Market Brief 29/07/2024

VIETNAM STOCK MARKET

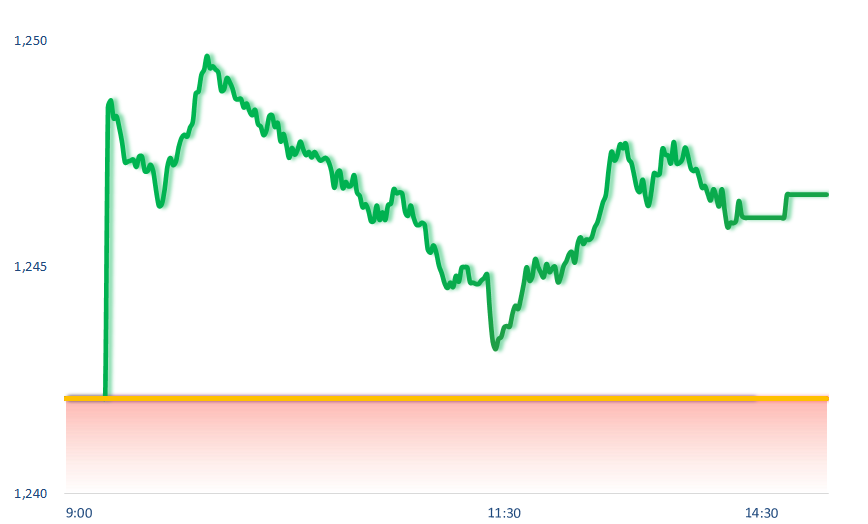

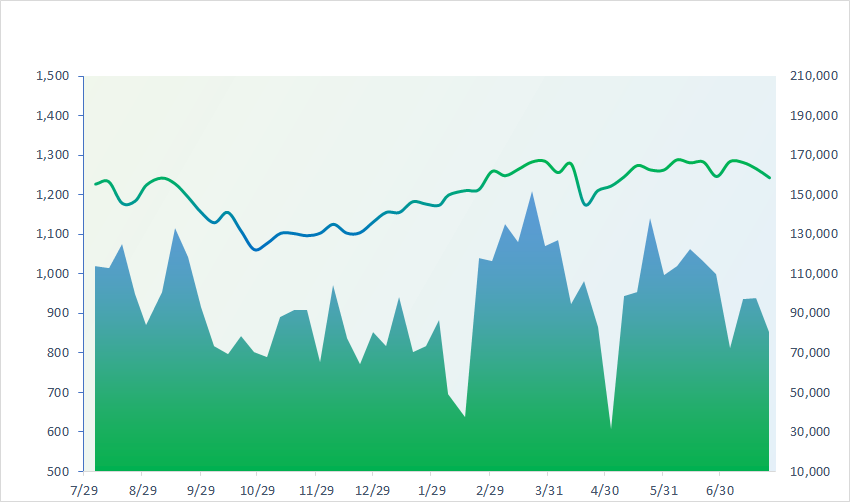

1,246.60

1D 0.36%

YTD 10.15%

237.52

1D 0.36%

YTD 3.27%

1,285.73

1D 0.30%

YTD 13.62%

95.46

1D 0.29%

YTD 9.00%

-315.72

1D 0.00%

YTD 0.00%

12,923.11

1D -1.75%

YTD -31.61%

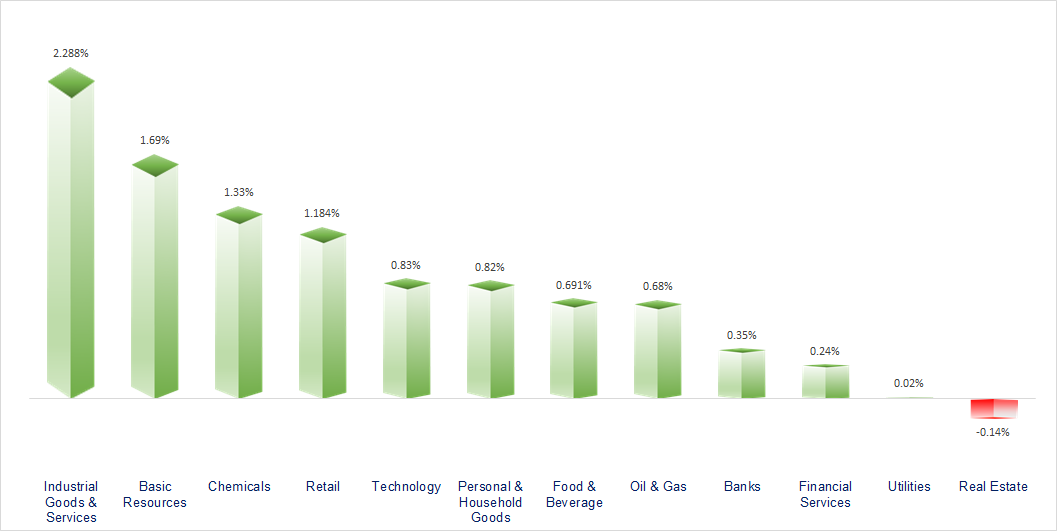

The stock market continued to recover thanks to positive data from the July socio-economic report in Vietnam. Almost all industry groups increased, with telecommunications, steel, and retail being the most prominent sectors.

ETF & DERIVATIVES

22,500

1D 0.36%

YTD 15.21%

15,440

1D 0.72%

YTD 14.80%

16,030

1D 0.38%

YTD 15.66%

19,460

1D 1.14%

YTD 14.61%

20,490

1D -0.44%

YTD 11.36%

32,760

1D 0.21%

YTD 25.85%

17,430

1D 0.98%

YTD 14.15%

1,288

1D 0.22%

YTD 0.00%

1,290

1D 0.33%

YTD 0.00%

1,290

1D 0.38%

YTD 0.00%

1,290

1D 0.40%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,468.63

1D 2.13%

YTD 14.95%

2,891.85

1D 0.03%

YTD -2.38%

17,238.34

1D 1.28%

YTD 2.68%

2,765.53

1D 1.23%

YTD 3.59%

81,355.84

1D 0.03%

YTD 13.16%

3,444.18

1D 0.52%

YTD 6.63%

1,307.21

1D 0.00%

YTD -8.80%

81.06

1D -0.41%

YTD 5.24%

2,393.98

1D -0.23%

YTD 15.27%

Asian markets mostly went up on Monday, led by Japan's Nikkei 225 index, after the US inflation report late Friday boosted hopes of interest rate cuts. This week, Asian countries will continue to await important information about the Bank of Japan's monetary policy meeting on July 30 as well as China's July PMI data.

VIETNAM ECONOMY

4.93%

YTD (bps) 133

4.60%

YTD (bps) -20

2.29%

1D (bps) 9

YTD (bps) 41

2.74%

YTD (bps) 56

2546400.00%

1D (%) 0.01%

YTD (%) 3.89%

2823400.00%

1D (%) 0.04%

YTD (%) 3.13%

356100.00%

1D (%) -0.34%

YTD (%) 2.45%

According to the recently released July socio-economic report of Vietnam, exports and imports in the first 7 months grew 15.7% and 18.5% respectively, equal to a trade surplus of USD14.08 billion. The average CPI in the first 7 months increased 4.12% yoy. Cumulative foreign investment capital since the beginning of the year also increased 10.9% yoy compared to 2023.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Credit growth reversed and declined to 5.3% by mid-July;

- Pangasius exports to China reached a 5-month peak;

- Nearly 10 million international visitors came to Vietnam in the first 7 months of the year;

- BRICS may have more new members;

- The recovery of the Japanese yen is going to face major risks this week;

- Luxury brands struggled as Chinese consumers "tighten their belts".

VN30

BANK

87,300

1D 0.00%

5D -0.46%

Buy Vol. 954,304

Sell Vol. 1,410,009

47,100

1D 1.84%

5D -1.26%

Buy Vol. 2,109,314

Sell Vol. 2,828,643

32,100

1D 0.16%

5D -4.61%

Buy Vol. 7,449,675

Sell Vol. 7,618,814

22,750

1D 0.00%

5D -3.81%

Buy Vol. 10,956,804

Sell Vol. 10,088,644

18,400

1D 0.00%

5D -2.13%

Buy Vol. 15,012,095

Sell Vol. 16,761,253

24,100

1D -0.82%

5D -4.37%

Buy Vol. 19,858,077

Sell Vol. 22,591,636

25,250

1D 0.60%

5D -0.20%

Buy Vol. 8,592,227

Sell Vol. 7,246,631

18,100

1D 1.40%

5D -2.69%

Buy Vol. 22,317,696

Sell Vol. 24,739,361

29,100

1D 0.00%

5D -3.00%

Buy Vol. 12,503,068

Sell Vol. 12,056,713

20,900

1D 0.00%

5D -2.11%

Buy Vol. 4,772,189

Sell Vol. 4,199,917

24,150

1D 0.21%

5D -2.42%

Buy Vol. 8,964,496

Sell Vol. 8,806,561

11,050

1D -0.45%

5D -1.34%

Buy Vol. 20,823,172

Sell Vol. 26,402,978

21,950

1D 0.00%

5D 3.78%

Buy Vol. 3,463,216

Sell Vol. 3,500,200

VIB: Pre-tax profit of VIB in the first 6 months reached over VND4,600 billion, decreased 18% year-on-year.

OIL & GAS

77,000

1D -0.26%

5D 1.12%

Buy Vol. 1,123,936

Sell Vol. 813,854

13,600

1D 0.37%

5D 3.13%

Buy Vol. 13,466,930

Sell Vol. 17,140,032

47,800

1D 0.00%

5D 2.09%

Buy Vol. 2,784,779

Sell Vol. 3,289,017

POW: PVPower estimated revenue in the first 6 months at VND16,000 billion, with pre-tax profit of VND725 billion.

VINGROUP

41,600

1D 0.00%

5D -2.11%

Buy Vol. 4,245,803

Sell Vol. 3,883,921

37,100

1D -1.72%

5D -5.49%

Buy Vol. 6,357,887

Sell Vol. 12,834,885

18,950

1D -1.81%

5D 2.75%

Buy Vol. 14,715,629

Sell Vol. 17,008,185

On July 27, the VinFast VF 6 test drive event simultaneously kicked off at 100 locations, including VinFast showrooms, dealers, and Vincom centers.

FOOD & BEVERAGE

67,200

1D 2.13%

5D 2.49%

Buy Vol. 11,291,523

Sell Vol. 11,804,427

74,000

1D 0.00%

5D -1.44%

Buy Vol. 5,740,274

Sell Vol. 9,132,175

54,900

1D -0.18%

5D 8.27%

Buy Vol. 797,250

Sell Vol. 1,006,295

MSN: WinCommerce recorded positive after-tax profit in June, with a 9% growth in store revenue in the first 2 quarters.

OTHERS

73,300

1D 1.10%

5D -3.13%

Buy Vol. 1,714,478

Sell Vol. 2,153,265

43,350

1D 0.35%

5D 0.85%

Buy Vol. 715,561

Sell Vol. 809,198

106,200

1D -1.48%

5D 3.95%

Buy Vol. 847,322

Sell Vol. 1,101,479

129,000

1D 0.78%

5D -5.05%

Buy Vol. 7,277,507

Sell Vol. 8,764,347

62,000

1D 1.64%

5D 2.29%

Buy Vol. 9,815,566

Sell Vol. 9,686,800

33,500

1D 1.21%

5D -7.07%

Buy Vol. 3,998,376

Sell Vol. 4,702,216

32,200

1D 0.31%

5D -0.53%

Buy Vol. 11,212,841

Sell Vol. 12,619,945

27,900

1D 1.64%

5D 0.00%

Buy Vol. 27,005,280

Sell Vol. 29,997,455

On July 26, the Ministry of Industry and Trade decided to investigate the application of trade defense measures on hot-rolled coil (HRC) imported from China and India, HPG is expected to benefit.

Market by numbers

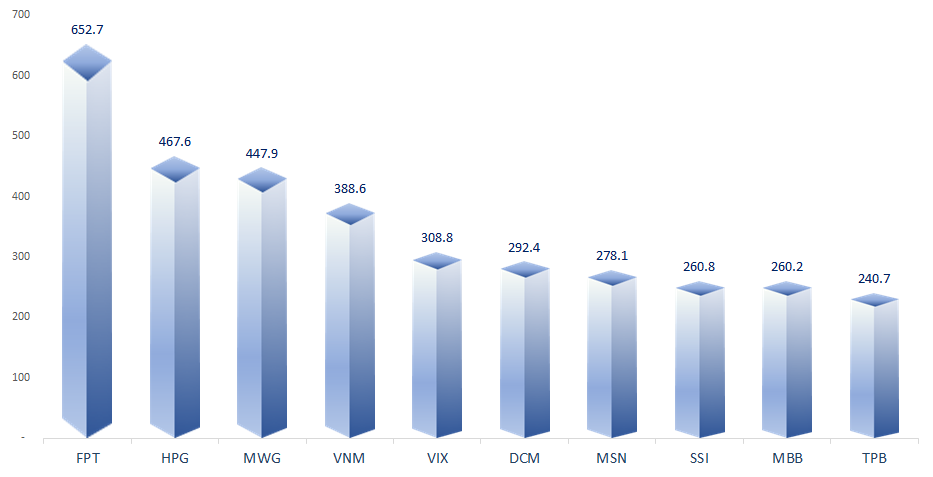

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

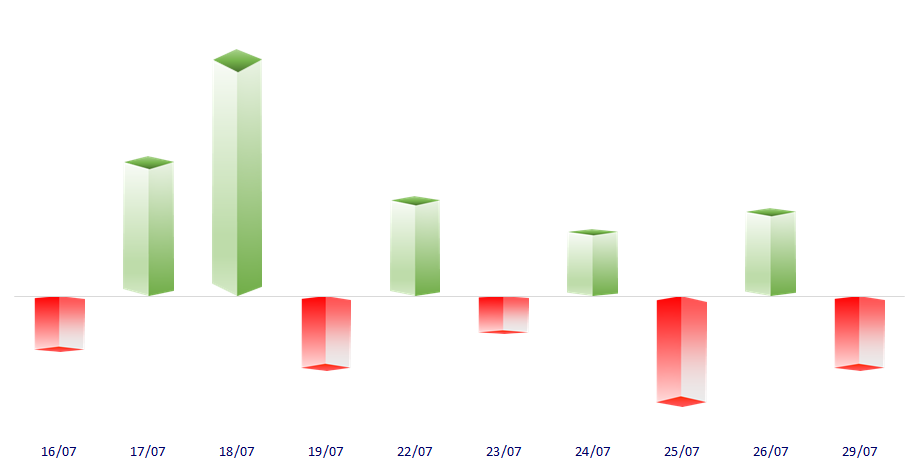

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

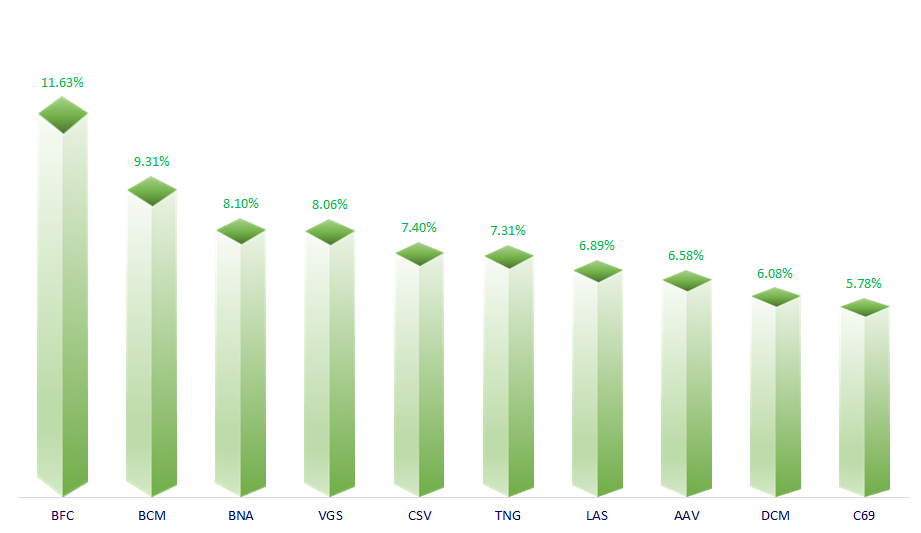

TOP INCREASES 3 CONSECUTIVE SESSIONS

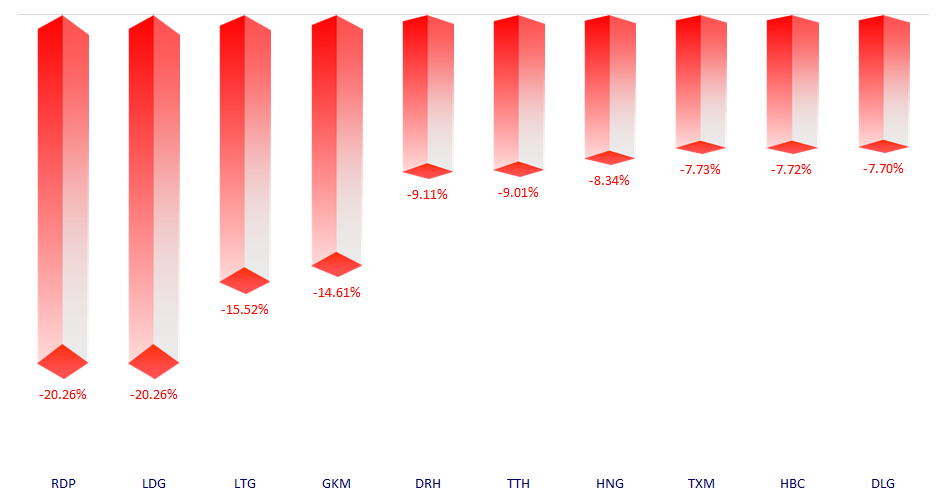

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.