Market brief 26/06/2024

VIETNAM STOCK MARKET

1,261.24

1D 0.37%

YTD 11.44%

239.68

1D -0.21%

YTD 4.21%

1,291.30

1D 0.19%

YTD 14.11%

98.90

1D 0.07%

YTD 12.93%

-566.58

1D 0.00%

YTD 0.00%

23,046.12

1D -3.21%

YTD 21.96%

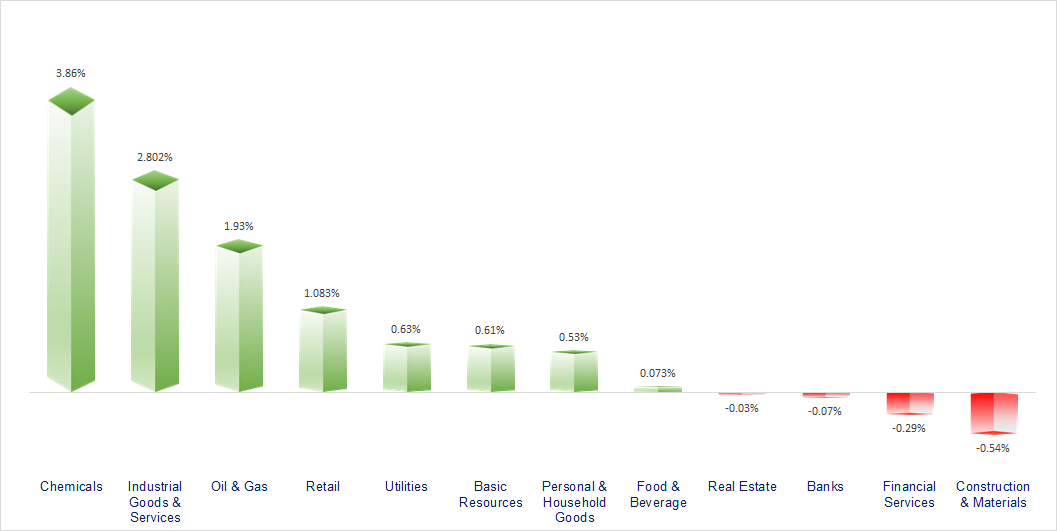

The market continued to fluctuate around the reference level. Chemicals and industrial real estate were the most active groups. On the contrary, financial services, banking and real estate were quite gloomy.

ETF & DERIVATIVES

22,460

1D -0.80%

YTD 15.00%

15,550

1D 0.71%

YTD 15.61%

15,880

1D -1.31%

YTD 14.57%

19,450

1D -0.26%

YTD 14.55%

20,320

1D -1.22%

YTD 10.43%

32,190

1D -0.65%

YTD 23.67%

17,450

1D 0.11%

YTD 14.28%

1,290

1D 0.18%

YTD 0.00%

1,291

1D 0.21%

YTD 0.00%

1,295

1D 0.49%

YTD 0.00%

1,293

1D 0.06%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,667.07

1D 1.26%

YTD 18.54%

2,972.53

1D 0.76%

YTD 0.35%

18,089.93

1D 0.09%

YTD 7.75%

2,792.05

1D 0.64%

YTD 4.58%

78,677.61

1D 0.90%

YTD 9.44%

3,326.39

1D 0.16%

YTD 2.99%

1,320.48

1D 0.18%

YTD -7.88%

84.60

1D -0.49%

YTD 9.83%

2,316.80

1D -0.12%

YTD 11.56%

Asian markets were mostly higher as investors braced for US inflation data this week. Another important piece of news was that Australia's inflation rate rose 4% in May, marking the third consecutive monthly increase and beating economists' forecasts.

VIETNAM ECONOMY

3.40%

YTD (bps) -20

4.60%

YTD (bps) -20

2.35%

1D (bps) -2

YTD (bps) 46

2.82%

1D (bps) 10

YTD (bps) 64

25,470

1D (%) 0.02%

YTD (%) 3.92%

27,980

1D (%) -0.24%

YTD (%) 2.21%

3,577

1D (%) 0.00%

YTD (%) 2.91%

While the USD price at commercial banks has been stable in recent days, the free USD price has suddenly increased sharply and approached the 26,000 VND mark, the highest level ever.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- State Bank raises interest rates on treasury bills, absorbing liquidity the most in nearly 15 months;

- Adding 8 industrial clusters to Hanoi planning;

- VND913 trillion needed to increase base salary, pensions from July 1;

- Nvidia “evaporates” USD430 billion in capitalization in 3 days, the sharpest decline in history;

- Fed official leaves open the possibility of raising interest rates if inflation does not decrease;

- JPMorgan Chase reveals expansion plans in South Florida.

VN30

BANK

85,200

1D -0.35%

5D -1.62%

Buy Vol. 2,697,439

Sell Vol. 3,083,935

44,500

1D 0.68%

5D -3.47%

Buy Vol. 3,695,932

Sell Vol. 3,124,386

31,300

1D -0.95%

5D -3.69%

Buy Vol. 13,861,240

Sell Vol. 11,932,634

24,000

1D 0.00%

5D -0.62%

Buy Vol. 12,027,059

Sell Vol. 13,414,171

19,000

1D 0.00%

5D 0.00%

Buy Vol. 47,996,979

Sell Vol. 42,233,657

22,500

1D -0.44%

5D -3.43%

Buy Vol. 25,116,342

Sell Vol. 22,714,170

22,700

1D 0.44%

5D -4.22%

Buy Vol. 12,009,229

Sell Vol. 7,935,630

17,550

1D 0.00%

5D -2.77%

Buy Vol. 9,162,216

Sell Vol. 8,021,261

29,500

1D -0.34%

5D -4.53%

Buy Vol. 27,811,653

Sell Vol. 20,707,561

21,250

1D -0.23%

5D -3.41%

Buy Vol. 5,959,507

Sell Vol. 4,739,585

24,100

1D 0.21%

5D -2.23%

Buy Vol. 18,572,998

Sell Vol. 16,574,356

11,350

1D -0.44%

5D -2.16%

Buy Vol. 26,998,156

Sell Vol. 33,523,584

21,150

1D 0.00%

5D -7.64%

Buy Vol. 4,833,312

Sell Vol. 5,193,173

After more than a year of adjusting savings interest rates down, up to now, BIDV and VietinBank are the 2 banks in the Big 4 group that have just adjusted online savings interest rates up with an average increase of 0.1-0.3%/year.

OIL & GAS

76,500

1D 0.26%

5D 2.34%

Buy Vol. 2,025,195

Sell Vol. 34,107,907

15,300

1D 2.00%

5D 2.17%

Buy Vol. 36,198,449

Sell Vol. 3,691,530

42,400

1D 3.41%

5D -0.72%

Buy Vol. 4,591,147

Sell Vol. 3,557,506

It is forecasted that in the price adjustment period tomorrow, June 27, gasoline prices will increase by about 400-500VND/liter.

VINGROUP

41,200

1D 0.00%

5D -1.32%

Buy Vol. 3,226,310

Sell Vol. 10,383,187

37,500

1D -0.79%

5D 0.73%

Buy Vol. 7,397,867

Sell Vol. 15,190,537

20,800

1D -2.35%

5D -0.15%

Buy Vol. 11,944,910

Sell Vol. 5,209,023

VIC: VinFast sells the second most electric cars in Southeast Asia.

FOOD & BEVERAGE

65,200

1D -0.46%

5D -2.12%

Buy Vol. 4,897,214

Sell Vol. 6,587,767

74,000

1D 0.14%

5D -3.23%

Buy Vol. 6,475,758

Sell Vol. 1,499,661

60,000

1D -0.99%

5D 5.26%

Buy Vol. 1,933,754

Sell Vol. 3,838,036

MSN: On July 3, Masan Consumer, a subsidiary of Masan, will pay a cash dividend at a rate of 55%.

OTHERS

66,000

1D 4.76%

5D -2.29%

Buy Vol. 3,985,521

Sell Vol. 737,890

44,750

1D -0.11%

5D -2.29%

Buy Vol. 611,234

Sell Vol. 737,890

101,600

1D 0.00%

5D -1.65%

Buy Vol. 1,047,357

Sell Vol. 1,101,194

131,800

1D 1.38%

5D 0.23%

Buy Vol. 10,801,481

Sell Vol. 10,899,843

62,600

1D 0.97%

5D -1.11%

Buy Vol. 14,076,230

Sell Vol. 14,726,599

35,950

1D 6.99%

5D 6.99%

Buy Vol. 15,688,999

Sell Vol. 15,596,914

34,400

1D -0.43%

5D -4.97%

Buy Vol. 21,261,352

Sell Vol. 21,067,666

28,900

1D 0.70%

5D -1.53%

Buy Vol. 38,981,123

Sell Vol. 41,717,821

MWG: After the first 5 months of the year, MWG brought in more than VND54 trillion in net revenue, up 15% over the same period last year, achieving 43% of the yearly plan.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.