Market Brief 04/02/2025

VIETNAM STOCK MARKET

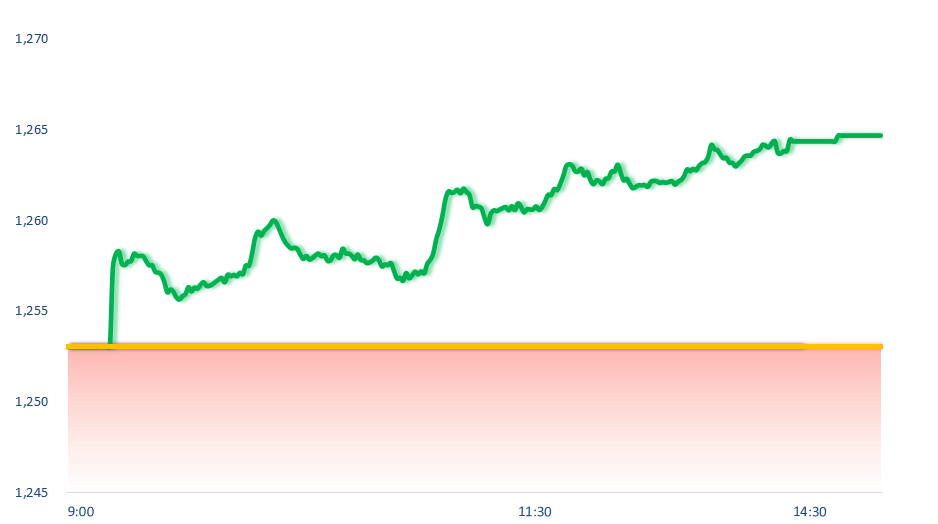

1,264.68

1D 0.93%

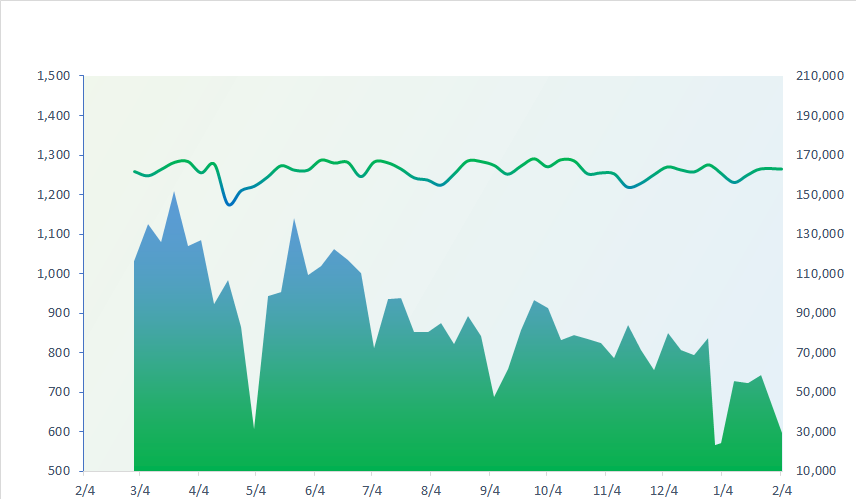

YTD -0.17%

226.61

1D 1.40%

YTD -0.36%

1,327.21

1D 0.89%

YTD -1.30%

95.31

1D 0.85%

YTD 0.26%

-985.57

1D 0.00%

YTD 0.00%

16,981.56

1D -6.34%

YTD -6.34%

VNIndex had an explosive session, filled with green with improved liquidity. The Government spending group broke out with CTD hitting the ceiling, HBC +4.8%, HTN +4.6%. Banking stocks continued to be the pillars of VNIndex with representatives such as CTG +3.5%, TPB +2.5%, EIB +2.2% or STB +2.1%.

ETF & DERIVATIVES

23,200

1D 0.96%

YTD -1.19%

16,030

1D 1.14%

YTD -1.54%

16,470

1D 0.98%

YTD -1.38%

19,950

1D 0.66%

YTD -0.75%

21,980

1D 1.01%

YTD -0.54%

32,780

1D 1.45%

YTD -2.21%

17,760

1D 0.79%

YTD -0.89%

1,329

1D 0.12%

YTD 0.00%

1,336

1D 0.18%

YTD 0.00%

1,339

1D 0.04%

YTD 0.00%

1,342

1D 0.40%

YTD 0.00%

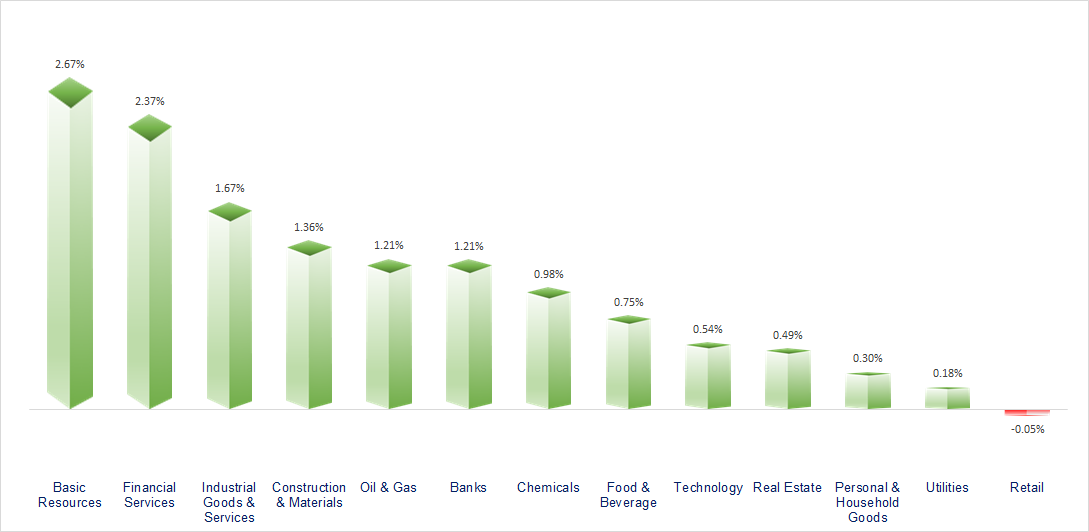

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,798.37

1D 0.72%

YTD -2.75%

3,250.60

1D 0.00%

YTD -3.02%

20,789.96

1D 2.83%

YTD 3.64%

2,481.69

1D 1.13%

YTD 3.43%

78,583.81

1D 1.73%

YTD 0.01%

3,823.01

1D -0.09%

YTD 0.93%

1,301.02

1D -0.23%

YTD -7.08%

75.07

1D -0.52%

YTD 0.03%

2,813.93

1D -0.24%

YTD 6.79%

Asia-Pacific markets rose Tuesday after Donald Trump paused tariffs on Mexico for a month, while Canada also said the U.S. president had put on hold proposed tariffs on its exports. Hong Kong’s Hang Seng index was up 2.83% in its last hour of trade, as China slapped tariffs on U.S. imports, in retaliation to the U.S. duties on its exports. Chinese markets remain closed for the Lunar New Year holiday.

VIETNAM ECONOMY

5.50%

1D (bps) 68

YTD (bps) 153

4.60%

2.54%

1D (bps) -1

YTD (bps) 6

2.94%

1D (bps) -5

YTD (bps) 9

2546000.00%

1D (%) -0.11%

YTD (%) -0.36%

2681456.00%

1D (%) 0.45%

YTD (%) -1.66%

354246.00%

1D (%) 1.08%

YTD (%) -0.52%

The price of SJC gold bars increased by VND800,000 at the bid price and VND1,300,000 at the ask price at most stores. After adjustment, today's gold price was bought at 88.1 million VND/tael and sold at 90.6 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister assigns EVN, PVN to be investors in two nuclear power plants;

- From March 1, electric cars will not be exempted from 100% registration fee;

- Retail rental prices in central Hanoi increase by 16%;

- China hits back with targeted tariffs after Trump imposes new levies;

- Trump signs order establishing a sovereign wealth fund that he says could buy TikTok;

- US national debt hits a new record.

VN30

BANK

92,000

1D 0.44%

5D -0.65%

Buy Vol. 2,669,417

Sell Vol. 1,551,977

39,650

1D 0.63%

5D -0.88%

Buy Vol. 7,282,798

Sell Vol. 8,440,536

39,400

1D 3.55%

5D 3.68%

Buy Vol. 30,136,026

Sell Vol. 24,878,013

24,650

1D 1.65%

5D -0.40%

Buy Vol. 22,321,734

Sell Vol. 21,822,801

18,750

1D 1.35%

5D -0.79%

Buy Vol. 25,863,787

Sell Vol. 22,639,213

22,450

1D 1.81%

5D 0.22%

Buy Vol. 21,657,814

Sell Vol. 19,100,693

22,600

1D 0.89%

5D -0.22%

Buy Vol. 13,506,495

Sell Vol. 13,387,940

16,550

1D 2.48%

5D 0.61%

Buy Vol. 26,093,004

Sell Vol. 20,803,645

37,300

1D 2.05%

5D 0.81%

Buy Vol. 22,960,668

Sell Vol. 21,515,739

20,350

1D 1.24%

5D -1.45%

Buy Vol. 18,476,996

Sell Vol. 12,148,464

25,250

1D 0.60%

5D -0.39%

Buy Vol. 12,359,586

Sell Vol. 8,818,127

10,550

1D 0.96%

5D 2.43%

Buy Vol. 26,306,463

Sell Vol. 38,098,456

18,800

1D 0.53%

5D 0.27%

Buy Vol. 3,183,454

Sell Vol. 3,526,807

BID: The State Bank has approved BIDV to increase its charter capital by VND1,238 billion through a private placement. The list of professional investors expected to participate in the offering includes 5 organizations. Of which, Vietnam Enterprise Investments Limited (VEIL) registered the largest volume with nearly 59 million shares, accounting for 47.7% of the total offering.

OIL & GAS

35,100

1D 0.00%

5D -2.09%

Buy Vol. 7,771,593

Sell Vol. 5,109,052

67,100

1D 0.00%

5D -1.18%

Buy Vol. 989,806

Sell Vol. 814,133

40,000

1D 1.78%

5D 1.27%

Buy Vol. 3,185,839

Sell Vol. 1,930,326

VINGROUP

40,100

1D 0.12%

5D -0.74%

Buy Vol. 2,199,480

Sell Vol. 2,559,995

38,750

1D -0.64%

5D -1.90%

Buy Vol. 10,062,747

Sell Vol. 10,131,146

16,300

1D 0.00%

5D -1.51%

Buy Vol. 8,582,952

Sell Vol. 7,934,190

VIC: In just 6 months, the Royal Bridge connecting Vingroup's Vu Yen Island with the center of Hai Phong City is expected to be completed.

FOOD & BEVERAGE

60,200

1D -0.50%

5D -3.22%

Buy Vol. 13,030,322

Sell Vol. 9,017,884

68,600

1D 0.88%

5D 0.88%

Buy Vol. 5,905,188

Sell Vol. 7,880,102

52,700

1D 0.00%

5D -2.04%

Buy Vol. 814,519

Sell Vol. 698,608

VNM: Foreign investors sold the most VNM shares with a net selling value of more than VND306 billion.

OTHERS

70,300

1D 0.43%

5D 1.44%

Buy Vol. 474,841

Sell Vol. 804,074

51,400

1D 1.38%

5D 1.18%

Buy Vol. 1,052,379

Sell Vol. 735,173

98,200

1D -0.61%

5D -1.60%

Buy Vol. 780,534

Sell Vol. 911,000

146,200

1D 0.48%

5D -4.69%

Buy Vol. 9,868,637

Sell Vol. 7,944,754

59,600

1D 0.00%

5D -0.83%

Buy Vol. 5,945,895

Sell Vol. 6,212,441

29,500

1D 0.85%

5D 2.43%

Buy Vol. 2,759,621

Sell Vol. 3,588,270

25,300

1D 2.02%

5D 0.20%

Buy Vol. 26,930,443

Sell Vol. 29,251,515

26,850

1D 1.70%

5D 1.13%

Buy Vol. 41,128,733

Sell Vol. 35,085,716

VJC: In the whole year of 2024, Vietjet's aviation revenue will reach VND71,545 billion, and more than VND1,301 billion in profit after tax, growing by 33% and 697%, respectively compared to 2023.

Market by numbers

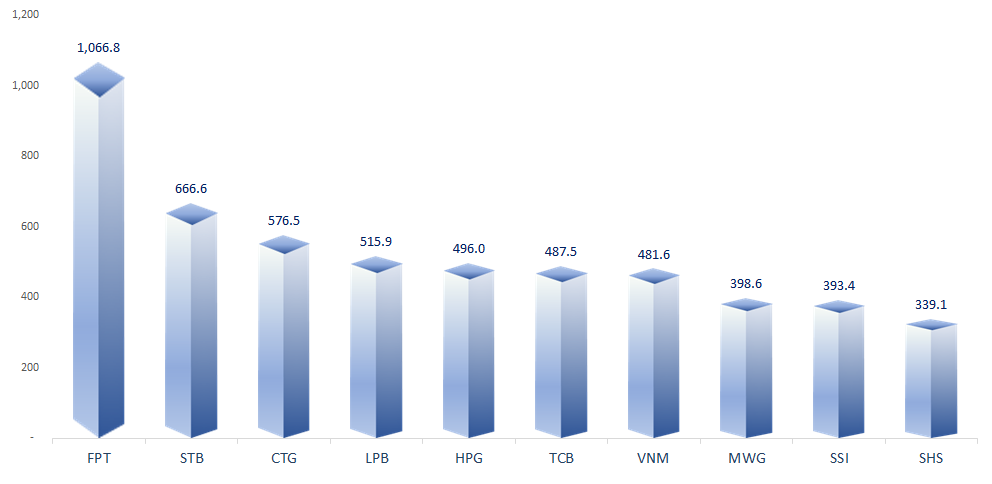

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

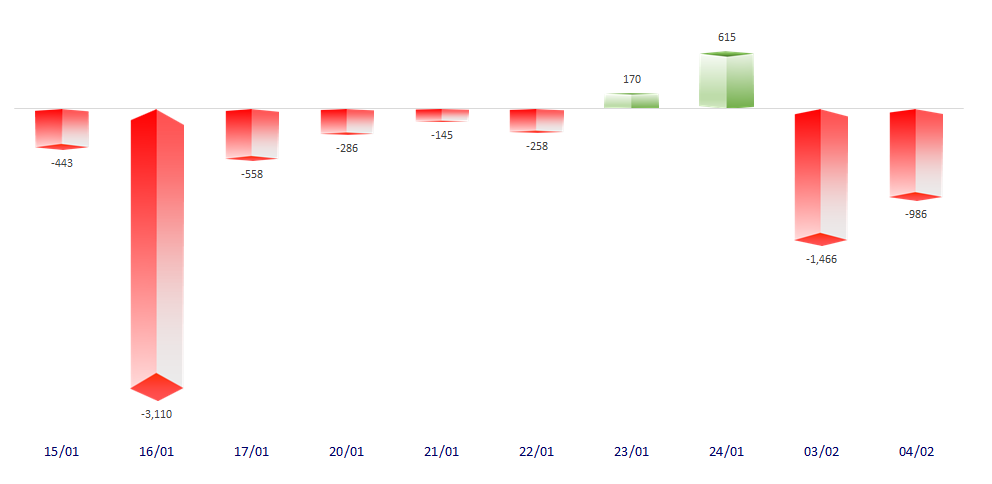

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

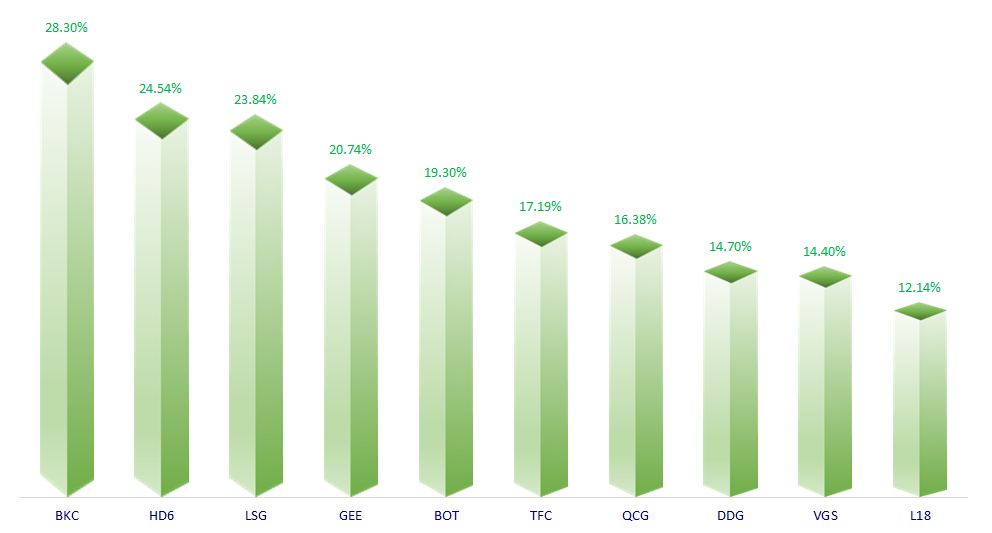

TOP INCREASES 3 CONSECUTIVE SESSIONS

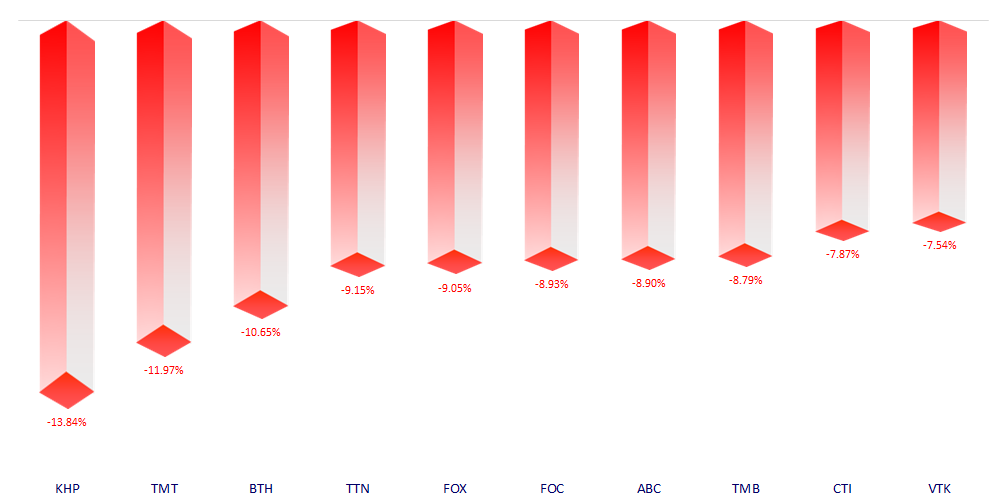

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.