Market brief 23/04/2024

VIETNAM STOCK MARKET

1,177.40

1D -1.08%

YTD 4.04%

222.63

1D -1.19%

YTD -3.20%

1,200.37

1D -0.52%

YTD 6.07%

87.51

1D -0.58%

YTD -0.08%

-290.33

1D 0.00%

YTD 0.00%

19,156.32

1D 7.42%

YTD 1.37%

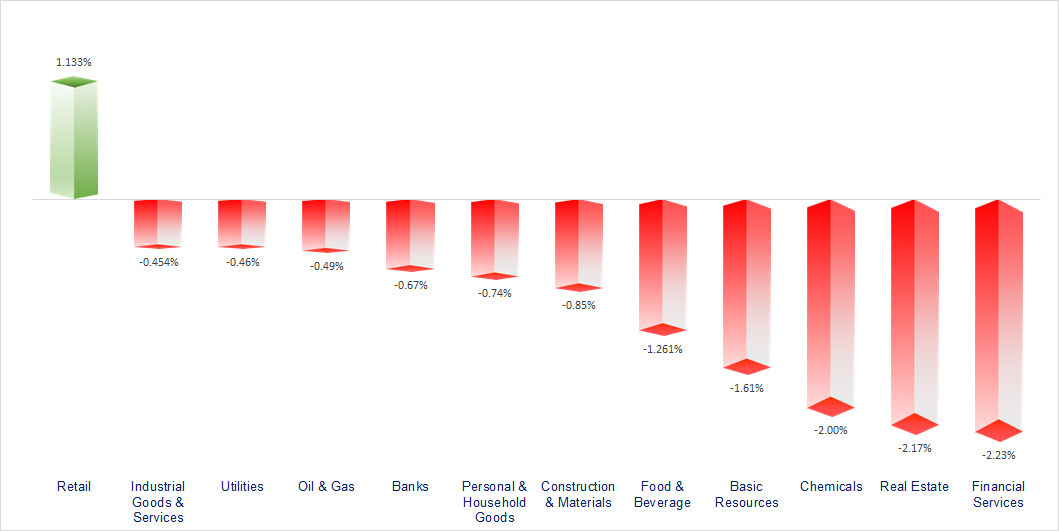

The market returned to decline after yesterday's impressive recovery session. Real estate, financial services and chemicals were the most negative sectors. On the contrary, retail and technology were the rare industries that increased.

ETF & DERIVATIVES

20,750

1D -0.86%

YTD 6.25%

14,230

1D -0.70%

YTD 5.80%

14,750

1D -0.74%

YTD 6.42%

17,830

1D -6.99%

YTD 5.01%

19,610

1D -0.96%

YTD 6.58%

29,050

1D 0.14%

YTD 11.60%

16,150

1D 0.31%

YTD 5.76%

1,201

1D -0.39%

YTD 0.00%

1,203

1D -0.36%

YTD 0.00%

1,202

1D -0.67%

YTD 0.00%

1,205

1D -0.41%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

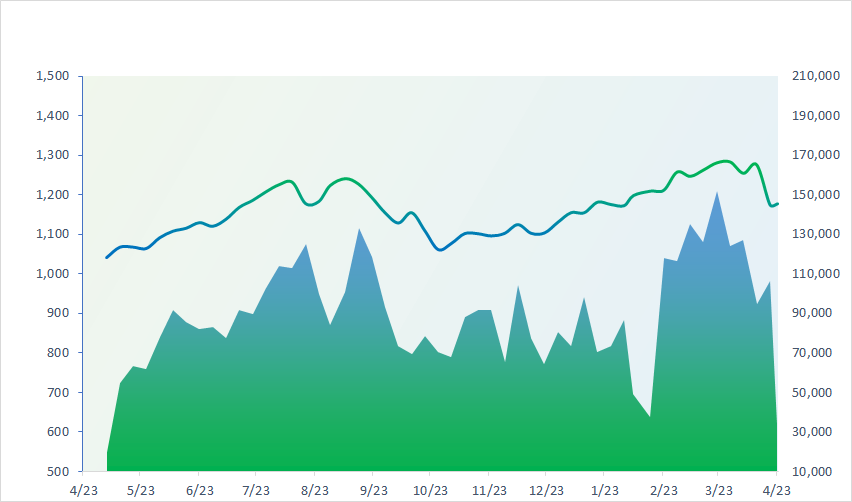

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

37,552.16

1D 0.30%

YTD 12.22%

3,021.98

1D -0.74%

YTD 2.02%

16,828.93

1D 1.92%

YTD 0.24%

2,623.02

1D -0.24%

YTD -1.75%

73,804.22

1D 0.44%

YTD 2.66%

3,272.72

1D 1.55%

YTD 1.32%

1,358.26

1D 0.69%

YTD -5.24%

87.19

1D -0.31%

YTD 13.20%

2,295.98

1D -1.39%

YTD 10.56%

Asian stock markets mostly extended gains from Monday's trading session, ahead of news that S&P Global announced that Japan and India's PMI indexes recorded better growth rates in April.

VIETNAM ECONOMY

3.95%

YTD (bps) 35

4.70%

YTD (bps) -10

2.42%

1D (bps) 7

YTD (bps) 54

2.69%

1D (bps) -14

YTD (bps) 52

25,488

1D (%) 0.01%

YTD (%) 3.99%

27,957

1D (%) 0.04%

YTD (%) 2.12%

3,583

1D (%) 0.03%

YTD (%) 3.08%

The State Bank has just announced the results of the auction for selling gold bars on April 23. Accordingly, only 2 members won the bid with a total volume of 34 lots (equivalent to 3,400 taels of gold) out of a total of 16,800 taels offered. The highest winning bid price was 81.33 million VND/tael and the lowest was 81.32 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- IMF expert: Vietnam is an attractive destination for foreign investment;

- NVIDIA leaders continue to come to Vietnam to work on semiconductors;

- Removing obstacles in capital attraction for the collective economic sector;

- Warning of tensions in the underground banking sector in Korea;

- AI chip demand increases, TSMC Group's first quarter 2024 revenue exceeds expectations;

- The Fed can adjust the timing of interest rate cuts.

VN30

BANK

90,100

1D -0.55%

5D -0.99%

Buy Vol. 2,084,252

Sell Vol. 2,145,563

49,400

1D -1.40%

5D -1.79%

Buy Vol. 3,304,326

Sell Vol. 4,311,608

31,500

1D -2.48%

5D -7.49%

Buy Vol. 18,126,765

Sell Vol. 20,608,047

46,200

1D 2.10%

5D 1.54%

Buy Vol. 24,706,458

Sell Vol. 30,762,315

18,400

1D 0.55%

5D -1.87%

Buy Vol. 25,031,546

Sell Vol. 26,370,249

22,000

1D -2.65%

5D -7.95%

Buy Vol. 50,896,174

Sell Vol. 49,717,170

22,200

1D -0.89%

5D -5.53%

Buy Vol. 12,472,480

Sell Vol. 12,038,224

17,250

1D -1.43%

5D -1.99%

Buy Vol. 10,551,773

Sell Vol. 12,856,768

27,800

1D 0.54%

5D 1.83%

Buy Vol. 29,311,029

Sell Vol. 29,419,635

21,000

1D -0.94%

5D -4.11%

Buy Vol. 10,349,584

Sell Vol. 11,172,335

26,650

1D -0.56%

5D -1.84%

Buy Vol. 13,083,747

Sell Vol. 12,729,398

10,950

1D -2.67%

5D -4.78%

Buy Vol. 52,470,576

Sell Vol. 65,250,072

22,000

1D -0.68%

5D -0.68%

Buy Vol. 3,041,814

Sell Vol. 3,412,850

TPB: In 2024, TPBank sets an individual bank pre-tax profit target of VND7,500 billion, an increase of 34% compared to 2023. Total assets are expected to increase by 9.36% to VND390,000 billion, outstanding loans for Corporate loans and bonds increased by 15.75% to VND251,821 billion, capital mobilization increased by 3.31% to VND327,000 billion.

OIL & GAS

74,200

1D -1.07%

5D -4.13%

Buy Vol. 829,727

Sell Vol. 10,546,689

10,450

1D -1.88%

5D -2.64%

Buy Vol. 8,146,203

Sell Vol. 1,096,818

35,000

1D 1.01%

5D -11.64%

Buy Vol. 814,497

Sell Vol. 4,992,732

POW: In the second quarter of 2024, PV Power aims to achieve electricity output of 4,669 million kWh, bringing in revenue of VND8,971 billion, an increase of 6.4% yoy.

VINGROUP

41,000

1D -2.38%

5D -5.85%

Buy Vol. 4,213,980

Sell Vol. 15,079,048

40,200

1D -3.02%

5D -1.35%

Buy Vol. 13,646,875

Sell Vol. 10,077,572

21,900

1D -2.23%

5D -0.78%

Buy Vol. 8,624,157

Sell Vol. 3,856,528

VRE: In the first quarter of 2024, Vincom Retail's revenue is expected to be VND2,250 billion, of which rental revenue is about 80%. Estimated PAT is VND1,080 billion.

FOOD & BEVERAGE

63,500

1D -0.78%

5D -2.12%

Buy Vol. 3,968,428

Sell Vol. 8,651,688

64,700

1D -3.29%

5D -3.28%

Buy Vol. 7,485,403

Sell Vol. 854,119

53,000

1D -0.38%

5D -9.17%

Buy Vol. 620,795

Sell Vol. 1,631,124

SAB: In 2024, Sabeco plans revenue of VND34,397 billion, an increase of 12.9% over the same period, expected profit after tax of VND4,580 billion, an increase of 7.6% compared to 2023.

OTHERS

50,500

1D -4.17%

5D -0.25%

Buy Vol. 1,149,992

Sell Vol. 658,279

39,250

1D -0.88%

5D -0.25%

Buy Vol. 419,479

Sell Vol. 658,279

102,800

1D -0.48%

5D -3.02%

Buy Vol. 1,351,176

Sell Vol. 1,420,465

112,300

1D 1.81%

5D -0.62%

Buy Vol. 6,768,285

Sell Vol. 9,641,386

49,800

1D 2.47%

5D -0.20%

Buy Vol. 29,071,568

Sell Vol. 25,983,935

27,600

1D -3.83%

5D -9.06%

Buy Vol. 7,719,524

Sell Vol. 8,234,414

34,500

1D -1.71%

5D -1.99%

Buy Vol. 28,869,219

Sell Vol. 35,631,660

27,600

1D -1.43%

5D -2.65%

Buy Vol. 26,949,796

Sell Vol. 31,106,966

FPT: According to the Memorandum of Understanding, FPT plans to cooperate with NVIDIA to invest USD200 million to build AI Factory to provide a Cloud Computing platform for AI research and development and sovereignty in Vietnam.

Market by numbers

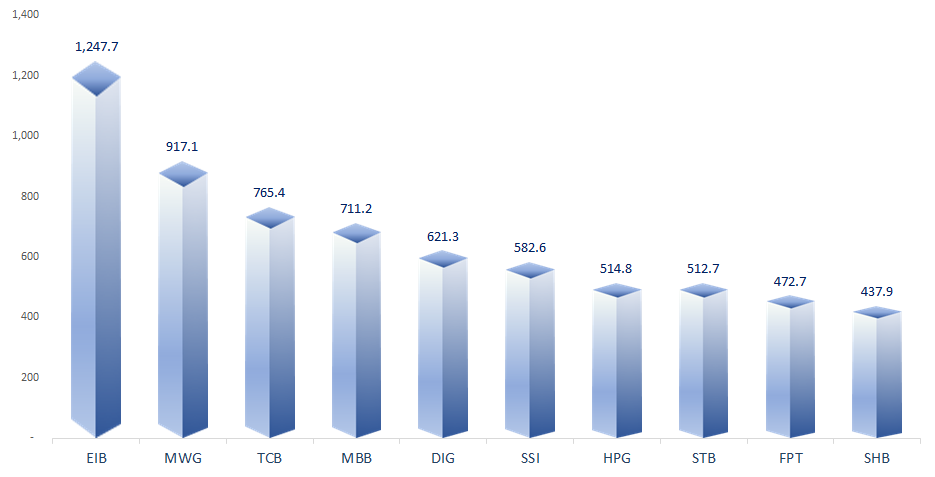

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

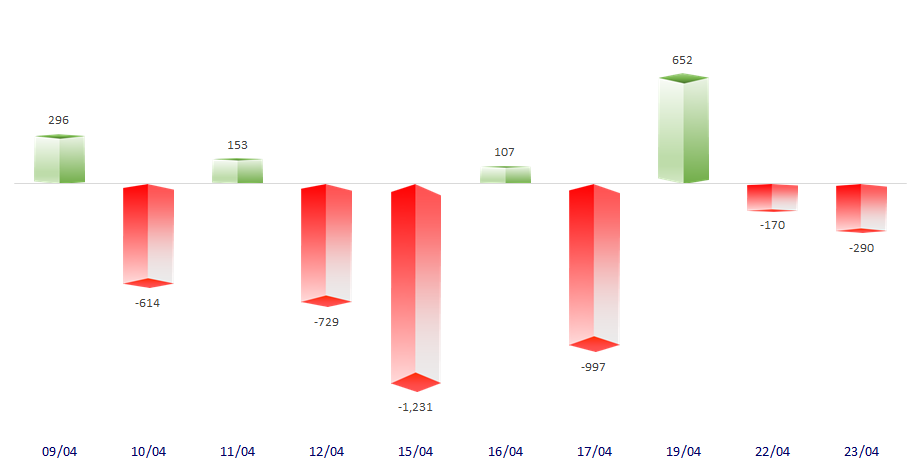

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

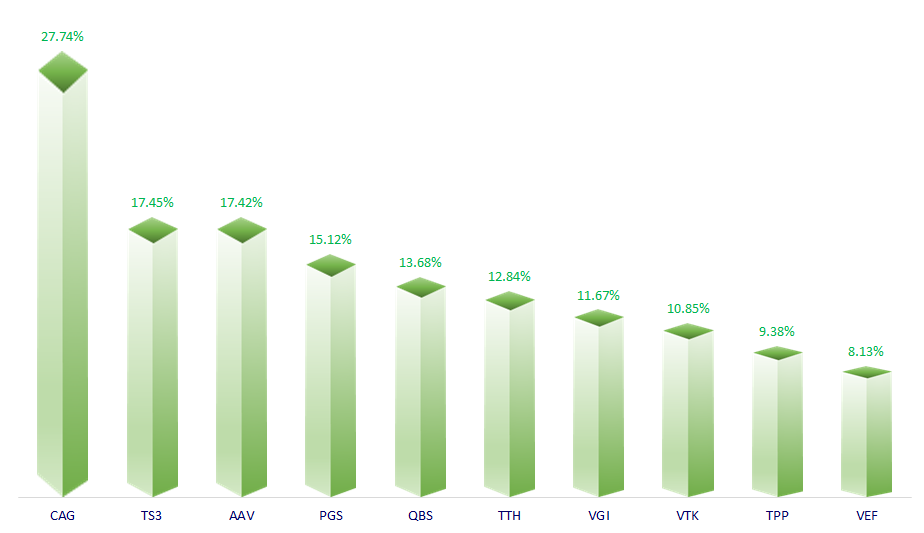

TOP INCREASES 3 CONSECUTIVE SESSIONS

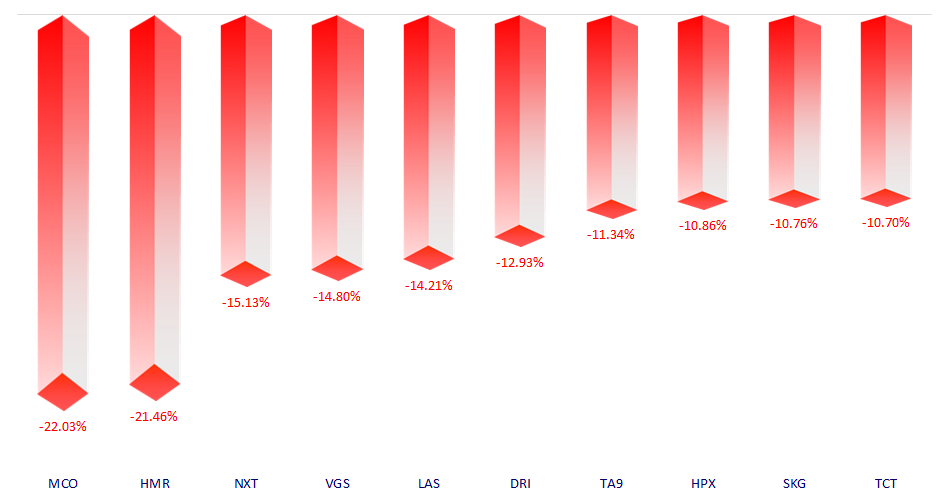

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.