Market Brief 24/05/2024

VIETNAM STOCK MARKET

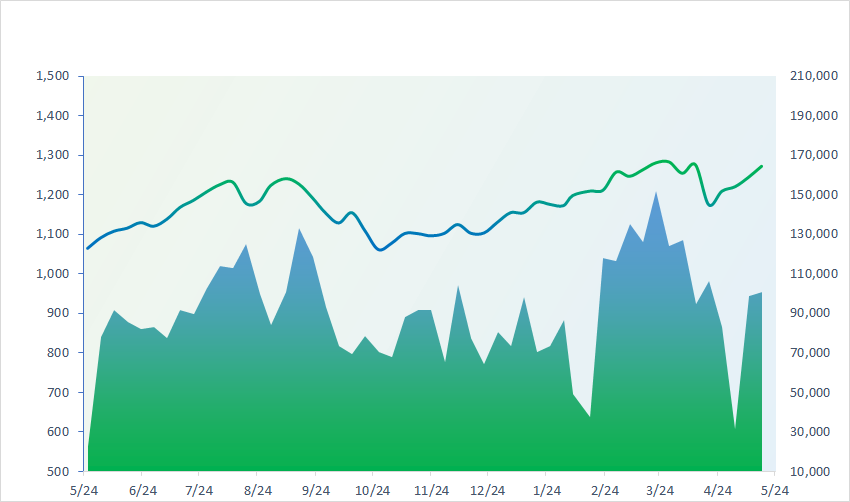

1,261.93

1D -1.49%

YTD 11.51%

241.72

1D -2.10%

YTD 5.10%

1,283.46

1D -1.63%

YTD 13.42%

94.40

1D -0.81%

YTD 7.79%

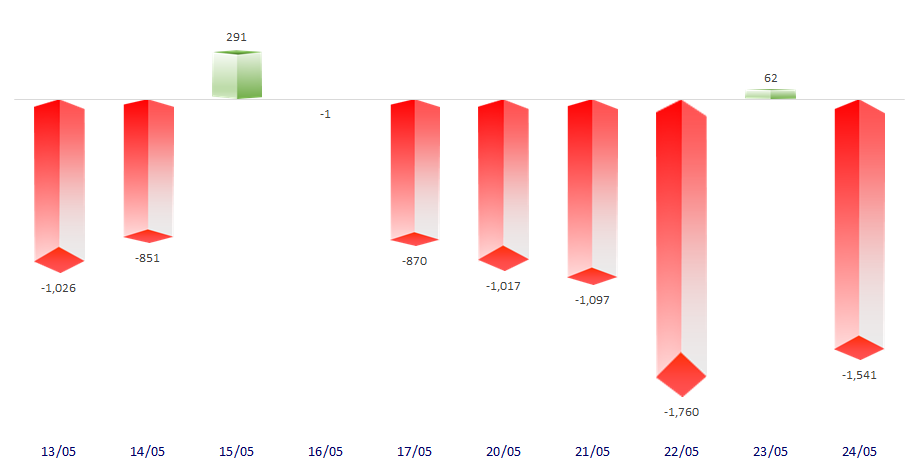

-1,541.21

1D 0.00%

YTD 0.00%

40,349.22

1D 48.17%

YTD 113.53%

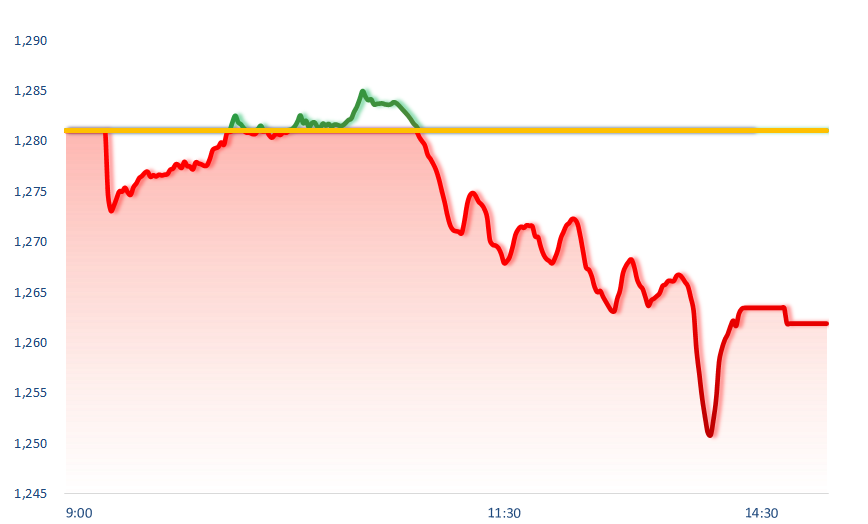

The market ended the trading week with a highly volatile session. Bluechips were hit very hard at the end of the session, and liquidity also increased nearly 1.5 times compared to yesterday's session. ACB was the stock that contributed the most points to VNINdex today with an increase of 2.8%. On the contrary, FPT was the stock that contributed the most to the decline of VNIndex.

ETF & DERIVATIVES

22,500

1D -0.22%

YTD 15.21%

15,290

1D -1.67%

YTD 13.68%

15,920

1D -0.62%

YTD 14.86%

19,420

1D -0.41%

YTD 14.37%

20,560

1D 0.00%

YTD 11.74%

31,780

1D -1.30%

YTD 22.09%

17,490

1D -0.06%

YTD 14.54%

1,278

1D -1.72%

YTD 0.00%

1,282

1D -0.47%

YTD 0.00%

1,282

1D -1.39%

YTD 0.00%

1,278

1D -1.75%

YTD 0.00%

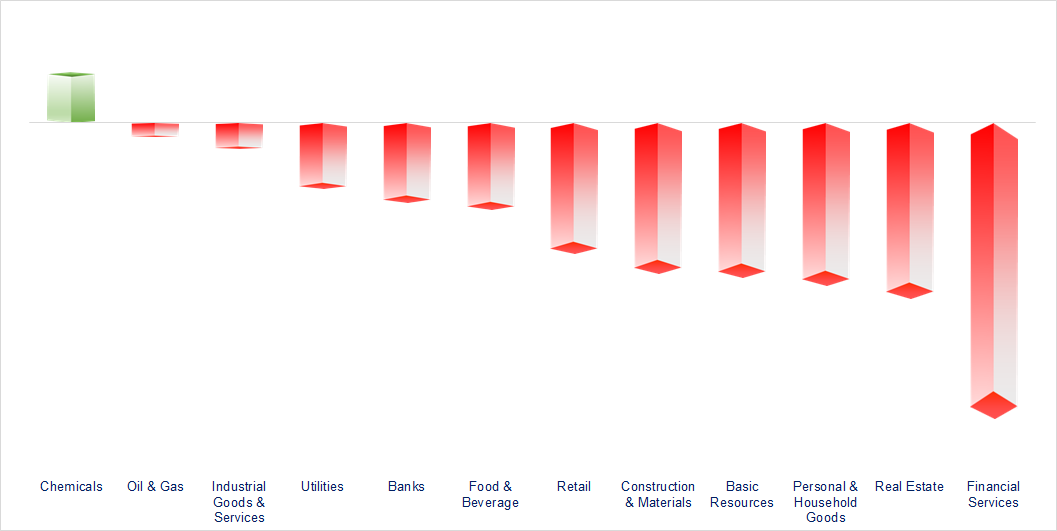

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,646.11

1D -1.17%

YTD 15.49%

3,088.87

1D -0.88%

YTD 4.27%

18,608.94

1D -1.38%

YTD 10.84%

2,687.60

1D -1.26%

YTD 0.67%

75,410.38

1D -0.01%

YTD 4.89%

3,316.56

1D -0.18%

YTD 2.68%

1,364.48

1D -0.25%

YTD -4.81%

80.73

1D -0.90%

YTD 4.81%

2,341.97

1D 0.38%

YTD 12.77%

Hong Kong stocks led losses in Asia Pacific on Friday after Wall Street tumbled overnight on rate worries, while investors also digested inflation data from Japan. Japan’s core inflation eased to 2.2% from 2.6% in March, in line with expectations. Headline inflation slowed to 2.5%, down from March’s 2.7% figure. In South Korea, the Kospi fell 1.26%, dragged by heavyweight Samsung Electronics.

VIETNAM ECONOMY

5.10%

1D (bps) 18

YTD (bps) 150

4.60%

YTD (bps) -20

2.49%

1D (bps) 2

YTD (bps) 61

2.84%

1D (bps) 4

YTD (bps) 66

25,477

1D (%) 0.03%

YTD (%) 3.95%

28,241

1D (%) -0.48%

YTD (%) 3.16%

3,586

1D (%) -0.06%

YTD (%) 3.16%

Today's session, the State Bank continued to inject more than VND27,000 billion on the OMO channel. Accordingly, the overnight interbank interest rate has increased to 5.1%/year. According to market sources, by the end of yesterday's session, the State Bank had sold about USD3.8 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank has withdrawn a large amount of VND from the market in the past month;

- Pangasius exports to the US increased sharply in April;

- The Deputy Prime Minister has just signed the Decision on investment policy for the Phung Hiep industrial park project in Hanoi;

- Goldman Sachs CEO: Fed will not reduce interest rates in 2024;

- Corporate profits fell worldwide for the first time in three quarters;

- UK’s accusation on China providing ‘lethal aid’ to Russia slammed by China, questioned by US.

VN30

BANK

90,200

1D -0.88%

5D -1.74%

Buy Vol. 4,360,972

Sell Vol. 3,170,289

49,200

1D -0.61%

5D -0.30%

Buy Vol. 4,305,951

Sell Vol. 5,183,373

32,500

1D -2.26%

5D -1.81%

Buy Vol. 21,418,185

Sell Vol. 24,840,673

46,400

1D -0.22%

5D -3.83%

Buy Vol. 24,441,637

Sell Vol. 23,597,608

18,000

1D -2.70%

5D -2.28%

Buy Vol. 28,703,423

Sell Vol. 36,205,432

22,450

1D -1.54%

5D -1.31%

Buy Vol. 77,998,114

Sell Vol. 61,972,663

24,200

1D -2.02%

5D -0.41%

Buy Vol. 11,098,112

Sell Vol. 11,248,363

17,750

1D -3.01%

5D -3.53%

Buy Vol. 25,416,919

Sell Vol. 25,173,100

28,700

1D 0.53%

5D 0.70%

Buy Vol. 43,718,938

Sell Vol. 49,603,913

22,000

1D -1.12%

5D -1.35%

Buy Vol. 22,080,573

Sell Vol. 26,705,725

29,250

1D 2.81%

5D 3.54%

Buy Vol. 67,381,552

Sell Vol. 52,893,242

11,550

1D -1.70%

5D -3.75%

Buy Vol. 72,186,779

Sell Vol. 86,448,289

21,850

1D -0.46%

5D -0.68%

Buy Vol. 2,691,757

Sell Vol. 2,753,657

As of May 10, credit growth reached 1.95% compared to the end of 2024, corresponding to outstanding credit debt of VND264,000 billion. According to the Governor, credit growth is slow due to weak demand and difficulties in implementing policy programs.

OIL & GAS

79,000

1D -1.13%

5D 0.89%

Buy Vol. 3,918,684

Sell Vol. 36,490,523

11,350

1D -1.73%

5D 8.04%

Buy Vol. 22,773,307

Sell Vol. 10,610,804

41,000

1D 1.74%

5D -4.06%

Buy Vol. 10,854,303

Sell Vol. 5,770,859

PLX: Petrolimex is about to receive VND115 billion in dividends from its subsidiary.

VINGROUP

44,950

1D -1.32%

5D -2.57%

Buy Vol. 5,378,466

Sell Vol. 23,231,313

39,800

1D -1.85%

5D -3.46%

Buy Vol. 20,514,497

Sell Vol. 23,453,290

22,300

1D -3.04%

5D -1.49%

Buy Vol. 22,676,339

Sell Vol. 7,799,915

VHM: Vinhomes said it is building May Chai Bridge (Royal Bridge) with a total investment of more than VND2,000 billion, connecting the Vu Yen island project with Hai Phong city center.

FOOD & BEVERAGE

66,000

1D -1.49%

5D -2.65%

Buy Vol. 7,505,496

Sell Vol. 14,254,246

73,500

1D -3.03%

5D -0.17%

Buy Vol. 11,731,675

Sell Vol. 2,709,128

58,000

1D -2.52%

5D 4.59%

Buy Vol. 2,280,467

Sell Vol. 3,347,912

MSN: Mitsubishi Materials Corporation registered to sell nearly 110 million shares of MSR (a subsidiary of MSN), equivalent to 10% ownership.

OTHERS

61,500

1D -4.21%

5D 9.18%

Buy Vol. 2,860,675

Sell Vol. 3,330,372

44,600

1D 0.00%

5D 9.18%

Buy Vol. 2,601,628

Sell Vol. 3,330,372

108,000

1D -3.05%

5D -8.01%

Buy Vol. 1,082,270

Sell Vol. 1,352,409

131,900

1D -4.07%

5D -1.93%

Buy Vol. 20,660,736

Sell Vol. 20,216,345

60,500

1D -2.42%

5D 1.51%

Buy Vol. 21,429,034

Sell Vol. 20,172,960

34,250

1D 2.54%

5D 2.70%

Buy Vol. 22,220,559

Sell Vol. 25,374,318

35,250

1D -3.95%

5D -3.16%

Buy Vol. 43,016,061

Sell Vol. 55,311,082

28,900

1D -2.03%

5D 0.60%

Buy Vol. 47,890,117

Sell Vol. 52,771,084

FPT: Today's session, foreign investors strongly net sold FPT shares with a net selling value of VND355 billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

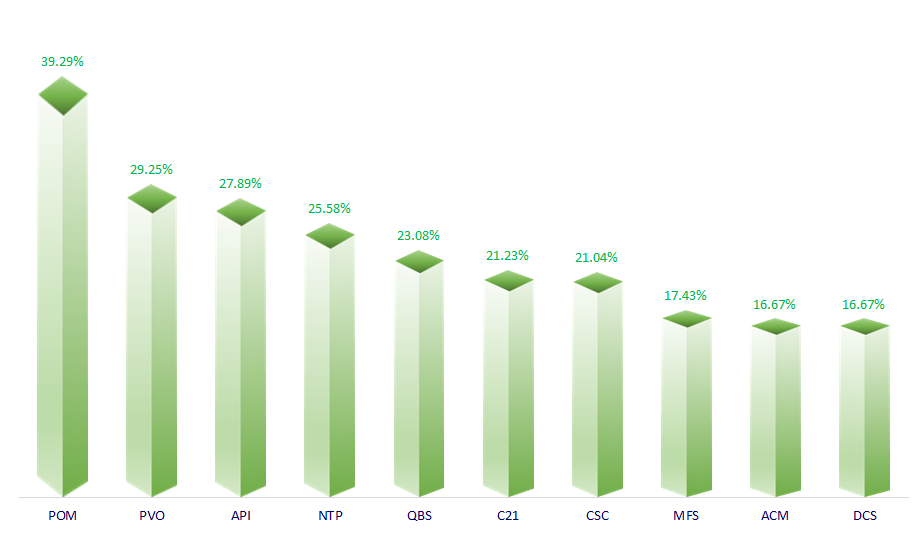

TOP INCREASES 3 CONSECUTIVE SESSIONS

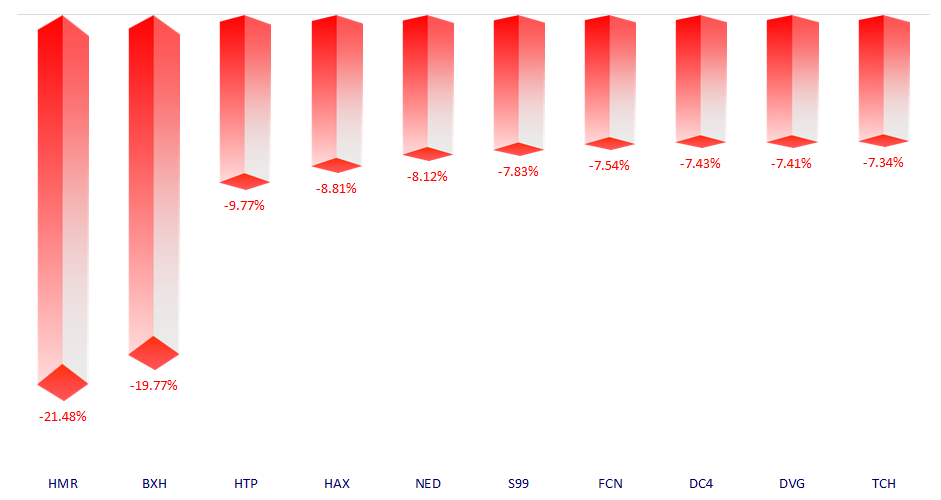

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.