Market Brief 08/04/2024

VIETNAM STOCK MARKET

1,250.35

1D -0.38%

YTD 10.48%

238.08

1D -0.67%

YTD 3.52%

1,254.72

1D -0.24%

YTD 10.88%

90.53

1D -0.13%

YTD 3.37%

-78.47

1D 0.00%

YTD 0.00%

23,201.63

1D -19.78%

YTD 22.78%

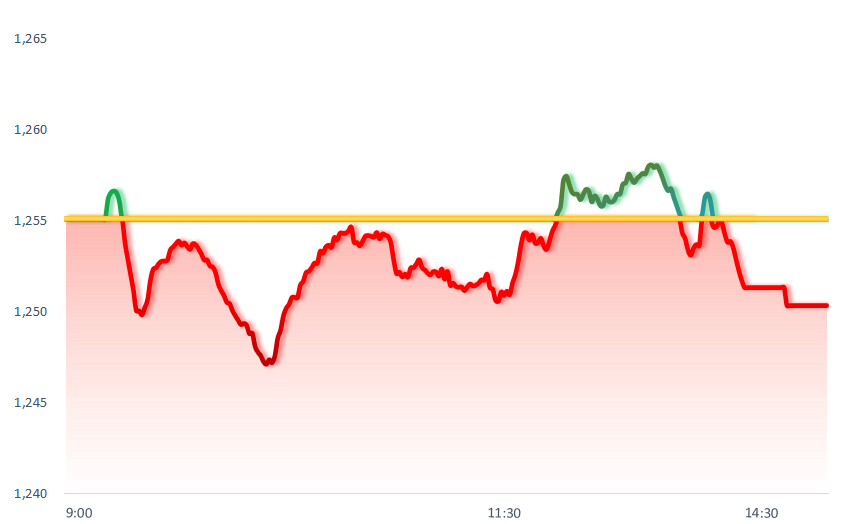

VNIndex continued to decline towards the end of the session, VRE was the falling stock that most affected VNIndex today. The banking industry has been a pillar supporting the market with many large bank stocks increasing such as HDB +2.4%, LPB +1.5%, BID +1.2%,...

ETF & DERIVATIVES

21,690

1D -0.55%

YTD 11.06%

14,900

1D -0.20%

YTD 10.78%

15,470

1D -0.32%

YTD 11.62%

18,800

1D -0.27%

YTD 10.72%

20,500

1D 0.00%

YTD 11.41%

29,860

1D -0.93%

YTD 14.71%

17,050

1D 0.77%

YTD 11.66%

1,254

1D -0.22%

YTD 0.00%

1,258

1D -0.25%

YTD 0.00%

1,258

1D -0.08%

YTD 0.00%

1,258

1D -0.42%

YTD 0.00%

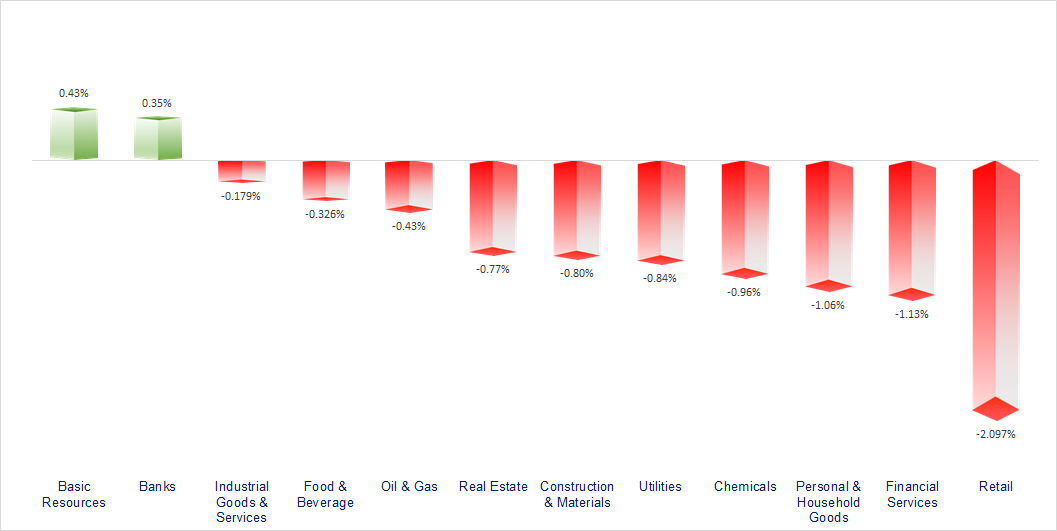

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

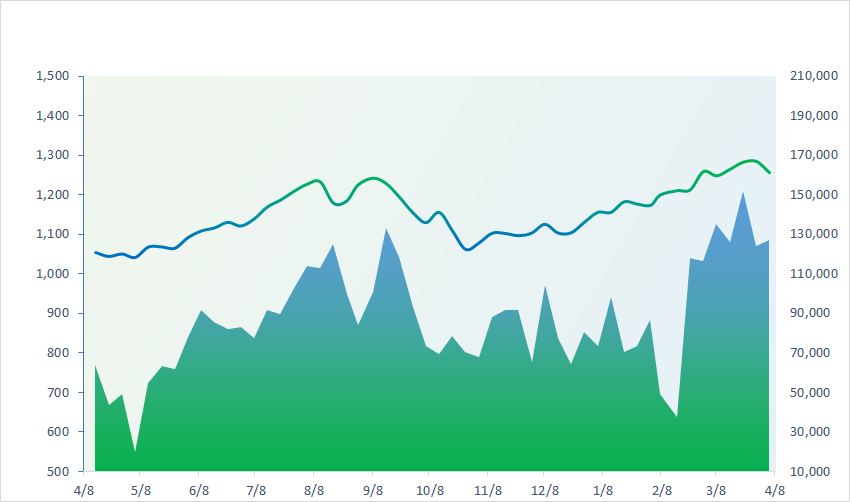

VNINDEX (12M)

GLOBAL MARKET

39,347.04

1D 0.91%

YTD 17.58%

3,047.05

1D -0.72%

YTD 2.86%

16,732.85

1D 0.05%

YTD -0.33%

2,717.65

1D 0.13%

YTD 1.79%

74,742.50

1D 0.67%

YTD 3.96%

3,215.99

1D -0.07%

YTD -0.43%

1,375.58

1D 0.12%

YTD -4.03%

90.49

1D 1.04%

YTD 17.48%

2,343.08

1D 0.45%

YTD 12.82%

Asia-Pacific markets were largely up ahead of central bank decisions this week, with investors also awaiting inflation numbers from the U.S. and China. The Bank of Korea, the Reserve Bank of New Zealand, the Bank of Thailand and the central bank of the Philippines have their monetary policy meetings scheduled this week.

VIETNAM ECONOMY

2.72%

1D (bps) 14

YTD (bps) -88

4.70%

YTD (bps) -10

2.24%

1D (bps) -1

YTD (bps) 36

2.76%

1D (bps) -2

YTD (bps) 58

25,160

1D (%) 0.05%

YTD (%) 2.65%

27,671

1D (%) -0.81%

YTD (%) 1.08%

3,519

1D (%) -0.11%

YTD (%) 1.24%

The State Bank injected a net of nearly VND12,000 billion in today's session when the T-bills issued on March 11 matured.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government proposes to amend the Electricity Law in 2024;

- Gold rings exceed 75 million VND/tael;

- Zarubezhneft Company wants to expand offshore wind power development in Vietnam;

- China adds gold holdings for 17th consecutive month amid drive to diversify reserves;

- TSMC retains 2024 revenue view in sign of limited impact of earthquake;

- Ukraine's international reserves are enough to cover 5.8 months of the country's imports.

VN30

BANK

94,900

1D 0.00%

5D -0.32%

Buy Vol. 1,694,351

Sell Vol. 1,495,899

50,800

1D 1.20%

5D -2.50%

Buy Vol. 2,239,043

Sell Vol. 2,746,752

33,500

1D 0.90%

5D -4.29%

Buy Vol. 22,163,486

Sell Vol. 21,833,847

45,500

1D 0.66%

5D -4.11%

Buy Vol. 19,869,797

Sell Vol. 19,546,714

19,400

1D -0.26%

5D -1.27%

Buy Vol. 16,773,974

Sell Vol. 21,691,312

23,500

1D 0.64%

5D -5.62%

Buy Vol. 55,250,982

Sell Vol. 48,744,545

23,900

1D 2.36%

5D -0.42%

Buy Vol. 12,997,492

Sell Vol. 10,396,372

18,250

1D 0.27%

5D -2.67%

Buy Vol. 20,415,821

Sell Vol. 24,171,873

29,000

1D -2.03%

5D -7.64%

Buy Vol. 42,346,070

Sell Vol. 41,545,388

22,700

1D 0.00%

5D -6.58%

Buy Vol. 20,483,755

Sell Vol. 22,829,454

27,150

1D 0.00%

5D -4.57%

Buy Vol. 15,674,326

Sell Vol. 20,665,701

11,100

1D -0.45%

5D -3.06%

Buy Vol. 38,958,456

Sell Vol. 34,987,498

21,900

1D -0.23%

5D -0.90%

Buy Vol. 1,976,845

Sell Vol. 2,967,288

CTG: Vietinbank will submit to shareholders for approval the profit distribution plan for 2023. Specifically, after making provisions for all funds, the retained profit for 2023 is VND13,927 billion. VietinBank proposes to use all remaining profits to pay dividends in stocks.

OIL & GAS

79,800

1D -1.36%

5D -1.32%

Buy Vol. 1,280,469

Sell Vol. 11,793,937

11,200

1D -0.44%

5D -1.07%

Buy Vol. 13,714,626

Sell Vol. 1,540,666

37,050

1D -0.27%

5D -0.31%

Buy Vol. 995,137

Sell Vol. 5,962,848

PLX: In 2024, PLX sets a revenue target of VND188,000 billion, down 32% over the same period; Target profit after tax is VND2,900 billion, down 26% compared to 2023.

VINGROUP

47,700

1D -0.21%

5D 0.23%

Buy Vol. 3,720,452

Sell Vol. 28,081,926

43,000

1D 0.12%

5D -8.17%

Buy Vol. 21,173,837

Sell Vol. 23,668,097

23,600

1D -4.45%

5D 0.00%

Buy Vol. 22,832,230

Sell Vol. 6,747,698

Vingroup completed divesting 55% of SDI's capital, no longer recording Vincom Retail as a subsidiary.

FOOD & BEVERAGE

67,000

1D -1.33%

5D -2.04%

Buy Vol. 6,205,630

Sell Vol. 5,881,012

71,900

1D 0.00%

5D -2.64%

Buy Vol. 5,683,094

Sell Vol. 2,667,831

55,300

1D -1.43%

5D -3.58%

Buy Vol. 1,749,175

Sell Vol. 1,927,303

VNM: Vinamilk plans to spend more than VND8,000 billion in dividends in 2024.

OTHERS

62,000

1D -0.96%

5D -2.00%

Buy Vol. 700,028

Sell Vol. 580,241

41,550

1D -0.36%

5D -2.00%

Buy Vol. 1,062,248

Sell Vol. 580,241

101,100

1D -0.79%

5D -1.56%

Buy Vol. 1,015,927

Sell Vol. 1,225,667

112,600

1D -0.97%

5D -3.60%

Buy Vol. 3,617,574

Sell Vol. 3,040,003

50,000

1D -1.96%

5D -2.72%

Buy Vol. 10,849,947

Sell Vol. 11,395,729

31,700

1D 0.63%

5D -3.79%

Buy Vol. 7,521,588

Sell Vol. 8,568,077

36,700

1D -0.27%

5D -5.41%

Buy Vol. 25,258,257

Sell Vol. 24,868,533

29,600

1D 0.51%

5D -1.66%

Buy Vol. 31,869,856

Sell Vol. 32,449,576

HPG: In March 2024, Hoa Phat Group produced 741,000 tons of crude steel, an increase of 7% compared to the previous month. Sales output of hot rolled steel products (HRC), construction steel, high quality steel and steel billet reached 693,000 tons, up 23.3% compared to February 2024 and up nearly 28% over the same period last year.

Market by numbers

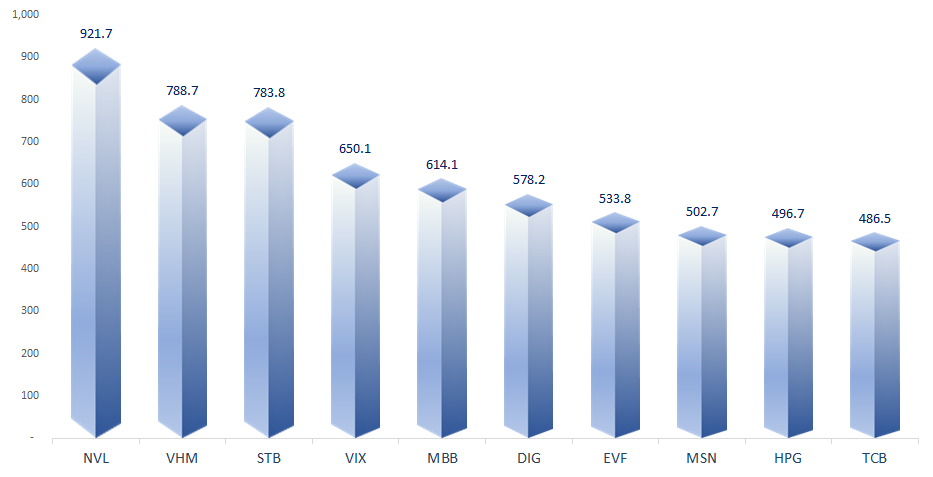

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

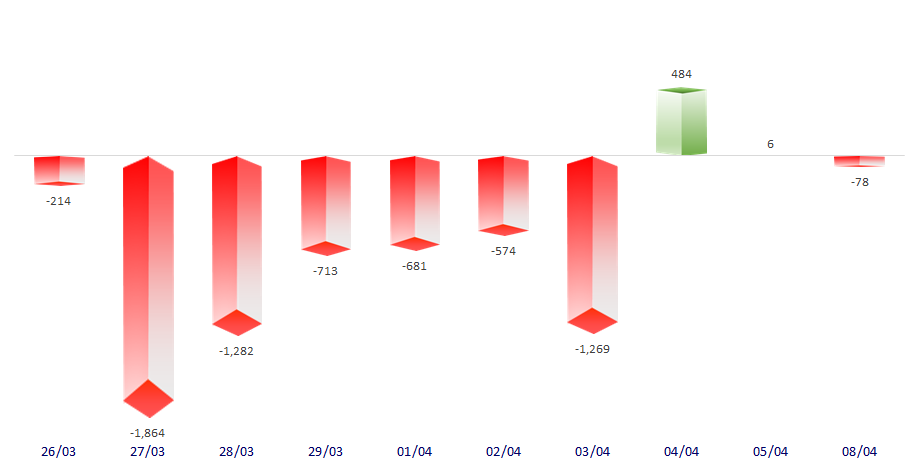

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

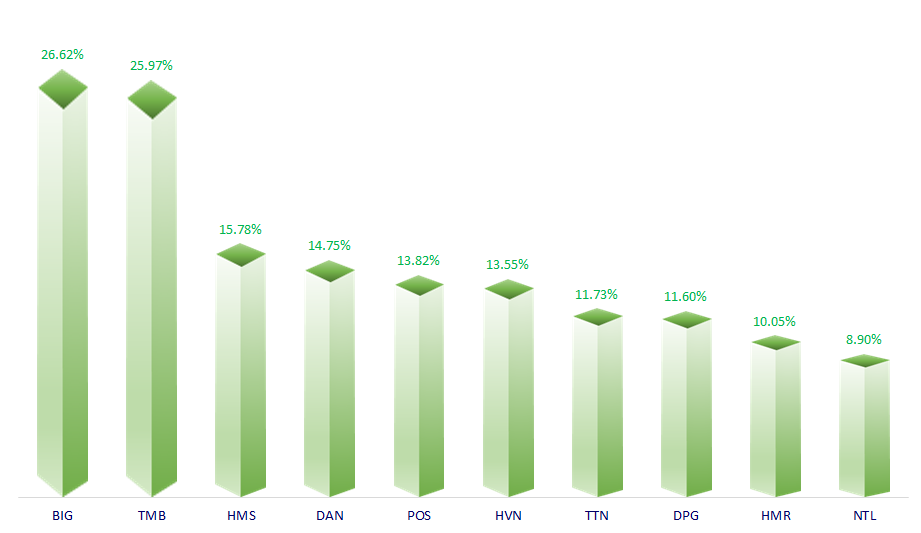

TOP INCREASES 3 CONSECUTIVE SESSIONS

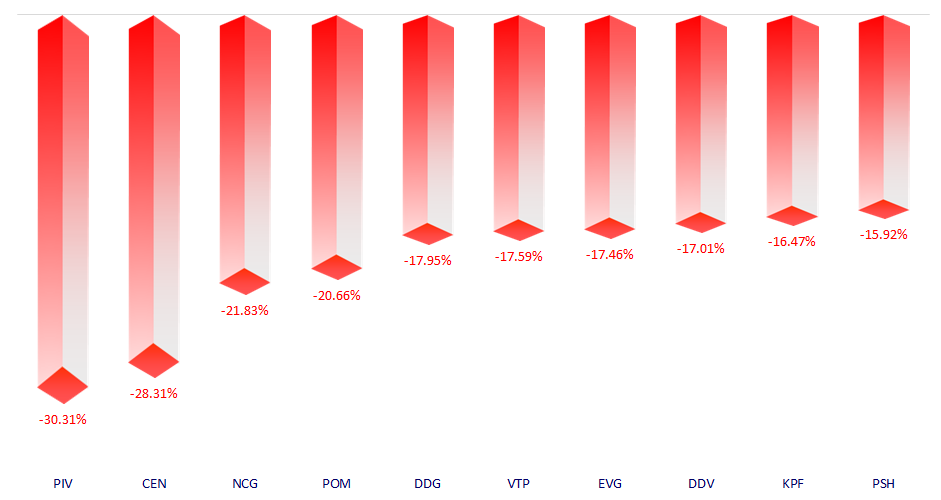

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.