Market brief 02/10/2024

VIETNAM STOCK MARKET

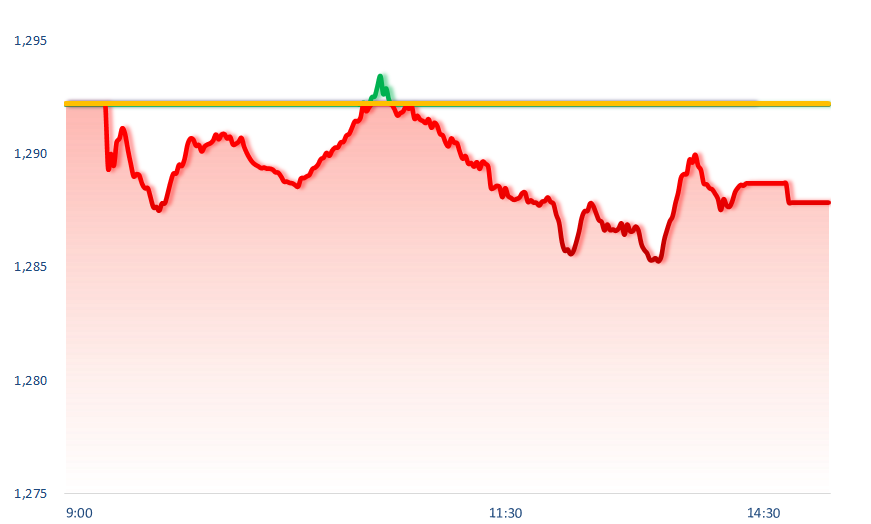

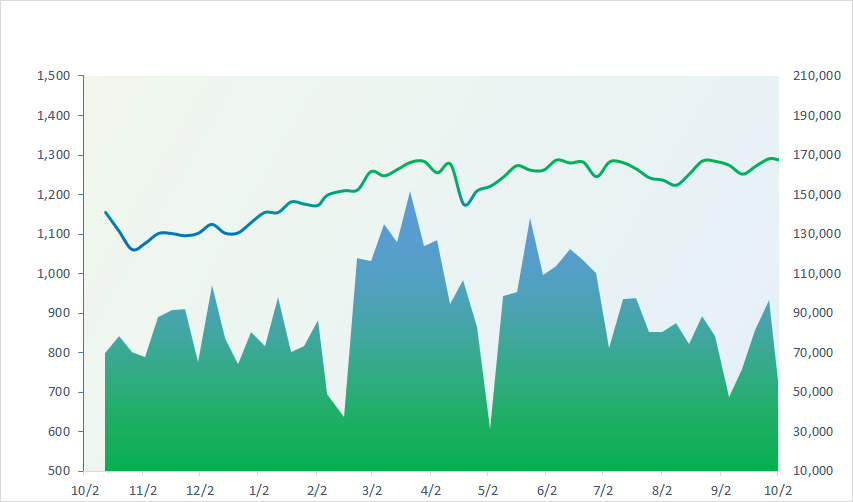

1,287.84

1D -0.34%

YTD 13.79%

235.05

1D -0.42%

YTD 2.20%

1,354.51

1D -0.32%

YTD 19.69%

93.28

1D 0.00%

YTD 6.51%

243.21

1D 0.00%

YTD 0.00%

19,475.76

1D -22.42%

YTD 3.07%

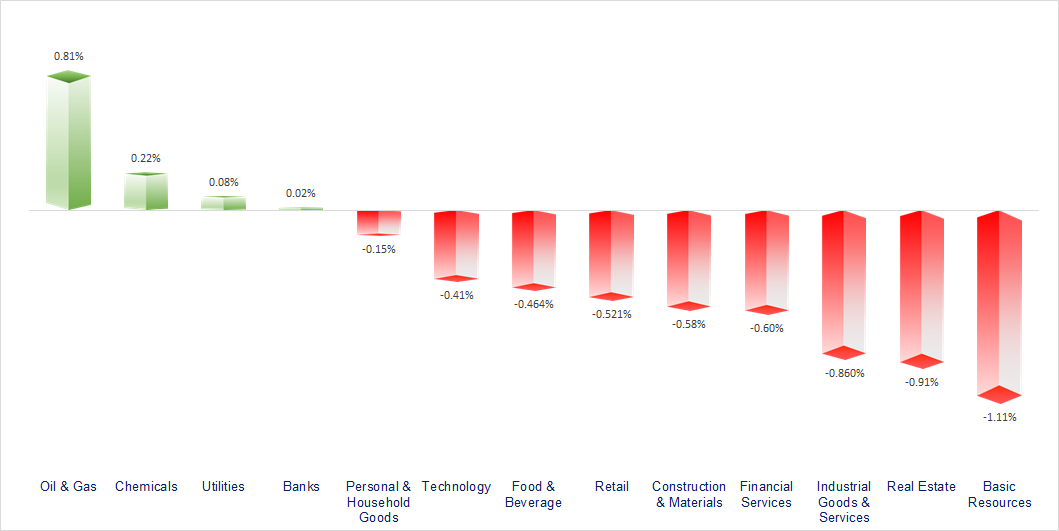

VNIndex had a session of trading in a narrow range. Oil & gas and chemicals were the most active sectors today. On the contrary, basic resources and real estate were quite gloomy.

ETF & DERIVATIVES

23,780

1D -0.13%

YTD 21.76%

16,280

1D -0.25%

YTD 21.04%

16,880

1D -0.88%

YTD 21.79%

20,230

1D -1.03%

YTD 19.14%

22,100

1D -0.27%

YTD 20.11%

34,050

1D -0.09%

YTD 30.81%

18,180

1D -0.38%

YTD 19.06%

1,357

1D -0.21%

YTD 0.00%

1,361

1D -0.12%

YTD 0.00%

1,357

1D -0.27%

YTD 0.00%

1,355

1D -0.47%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

37,808.76

1D -2.18%

YTD 12.98%

3,336.50

1D 0.00%

YTD 12.63%

22,443.73

1D 6.20%

YTD 33.68%

2,561.69

1D -1.22%

YTD -4.05%

84,266.29

1D 0.00%

YTD 17.21%

3,589.87

1D 0.14%

YTD 11.14%

1,451.40

1D -0.91%

YTD 1.26%

75.78

1D 1.61%

YTD -1.62%

2,653.44

1D 0.16%

YTD 27.77%

While mainland China remains closed for a holiday, Hong Kong markets led Asian stocks today, boosted by real estate sector. Most HK-listed real estate stocks surged, with Shimao Group surging more than 90% to its highest price of the year.

VIETNAM ECONOMY

4.14%

1D (bps) -16

YTD (bps) 54

4.60%

YTD (bps) -20

2.31%

1D (bps) -16

YTD (bps) 43

3.16%

1D (bps) 20

YTD (bps) 99

2482000.00%

1D (%) 0.17%

YTD (%) 1.26%

2793400.00%

1D (%) -0.53%

YTD (%) 2.04%

358200.00%

1D (%) 0.17%

YTD (%) 3.05%

The USD exchange rate at domestic banks this morning has increased again in the range of 40 to 52 VND. Of which, VietinBank is the bank with the most significant exchange rate increase in both buying and selling directions.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- IMF optimistic about Vietnam's economic growth prospects, forecasting 6.1%;

- Ben Tre starts construction of Ba Lai 8 bridge worth over VND2,200 billion;

- Ho Chi Minh City's economy must grow over 9% in the fourth quarter to reach the 2024 growth target;

- Risk of oil supply disruption due to Israel-Iran conflict;

- Strike at US seaport: Loss of up to 5 billion USD/day;

- S&P downgrades Israel's credit rating due to concerns about the possibility of conflict escalation.

VN30

BANK

92,700

1D 0.76%

5D -0.11%

Buy Vol. 2,037,062

Sell Vol. 2,376,340

49,800

1D 0.20%

5D -0.40%

Buy Vol. 4,386,620

Sell Vol. 4,539,130

36,000

1D -1.37%

5D 0.00%

Buy Vol. 21,497,759

Sell Vol. 19,892,686

24,900

1D 1.01%

5D 4.62%

Buy Vol. 49,622,060

Sell Vol. 56,465,234

19,700

1D -1.01%

5D 1.29%

Buy Vol. 71,289,134

Sell Vol. 59,404,676

25,700

1D 0.19%

5D -0.19%

Buy Vol. 37,029,384

Sell Vol. 30,258,420

27,550

1D -1.61%

5D 1.10%

Buy Vol. 13,633,655

Sell Vol. 15,412,362

17,500

1D 2.34%

5D 12.18%

Buy Vol. 69,032,132

Sell Vol. 59,510,061

33,550

1D 0.15%

5D 2.60%

Buy Vol. 31,394,382

Sell Vol. 23,135,192

19,550

1D -1.26%

5D 0.51%

Buy Vol. 15,445,008

Sell Vol. 19,300,098

25,800

1D 0.19%

5D -1.53%

Buy Vol. 22,545,799

Sell Vol. 19,708,043

10,900

1D -1.36%

5D 3.32%

Buy Vol. 47,416,185

Sell Vol. 52,224,395

17,550

1D 0.57%

5D 5.41%

Buy Vol. 3,156,365

Sell Vol. 4,092,161

STB: Sacombank has just announced the decision to reappoint two Deputy General Directors. Specifically, Mr. Ho Doan Cuong and Mr. Ha Van Trung will continue to hold the position of Deputy General Directors from October 1 and October 10, 2024. The appointment decisions are valid for 4 years.

OIL & GAS

72,900

1D -0.14%

5D -1.22%

Buy Vol. 1,838,646

Sell Vol. 2,263,473

13,150

1D -0.38%

5D 0.77%

Buy Vol. 7,904,018

Sell Vol. 11,106,007

44,950

1D 1.01%

5D -0.99%

Buy Vol. 1,914,510

Sell Vol. 2,659,747

POW: PV Power announced a loan package of over USD500 million for Nhon Trach 3&4 project.

VINGROUP

42,050

1D -0.59%

5D -1.29%

Buy Vol. 2,844,036

Sell Vol. 3,157,735

43,400

1D -0.12%

5D -1.70%

Buy Vol. 16,553,320

Sell Vol. 13,921,415

19,150

1D -1.29%

5D 0.26%

Buy Vol. 12,273,156

Sell Vol. 14,349,938

VIC: Mr. Pham Nhat Vuong wants to cooperate with 50 taxi companies to convert to electric vehicles.

FOOD & BEVERAGE

70,100

1D 0.00%

5D 0.72%

Buy Vol. 3,959,280

Sell Vol. 4,596,843

76,000

1D -0.78%

5D 0.66%

Buy Vol. 4,317,090

Sell Vol. 4,538,183

56,900

1D -1.56%

5D -0.87%

Buy Vol. 1,051,714

Sell Vol. 1,436,444

MSN: It is expected that MCH shares of Masan Consumer, a subsidiary of Masan Group, will be officially listed on HoSE in 2025.

OTHERS

69,500

1D -1.14%

5D -4.14%

Buy Vol. 845,032

Sell Vol. 929,001

43,200

1D -0.46%

5D -0.35%

Buy Vol. 633,337

Sell Vol. 716,619

105,000

1D -0.28%

5D 0.38%

Buy Vol. 819,164

Sell Vol. 980,154

135,400

1D -0.37%

5D 0.45%

Buy Vol. 2,933,673

Sell Vol. 3,373,056

67,400

1D -0.59%

5D -1.89%

Buy Vol. 12,524,970

Sell Vol. 13,664,182

36,150

1D 0.42%

5D 0.42%

Buy Vol. 5,215,361

Sell Vol. 6,507,825

27,600

1D -0.72%

5D 0.55%

Buy Vol. 27,801,353

Sell Vol. 22,038,152

26,300

1D -1.68%

5D 0.38%

Buy Vol. 37,675,077

Sell Vol. 42,460,282

GVR: GVR's leaders said that after 9 months of 2024, the company recorded revenue of VND16,207 billion, achieving 65% of the yearly plan. Estimated profit after tax reached VND2,386 billion, up 22% over the same period. Thus, in the third quarter of 2024, GVR's profit after tax is estimated at VND801 billion, up 62% over the same period last year.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

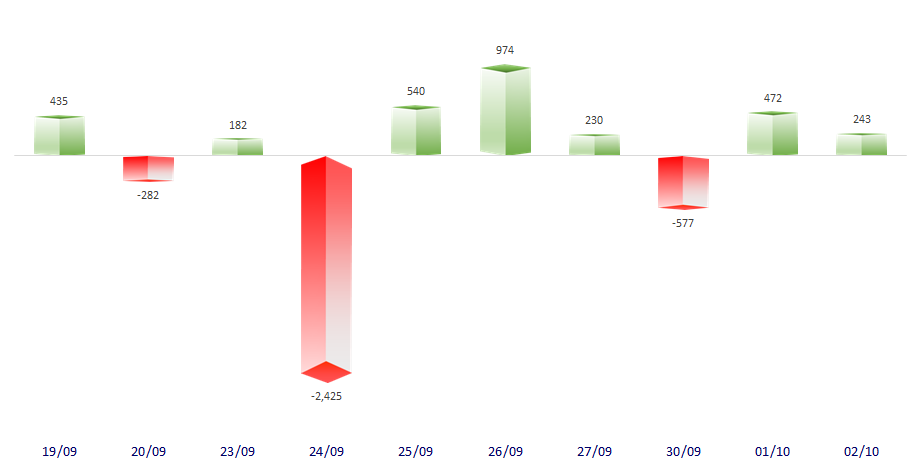

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

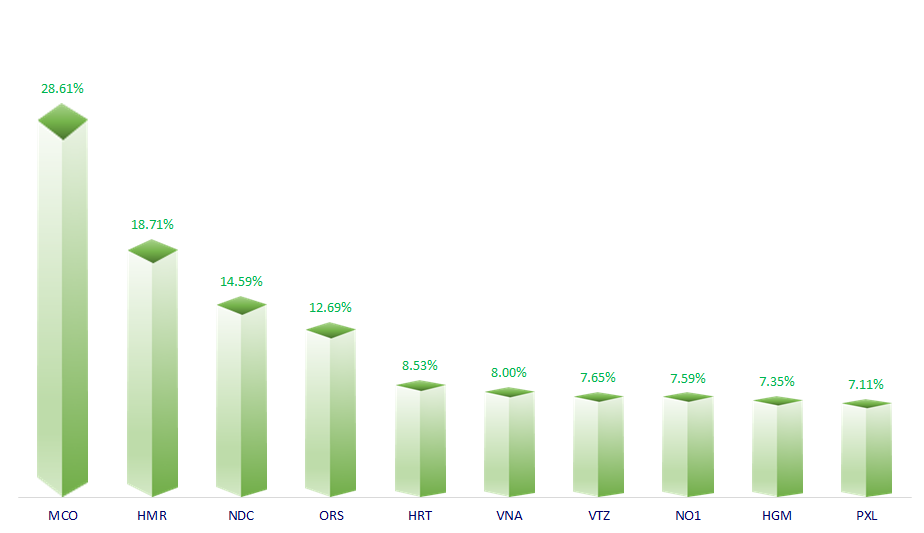

TOP INCREASES 3 CONSECUTIVE SESSIONS

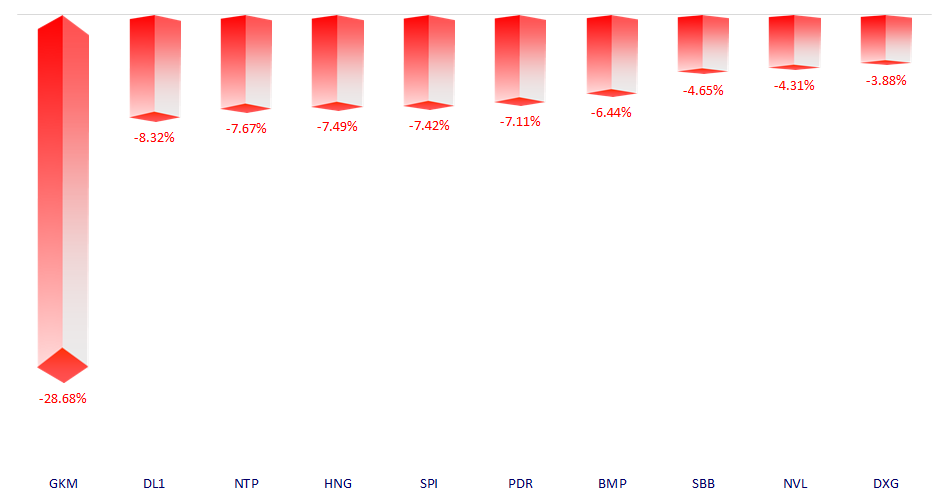

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.