Market brief 22/01/2025

VIETNAM STOCK MARKET

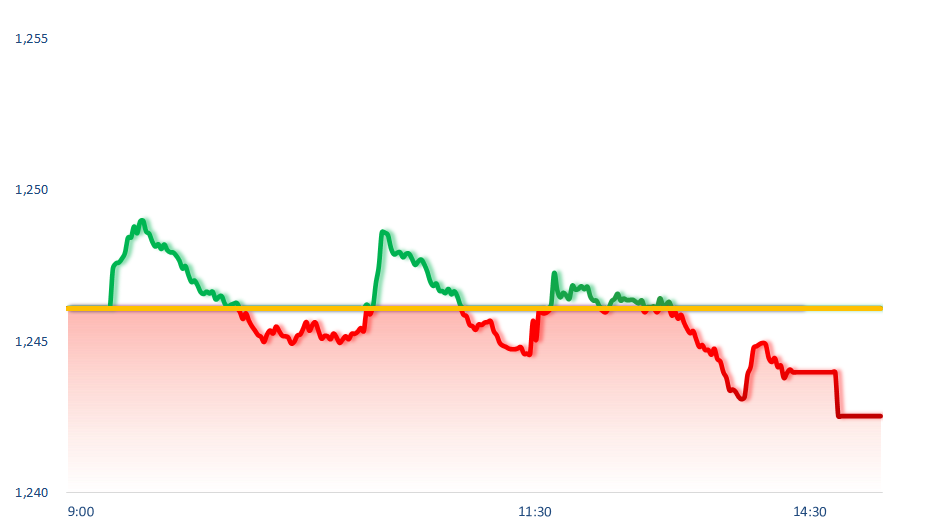

1,242.53

1D -0.29%

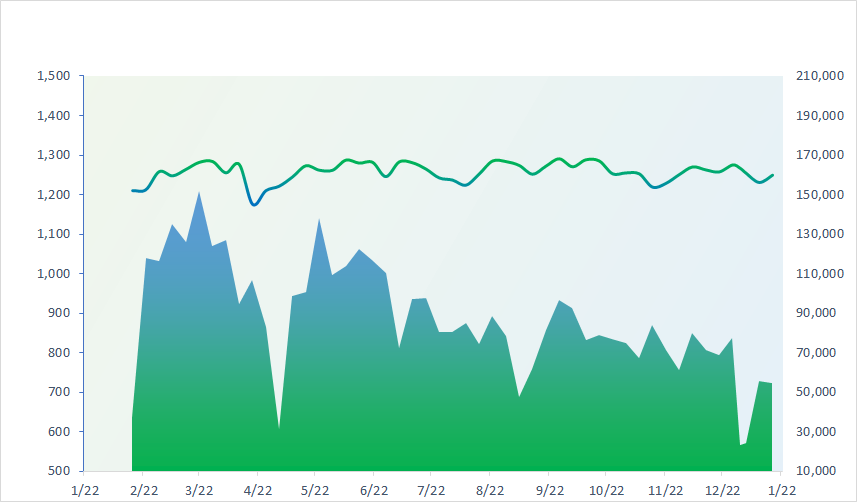

YTD -1.91%

220.67

1D -0.46%

YTD -2.97%

1,309.72

1D -0.39%

YTD -2.60%

93.08

1D 0.26%

YTD -2.08%

-257.90

1D 0.00%

YTD 0.00%

13,852.30

1D -23.60%

YTD -23.60%

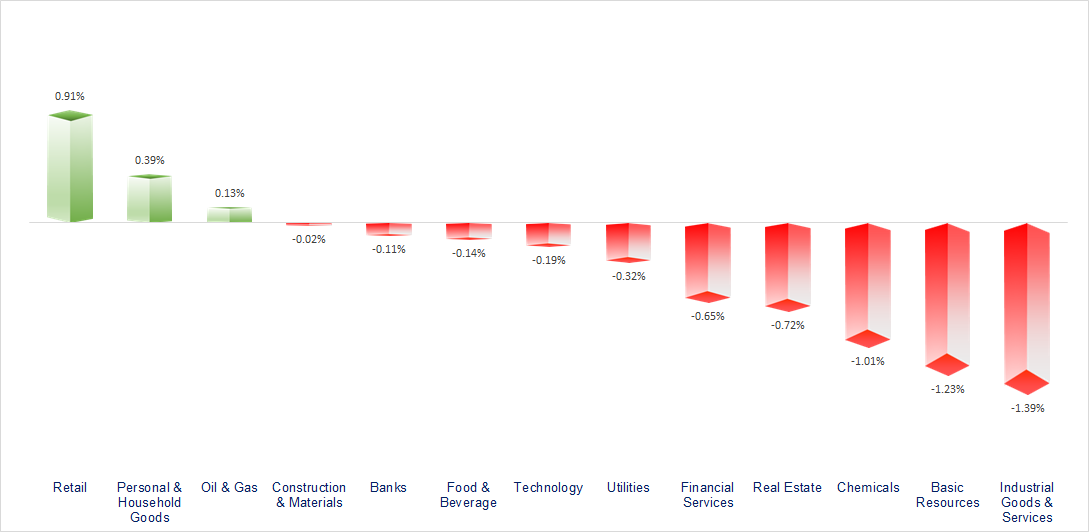

VNIndex declined for three consecutive sessions under the pressure of profit-taking ahead of the Tet holiday, while foreign investors continued to net sell for more than 10 consecutive sessions. Almost all sectors were in the red, except for Telecommunications, Retail, and Pharmaceuticals, which were the rare sectors that saw gains.

ETF & DERIVATIVES

22,900

1D -0.69%

YTD -2.47%

15,890

1D 0.00%

YTD -2.40%

16,300

1D -0.55%

YTD -2.40%

19,600

1D -0.86%

YTD -2.49%

21,300

1D -0.93%

YTD -3.62%

32,310

1D -0.58%

YTD -3.61%

17,490

1D -0.57%

YTD -2.40%

1,321

1D -0.17%

YTD 0.00%

1,328

1D 0.05%

YTD 0.00%

1,330

1D -0.18%

YTD 0.00%

1,331

1D 0.02%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,646.25

1D 1.58%

YTD -0.62%

3,213.62

1D -0.89%

YTD -4.12%

19,778.77

1D -1.63%

YTD -1.40%

2,547.06

1D 1.15%

YTD 6.15%

76,402.00

1D 0.75%

YTD -2.77%

3,781.21

1D -0.37%

YTD -0.17%

1,361.44

1D 0.65%

YTD -2.77%

79.60

1D 0.39%

YTD 6.06%

2,759.97

1D 0.40%

YTD 4.74%

The Asian markets showed mixed trends, with Hong Kong and China leading the decline after U.S. President Donald Trump recently stated in an interview that he is considering imposing a 10% tariff on goods from China starting early next month.

VIETNAM ECONOMY

3.95%

1D (bps) -5

YTD (bps) -2

4.60%

2.54%

1D (bps) 3

YTD (bps) 6

2.93%

YTD (bps) 8

2532000.00%

1D (%) -0.51%

YTD (%) -0.90%

2693282.00%

1D (%) 0.03%

YTD (%) -1.22%

350911.00%

1D (%) -0.53%

YTD (%) -1.46%

Gold prices have risen to their highest level in over two months, thanks to a weaker USD and as the market rushes into safe-haven assets amidst uncertainty surrounding U.S. President Donald Trump's potential tariff. In the domestic market, the price of SJC gold bars increased by 800,000 VND/tael in both sides, reaching VND86 million for bid price and 88 million VND for ask price.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Top 10 provinces and cities attracting FDI: Only two leading localities have reached over USD10 billion;

- Approval of the investment policy adjustment for the Mỹ Xuân International Multi-purpose Port project;

- Disbursement of 2024 planned capital reached 72.9%;

- Upon taking office, President Trump 'shakes hands' with a series of billionaires to invest USD500 billion in the world's 'hottest' sector;

- Mr. Trump considers a 10% tariff on Chinese goods, potentially to be imposed as early as February 1;

- South Korea: President Yoon Suk-yeol appears in court, denying all charges.

VN30

BANK

91,200

1D -0.22%

5D -0.22%

Buy Vol. 2,041,662

Sell Vol. 1,901,440

39,500

1D -0.75%

5D 0.77%

Buy Vol. 3,752,901

Sell Vol. 4,192,395

37,300

1D 0.00%

5D 1.50%

Buy Vol. 7,723,409

Sell Vol. 11,211,062

24,200

1D 0.00%

5D 2.11%

Buy Vol. 13,888,812

Sell Vol. 17,984,480

18,350

1D -0.27%

5D -0.27%

Buy Vol. 21,199,187

Sell Vol. 18,894,730

21,800

1D -0.23%

5D 2.11%

Buy Vol. 10,698,386

Sell Vol. 15,417,547

22,000

1D -2.87%

5D 1.62%

Buy Vol. 28,377,798

Sell Vol. 31,248,917

16,100

1D -0.62%

5D 0.63%

Buy Vol. 9,435,177

Sell Vol. 13,986,482

36,350

1D 0.83%

5D 3.56%

Buy Vol. 12,726,882

Sell Vol. 16,249,182

19,950

1D -0.75%

5D 1.53%

Buy Vol. 15,449,029

Sell Vol. 14,772,169

24,850

1D -0.40%

5D -0.20%

Buy Vol. 6,188,485

Sell Vol. 7,424,645

10,150

1D -0.49%

5D 0.00%

Buy Vol. 18,541,202

Sell Vol. 24,982,744

18,750

1D 1.63%

5D 5.93%

Buy Vol. 3,605,301

Sell Vol. 3,470,363

ACB: Asia Commercial Bank (ACB) has just announced its business results for 2024, with pre-tax profit reaching over VND21,000 billion, an increase of 5% compared to 2023. Notably, interest income increased by 11.4% due to credit growth, while service fee income rose by 10.8% thanks to the diversification of fee sources. The CIR ratio is well controlled, reduced to 32.5%. ROE reached 22%, placing it among the highest in the industry.

OIL & GAS

66,800

1D -0.45%

5D 0.00%

Buy Vol. 690,527

Sell Vol. 979,678

11,300

1D -0.88%

5D -5.04%

Buy Vol. 7,508,022

Sell Vol. 7,266,182

39,150

1D -1.76%

5D -2.13%

Buy Vol. 2,073,352

Sell Vol. 2,527,389

At 16:15 (Vietnam time) today, Brent oil prices rebounded by over 0.4% to 79.7 USD/barrel, while WTI crude oil also recovered by 0.5% to 76.25 USD/barrel.

VINGROUP

40,400

1D -0.12%

5D 0.37%

Buy Vol. 1,810,820

Sell Vol. 2,491,975

39,500

1D -1.25%

5D -1.25%

Buy Vol. 5,207,700

Sell Vol. 8,208,701

16,300

1D -1.81%

5D -1.21%

Buy Vol. 5,685,492

Sell Vol. 10,095,777

VHM: Long An has handed over more than 121 hectares of land for Vinhomes’ VND28,200 billion mega project.

FOOD & BEVERAGE

61,600

1D -0.32%

5D -0.16%

Buy Vol. 3,606,658

Sell Vol. 3,829,694

65,200

1D -0.76%

5D -0.91%

Buy Vol. 4,267,100

Sell Vol. 4,999,466

53,700

1D 0.19%

5D -2.36%

Buy Vol. 650,046

Sell Vol. 834,932

VNM: Foreign investors today net purchased over VND20 billion worth of VNM shares.

OTHERS

67,400

1D -1.89%

5D -2.60%

Buy Vol. 416,452

Sell Vol. 735,047

50,700

1D -2.50%

5D -0.98%

Buy Vol. 881,157

Sell Vol. 1,629,759

98,800

1D 0.00%

5D 0.10%

Buy Vol. 620,433

Sell Vol. 778,263

149,700

1D -0.13%

5D 2.89%

Buy Vol. 4,949,251

Sell Vol. 5,535,533

57,400

1D -0.52%

5D 0.17%

Buy Vol. 4,722,559

Sell Vol. 5,393,373

28,000

1D -1.41%

5D -0.71%

Buy Vol. 2,236,944

Sell Vol. 2,852,270

24,400

1D -0.20%

5D 1.04%

Buy Vol. 16,033,015

Sell Vol. 23,045,905

26,150

1D -0.57%

5D -0.19%

Buy Vol. 19,810,295

Sell Vol. 20,464,755

MWG: Topzone – a chain of stores specializing in Apple products under Thế Giới Di Động (MWG) – achieved revenue of VND3,000 billion with a profit of over VND80 billion in 2024.

Market by numbers

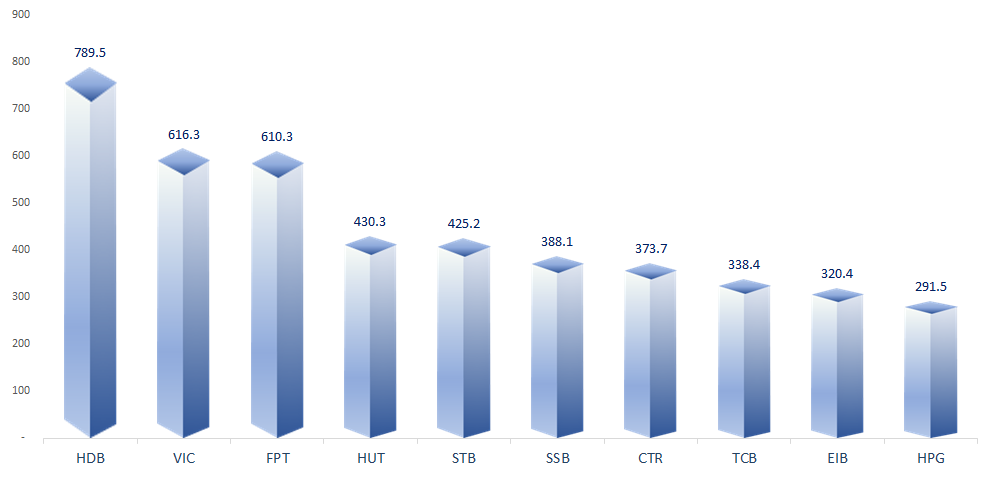

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

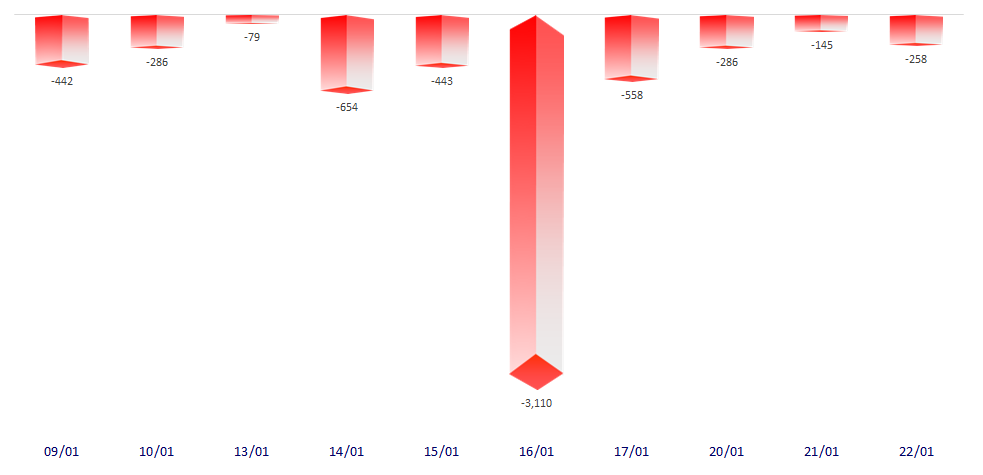

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

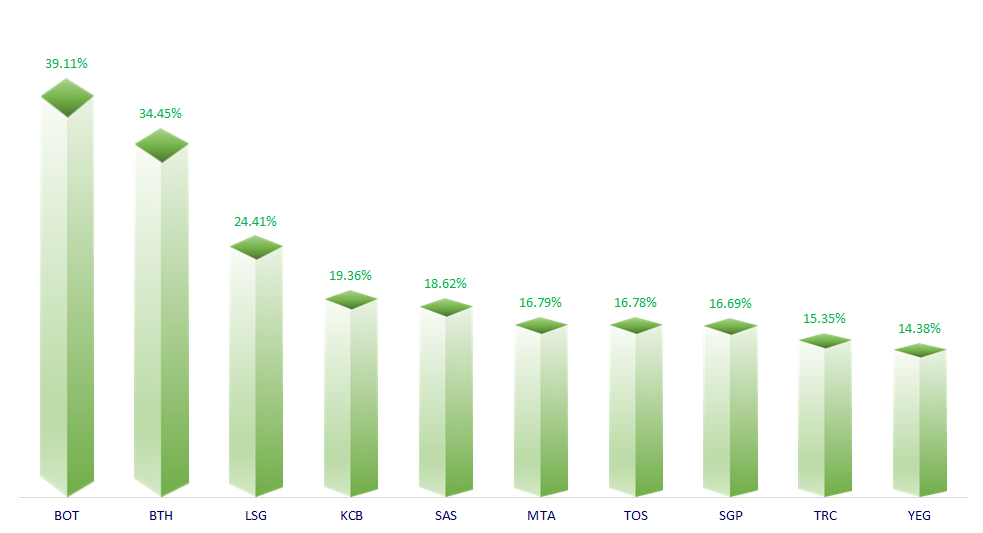

TOP INCREASES 3 CONSECUTIVE SESSIONS

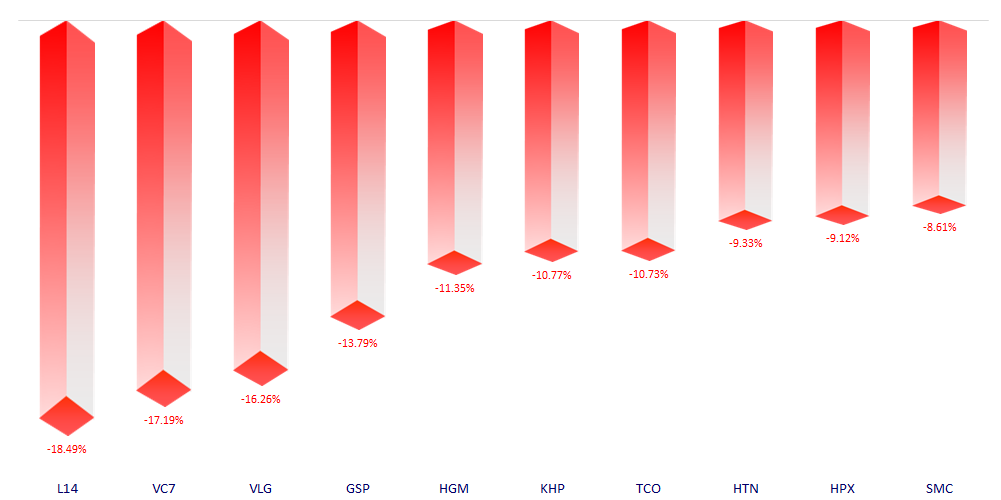

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.