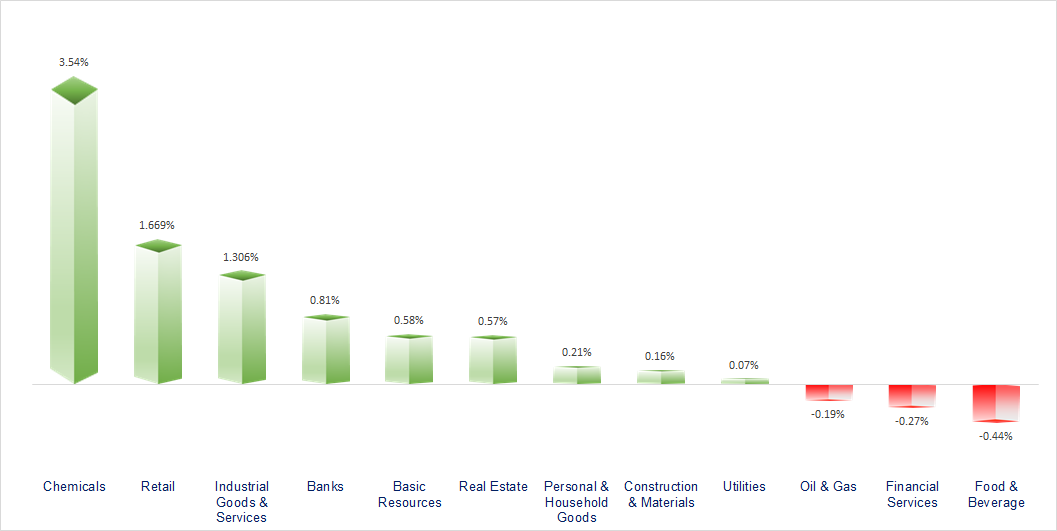

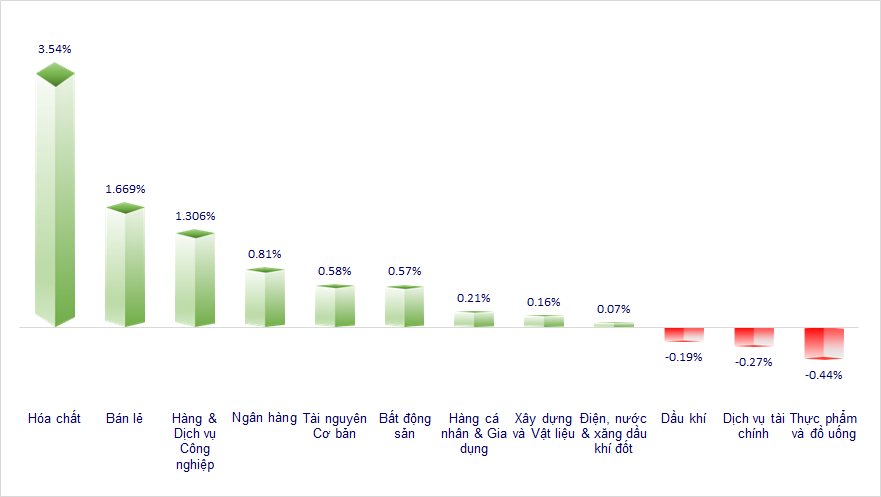

The market had a recovery session after 2 sessions of sharp decline. The industrial zone group led the market today, while food, beverage and financial services were the two most negative groups.

ETF & DERIVATIVES

21,400

1D -0.70%

YTD 9.58%

14,720

1D 0.41%

YTD 9.44%

15,370

1D 1.12%

YTD 10.89%

17,800

1D -0.50%

YTD 4.83%

20,120

1D 0.00%

YTD 9.35%

29,400

1D 0.75%

YTD 12.95%

16,800

1D -0.18%

YTD 10.02%

1,240

1D 0.71%

YTD 0.00%

1,244

1D 0.76%

YTD 0.00%

1,240

1D 0.48%

YTD 0.00%

1,237

1D 0.24%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,797.51

1D -0.06%

YTD 15.94%

3,055.94

1D -0.41%

YTD 3.16%

17,093.50

1D 3.05%

YTD 1.82%

2,681.81

1D 0.83%

YTD 0.45%

73,677.24

1D 0.24%

YTD 2.48%

3,141.47

1D 0.10%

YTD -2.74%

1,380.21

1D 0.00%

YTD -3.71%

82.78

1D 0.45%

YTD 5.00%

2,178.40

1D -0.11%

YTD 4.89%

Asian markets had mixed movements today, with the strongest increase being the Hang Seng index in Hong Kong, led by real estate stocks. Yesterday, Moody's downgraded China Vanke's credit rating for financial activities to the lowest level and also said it would consider lowering all other ratings of this business. Soon after, China Vanke announced that the group's financial performance and refinancing activities remained stable.

VIETNAM ECONOMY

1.50%

1D (bps) 73

YTD (bps) -210

4.70%

YTD (bps) -10

1.78%

1D (bps) 8

YTD (bps) -10

2.33%

1D (bps) -3

YTD (bps) 15

24,826

1D (%) 0.04%

YTD (%) 1.29%

27,716

1D (%) 0.03%

YTD (%) 1.24%

3,506

1D (%) 0.17%

YTD (%) 0.86%

After the SBV took measures to control exchange rates, the foreign currency market has cooled down but the USD price is still anchored at a high level. Early on March 12, the SBV announced the central exchange rate at 23,955 VND/USD, down another 23 VND compared to the previous day.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Domestic airfare prices begin to cool down after Tet;

- Name the Top 4 industries with growth potential in 2024;

- New progress for Metro line No. 2;

- EIA: US leads global oil production for 6th consecutive year;

- Canada keeps its key interest rate unchanged at 5%;

- China's Housing Minister: Allow real estate businesses to go bankrupt if necessary.

VN30

BANK

94,400

1D 0.32%

5D -1.15%

Buy Vol. 2,351,051

Sell Vol. 1,862,656

52,000

1D 2.97%

5D -4.41%

Buy Vol. 3,459,909

Sell Vol. 2,562,761

34,500

1D 1.02%

5D -5.35%

Buy Vol. 14,417,636

Sell Vol. 12,162,437

41,200

1D 1.98%

5D -2.37%

Buy Vol. 16,509,942

Sell Vol. 11,806,725

18,550

1D 0.00%

5D -6.08%

Buy Vol. 23,615,758

Sell Vol. 22,246,337

23,100

1D 0.65%

5D -6.10%

Buy Vol. 46,072,324

Sell Vol. 29,487,043

22,950

1D -0.65%

5D -2.34%

Buy Vol. 8,774,670

Sell Vol. 10,891,586

18,500

1D 0.00%

5D -4.64%

Buy Vol. 15,004,776

Sell Vol. 21,879,255

30,250

1D 0.17%

5D -5.17%

Buy Vol. 29,847,916

Sell Vol. 24,041,738

21,300

1D 0.00%

5D -3.62%

Buy Vol. 7,680,384

Sell Vol. 6,419,177

26,750

1D 0.00%

5D -4.29%

Buy Vol. 16,599,103

Sell Vol. 13,394,024

11,300

1D -0.88%

5D -4.64%

Buy Vol. 55,264,865

Sell Vol. 46,477,142

22,550

1D 0.00%

5D -1.31%

Buy Vol. 1,938,617

Sell Vol. 2,605,600

TCB: Techcombank has just announced adjusting savings interest rates for deposit terms of less than 6 months. The new interest rate schedule, lower than the old level, takes effect from March 11, 2024. For terms of 1-2 months, the interest rate decreased by 0.1% to 2.35%/year; 3-5 months reduced by 0.4% to 2.45%/year. Interest rates for the remaining terms remain the same.

OIL & GAS

77,900

1D 0.13%

5D -2.95%

Buy Vol. 2,183,097

Sell Vol. 13,866,245

11,500

1D -0.86%

5D 1.11%

Buy Vol. 12,058,808

Sell Vol. 1,781,740

36,350

1D 1.11%

5D -2.54%

Buy Vol. 1,769,448

Sell Vol. 5,861,667

POW: PV Power (POW) achieved VND3,604 billion in revenue in the first 2 months of the year, down 27%.

VINGROUP

44,150

1D -0.45%

5D -2.18%

Buy Vol. 4,780,563

Sell Vol. 8,335,616

42,700

1D 0.35%

5D -5.62%

Buy Vol. 9,193,767

Sell Vol. 16,068,864

25,200

1D 2.86%

5D -4.11%

Buy Vol. 27,015,736

Sell Vol. 6,605,594

VHM: The Ministry of Planning and Investment has just proposed to the Prime Minister to approve the policy of investing in an industrial park of more than 964 hectares for Vinhomes.

FOOD & BEVERAGE

70,000

1D -0.43%

5D 3.96%

Buy Vol. 6,779,359

Sell Vol. 9,012,501

78,700

1D 1.55%

5D 0.34%

Buy Vol. 12,063,545

Sell Vol. 3,038,503

59,100

1D -0.34%

5D 3.66%

Buy Vol. 2,143,858

Sell Vol. 2,897,937

VNM: On March 18, Vinamilk will finalize the list of shareholders attending the 2024 AGM of Shareholders and advance dividends for the third period of 2023.

OTHERS

67,900

1D 1.19%

5D 0.23%

Buy Vol. 3,108,094

Sell Vol. 1,237,982

43,400

1D 0.12%

5D 0.23%

Buy Vol. 1,564,849

Sell Vol. 1,237,982

102,500

1D -0.49%

5D -1.82%

Buy Vol. 765,525

Sell Vol. 919,688

111,900

1D 1.73%

5D 1.08%

Buy Vol. 5,541,082

Sell Vol. 6,403,408

46,750

1D 0.75%

5D -6.50%

Buy Vol. 27,937,765

Sell Vol. 23,646,800

31,600

1D 6.94%

5D 6.40%

Buy Vol. 18,073,851

Sell Vol. 12,315,806

36,300

1D -0.14%

5D -2.94%

Buy Vol. 44,411,631

Sell Vol. 39,929,835

30,200

1D 1.00%

5D -3.05%

Buy Vol. 64,519,903

Sell Vol. 58,442,067

HPG: In the document submitted to the Congress, Hoa Phat expects the revenue to reach VND140,000 billion and profit after tax to reach VND10,000 billion. With this plan, Hoa Phat's revenue and profit after tax will increase by 17% and 46% respectively compared to 2023 results.

Market by numbers

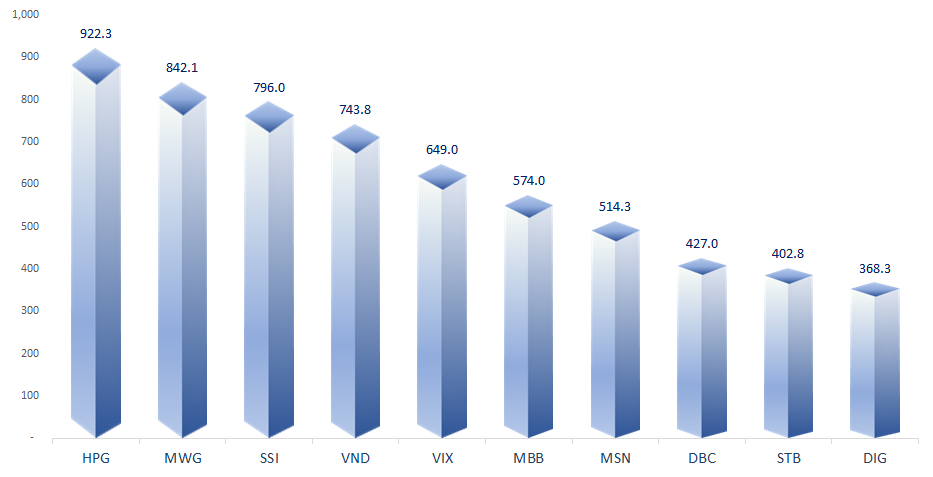

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

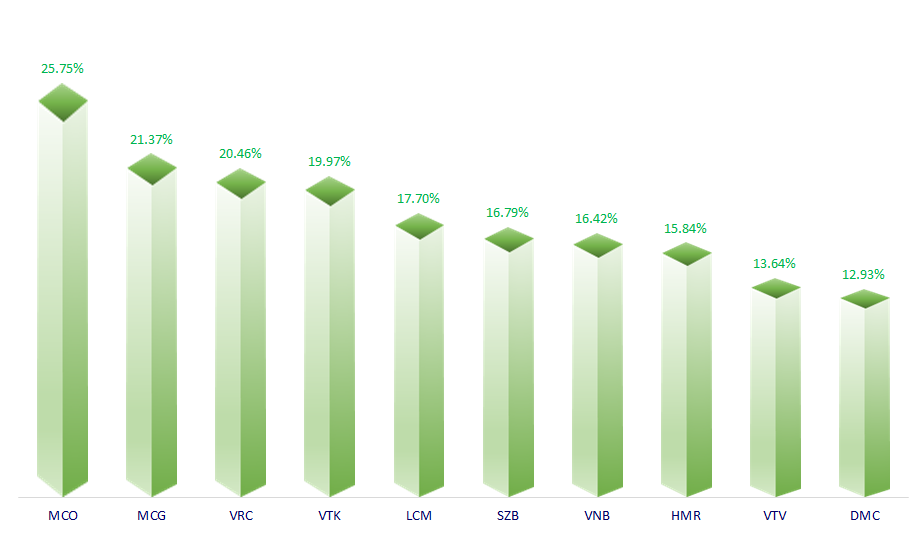

TOP INCREASES 3 CONSECUTIVE SESSIONS

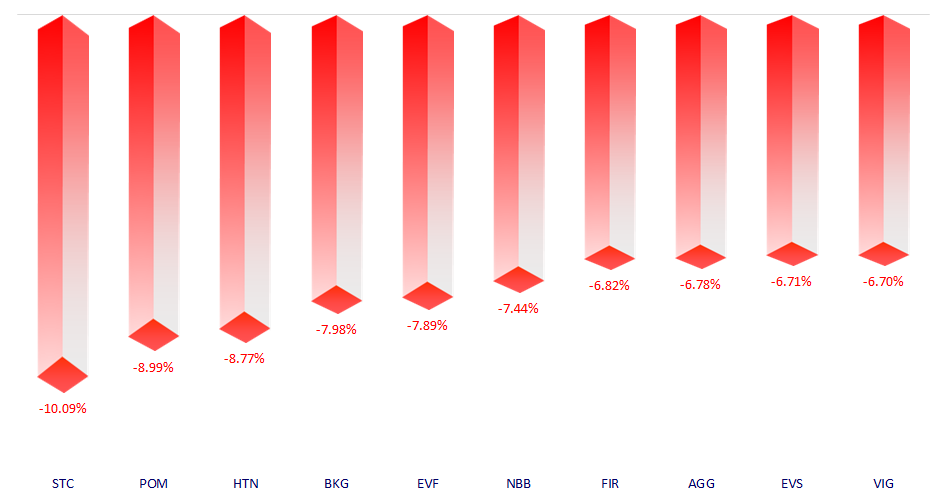

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.