Market brief 01/10/2024

VIETNAM STOCK MARKET

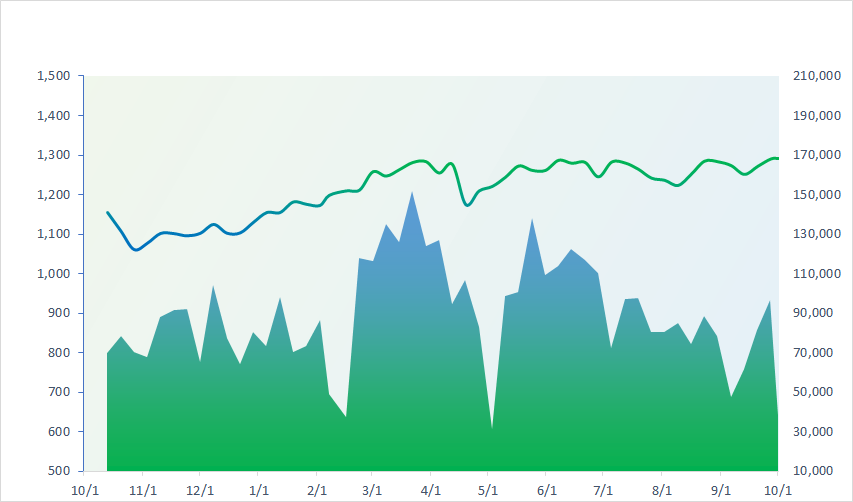

1,292.20

1D 0.33%

YTD 14.18%

236.05

1D 0.49%

YTD 2.63%

1,358.88

1D 0.47%

YTD 20.08%

93.28

1D -0.30%

YTD 6.51%

471.62

1D 0.00%

YTD 0.00%

25,103.95

1D 38.77%

YTD 32.85%

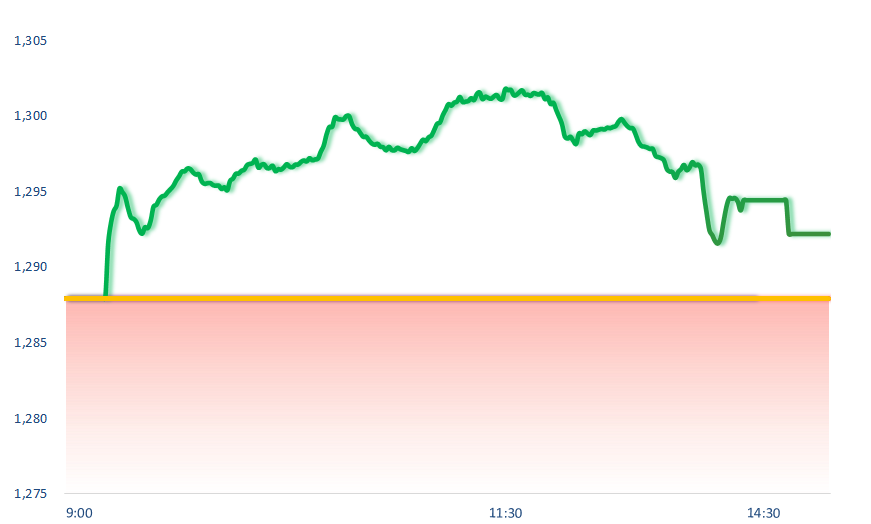

VNIndex continued to face strong profit-taking pressure after reaching the 1,300 mark in today's session. Telecommunications, insurance, and basic resources were the most active groups. In contrast, retail and oil & gas were quite gloomy.

ETF & DERIVATIVES

23,810

1D 0.68%

YTD 21.92%

16,320

1D 0.55%

YTD 21.34%

17,030

1D 0.89%

YTD 22.87%

20,440

1D 1.19%

YTD 20.38%

22,160

1D 0.64%

YTD 20.43%

34,080

1D 0.24%

YTD 30.93%

18,250

1D 0.83%

YTD 19.52%

1,360

1D 0.22%

YTD 0.00%

1,363

1D 0.38%

YTD 0.00%

1,361

1D 0.54%

YTD 0.00%

1,361

1D 0.36%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,651.97

1D 1.93%

YTD 15.50%

3,336.50

1D 0.00%

YTD 12.63%

21,133.68

1D 0.00%

YTD 25.88%

2,593.27

1D 0.00%

YTD -2.87%

84,264.00

1D -0.04%

YTD 17.21%

3,584.70

1D -0.02%

YTD 10.98%

1,464.66

1D 1.09%

YTD 2.18%

70.63

1D -1.67%

YTD -8.30%

2,649.11

1D 0.38%

YTD 27.56%

Asian stocks reacted mixedly to the Fed chairman's comments. Japan's Nikkei 225 index rose slightly, as the BOJ's third-quarter survey showed sentiment among non-manufacturing companies improved to 34, beating Reuters' expectations. Markets in China and Hong Kong were closed for the Golden Week from October 1 to 7.

VIETNAM ECONOMY

4.30%

1D (bps) -17

YTD (bps) 70

4.60%

YTD (bps) -20

2.47%

1D (bps) 1

YTD (bps) 58

2.97%

1D (bps) 1

YTD (bps) 79

2477900.00%

1D (%) 0.16%

YTD (%) 1.10%

2808400.00%

1D (%) -0.33%

YTD (%) 2.59%

357600.00%

1D (%) -0.03%

YTD (%) 2.88%

The central exchange rate today (October 1) was announced by the State Bank at 24,081 VND/USD, down 12 VND compared to the listed rate at the beginning of the week. Applying a 5% band, the current USD exchange rate that commercial banks are allowed to trade is from 22,877 - 25,285 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The North-South high-speed railway project is expected to cost USD67.34 billion and be completed in 2035;

- Many major Chinese automakers have planned to expand their investment and production in Vietnam;

- A series of urban area projects in Luong Son (Hoa Binh) are behind schedule;

- Asia's manufacturing activities in September were affected by global instability;

- Google invests USD1 billion in a data center in Thailand;

- OpenAI may lose USD5 billion, plans to increase ChatGPT usage fees.

VN30

BANK

92,000

1D 0.00%

5D 0.88%

Buy Vol. 2,457,978

Sell Vol. 3,410,876

49,700

1D 0.00%

5D 0.91%

Buy Vol. 4,957,861

Sell Vol. 6,416,091

36,500

1D -1.22%

5D 1.25%

Buy Vol. 19,035,778

Sell Vol. 22,369,593

24,650

1D 1.86%

5D 4.67%

Buy Vol. 63,142,516

Sell Vol. 66,439,689

19,900

1D -1.00%

5D 3.65%

Buy Vol. 54,030,094

Sell Vol. 72,776,599

25,650

1D -0.19%

5D 1.58%

Buy Vol. 43,669,991

Sell Vol. 38,658,777

28,000

1D -0.71%

5D 3.70%

Buy Vol. 12,906,821

Sell Vol. 18,005,097

17,100

1D -0.58%

5D 11.04%

Buy Vol. 54,451,522

Sell Vol. 61,114,025

33,500

1D 0.45%

5D 5.18%

Buy Vol. 30,515,840

Sell Vol. 29,318,802

19,800

1D 2.59%

5D 3.66%

Buy Vol. 58,754,504

Sell Vol. 50,571,830

25,750

1D 0.00%

5D -0.19%

Buy Vol. 18,115,871

Sell Vol. 20,119,087

11,050

1D 0.45%

5D 5.74%

Buy Vol. 54,623,112

Sell Vol. 65,999,063

17,450

1D 2.35%

5D 5.76%

Buy Vol. 4,261,980

Sell Vol. 3,608,118

VPB: On September 27, VPBank and LOTTE C&F held a signing ceremony of a Memorandum of Understanding (MOU). Accordingly, VPBank and LOTTE C&F plan to cooperate in developing and managing co-branded card products and buy-now-pay-later services to meet the needs of LOTTE customers.

OIL & GAS

73,000

1D -0.27%

5D -0.95%

Buy Vol. 1,745,534

Sell Vol. 2,317,356

13,200

1D 0.76%

5D 4.76%

Buy Vol. 13,599,120

Sell Vol. 16,959,871

44,500

1D 0.00%

5D -1.55%

Buy Vol. 1,882,584

Sell Vol. 2,312,377

GAS: PV GAS works with the world's second largest LNG producer with a capitalization of USD38 billion.

VINGROUP

42,300

1D 0.71%

5D -0.59%

Buy Vol. 3,504,530

Sell Vol. 4,010,771

43,450

1D 1.52%

5D -1.81%

Buy Vol. 25,312,588

Sell Vol. 21,738,763

19,400

1D 1.57%

5D 1.84%

Buy Vol. 24,932,366

Sell Vol. 19,839,929

VHM: Foreign investors returned to net buying VHM shares in September after 10 consecutive months of net selling, bringing the ownership ratio to the lowest level since listing.

FOOD & BEVERAGE

70,100

1D 0.00%

5D -0.28%

Buy Vol. 4,143,156

Sell Vol. 4,720,351

76,600

1D 1.19%

5D 2.41%

Buy Vol. 11,321,810

Sell Vol. 13,192,577

57,800

1D 0.00%

5D 0.52%

Buy Vol. 1,191,452

Sell Vol. 1,628,482

MSN: J.P Morgan recommends increasing Masan's MSN stock weight.

OTHERS

70,300

1D 0.14%

5D -2.36%

Buy Vol. 987,207

Sell Vol. 1,087,226

43,400

1D 1.28%

5D -0.57%

Buy Vol. 1,467,340

Sell Vol. 1,426,774

105,300

1D 0.29%

5D 0.19%

Buy Vol. 951,779

Sell Vol. 1,011,971

135,900

1D 1.04%

5D 1.04%

Buy Vol. 6,378,602

Sell Vol. 8,454,858

67,800

1D -0.44%

5D -0.44%

Buy Vol. 13,605,507

Sell Vol. 19,053,365

36,000

1D 0.70%

5D -0.41%

Buy Vol. 6,755,325

Sell Vol. 8,494,738

27,800

1D -0.36%

5D 4.51%

Buy Vol. 23,457,155

Sell Vol. 34,596,380

26,750

1D 1.52%

5D 3.48%

Buy Vol. 65,761,398

Sell Vol. 76,448,863

HPG: Since the beginning of August, foreign investors have net sold a total of 144 million HPG shares, worth VND3,700 billion. This is also a record number in many years for Hoa Phat Group.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

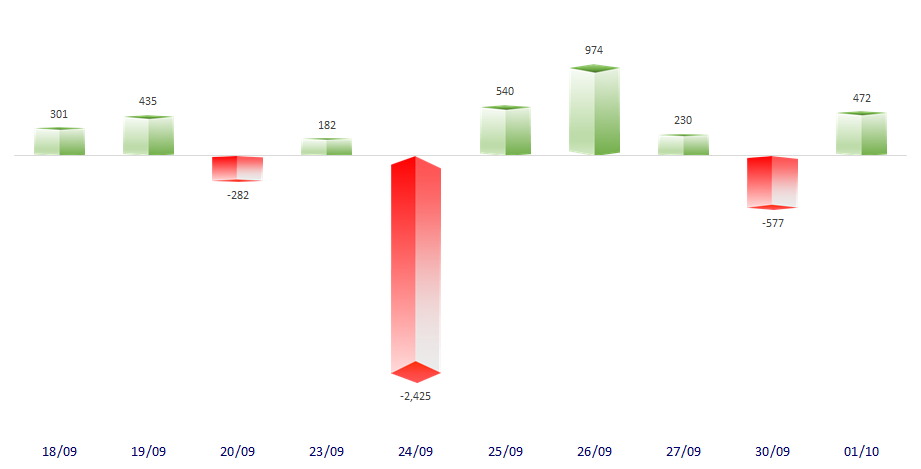

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

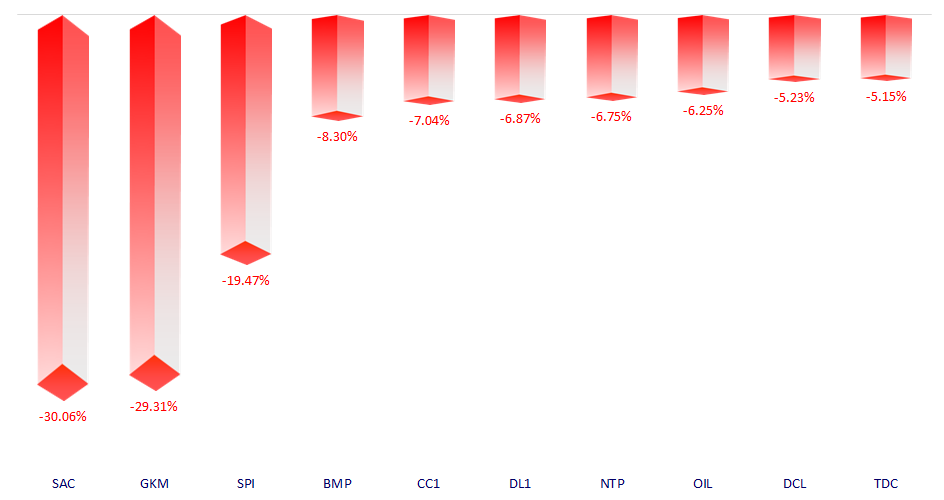

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.