Market brief 17/10/2024

VIETNAM STOCK MARKET

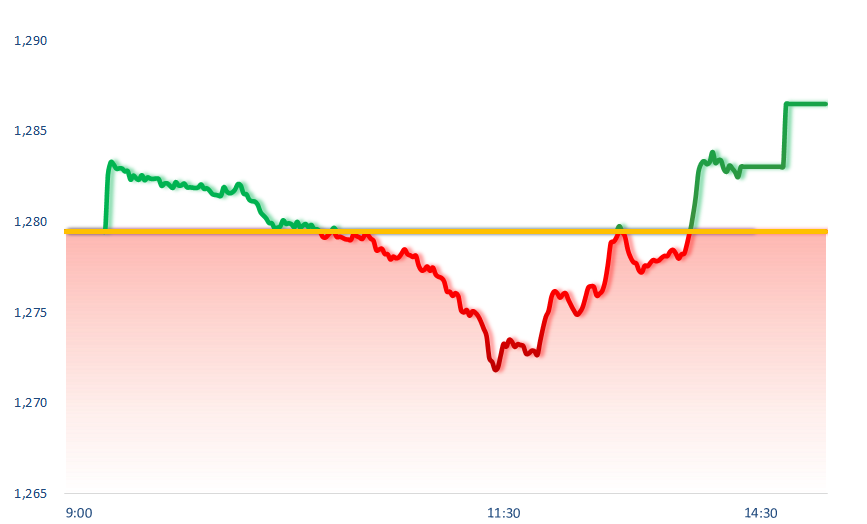

1,286.52

1D 0.55%

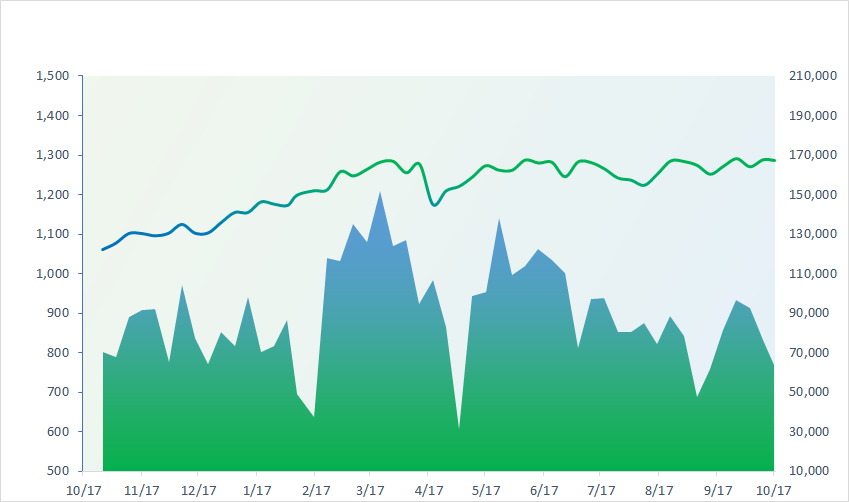

YTD 13.68%

230.12

1D 0.81%

YTD 0.06%

1,362.89

1D 0.65%

YTD 20.43%

92.70

1D 0.41%

YTD 5.85%

-418.79

1D 0.00%

YTD 0.00%

18,542.82

1D 27.64%

YTD -1.87%

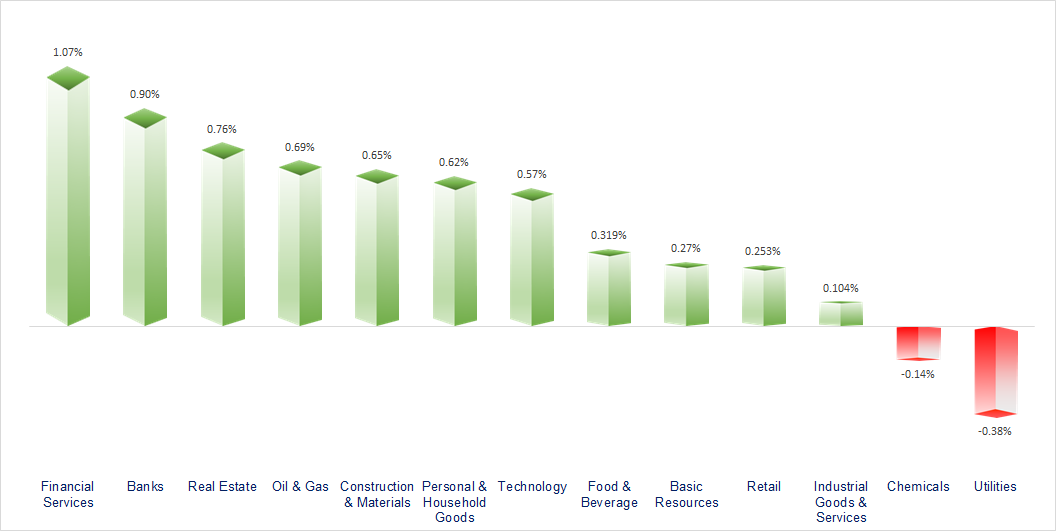

The market had an emotional October derivatives expiration session. Almost all industry groups increased points in today's session, with the most positive being real estate, banking and financial services.

ETF & DERIVATIVES

23,780

1D 0.34%

YTD 21.76%

16,370

1D 0.49%

YTD 21.71%

16,850

1D 0.00%

YTD 21.57%

20,330

1D -2.21%

YTD 19.73%

22,200

1D 0.91%

YTD 20.65%

33,580

1D 0.51%

YTD 29.00%

18,100

1D 0.17%

YTD 18.53%

1,358

1D 0.27%

YTD 0.00%

1,369

1D 0.45%

YTD 0.00%

1,373

1D 0.65%

YTD 0.00%

1,368

1D 0.47%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,911.19

1D -0.69%

YTD 16.28%

3,169.38

1D -1.05%

YTD 6.99%

20,079.10

1D -1.02%

YTD 19.60%

2,609.30

1D -0.04%

YTD -2.27%

81,007.77

1D -0.68%

YTD 12.68%

3,624.81

1D 0.90%

YTD 12.22%

1,495.02

1D 0.80%

YTD 4.30%

74.56

1D -0.09%

YTD -3.20%

2,680.81

1D 0.13%

YTD 29.09%

Asian markets fell across the board after the Chinese government's press conference on the property market. Specifically, the Chinese government's policies focus mainly on low-cost and degraded real estate, promoting the message that houses are for living.

VIETNAM ECONOMY

2.74%

1D (bps) -6

YTD (bps) -86

4.60%

YTD (bps) -20

2.61%

1D (bps) -27

YTD (bps) 73

3.99%

1D (bps) 20

YTD (bps) 181

2537500.00%

1D (%) 0.85%

YTD (%) 3.53%

2811300.00%

1D (%) 0.50%

YTD (%) 2.69%

360700.00%

1D (%) 0.70%

YTD (%) 3.77%

The USD exchange rate at domestic banks today witnessed another strong increase. The USD buying price is currently in the range of 24,810 - 24,855 VND/USD, of which VietinBank has the highest USD buying price. The selling price is currently fluctuating in the range of 25,180 - 25,245 VND/USD with the lowest USD offering price at BIDV.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Exports in the first 9 months of 2023 increased by 15.4% compared to the same period last year;

- Proposal to approve the Lao Cai - Quang Ninh railway worth over VND179,000 billion;

- Prime Minister: Efforts to complete 600 km of expressway in the Mekong Delta in 2025;

- ECB may lower interest rates for the second time in a row;

- WorldSteel forecasts steel demand to decrease in 2024, expects growth in 2025;

- China expands stimulus package for the real estate market.

VN30

BANK

92,200

1D 0.77%

5D 0.33%

Buy Vol. 2,667,939

Sell Vol. 2,194,190

50,300

1D 0.90%

5D 1.11%

Buy Vol. 4,892,942

Sell Vol. 5,194,459

36,550

1D 0.69%

5D 1.11%

Buy Vol. 11,938,536

Sell Vol. 12,636,388

24,350

1D 0.62%

5D -0.81%

Buy Vol. 17,908,911

Sell Vol. 18,525,564

20,900

1D 0.24%

5D 1.70%

Buy Vol. 40,595,403

Sell Vol. 50,986,916

25,900

1D 1.57%

5D 1.57%

Buy Vol. 28,630,879

Sell Vol. 21,460,533

26,600

1D -1.66%

5D -3.10%

Buy Vol. 14,673,586

Sell Vol. 16,398,749

17,900

1D 2.29%

5D 2.58%

Buy Vol. 56,768,594

Sell Vol. 44,410,413

34,600

1D 2.98%

5D 2.98%

Buy Vol. 59,099,937

Sell Vol. 38,377,481

19,350

1D 1.04%

5D 1.31%

Buy Vol. 22,978,292

Sell Vol. 23,000,967

26,150

1D 1.55%

5D -0.19%

Buy Vol. 18,663,312

Sell Vol. 17,137,411

10,800

1D 0.47%

5D 0.47%

Buy Vol. 34,535,873

Sell Vol. 38,230,537

16,750

1D 0.30%

5D -4.29%

Buy Vol. 3,890,654

Sell Vol. 3,065,431

CTG: Vietinbank has just announced the list of two candidates to be elected to the Board of Directors (BOD) for the 2024 - 2029 term at the Extraordinary General Meeting of Shareholders held on October 17. Accordingly, Mr. Nguyen Tran Manh Trung and Mr. Nguyen Viet Dung will be the two youngest members of VietinBank's BOD if selected by the General Meeting of Shareholders.

OIL & GAS

71,500

1D -0.69%

5D -2.46%

Buy Vol. 1,587,114

Sell Vol. 1,468,118

12,550

1D -0.40%

5D -2.71%

Buy Vol. 8,365,195

Sell Vol. 11,042,093

42,250

1D 0.96%

5D -5.06%

Buy Vol. 2,617,972

Sell Vol. 2,000,392

Gasoline prices slightly decreased, RON95-III fell below the threshold of VND21,000 per liter.

VINGROUP

41,550

1D 0.12%

5D 0.36%

Buy Vol. 2,102,270

Sell Vol. 2,860,086

45,100

1D 0.22%

5D 7.00%

Buy Vol. 12,783,198

Sell Vol. 15,812,433

18,750

1D 0.27%

5D 1.63%

Buy Vol. 10,743,274

Sell Vol. 11,723,921

VIC: Vingroup plans to complete construction of the National Exhibition and Convention Center in July 2025.

FOOD & BEVERAGE

67,600

1D 0.15%

5D -0.15%

Buy Vol. 3,609,712

Sell Vol. 4,276,973

81,000

1D 0.75%

5D 1.25%

Buy Vol. 12,482,823

Sell Vol. 10,010,611

57,300

1D -0.87%

5D -0.69%

Buy Vol. 684,558

Sell Vol. 1,001,442

MSN: Masan wants to increase ownership at MSR to nearly 95%.

OTHERS

67,500

1D -0.44%

5D -1.17%

Buy Vol. 545,843

Sell Vol. 585,412

44,000

1D 0.46%

5D 0.23%

Buy Vol. 466,926

Sell Vol. 491,898

105,300

1D -0.47%

5D -0.66%

Buy Vol. 957,631

Sell Vol. 1,494,160

137,000

1D 0.51%

5D -3.32%

Buy Vol. 5,420,657

Sell Vol. 4,057,560

65,800

1D 0.46%

5D 1.23%

Buy Vol. 11,664,955

Sell Vol. 12,396,860

36,000

1D -0.28%

5D 0.98%

Buy Vol. 4,132,065

Sell Vol. 5,632,588

27,450

1D 1.29%

5D -0.36%

Buy Vol. 23,538,379

Sell Vol. 19,673,510

27,250

1D 0.55%

5D 0.00%

Buy Vol. 36,171,642

Sell Vol. 38,663,739

BCM: Binh Phuoc has approved the plan to locally adjust the zoning plan of Becamex Binh Phuoc Industrial Park with a scale of VND20,000 billion of Becamex IDC.

Market by numbers

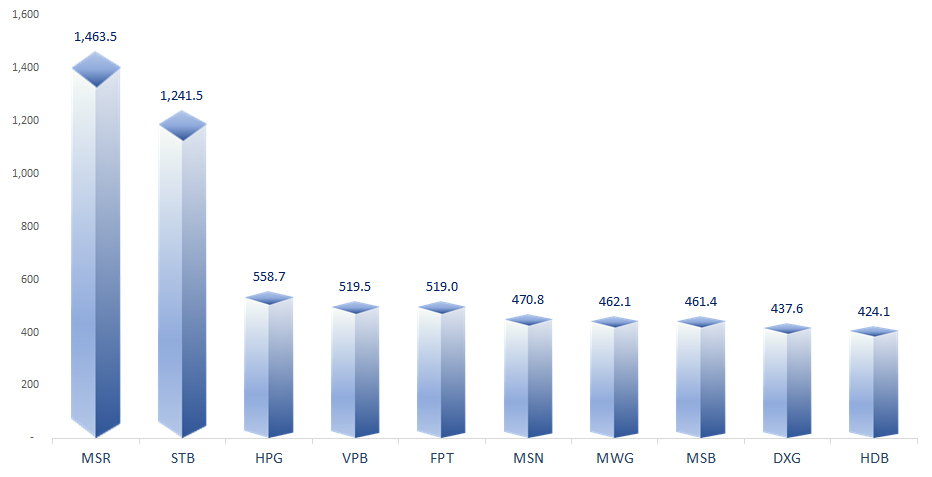

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

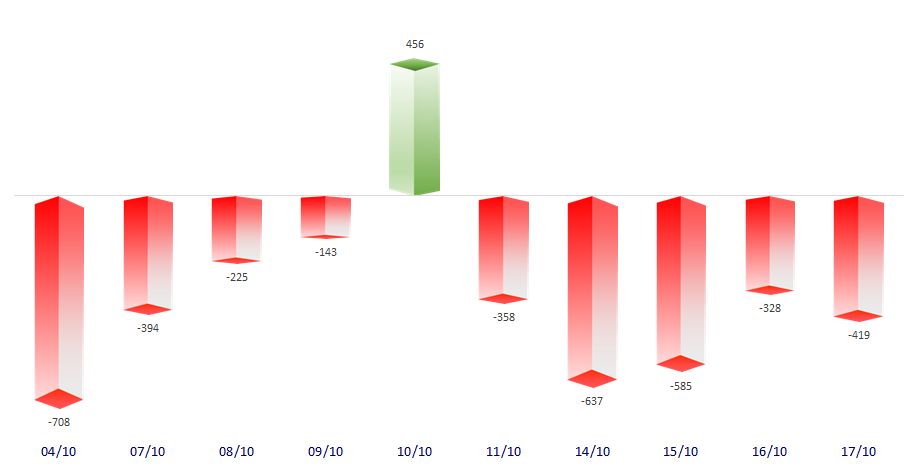

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

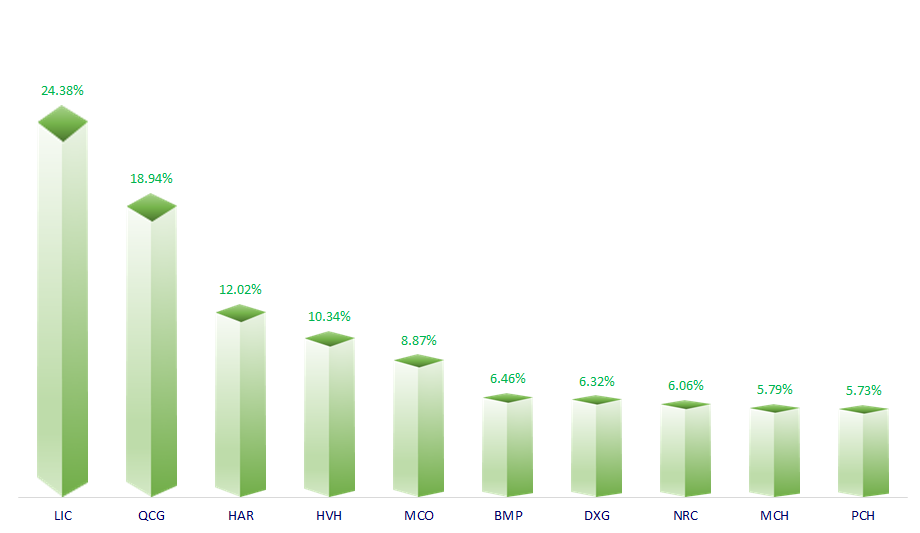

TOP INCREASES 3 CONSECUTIVE SESSIONS

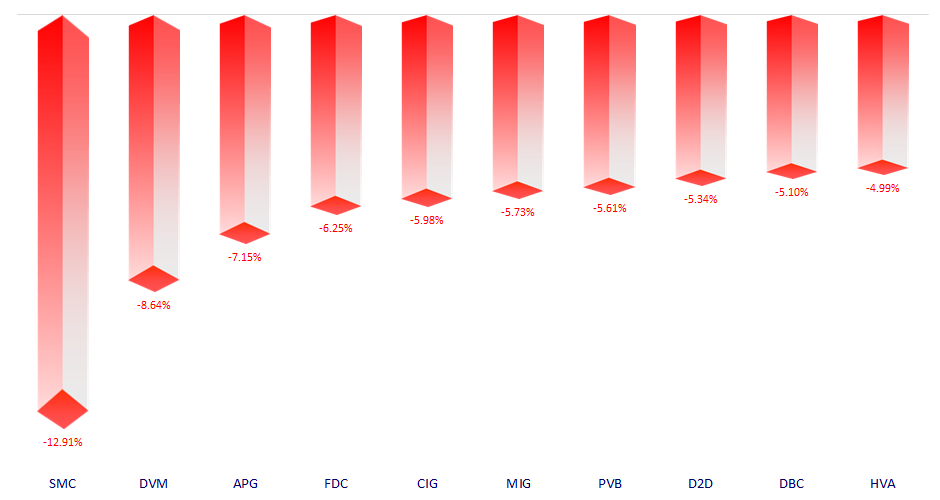

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.