Market Brief 09/12/2024

VIETNAM STOCK MARKET

1,273.84

1D 0.29%

YTD 12.56%

229.21

1D 0.12%

YTD -0.34%

1,336.18

1D -0.08%

YTD 18.07%

92.91

1D 0.11%

YTD 6.09%

-488.41

1D 0.00%

YTD 0.00%

18,410.65

1D -29.01%

YTD -2.57%

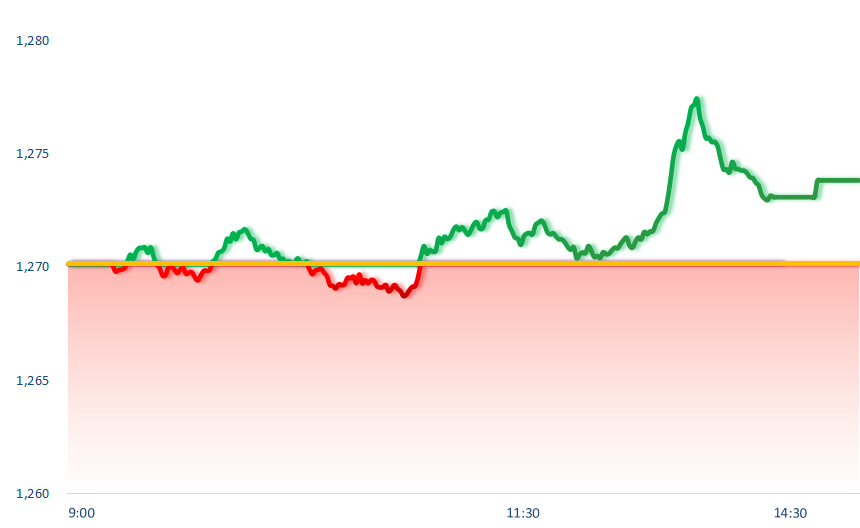

Today, VNIndex fluctuated strongly at 1,275 points. The real estate group was filled with green, led by HDG +2.81%, DXG +1.69%, followed by DIG +0.72%, PDR +0.91%. The electricity group continued to attract cash flow, with TTA hitting the ceiling, QTP +3.6%, TV2 +2.4% and POW +0.4%.

ETF & DERIVATIVES

23,350

1D 0.00%

YTD 19.56%

16,200

1D 0.43%

YTD 20.45%

16,580

1D -0.30%

YTD 19.62%

19,970

1D -0.25%

YTD 17.61%

21,550

1D 0.51%

YTD 17.12%

33,270

1D 0.24%

YTD 27.81%

17,840

1D -0.06%

YTD 16.83%

1,340

1D -0.16%

YTD 0.00%

1,345

1D -0.13%

YTD 0.00%

1,347

1D 0.08%

YTD 0.00%

1,345

1D -0.22%

YTD 0.00%

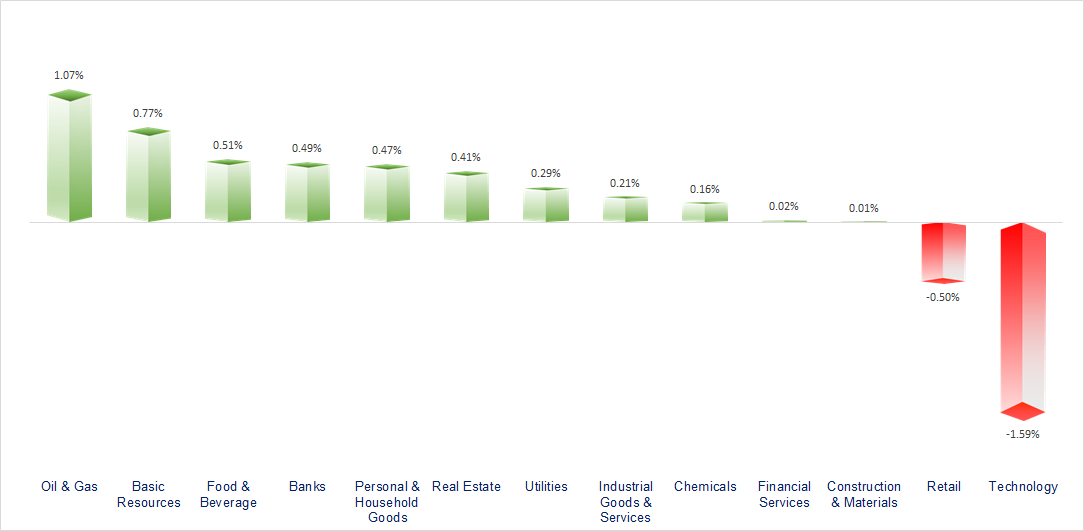

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

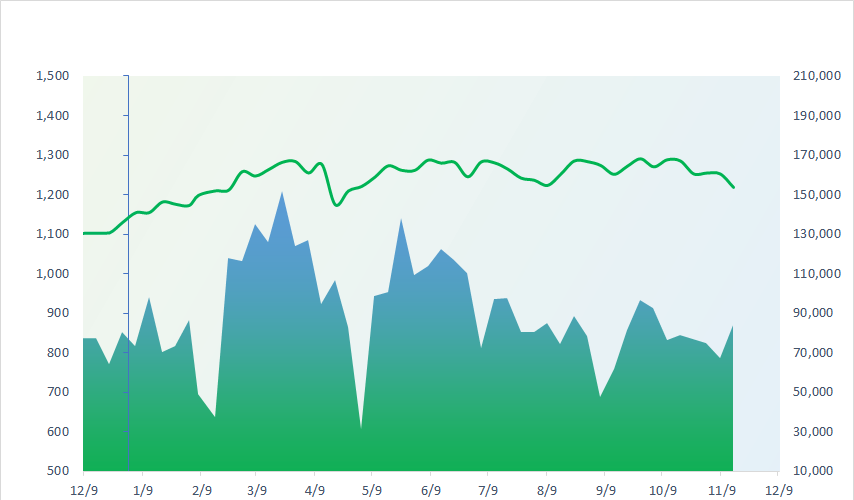

VNINDEX (12M)

GLOBAL MARKET

39,160.50

1D 0.18%

YTD 17.02%

3,402.53

1D -0.05%

YTD 14.86%

20,414.09

1D 2.76%

YTD 21.60%

2,360.58

1D -2.78%

YTD -11.58%

81,508.46

1D -0.26%

YTD 13.38%

3,794.92

1D -0.03%

YTD 17.49%

1,447.53

1D -0.31%

YTD 0.99%

71.96

1D 0.76%

YTD -6.58%

2,657.95

1D 0.44%

YTD 27.99%

Hong Kong’s Hang Seng index jumped nearly 3% in its final hour of trade, after china vowed “more proactive” fiscal measures and “moderately” looser monetary policy next year to boost domestic consumption. Prior to the news, mainland China’s index fell after China’s consumer price growth came in below expectations in November. CPI rose 0.2% year on year, down from a 0.3% increase in October, according to the National Bureau of Statistics on Monday. Economists from Reuters forecast price growth of 0.5%.

VIETNAM ECONOMY

4.05%

1D (bps) 5

YTD (bps) 45

4.60%

YTD (bps) -20

2.27%

1D (bps) -6

YTD (bps) 39

2.60%

1D (bps) -11

YTD (bps) 42

2546000.00%

1D (%) -0.03%

YTD (%) 3.88%

2755484.00%

1D (%) -0.19%

YTD (%) 0.65%

354841.00%

1D (%) -0.15%

YTD (%) 2.08%

Amid high credit demand at the end of the year, deposit interest rates have risen again in November. Many banks, such as MB, VIB, and MSB, have adjusted to increase deposit interest rates across various terms. According to data from SBV, credit growth as of December 7 has increased by 12.5% compared to the end of 2023. Meanwhile, during the same period last year, credit growth was only around 9%. At the same time, capital mobilization reached VND14.8 trillion, with a growth rate of 7.36%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- As of December 7, credit growth reached 12.5%;

- National Assembly approved a plan to remove difficulties for Vietnam Airlines;

- Vietnam's rice exports hit a new record;

- Korean politics in turmoil: Prime Minister will replace President to handle state affairs;

- Trump calls for "immediate" ceasefire in Ukraine, says a U.S. withdrawal from NATO is possible;

- China's central bank resumed buying gold for its reserves in November after a six-month pause.

VN30

BANK

95,300

1D 1.17%

5D 1.17%

Buy Vol. 3,526,333

Sell Vol. 3,543,935

46,700

1D 0.21%

5D 0.43%

Buy Vol. 3,522,756

Sell Vol. 4,646,936

36,450

1D 0.55%

5D 1.67%

Buy Vol. 9,448,515

Sell Vol. 8,754,482

24,150

1D 0.00%

5D 2.11%

Buy Vol. 17,242,382

Sell Vol. 15,570,484

19,400

1D 0.26%

5D 1.04%

Buy Vol. 35,273,779

Sell Vol. 35,673,474

24,400

1D 0.21%

5D 1.04%

Buy Vol. 13,542,842

Sell Vol. 13,023,014

27,000

1D 0.56%

5D 6.30%

Buy Vol. 13,364,056

Sell Vol. 17,993,793

16,400

1D 0.92%

5D 1.86%

Buy Vol. 18,422,648

Sell Vol. 20,433,462

34,000

1D 0.59%

5D 2.72%

Buy Vol. 10,495,218

Sell Vol. 14,024,981

19,300

1D 0.26%

5D 2.39%

Buy Vol. 10,118,273

Sell Vol. 14,050,815

25,500

1D -0.58%

5D 1.39%

Buy Vol. 10,270,176

Sell Vol. 12,023,746

10,350

1D 0.00%

5D 0.49%

Buy Vol. 24,664,669

Sell Vol. 26,746,080

17,300

1D 0.29%

5D 2.06%

Buy Vol. 3,889,056

Sell Vol. 3,692,941

BID: The State Bank of Vietnam has approved BIDV to increase its charter capital by VND11,971 billion by issuing shares to pay dividends. After completion, BIDV's charter capital is expected to increase from VND57,004 billion to VND68,975 billion.

OIL & GAS

69,300

1D 0.14%

5D 0.14%

Buy Vol. 941,273

Sell Vol. 923,334

12,500

1D 0.40%

5D 0.81%

Buy Vol. 11,443,120

Sell Vol. 13,994,498

40,150

1D -0.74%

5D 1.01%

Buy Vol. 1,143,260

Sell Vol. 1,341,531

World oil prices climbed on Monday after the fall of Syrian President Bashar al-Assad's regime introduced greater uncertainty to the Middle East.

VINGROUP

41,850

1D 0.00%

5D 3.72%

Buy Vol. 5,199,460

Sell Vol. 9,016,058

41,450

1D -0.12%

5D 1.72%

Buy Vol. 7,018,323

Sell Vol. 8,748,091

17,700

1D 0.00%

5D -0.84%

Buy Vol. 10,085,769

Sell Vol. 11,447,665

VinFast urgently recruits staff for its electric car factory in Ha Tinh.

FOOD & BEVERAGE

64,100

1D 0.00%

5D -0.62%

Buy Vol. 3,816,807

Sell Vol. 3,697,445

73,200

1D -0.27%

5D 0.83%

Buy Vol. 4,408,000

Sell Vol. 5,128,069

57,500

1D -0.35%

5D 2.31%

Buy Vol. 1,145,015

Sell Vol. 1,060,015

VNM: Vinamilk plans to pay the second interim dividend of 2024 at the end of February 2025. The total dividend payment ratio is 5% in cash (500 VND/share).

OTHERS

67,900

1D 0.89%

5D 2.11%

Buy Vol. 433,245

Sell Vol. 714,909

51,700

1D -0.58%

5D 5.51%

Buy Vol. 1,703,689

Sell Vol. 1,646,686

102,700

1D -0.10%

5D 0.39%

Buy Vol. 1,198,381

Sell Vol. 979,249

147,000

1D -1.67%

5D 3.38%

Buy Vol. 8,213,835

Sell Vol. 8,544,164

61,100

1D 0.00%

5D 1.16%

Buy Vol. 7,149,400

Sell Vol. 8,718,720

32,100

1D 0.16%

5D 2.07%

Buy Vol. 3,853,891

Sell Vol. 5,546,052

26,200

1D -0.57%

5D 7.16%

Buy Vol. 35,317,082

Sell Vol. 32,747,821

27,650

1D 0.18%

5D 2.79%

Buy Vol. 42,937,940

Sell Vol. 39,222,596

HPG: Hoa Phat Dung Quat Steel accounts for 65% of Quang Ngai province's import-export revenue.

Market by numbers

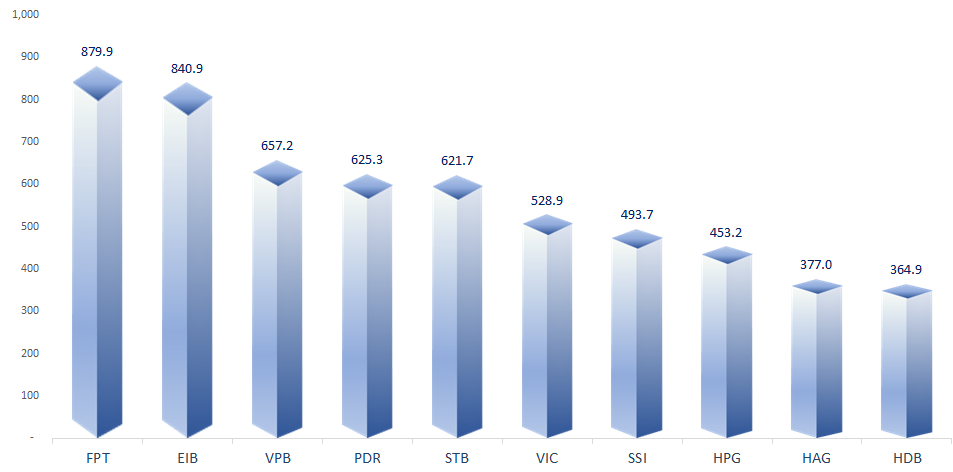

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

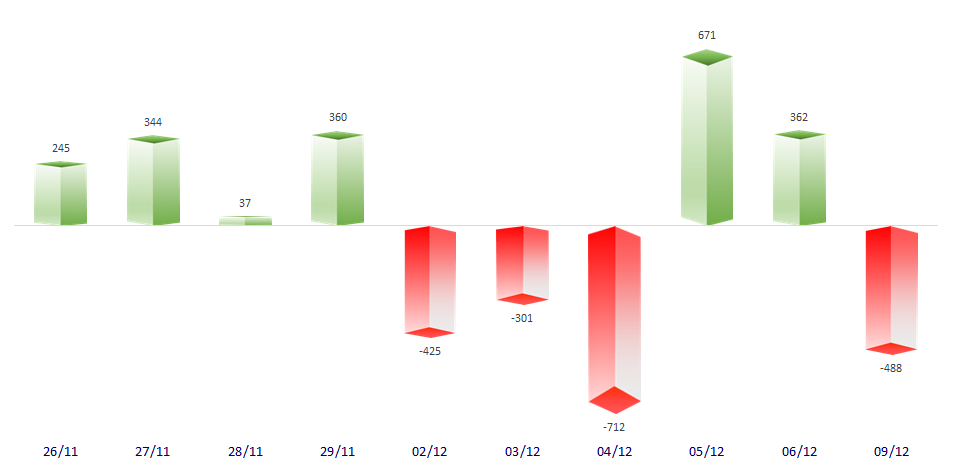

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

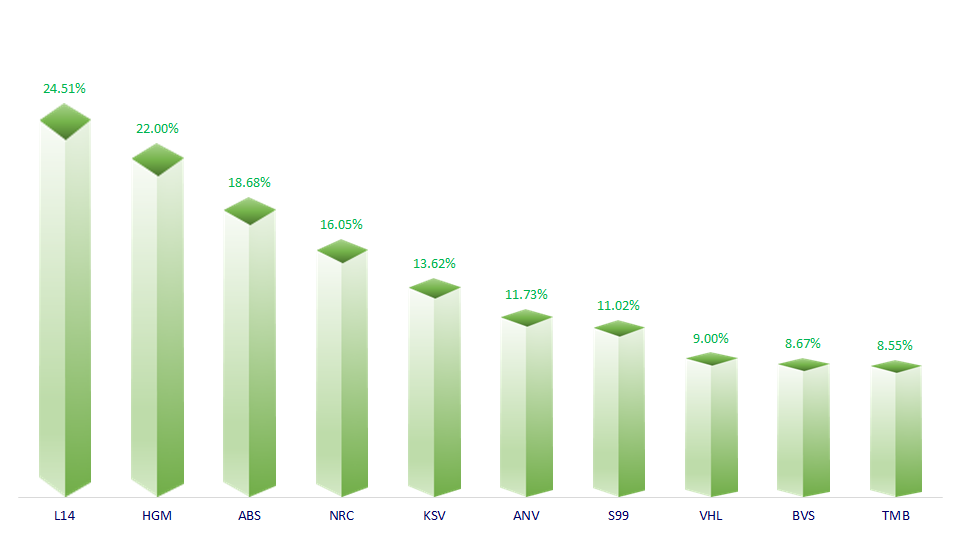

TOP INCREASES 3 CONSECUTIVE SESSIONS

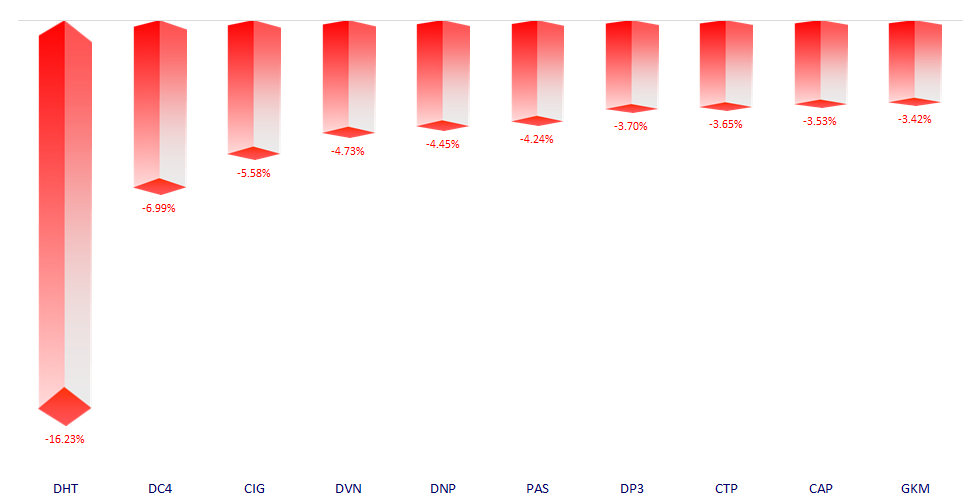

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.