Market Brief 03/04/2024

VIETNAM STOCK MARKET

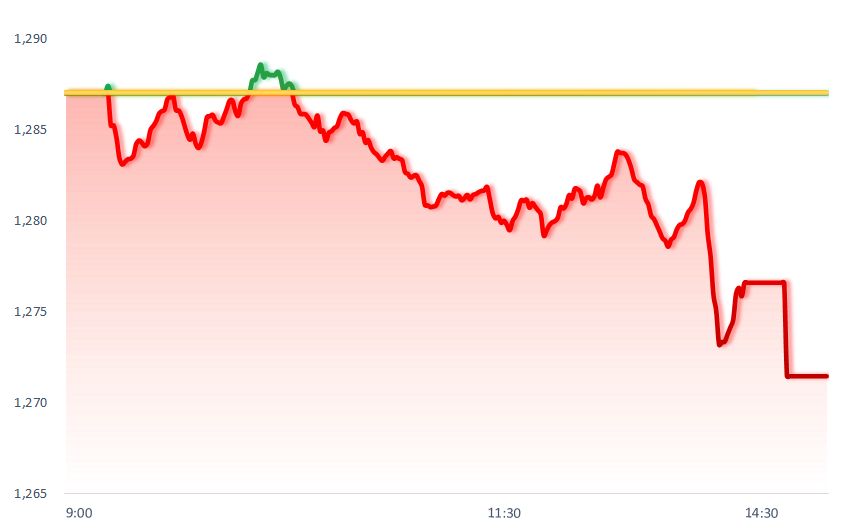

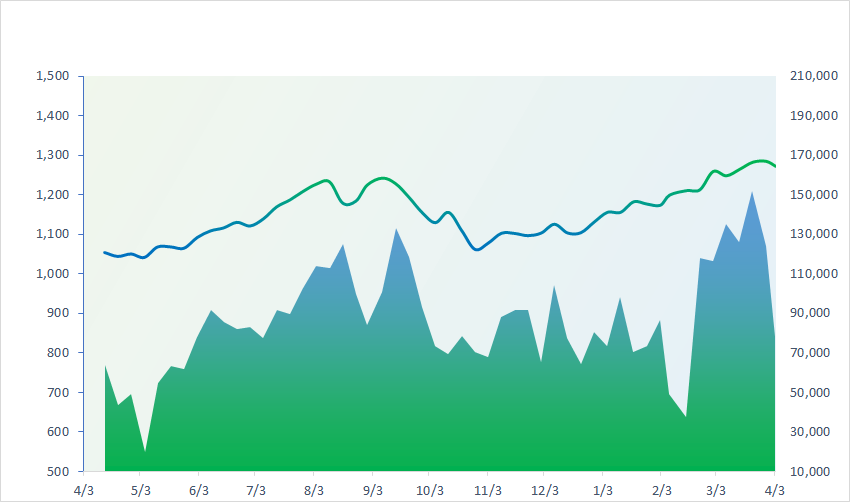

1,271.47

1D -1.21%

YTD 12.35%

243.96

1D -0.79%

YTD 6.07%

1,274.27

1D -1.40%

YTD 12.60%

91.15

1D -0.27%

YTD 4.08%

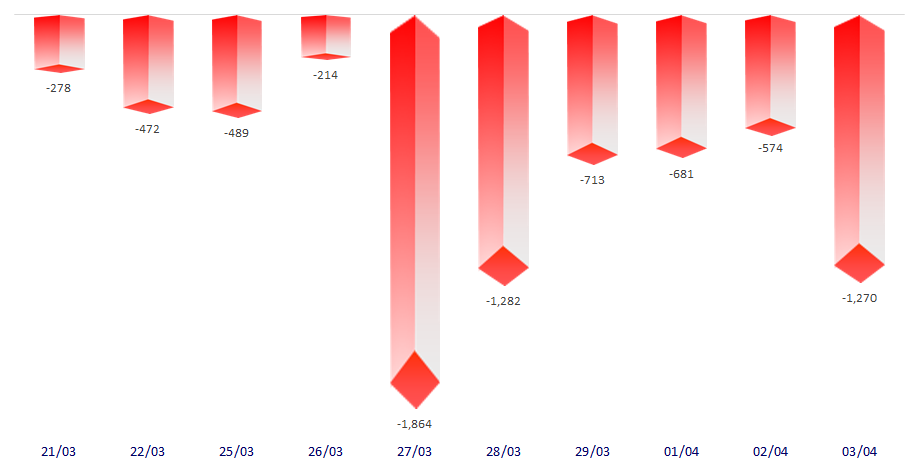

-1,270.31

1D 0.00%

YTD 0.00%

31,041.34

1D 0.14%

YTD 64.27%

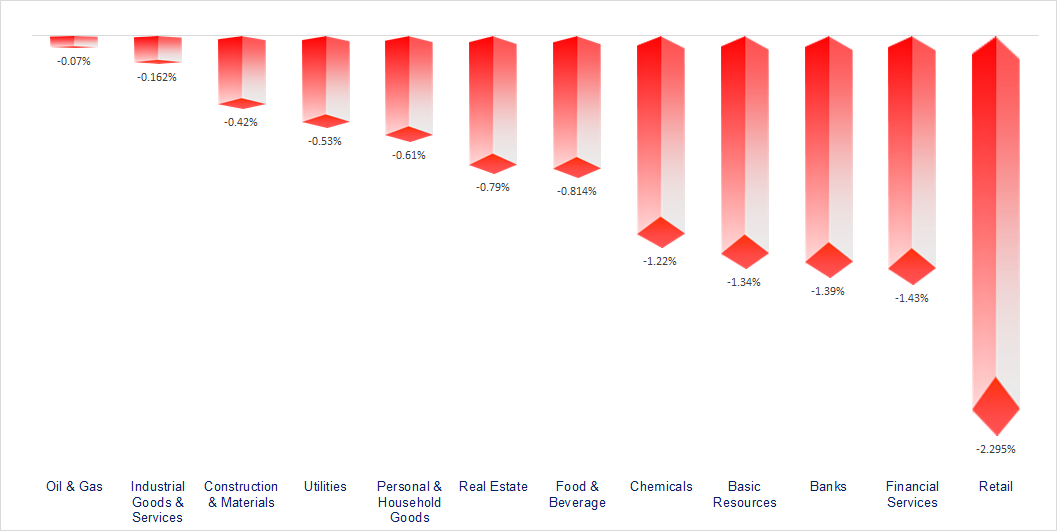

Strong and continuous net selling by foreign investors caused VNIndex to drop sharply today. Most industries plunged, the most negative being retail and financial services. Chemical stocks, especially the fertilizer group, were the bright spot today when stocks increased simultaneously such as LAS +9.2%, BFC +6.1%, DCM +2.2%, DPM +2%.

ETF & DERIVATIVES

22,180

1D -0.09%

YTD 13.57%

15,090

1D -1.18%

YTD 12.19%

15,630

1D -1.57%

YTD 12.77%

19,100

1D 0.95%

YTD 12.49%

20,900

1D -1.79%

YTD 13.59%

30,540

1D -1.17%

YTD 17.33%

17,190

1D -1.38%

YTD 12.57%

1,272

1D -1.40%

YTD 0.00%

1,276

1D -1.34%

YTD 0.00%

1,275

1D -1.41%

YTD 0.00%

1,275

1D -1.51%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,451.85

1D -0.97%

YTD 17.89%

3,069.29

1D -0.18%

YTD 3.61%

16,725.10

1D -1.22%

YTD -0.38%

2,706.97

1D -1.68%

YTD 1.39%

73,908.68

1D 0.01%

YTD 2.80%

3,223.61

1D -0.74%

YTD -0.20%

1,377.64

1D -0.13%

YTD -3.89%

89.11

1D 0.08%

YTD 13.03%

2,270.93

1D -0.32%

YTD 9.35%

Asia-Pacific stocks fell, tracking declines on Wall Street overnight, with shares of electric vehicle makers dropping on demand worries. Besides, investors were also concerned about the level of losses caused by a powerful earthquake in Taiwan early this morning. BYD shares fell 2% after the Chinese EV maker said its first-quarter sales plunged 43% quarter over quarter.

VIETNAM ECONOMY

4.42%

1D (bps) 97

YTD (bps) 82

4.70%

YTD (bps) -10

2.28%

1D (bps) 20

YTD (bps) 40

2.64%

1D (bps) -8

YTD (bps) 46

25,175

1D (%) 0.26%

YTD (%) 2.71%

27,748

1D (%) 0.25%

YTD (%) 1.36%

3,525

1D (%) 0.23%

YTD (%) 1.41%

After breaking through the peak on March 15, 2024, exchange rates at banks continued to set new peaks. Early this afternoon, the listed exchange rate at Vietcombank increased by VND70 in both buying and selling directions compared to yesterday, reaching 24,750 VND/USD (buying) and 25,120 VND/USD (selling). Overall, over the past 3 months, the exchange rate at banks has increased by VND700.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hot news: USD price at banks increased to the ceiling, exceeding the State Bank's intervention selling price;

- Textile and garment enterprises have received many positive signals;

- The average export price of pangasius increased slightly in February;

- US manufacturing sector on cusp of recovery;

- India wants to replace China as Asia's leading manufacturer;

- The BOJ's next interest rate hike could take place in October.

VN30

BANK

93,800

1D -0.74%

5D -2.09%

Buy Vol. 2,068,264

Sell Vol. 2,316,590

51,000

1D -1.73%

5D -2.86%

Buy Vol. 2,564,390

Sell Vol. 2,758,875

34,050

1D -2.71%

5D -4.08%

Buy Vol. 13,483,983

Sell Vol. 18,856,422

46,800

1D -1.78%

5D 2.74%

Buy Vol. 13,657,392

Sell Vol. 19,779,288

19,350

1D -1.02%

5D -1.28%

Buy Vol. 30,926,139

Sell Vol. 33,731,289

24,200

1D -2.42%

5D -4.35%

Buy Vol. 36,704,448

Sell Vol. 35,256,094

23,400

1D -2.09%

5D -3.11%

Buy Vol. 9,483,577

Sell Vol. 9,537,788

18,500

1D -1.86%

5D -3.65%

Buy Vol. 13,082,800

Sell Vol. 21,676,303

30,100

1D -0.33%

5D -2.59%

Buy Vol. 46,194,580

Sell Vol. 50,131,891

23,550

1D -2.28%

5D -2.69%

Buy Vol. 13,353,285

Sell Vol. 12,954,548

28,000

1D -1.41%

5D 0.00%

Buy Vol. 15,364,651

Sell Vol. 22,880,986

11,250

1D -1.32%

5D -2.17%

Buy Vol. 47,890,817

Sell Vol. 49,390,876

22,000

1D -0.23%

5D -0.90%

Buy Vol. 2,959,813

Sell Vol. 3,432,964

VPB: In the draft report submitted to the General Meeting of Shareholders, VPB sets a consolidated pre-tax profit target of VND23,165 billion in 2024, an increase of 114% compared to 2023. Of which, the parent bank is expected to contribute VND20,709 billion; VPBankS is expected to contribute VND1,902 billion and OPES is expected to contribute VND873 billion to total profit.

OIL & GAS

81,800

1D -0.85%

5D -0.44%

Buy Vol. 2,670,042

Sell Vol. 21,064,175

11,400

1D -1.30%

5D -1.05%

Buy Vol. 13,415,658

Sell Vol. 2,677,904

37,600

1D -0.79%

5D 1.49%

Buy Vol. 1,669,689

Sell Vol. 7,567,764

GAS: The Block-B O Mon Gas Project has a total investment of about USD1,277 billion, of which PV GAS contributes up to 51%.

VINGROUP

47,750

1D -0.10%

5D 1.41%

Buy Vol. 5,896,724

Sell Vol. 22,682,376

43,100

1D -0.12%

5D -1.73%

Buy Vol. 16,441,044

Sell Vol. 14,137,765

25,500

1D -0.20%

5D -1.48%

Buy Vol. 13,154,788

Sell Vol. 7,847,438

VHM: In 2024, Vinhomes sets a revenue target of VND120,000 billion, an increase of 16% and profit after tax of VND35,000 billion, an increase of more than 4% compared to 2023.

FOOD & BEVERAGE

66,700

1D -0.89%

5D -2.65%

Buy Vol. 8,306,818

Sell Vol. 9,272,629

73,400

1D -1.48%

5D -2.61%

Buy Vol. 8,618,306

Sell Vol. 2,541,373

56,000

1D -0.71%

5D -1.23%

Buy Vol. 2,314,793

Sell Vol. 2,138,542

MSN: Masan expects the consumer business to be positive again thanks to the recovery of the Vietnamese consumer market.

OTHERS

64,400

1D -1.53%

5D -2.31%

Buy Vol. 1,148,417

Sell Vol. 791,668

42,300

1D -0.24%

5D -2.31%

Buy Vol. 511,939

Sell Vol. 791,668

102,200

1D -0.78%

5D -0.78%

Buy Vol. 1,030,797

Sell Vol. 1,178,675

115,100

1D -1.62%

5D -0.09%

Buy Vol. 4,290,712

Sell Vol. 4,305,338

50,200

1D -2.71%

5D -0.99%

Buy Vol. 22,050,710

Sell Vol. 21,902,082

34,250

1D -2.84%

5D 2.54%

Buy Vol. 7,235,934

Sell Vol. 8,393,933

38,050

1D -2.19%

5D -1.17%

Buy Vol. 42,972,024

Sell Vol. 49,766,540

29,950

1D -1.48%

5D -2.12%

Buy Vol. 33,802,398

Sell Vol. 41,286,203

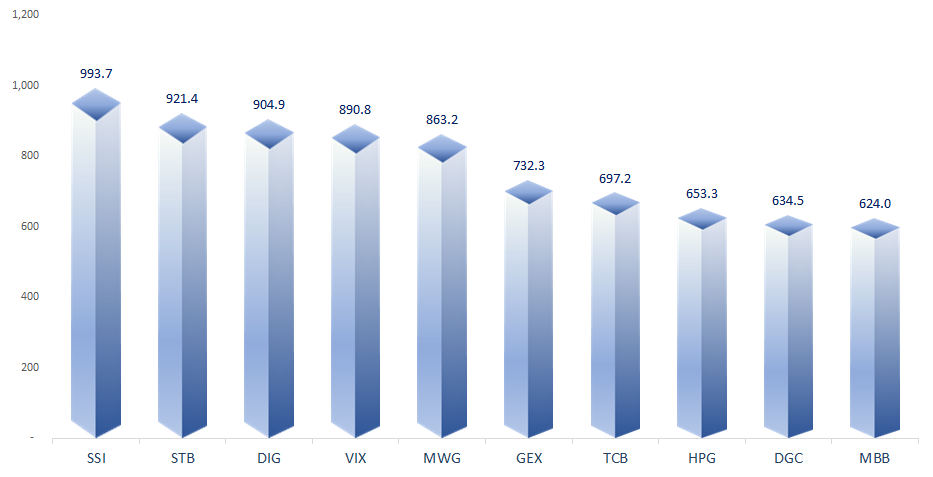

SSI: SSI plans to present to the general meeting of shareholders a business plan with revenue of VND8,112 billion and pre-tax profit of VND3,398 billion, growth of 11% and 19%, respectively.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

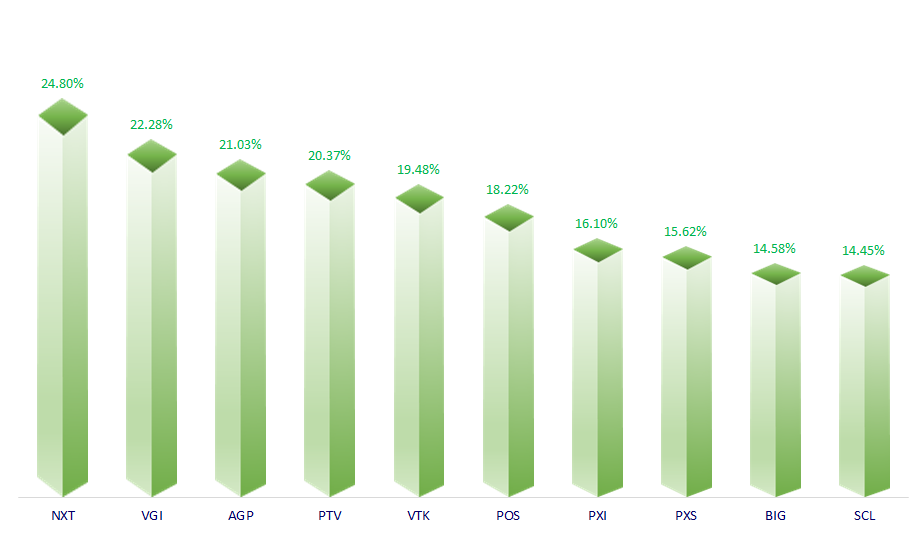

TOP INCREASES 3 CONSECUTIVE SESSIONS

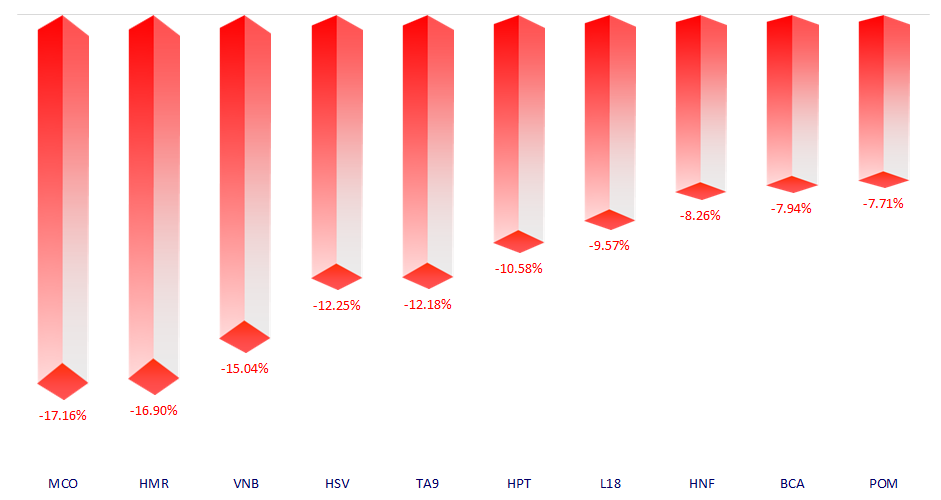

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.