Market brief 14/05/2024

VIETNAM STOCK MARKET

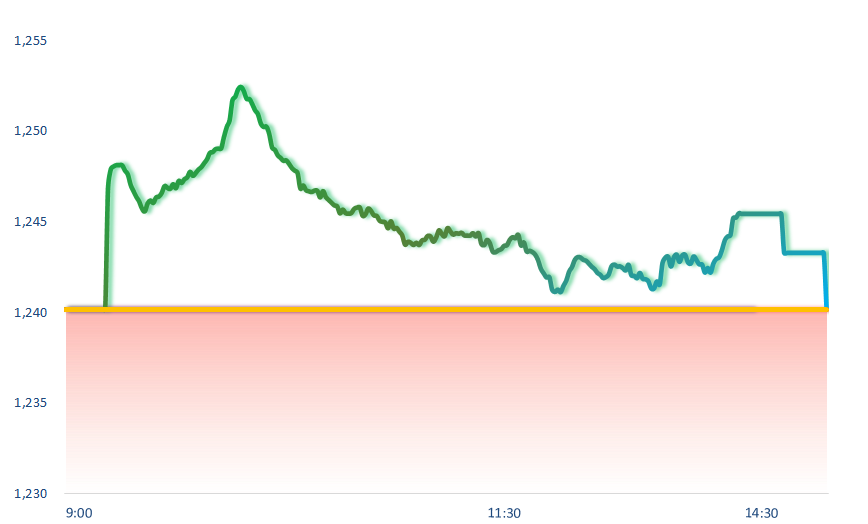

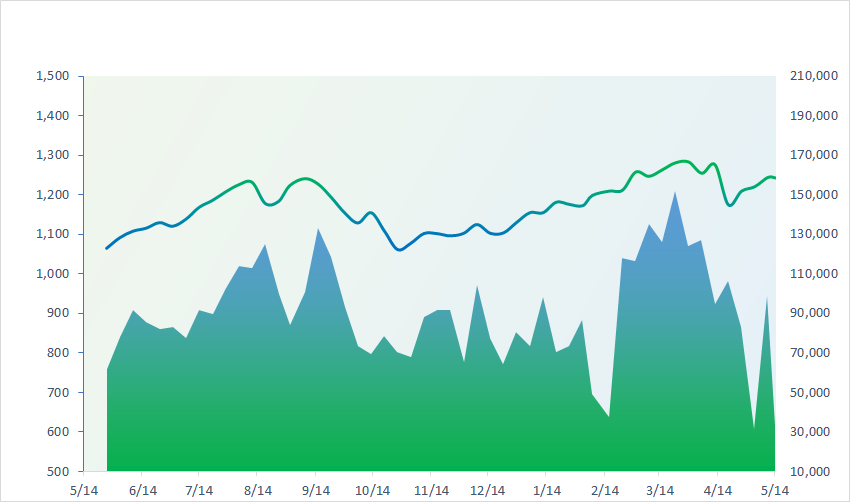

1,243.28

1D 0.25%

YTD 9.86%

236.95

1D 0.25%

YTD 3.03%

1,277.31

1D 0.38%

YTD 12.87%

91.62

1D 0.15%

YTD 4.61%

-851.04

1D 0.00%

YTD 0.00%

17,745.74

1D -8.93%

YTD -6.09%

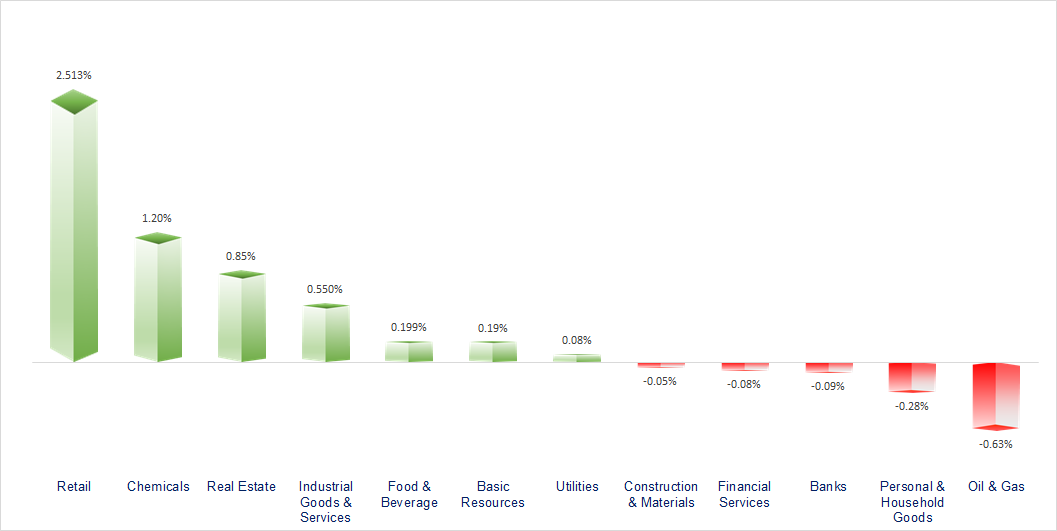

The stock market continues to have a struggling trading session above the reference level. Retail services, chemicals and technology were the most active groups in today's session.

ETF & DERIVATIVES

22,090

1D 0.73%

YTD 13.11%

15,120

1D 0.33%

YTD 12.42%

15,750

1D 0.70%

YTD 13.64%

19,000

1D -0.52%

YTD 11.90%

20,220

1D 0.30%

YTD 9.89%

31,300

1D 0.32%

YTD 20.25%

16,990

1D 0.35%

YTD 11.26%

1,274

1D 0.66%

YTD 0.00%

1,276

1D 0.74%

YTD 0.00%

1,275

1D 0.50%

YTD 0.00%

1,280

1D 0.68%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,356.06

1D 0.46%

YTD 14.62%

3,145.77

1D -0.07%

YTD 6.19%

19,073.71

1D -0.22%

YTD 13.61%

2,730.34

1D 0.11%

YTD 2.27%

73,104.61

1D 0.42%

YTD 1.69%

3,313.35

1D 0.29%

YTD 2.58%

1,376.57

1D 0.30%

YTD -3.96%

83.36

1D -0.13%

YTD 8.22%

2,346.15

1D 0.07%

YTD 12.97%

Asian stock markets recorded positive developments. Nikkei 225 index increased 0.46%, KOSPI increased 0.11%. However, the Chinese market dropped after negative information about the country's real estate market.

VIETNAM ECONOMY

4.28%

1D (bps) 5

YTD (bps) 68

4.60%

YTD (bps) -20

2.41%

1D (bps) -4

YTD (bps) 52

2.71%

1D (bps) -7

YTD (bps) 54

25,482

1D (%) 0.01%

YTD (%) 3.97%

28,302

1D (%) 0.12%

YTD (%) 3.38%

3,588

1D (%) 0.03%

YTD (%) 3.22%

The State Bank has just announced the results of the gold bar auction on May 14 with more positive results than previous auctions. Specifically, 8 members won the bid with a total volume of 81 lots (8,100 taels of gold).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ba Ria - Vung Tau aspires to become a marine economic center;

- The disbursement rate of public investment capital is continuously improved;

- Bidding for 8 rest stops on the North-South expressway is about to open;

- India may consider lifting the rice export ban;

- China will issue USD138 billion in bonds to stimulate the economy;

- Global rice consumption is forecast to reach a record level of more than 526 million tons in 2024.

VN30

BANK

90,600

1D -0.44%

5D -2.48%

Buy Vol. 2,067,060

Sell Vol. 1,545,238

48,100

1D -1.03%

5D -3.80%

Buy Vol. 3,610,998

Sell Vol. 2,988,302

32,300

1D 0.00%

5D -1.52%

Buy Vol. 9,641,420

Sell Vol. 11,192,855

47,900

1D -1.03%

5D 0.00%

Buy Vol. 13,076,141

Sell Vol. 15,526,846

19,100

1D 1.60%

5D 1.60%

Buy Vol. 39,884,185

Sell Vol. 41,267,288

22,850

1D 0.88%

5D 0.44%

Buy Vol. 41,079,468

Sell Vol. 34,317,302

23,300

1D 0.22%

5D -4.12%

Buy Vol. 9,873,688

Sell Vol. 10,247,205

18,000

1D 0.00%

5D 1.41%

Buy Vol. 7,258,090

Sell Vol. 12,517,677

27,250

1D 0.00%

5D -3.71%

Buy Vol. 14,656,760

Sell Vol. 12,719,343

21,750

1D 1.87%

5D 0.23%

Buy Vol. 14,316,266

Sell Vol. 13,119,735

27,750

1D 0.18%

5D 0.36%

Buy Vol. 8,301,858

Sell Vol. 10,420,489

11,600

1D -0.43%

5D -0.43%

Buy Vol. 33,031,910

Sell Vol. 52,196,713

21,700

1D -0.23%

5D -1.59%

Buy Vol. 1,769,365

Sell Vol. 2,028,386

VPB: VPBank Board of Directors has just approved May 23, 2024 as the last registration date to receive cash dividends in 2023. With a dividend payment rate of 10% (one share is multiplied by 1,000 VND, the amount VPBank plans to use to pay dividends this time is VND7,934 billion. The dividend payment date is May 31, 2024.

OIL & GAS

75,200

1D 0.00%

5D -1.35%

Buy Vol. 1,662,078

Sell Vol. 10,411,321

10,950

1D -0.45%

5D 0.68%

Buy Vol. 7,880,821

Sell Vol. 4,024,817

37,500

1D -2.22%

5D 2.33%

Buy Vol. 3,725,917

Sell Vol. 11,237,713

POW: has just announced that it will conduct a test run of Nhon Trach 3 Power Plant this month, striving to generate commercial electricity in November 2024.

VINGROUP

46,050

1D 2.33%

5D -2.19%

Buy Vol. 8,529,363

Sell Vol. 13,761,647

40,150

1D 0.12%

5D -4.71%

Buy Vol. 10,730,564

Sell Vol. 10,311,435

22,250

1D 0.00%

5D -2.21%

Buy Vol. 10,371,378

Sell Vol. 5,233,215

VIC: From May 13, VinFast has officially received sample deposits for the VF 3 mini electric car model.

FOOD & BEVERAGE

66,500

1D 1.06%

5D -0.84%

Buy Vol. 4,790,587

Sell Vol. 6,511,132

70,600

1D -0.28%

5D -1.04%

Buy Vol. 6,471,943

Sell Vol. 1,270,265

57,100

1D 0.35%

5D 6.57%

Buy Vol. 995,624

Sell Vol. 2,277,126

MSN: On May 14, 2024, Masan High-Tech Materials announced that it had reached a Framework Agreement with Mitsubishi Materials Corporation Group on the sale of 100% of H.C. Starck Holding.

OTHERS

58,400

1D 3.91%

5D -2.42%

Buy Vol. 2,222,251

Sell Vol. 478,906

40,400

1D -0.12%

5D -2.42%

Buy Vol. 375,058

Sell Vol. 478,906

117,000

1D -1.52%

5D -1.35%

Buy Vol. 1,339,956

Sell Vol. 1,806,109

130,500

1D 0.62%

5D -0.61%

Buy Vol. 4,677,056

Sell Vol. 4,889,066

60,100

1D 3.09%

5D 1.35%

Buy Vol. 27,245,941

Sell Vol. 27,711,123

32,500

1D 1.56%

5D 3.34%

Buy Vol. 8,160,684

Sell Vol. 10,049,051

35,500

1D -0.28%

5D -0.14%

Buy Vol. 13,709,231

Sell Vol. 19,516,145

30,200

1D 0.00%

5D 0.17%

Buy Vol. 34,566,807

Sell Vol. 36,020,867

MWG: According to the April 2024 business update report, MWG recorded preliminary revenue of VND11,500 billion, an increase of 15% over the same period in 2023. Notably, Bach Hoa Xanh's (BHX) revenue exceeded VND3,200 billion in April, an increase of 40% over the same period in 2023. Average revenue reached approximately VND 1.9 billion/store.

Market by numbers

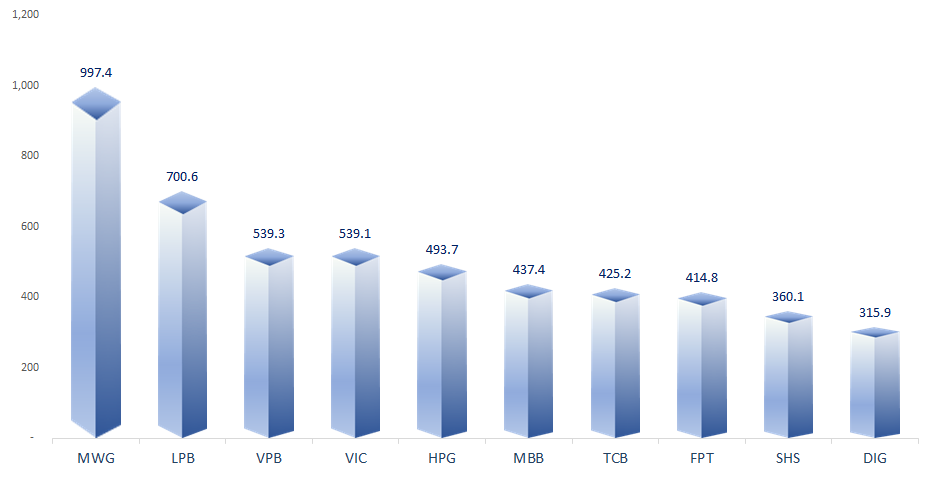

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

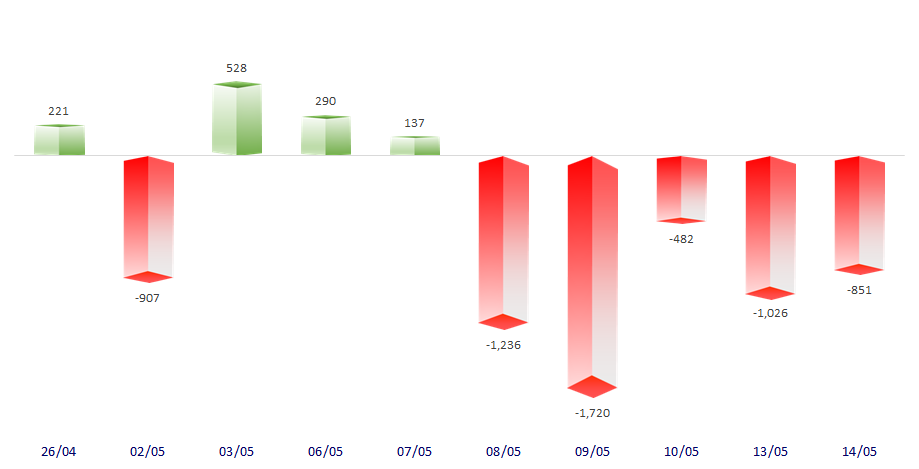

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

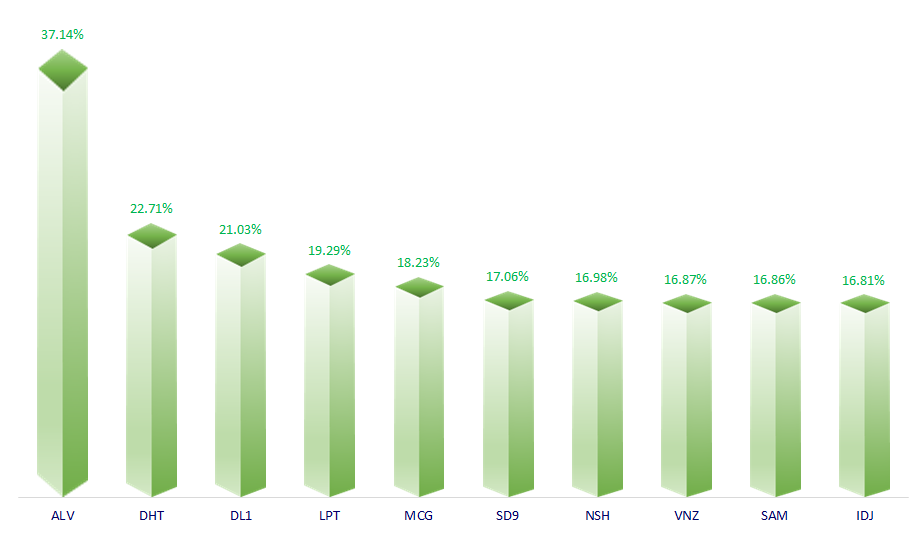

TOP INCREASES 3 CONSECUTIVE SESSIONS

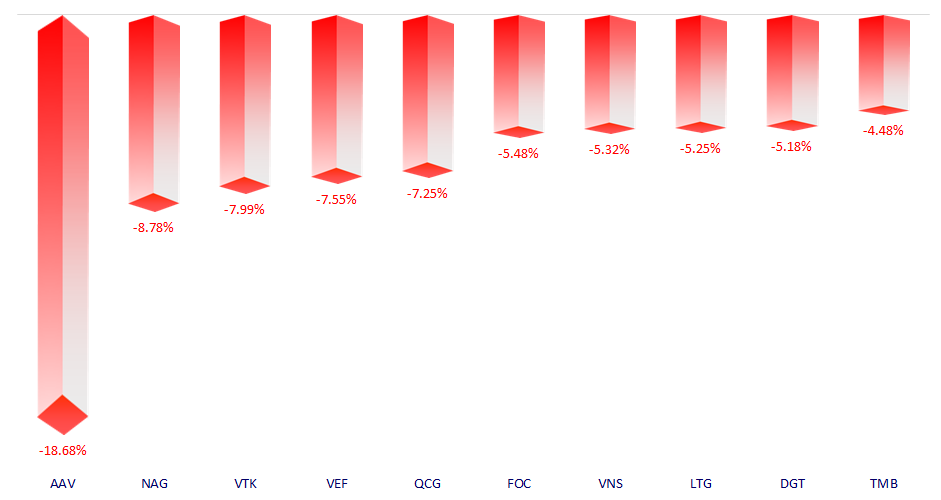

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.