Market brief 30/10/2024

VIETNAM STOCK MARKET

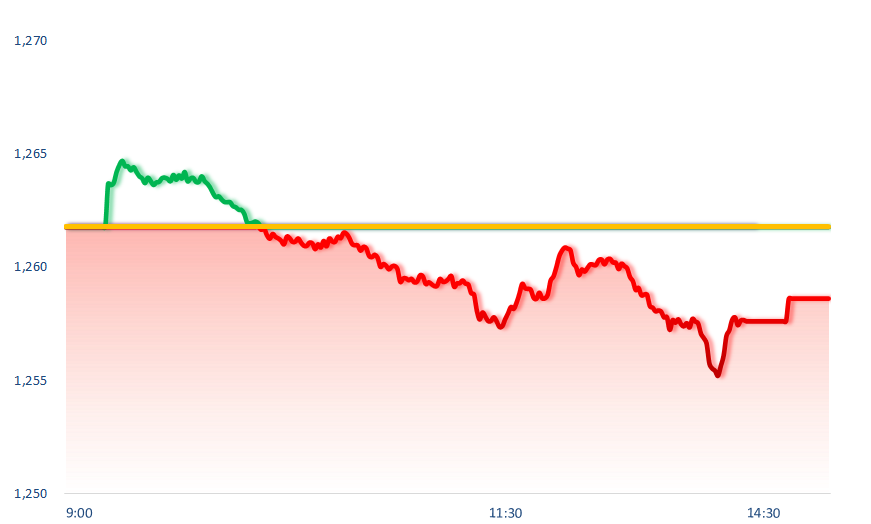

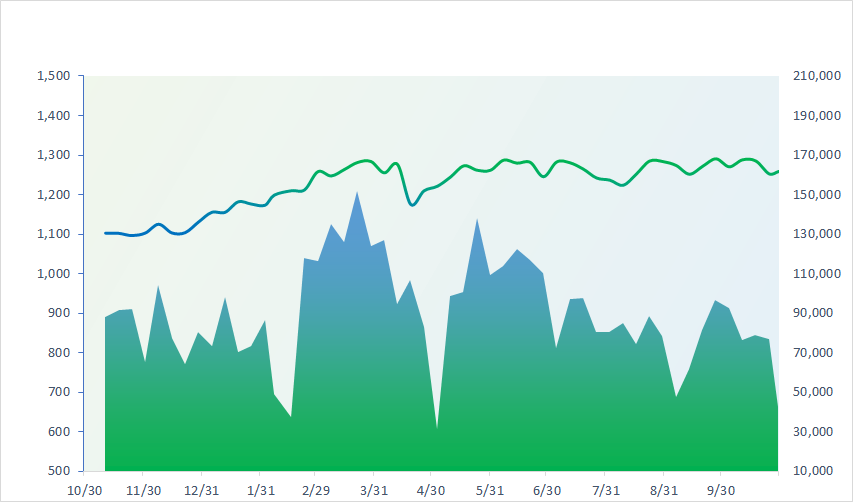

1,258.63

1D -0.25%

YTD 11.21%

225.88

1D 0.14%

YTD -1.79%

1,333.85

1D -0.14%

YTD 17.87%

92.46

1D 0.15%

YTD 5.57%

-146.16

1D 0.00%

YTD 0.00%

14,125.32

1D -28.43%

YTD -25.25%

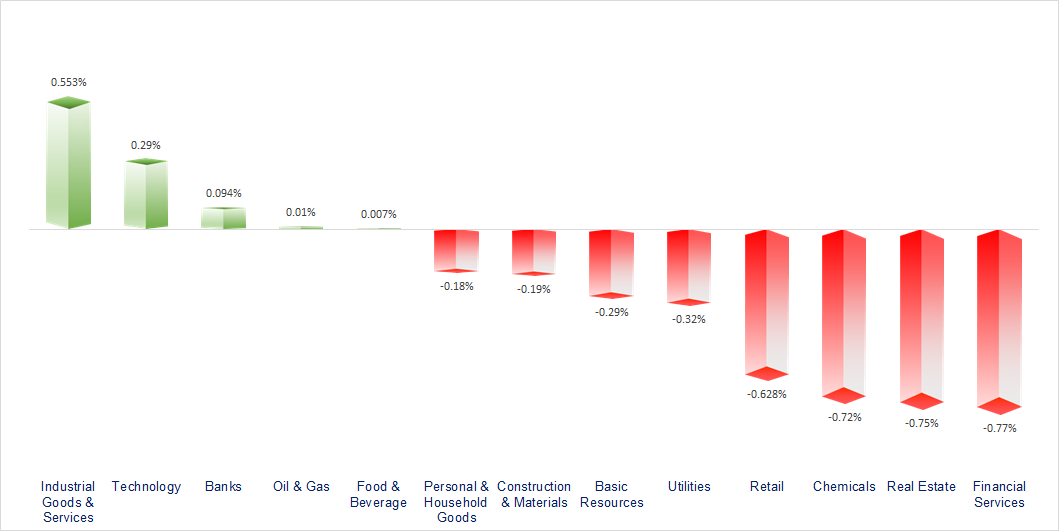

VNIndex fell due to profit-taking pressure from VHM. Entertainment services, industrial real estate and technology were the most active groups. In contrast, financial services, retail and real estate were quite gloomy.

ETF & DERIVATIVES

23,350

1D 0.17%

YTD 19.56%

16,040

1D -0.31%

YTD 19.26%

16,570

1D 0.00%

YTD 19.55%

20,300

1D 1.50%

YTD 19.55%

21,720

1D -0.14%

YTD 18.04%

33,180

1D 0.15%

YTD 27.47%

17,770

1D -0.06%

YTD 16.37%

1,342

1D 0.19%

YTD 0.00%

1,343

1D 0.10%

YTD 0.00%

1,341

1D 0.20%

YTD 0.00%

1,345

1D 0.43%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,277.39

1D 0.96%

YTD 17.37%

3,266.24

1D -0.61%

YTD 10.26%

20,380.64

1D -1.55%

YTD 21.40%

2,593.79

1D -0.92%

YTD -2.85%

79,982.92

1D -0.48%

YTD 11.25%

3,565.07

1D -0.35%

YTD 10.38%

1,445.61

1D -0.38%

YTD 0.85%

71.19

1D 0.15%

YTD -7.58%

2,782.30

1D 0.03%

YTD 33.97%

Asian stocks mostly fell, with the most negative indices in China as investors braced for the outcome of the US election that could have a major impact on the Chinese economy.

VIETNAM ECONOMY

3.74%

1D (bps) -90

YTD (bps) 14

4.60%

YTD (bps) -20

2.26%

1D (bps) 1

YTD (bps) 37

2.64%

1D (bps) 2

YTD (bps) 46

2545800.00%

1D (%) 0.00%

YTD (%) 3.87%

2816600.00%

1D (%) 0.04%

YTD (%) 2.89%

362000.00%

1D (%) -0.06%

YTD (%) 4.14%

The domestic USD exchange rate today continues to witness many downward adjustments at banks. Specifically, except for Techcombank, other banks have reduced the USD buying price by 8 to 40 VND.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Thai Binh - Nam Dinh strive to cooperate to start construction of nearly VND20 trillion highway project;

- Saudi Arabia's largest industrial investment group will expand investment in Vietnam;

- Thousands of billions of VND of bonds due in October are delayed in payment;

- EU imposes additional tariffs on electric cars imported from China;

- China may launch another stimulus package of more than USD1,400 billion;

- China's real estate market is expected to bottom out in 2025.

VN30

BANK

91,700

1D -0.33%

5D 0.22%

Buy Vol. 1,185,582

Sell Vol. 1,194,412

47,700

1D 0.32%

5D -1.45%

Buy Vol. 3,143,570

Sell Vol. 3,628,914

34,750

1D -0.57%

5D -0.86%

Buy Vol. 5,744,623

Sell Vol. 5,760,708

24,000

1D 1.05%

5D -0.83%

Buy Vol. 18,177,063

Sell Vol. 18,165,937

20,250

1D 0.00%

5D -0.98%

Buy Vol. 23,925,190

Sell Vol. 30,325,443

25,000

1D 0.00%

5D -0.99%

Buy Vol. 12,003,499

Sell Vol. 15,916,329

27,200

1D -0.37%

5D 0.93%

Buy Vol. 9,277,728

Sell Vol. 11,592,986

17,250

1D 0.88%

5D -2.27%

Buy Vol. 25,341,834

Sell Vol. 25,514,478

34,800

1D 2.20%

5D -2.79%

Buy Vol. 25,236,040

Sell Vol. 35,074,505

19,000

1D 1.33%

5D 1.60%

Buy Vol. 39,151,997

Sell Vol. 47,284,692

25,100

1D -0.40%

5D -1.18%

Buy Vol. 8,409,966

Sell Vol. 8,536,578

10,500

1D 0.00%

5D -1.41%

Buy Vol. 21,665,091

Sell Vol. 17,987,838

16,500

1D -0.60%

5D -0.90%

Buy Vol. 4,258,918

Sell Vol. 5,227,485

STB: Sacombank announced its third quarter profit of VND2,752 billion, up 32% year-on-year. In the first 9 months, Sacombank's profit reached VND8,094 billion, up 18% and fulfilling 76.4% of the plan. Sacombank's third quarter profit maintained its growth momentum thanks to net interest income being 31% higher than the same period last year.

OIL & GAS

70,600

1D -0.28%

5D -0.42%

Buy Vol. 587,185

Sell Vol. 841,822

12,050

1D 0.00%

5D -1.63%

Buy Vol. 5,312,664

Sell Vol. 8,208,662

41,400

1D -1.19%

5D -2.13%

Buy Vol. 1,256,465

Sell Vol. 2,141,617

POW: PV Power inaugurates first pilot electric vehicle charging station.

VINGROUP

41,000

1D -0.85%

5D -5.09%

Buy Vol. 3,791,121

Sell Vol. 5,072,961

41,150

1D -3.74%

5D -12.45%

Buy Vol. 47,447,256

Sell Vol. 46,308,307

18,200

1D 0.28%

5D -2.41%

Buy Vol. 8,595,607

Sell Vol. 12,158,918

VRE: In the first 9 months of the year, Vincom Retail recorded net revenue of VND6,811 billion, reaching 72% of the plan and PAT of VND3,010 billion, equivalent to 68% of the yearly plan.

FOOD & BEVERAGE

66,300

1D -1.04%

5D -1.49%

Buy Vol. 5,391,907

Sell Vol. 5,352,650

78,100

1D 0.13%

5D -1.64%

Buy Vol. 9,836,335

Sell Vol. 9,911,439

55,200

1D -0.36%

5D -1.43%

Buy Vol. 807,125

Sell Vol. 892,773

MSN: WinCommerce recorded a 9% increase in third quarter revenue over the same period, reaching over VND8,600 billion, and PAT also reached VND20 billion.

OTHERS

66,400

1D -0.60%

5D 1.22%

Buy Vol. 364,615

Sell Vol. 654,116

42,950

1D -0.69%

5D -0.81%

Buy Vol. 290,993

Sell Vol. 317,552

103,900

1D 0.00%

5D -0.48%

Buy Vol. 955,568

Sell Vol. 999,783

135,900

1D 0.37%

5D 1.27%

Buy Vol. 3,229,491

Sell Vol. 3,148,075

66,000

1D -0.75%

5D 0.46%

Buy Vol. 14,423,772

Sell Vol. 17,156,529

32,700

1D -0.76%

5D -2.39%

Buy Vol. 2,932,665

Sell Vol. 4,272,122

26,350

1D -1.31%

5D -2.04%

Buy Vol. 20,379,708

Sell Vol. 21,972,085

27,000

1D -0.18%

5D 2.08%

Buy Vol. 34,082,221

Sell Vol. 27,144,894

MWG: Mobile World has announced its business results for the first 9 months of 2024. Total revenue reached VND99,767 billion, up 15% over the same period in 2023 and completing 80% of the yearly plan.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

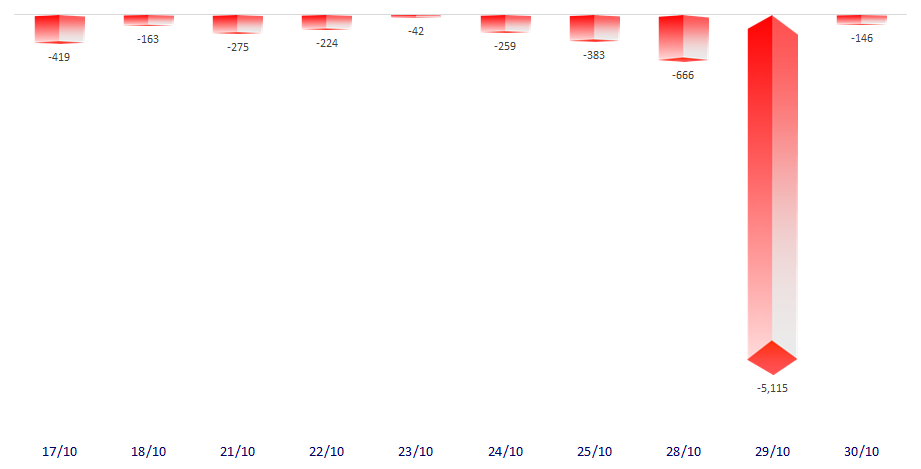

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

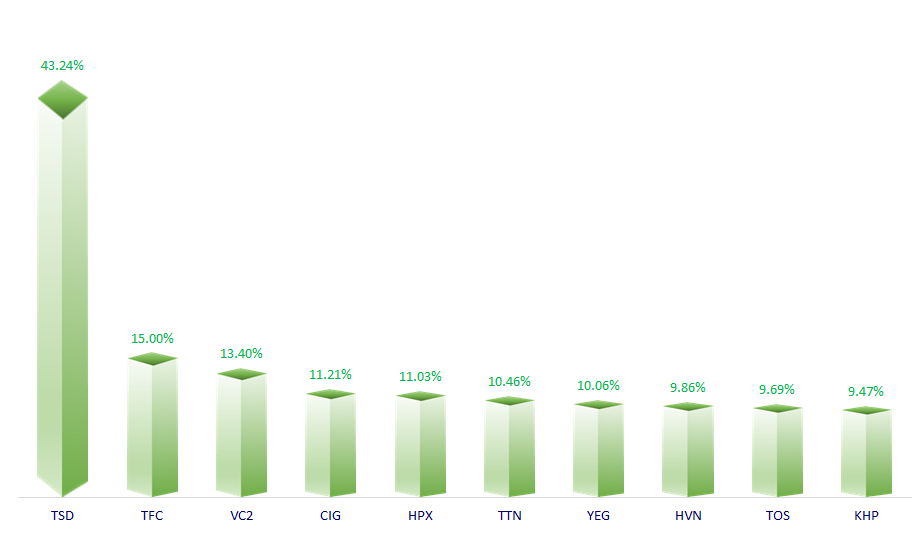

TOP INCREASES 3 CONSECUTIVE SESSIONS

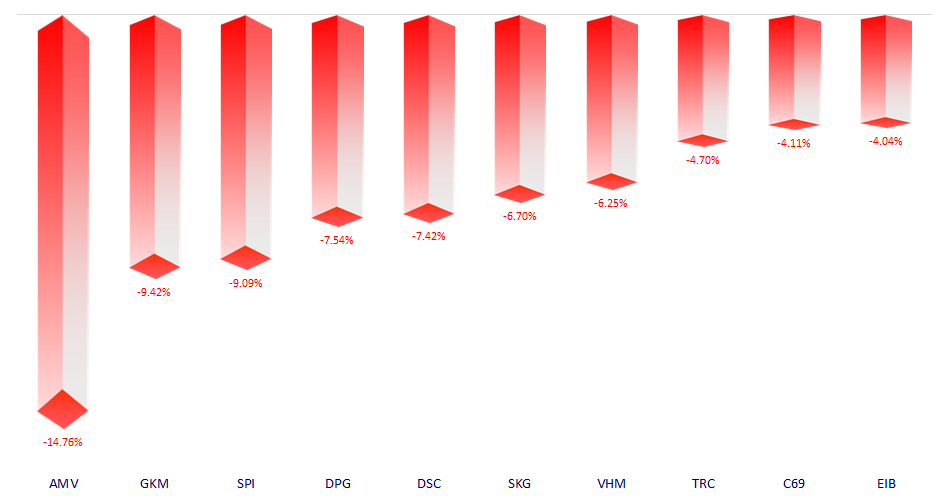

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.