Market brief 25/11/2024

VIETNAM STOCK MARKET

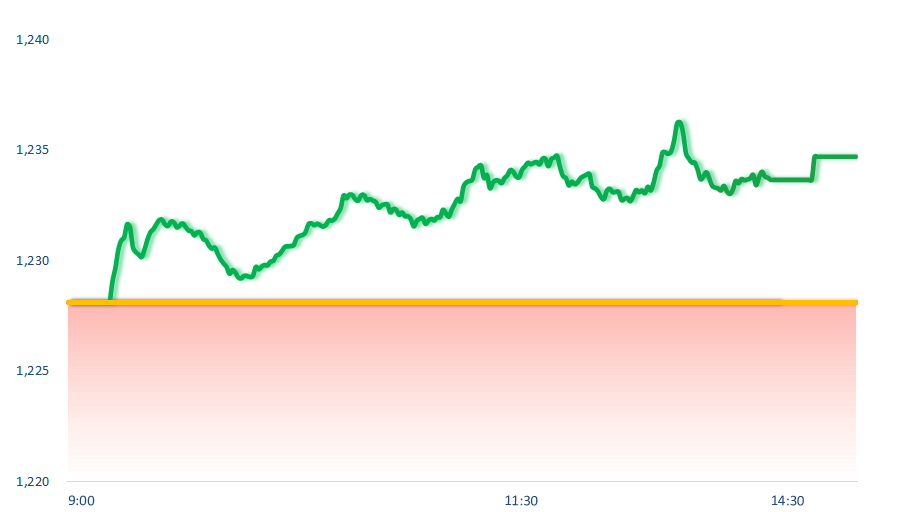

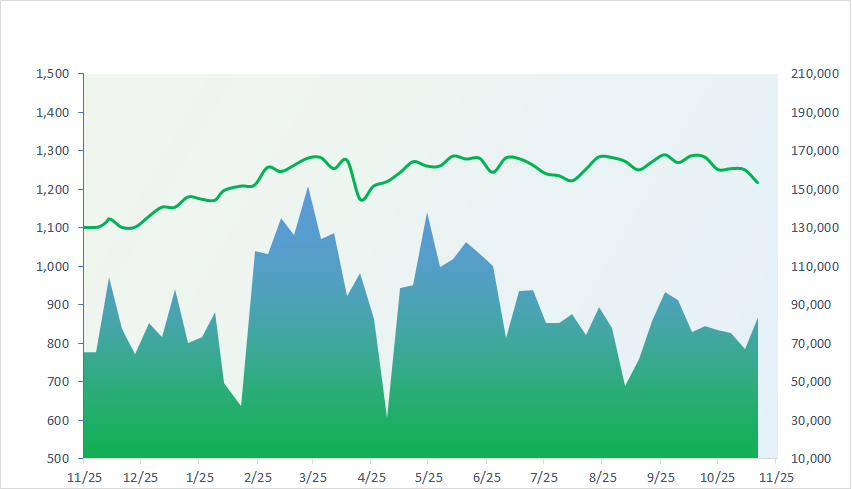

1,234.70

1D 0.54%

YTD 9.10%

225.25

1D 1.79%

YTD -2.06%

1,291.94

1D 0.46%

YTD 14.17%

91.82

1D 0.35%

YTD 4.84%

116.21

1D 0.00%

YTD 0.00%

13,046.94

1D -8.50%

YTD -30.96%

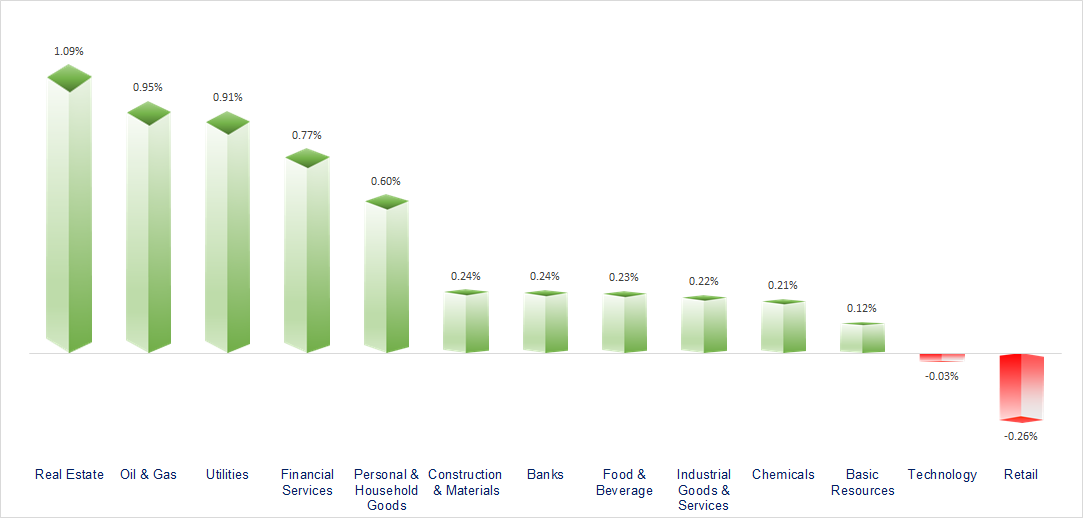

VNINDEX approaches the resistance zone of 1240, with foreign investors returning to net buying for the second consecutive session. The Real Estate, Oil & Gas, and Power sectors led the market with impressive growth, becoming the highlights of today's trading. In contrast, sectors such as Retail and Technology showed a lack of positivity in today's session.

ETF & DERIVATIVES

22,580

1D 0.36%

YTD 15.62%

15,550

1D 0.19%

YTD 15.61%

16,040

1D -0.25%

YTD 15.73%

19,020

1D -0.68%

YTD 12.01%

20,750

1D 0.10%

YTD 12.77%

31,830

1D 0.28%

YTD 22.28%

17,260

1D 0.41%

YTD 13.03%

1,298

1D 0.03%

YTD 0.00%

1,305

1D 0.28%

YTD 0.00%

1,304

1D 0.03%

YTD 0.00%

1,305

1D 0.20%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,780.14

1D 1.30%

YTD 15.89%

3,263.76

1D -0.10%

YTD 10.18%

19,150.99

1D -0.41%

YTD 14.07%

2,534.34

1D 1.32%

YTD -5.07%

80,109.88

1D 1.25%

YTD 11.43%

3,731.39

1D -0.39%

YTD 15.52%

1,443.31

1D -0.21%

YTD 0.69%

74.62

1D 0.11%

YTD -3.12%

2,671.00

1D -1.30%

YTD 28.61%

Asian stock markets mostly rose today, except for Hong Kong and China. Notably, Singapore recently released its October inflation index, which dropped to 1.4%, the lowest level since March 2021. Investors are awaiting a series of economic data this week, including China’s industrial data, India’s third-quarter GDP numbers, and the interest rate decision from South Korea’s central bank.

VIETNAM ECONOMY

5.48%

1D (bps) 88

YTD (bps) 188

4.60%

YTD (bps) -20

2.28%

1D (bps) 4

YTD (bps) 40

2.65%

1D (bps) 2

YTD (bps) 47

2550600.00%

1D (%) -0.01%

YTD (%) 4.06%

2739435.00%

1D (%) 0.92%

YTD (%) 0.07%

356602.00%

1D (%) 0.02%

YTD (%) 2.59%

The black market exchange rate surged today to 25,840 VND/USD, with both the buying and selling sides increasing by VND90 compared to the end of last week.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The General Secretary, To Lam, chaired the 13th Central Committee's Executive Committee meeting;

- Exports and imports exceeded USD681 billion;

- Bus fares increased by 40-60% during the Lunar New Year;

- Concerns about trade wars pushed the euro to its lowest level in 2 years;

- Germany's economy showed low growth in Q3/2024;

- Russia has regained its position as the main natural gas supplier to the EU.

VN30

BANK

91,300

1D 0.77%

5D 0.33%

Buy Vol. 3,176,550

Sell Vol. 3,056,414

45,550

1D -0.33%

5D 2.47%

Buy Vol. 1,987,915

Sell Vol. 2,992,057

35,100

1D 0.29%

5D 5.41%

Buy Vol. 6,417,644

Sell Vol. 8,490,498

23,500

1D 0.00%

5D 4.68%

Buy Vol. 14,926,808

Sell Vol. 17,814,409

19,050

1D 0.00%

5D 1.87%

Buy Vol. 14,243,171

Sell Vol. 22,258,341

23,950

1D -0.21%

5D 2.35%

Buy Vol. 10,559,795

Sell Vol. 11,300,492

24,700

1D 0.00%

5D 0.61%

Buy Vol. 11,461,751

Sell Vol. 10,601,563

16,150

1D 0.31%

5D 0.94%

Buy Vol. 12,401,664

Sell Vol. 15,067,550

32,850

1D 0.61%

5D 0.77%

Buy Vol. 12,231,923

Sell Vol. 12,037,206

18,500

1D 1.65%

5D 1.65%

Buy Vol. 20,015,866

Sell Vol. 18,670,616

24,900

1D -0.20%

5D 1.63%

Buy Vol. 6,630,753

Sell Vol. 10,148,693

10,300

1D 0.49%

5D 0.98%

Buy Vol. 18,230,712

Sell Vol. 21,107,373

16,850

1D -0.30%

5D 0.00%

Buy Vol. 3,590,443

Sell Vol. 3,453,664

HDB: HDBank has just announced the resolution of its Board of Directors regarding the organization of an extraordinary general meeting in 2024 to approve strategic personnel plans aligned with sustainable development goals in the new phase.

OIL & GAS

69,300

1D 0.14%

5D 0.43%

Buy Vol. 1,633,801

Sell Vol. 1,860,755

12,150

1D 6.58%

5D 7.52%

Buy Vol. 48,399,881

Sell Vol. 26,253,904

39,400

1D 0.64%

5D 4.51%

Buy Vol. 769,140

Sell Vol. 1,275,483

POW: PV Power has signed a partnership agreement with Vingroup Group to develop a nationwide electric vehicle charging station system.

VINGROUP

41,000

1D 1.36%

5D 1.49%

Buy Vol. 3,690,067

Sell Vol. 3,714,933

42,700

1D 2.64%

5D 4.66%

Buy Vol. 10,098,644

Sell Vol. 9,178,140

18,250

1D 0.83%

5D 0.83%

Buy Vol. 12,208,340

Sell Vol. 13,178,256

VIC: On November 22, just over 9 months after entering the Indonesian market, VinFast officially delivered two electric car models in the most popular segments, the VF5 and VFe34.

FOOD & BEVERAGE

64,300

1D 0.00%

5D 1.74%

Buy Vol. 3,557,344

Sell Vol. 4,174,730

72,200

1D 1.69%

5D 2.70%

Buy Vol. 8,557,462

Sell Vol. 9,817,646

55,500

1D 0.18%

5D 0.00%

Buy Vol. 823,557

Sell Vol. 972,962

SAB: Sabeco has just inaugurated the Sabeco Beer Industry Research and Development Center (SRC).

OTHERS

65,700

1D -0.15%

5D -1.94%

Buy Vol. 316,124

Sell Vol. 339,816

44,250

1D 0.11%

5D 3.40%

Buy Vol. 769,510

Sell Vol. 1,066,560

102,800

1D 1.08%

5D 1.08%

Buy Vol. 1,203,353

Sell Vol. 1,043,007

133,900

1D 0.00%

5D -0.07%

Buy Vol. 3,343,678

Sell Vol. 4,378,507

59,000

1D 0.00%

5D 0.17%

Buy Vol. 6,806,283

Sell Vol. 9,847,502

30,900

1D 0.00%

5D -0.80%

Buy Vol. 3,865,192

Sell Vol. 4,406,361

24,500

1D 0.62%

5D 0.82%

Buy Vol. 21,150,833

Sell Vol. 20,100,066

26,300

1D 0.77%

5D 1.94%

Buy Vol. 25,796,981

Sell Vol. 28,549,408

BCM: Becamex plans to issue 10,800 bonds and offer 300 million shares, aiming to raise a total of over VND16,000 billion for financial restructuring and investment in key projects.

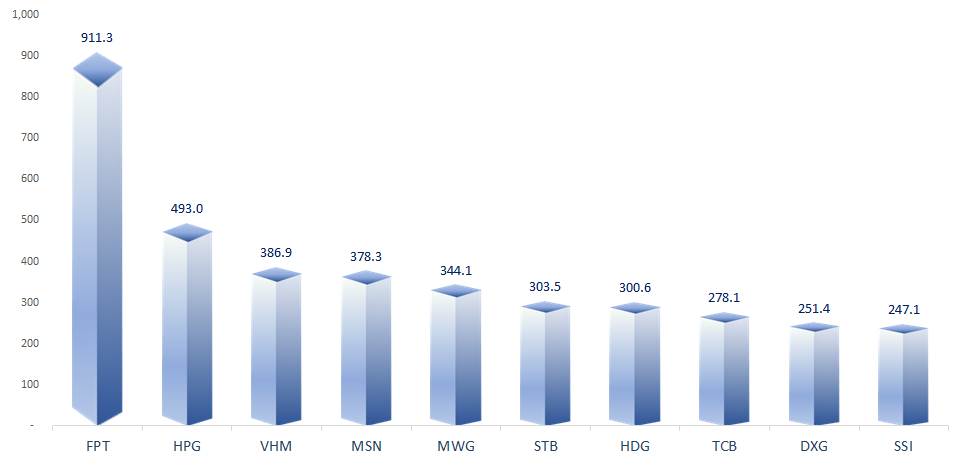

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

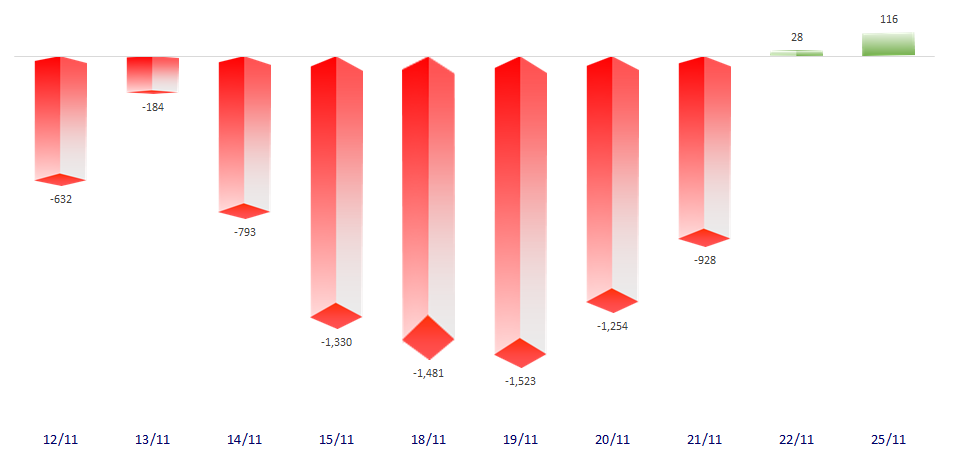

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

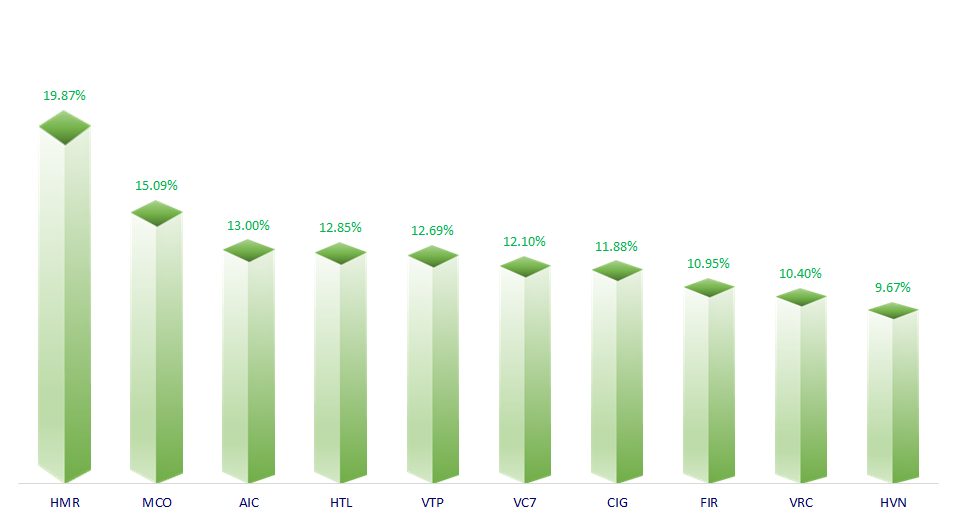

TOP INCREASES 3 CONSECUTIVE SESSIONS

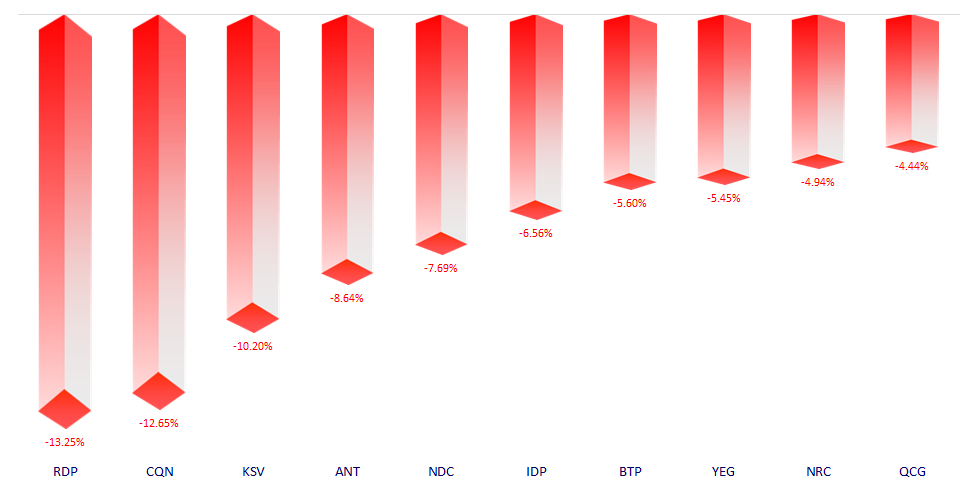

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.