Market brief 12/11/2024

VIETNAM STOCK MARKET

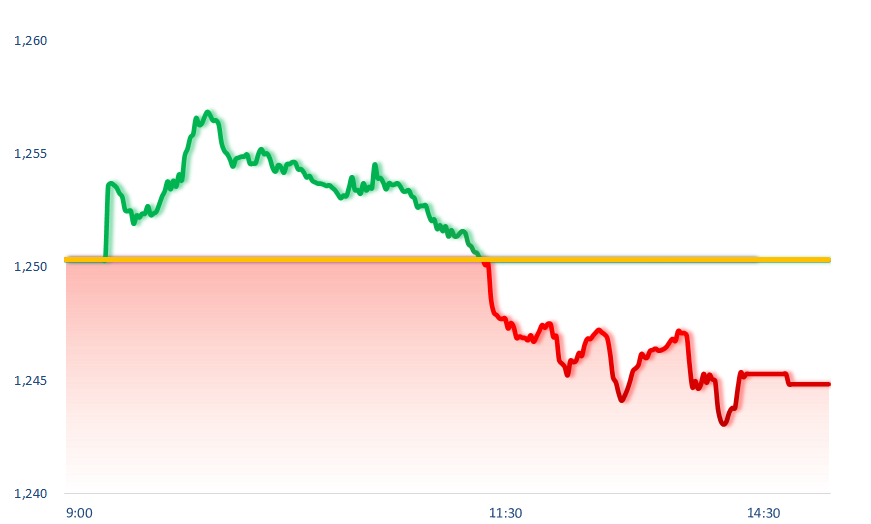

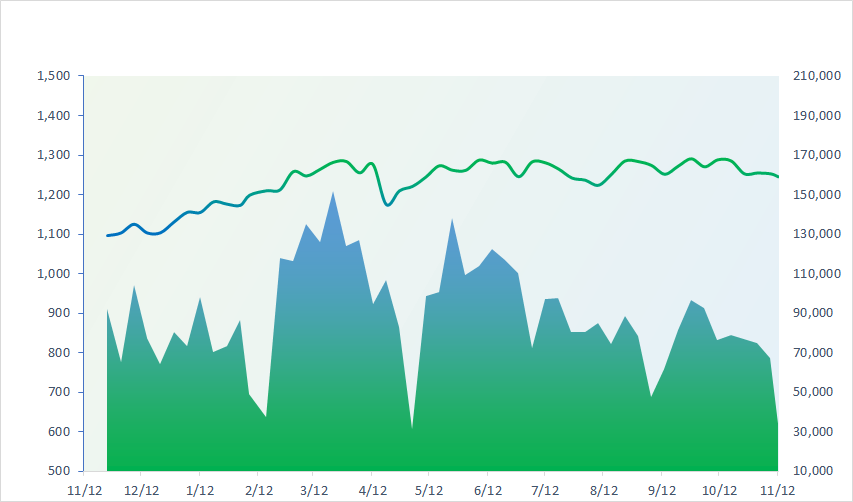

1,244.82

1D -0.44%

YTD 9.99%

226.69

1D -0.07%

YTD -1.43%

1,301.95

1D -0.65%

YTD 15.05%

92.39

1D -0.01%

YTD 5.49%

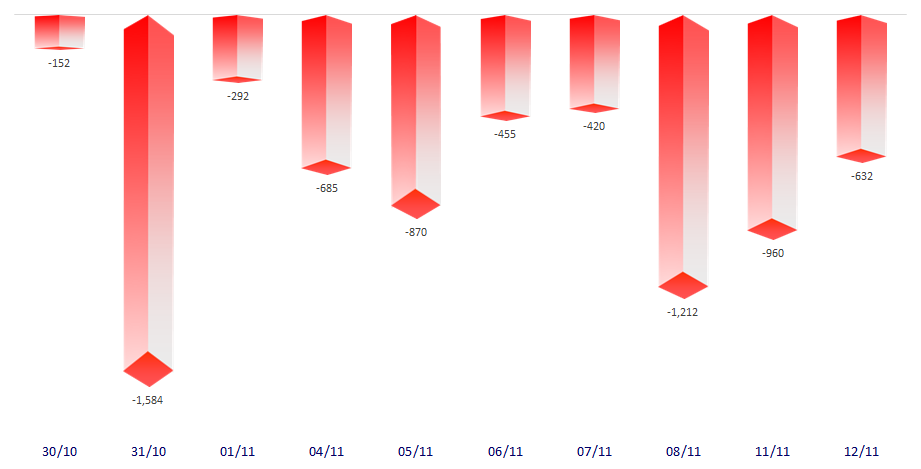

-632.29

1D 0.00%

YTD 0.00%

15,556.52

1D -26.47%

YTD -17.68%

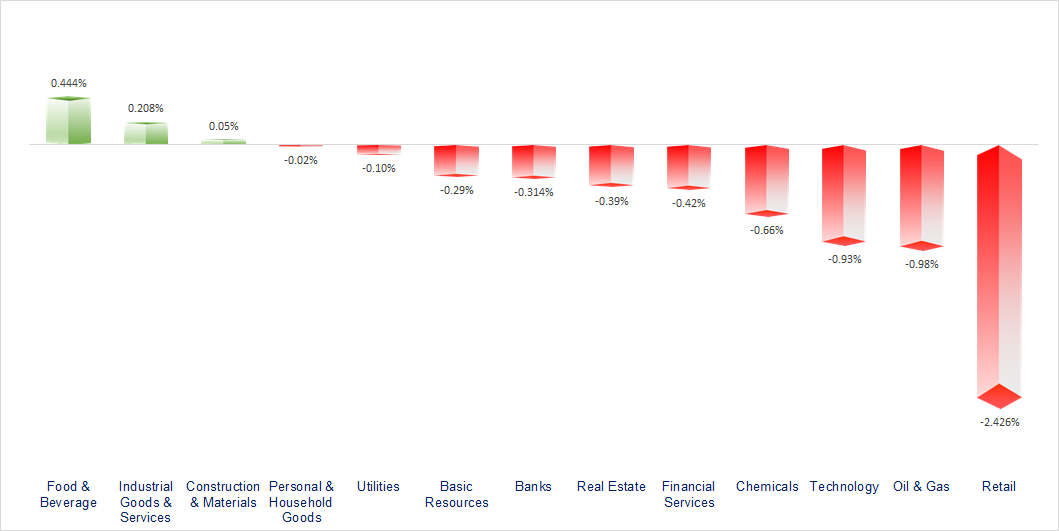

Vietnam's stock market fell for the fourth consecutive session. Retail, oil & gas and technology were the worst performers, while telecommunications continued to boom.

ETF & DERIVATIVES

22,900

1D -0.43%

YTD 17.26%

15,650

1D -1.14%

YTD 16.36%

16,500

1D 0.86%

YTD 19.05%

19,900

1D 1.74%

YTD 17.20%

21,300

1D 0.61%

YTD 15.76%

32,280

1D -0.25%

YTD 24.01%

17,460

1D 0.06%

YTD 14.34%

1,310

1D -0.77%

YTD 0.00%

1,313

1D -0.64%

YTD 0.00%

1,311

1D -0.77%

YTD 0.00%

1,312

1D -0.59%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,376.09

1D -0.40%

YTD 17.67%

3,421.97

1D -1.39%

YTD 15.52%

19,846.88

1D -2.84%

YTD 18.22%

2,482.57

1D -1.94%

YTD -7.01%

78,894.38

1D -0.76%

YTD 9.74%

3,705.01

1D -0.84%

YTD 14.71%

1,444.83

1D -0.80%

YTD 0.80%

72.10

1D -1.14%

YTD -6.39%

2,594.93

1D -2.76%

YTD 24.95%

Asian markets fell across the board as China's stimulus measures fell short of expectations. Investors' attention will now turn to US inflation data for October due this week.

VIETNAM ECONOMY

4.76%

1D (bps) 16

YTD (bps) 116

4.60%

YTD (bps) -20

2.10%

1D (bps) -1

YTD (bps) 22

2.67%

1D (bps) -2

YTD (bps) 49

2548000.00%

1D (%) 0.02%

YTD (%) 3.96%

2770600.00%

1D (%) 0.04%

YTD (%) 1.21%

357300.00%

1D (%) -0.42%

YTD (%) 2.79%

The domestic USD exchange rate today has recorded an increase again at banks. Specifically, except for Vietcombank, which slightly increased the USD buying price by 4 VND, the remaining banks increased significantly from 20 to 90 VND, the most at Techcombank. Currently, the USD buying price is in the range of 25,090 - 25,163 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Abundant orders, textile industry expected to reach export target of USD44 billion;

- Wood exports face many challenges when Mr. Donald Trump is elected US President;

- Elon Musk's company considers moving production to Vietnam;

- China imposes temporary anti-dumping tax on EU spirits;

- Mr. Ishiba is re-elected as Japanese Prime Minister;

- Bitcoin approaches the USD90,000 mark after a 1-day surge of more than USD9,000.

VN30

BANK

91,900

1D -0.11%

5D -0.76%

Buy Vol. 2,610,890

Sell Vol. 2,978,242

46,300

1D -0.43%

5D -2.32%

Buy Vol. 3,240,169

Sell Vol. 3,104,108

34,500

1D -1.29%

5D -1.57%

Buy Vol. 6,886,267

Sell Vol. 8,378,987

23,050

1D -0.65%

5D -1.71%

Buy Vol. 20,568,236

Sell Vol. 22,986,001

19,100

1D -0.52%

5D -3.05%

Buy Vol. 28,488,918

Sell Vol. 31,659,710

24,100

1D -0.82%

5D -1.43%

Buy Vol. 16,740,449

Sell Vol. 16,205,239

25,800

1D 0.98%

5D -0.96%

Buy Vol. 10,582,509

Sell Vol. 9,374,633

16,100

1D -0.62%

5D -2.72%

Buy Vol. 21,977,200

Sell Vol. 23,777,590

33,550

1D -0.74%

5D -3.73%

Buy Vol. 25,476,117

Sell Vol. 24,172,228

18,350

1D 0.82%

5D -0.81%

Buy Vol. 16,715,019

Sell Vol. 15,343,777

24,850

1D 0.00%

5D 0.40%

Buy Vol. 10,604,554

Sell Vol. 11,575,499

10,450

1D -0.48%

5D -0.95%

Buy Vol. 21,087,918

Sell Vol. 21,342,365

16,650

1D -0.30%

5D -0.60%

Buy Vol. 3,102,630

Sell Vol. 3,134,796

VPB: Sharing with investors in the recent meeting to update Q3 business results, VPBank's board of directors said that the bank will continue to adhere to its business orientation, focusing on traditional and emerging growth drivers including retail, SME and FDI, to optimize market opportunities and expand revenue sources for the bank in the last months of 2024.

OIL & GAS

69,800

1D -0.43%

5D 0.29%

Buy Vol. 863,068

Sell Vol. 1,422,290

11,700

1D 0.00%

5D 1.30%

Buy Vol. 13,690,804

Sell Vol. 12,852,525

39,400

1D 0.38%

5D -1.62%

Buy Vol. 1,519,821

Sell Vol. 1,201,741

POW: In the first 10 months of this year, PV Power recorded a total electricity output of nearly 12.7 billion kWh and revenue of nearly VND24,400 billion.

VINGROUP

40,550

1D -0.61%

5D -1.82%

Buy Vol. 4,352,060

Sell Vol. 4,197,586

40,300

1D -0.74%

5D -2.89%

Buy Vol. 26,258,985

Sell Vol. 24,461,047

18,000

1D 0.00%

5D 1.41%

Buy Vol. 9,222,914

Sell Vol. 10,733,070

VIC: VinFast sold 51,000 cars in 10 months, becoming the number 1 car company in Vietnam.

FOOD & BEVERAGE

64,900

1D -0.46%

5D -0.92%

Buy Vol. 3,120,870

Sell Vol. 3,645,967

72,500

1D -1.36%

5D -0.82%

Buy Vol. 7,343,157

Sell Vol. 7,649,712

56,600

1D 2.35%

5D 1.98%

Buy Vol. 2,246,929

Sell Vol. 2,439,152

SAB: Leaders and relatives simultaneously registered to divest all capital from Sabibeco.

OTHERS

67,800

1D 0.44%

5D 3.04%

Buy Vol. 470,854

Sell Vol. 998,671

45,200

1D -1.20%

5D 2.73%

Buy Vol. 863,184

Sell Vol. 1,043,538

104,500

1D 0.00%

5D 0.97%

Buy Vol. 919,126

Sell Vol. 1,199,860

136,800

1D -1.08%

5D 3.17%

Buy Vol. 4,414,303

Sell Vol. 6,061,547

60,800

1D -3.49%

5D -7.32%

Buy Vol. 16,268,247

Sell Vol. 18,673,488

32,900

1D -1.50%

5D 2.49%

Buy Vol. 3,359,949

Sell Vol. 5,762,332

25,700

1D 0.00%

5D -1.72%

Buy Vol. 17,899,516

Sell Vol. 20,268,940

27,500

1D -0.72%

5D 3.77%

Buy Vol. 37,631,996

Sell Vol. 56,955,063

BVH: With more than 742.3 million listed and outstanding shares, Bao Viet will have to spend approximately VND745 billion to pay dividends to existing shareholders. The ex-right date is November 19, the expected dividend payment date is December 20.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

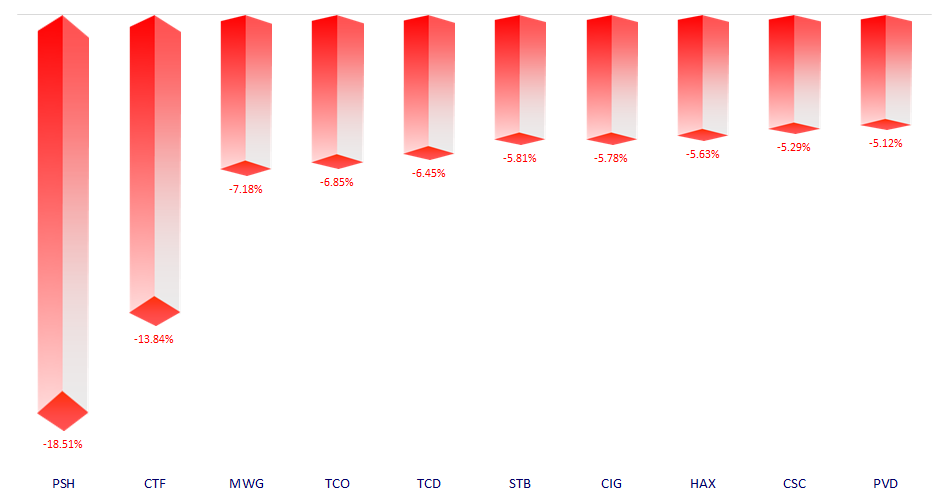

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.