Market brief 20/03/2025

VIETNAM STOCK MARKET

1,323.93

1D -0.05%

YTD 4.51%

245.77

1D 0.20%

YTD 8.06%

1,378.95

1D 0.10%

YTD 2.54%

99.16

1D -0.20%

YTD 4.31%

-1,455.26

1D 0.00%

YTD 0.00%

21,372.25

1D 17.88%

YTD 17.88%

The optimism from the global market last night helped the VN-Index open with a growth of over 7 points. However, the VN-Index closed near the reference price after a volatile session, following negative news related to Bamboo Capital, which impacted several stocks such as TPB (-5.3%) and ORS, which hit the floor price.

ETF & DERIVATIVES

24,100

1D -0.04%

YTD 2.64%

16,600

1D 0.30%

YTD 1.97%

17,060

1D -0.41%

YTD 2.16%

20,490

1D -0.49%

YTD 1.94%

23,390

1D -1.31%

YTD 5.84%

32,320

1D 0.37%

YTD -3.58%

18,350

1D -0.54%

YTD 2.40%

1,377

1D -0.04%

YTD 0.00%

1,373

1D -0.33%

YTD 0.00%

1,371

1D -0.23%

YTD 0.00%

1,371

1D -0.26%

YTD 0.00%

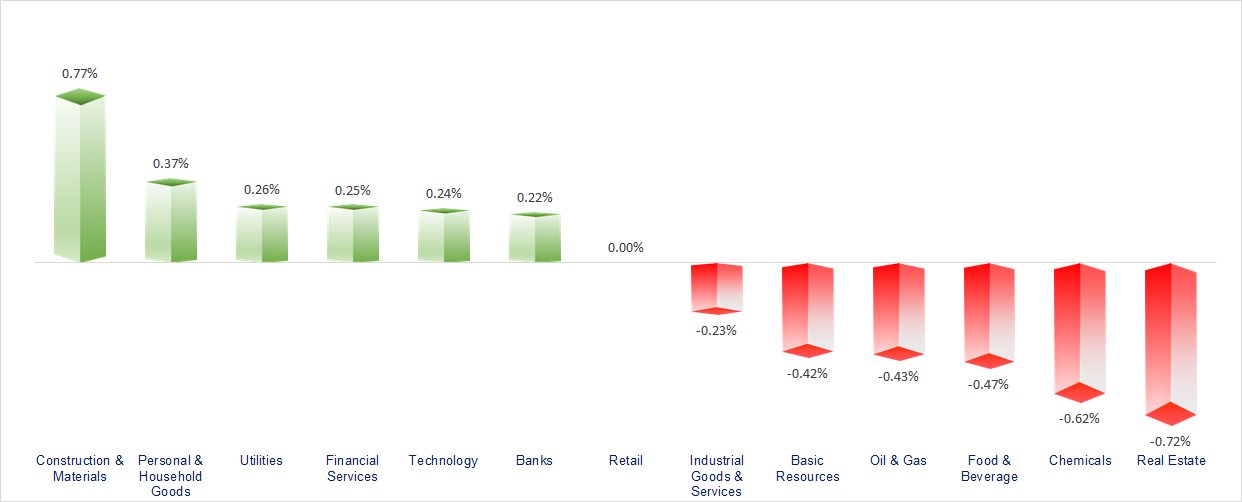

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

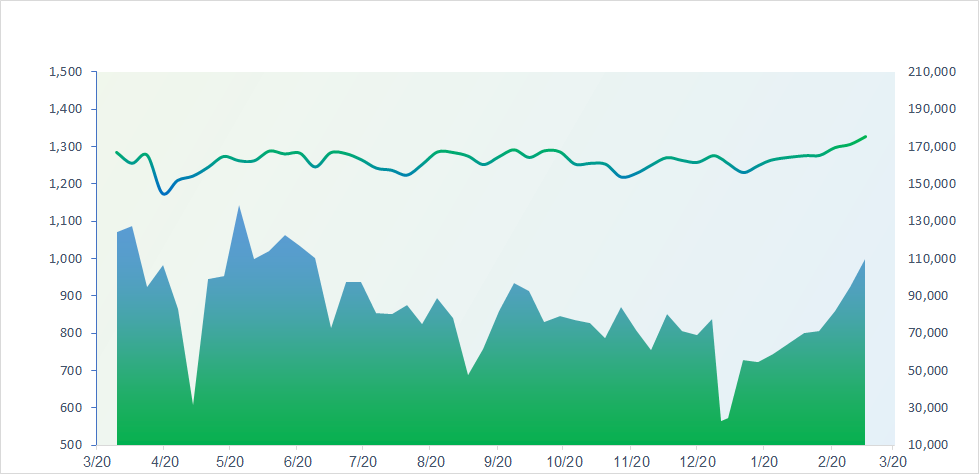

VNINDEX (12M)

GLOBAL MARKET

37,513.50

1D -0.83%

YTD -5.97%

3,408.95

1D -0.51%

YTD 1.71%

24,219.96

1D -2.23%

YTD 20.74%

2,637.10

1D 0.32%

YTD 9.90%

76,348.06

1D 1.18%

YTD -2.83%

3,930.50

1D 0.57%

YTD 3.77%

1,181.71

1D -0.67%

YTD -15.60%

70.39

1D -0.09%

YTD -6.22%

3,029.00

1D -0.60%

YTD 14.95%

Asia-Pacific markets traded mixed as China’s central bank kept interest rates steady, after the U.S. Federal Reserve kept benchmark rates unchanged overnight. The People’s Bank of China kept the 1-year loan prime rate at 3.1% and the 5-year LPR at 3.6%, where they have been since a quarter-percentage-point cut in October. Japan markets were closed for a holiday.

VIETNAM ECONOMY

4.04%

1D (bps) -6

YTD (bps) 7

4.60%

2.47%

1D (bps) -5

YTD (bps) -1

2.95%

1D (bps) 1

YTD (bps) 10

2574000.00%

1D (%) 0.04%

YTD (%) 0.74%

2866392.00%

1D (%) -0.15%

YTD (%) 5.13%

358998.00%

1D (%) 0.07%

YTD (%) 0.81%

The domestic gold market on the morning of March 20 witnessed a sharp increase in prices across most gold types compared to the previous session. Accordingly, SJC gold bars continued to reach a new peak of 100.4 million VND/tael, while plain gold rings also recorded a historic high, approaching 101 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposal for an urban railway connecting downtown Ho Chi Minh City with Can Gio;

- Proposal to increase the profit margin for social housing projects to 13% for investors;

- The Ministry of Finance has submitted a draft resolution on the pilot issuance and trading of digital assets;

- The Fed chairman stated reasons for wanting to cut interest rates twice but is willing to keep rates high under one condition;

- Former White House official: President Trump seeks to run for re-election in 2028;

- The U.S. reinstates nearly 25,000 previously laid-off employees.

VN30

BANK

66,800

1D 0.45%

5D 1.98%

Buy Vol. 3,007,185

Sell Vol. 3,332,016

39,800

1D 0.00%

5D -1.00%

Buy Vol. 5,306,978

Sell Vol. 4,322,750

41,600

1D 0.12%

5D -1.65%

Buy Vol. 14,803,701

Sell Vol. 13,931,045

27,450

1D 0.73%

5D 0.55%

Buy Vol. 27,151,384

Sell Vol. 25,291,452

19,600

1D 0.77%

5D 1.82%

Buy Vol. 37,393,210

Sell Vol. 34,449,155

24,250

1D 1.68%

5D -0.21%

Buy Vol. 48,977,371

Sell Vol. 38,105,614

23,100

1D 0.22%

5D -0.22%

Buy Vol. 19,470,200

Sell Vol. 19,241,388

15,200

1D -5.30%

5D -5.30%

Buy Vol. 127,385,893

Sell Vol. 129,240,691

38,900

1D 1.30%

5D -0.26%

Buy Vol. 17,183,103

Sell Vol. 16,858,601

20,400

1D -0.49%

5D 0.49%

Buy Vol. 16,000,572

Sell Vol. 17,542,455

26,250

1D 0.19%

5D 0.57%

Buy Vol. 11,962,754

Sell Vol. 10,965,520

11,750

1D 0.86%

5D 17.50%

Buy Vol. 163,325,106

Sell Vol. 172,027,240

19,850

1D 0.25%

5D 0.25%

Buy Vol. 2,762,695

Sell Vol. 2,916,903

35,550

1D -1.11%

5D 0.71%

Buy Vol. 5,832,040

Sell Vol. 6,286,853

According to the provisions of Decree No. 69, from March 19, 2025, banks undergoing mandatory transfers—except for Vietcombank (as the State holds over 50% of its charter capital)—will have their foreign ownership limit increased to 49% instead of the current 30%. These banks include MBBank, VPBank and HDBank.

OIL & GAS

68,600

1D -0.29%

5D 0.44%

Buy Vol. 1,633,420

Sell Vol. 1,750,384

41,300

1D -0.48%

5D -0.96%

Buy Vol. 1,728,302

Sell Vol. 1,722,519

From 3 PM today, the price of RON 95-III gasoline increased by 440 VND/liter to 20,080 VND/liter. E5 RON 92 rose by VND410, reaching 19,690 VND/liter.

VINGROUP

51,500

1D -0.77%

5D 0.19%

Buy Vol. 11,068,006

Sell Vol. 13,514,880

47,350

1D 0.00%

5D -0.94%

Buy Vol. 21,914,676

Sell Vol. 22,841,908

18,400

1D -0.27%

5D -2.13%

Buy Vol. 6,794,379

Sell Vol. 10,821,688

VinFast plans to double the production capacity of its automobile manufacturing plant in Cat Hai (Hai Phong) to 500,000 vehicles/year in the next phase.

FOOD & BEVERAGE

61,800

1D -0.80%

5D -0.32%

Buy Vol. 6,973,509

Sell Vol. 8,154,716

68,400

1D -0.15%

5D -2.84%

Buy Vol. 5,751,629

Sell Vol. 6,958,787

50,600

1D -0.39%

5D -0.98%

Buy Vol. 2,302,279

Sell Vol. 2,629,390

SAB: SAB stock closed on March 20 at its lowest price since the session on August 5, 2024.

OTHERS

79,500

1D -1.49%

5D 0.89%

Buy Vol. 1,742,682

Sell Vol. 1,783,511

53,000

1D -0.75%

5D -2.03%

Buy Vol. 1,115,926

Sell Vol. 1,268,599

96,200

1D -1.64%

5D -1.13%

Buy Vol. 784,217

Sell Vol. 1,184,751

125,000

1D 0.32%

5D -8.42%

Buy Vol. 14,658,105

Sell Vol. 11,839,578

60,000

1D 0.84%

5D -2.44%

Buy Vol. 7,921,789

Sell Vol. 7,309,126

34,500

1D -0.86%

5D 4.55%

Buy Vol. 4,116,822

Sell Vol. 5,893,934

26,550

1D 0.00%

5D -1.48%

Buy Vol. 35,756,788

Sell Vol. 42,145,585

27,150

1D -0.37%

5D -1.99%

Buy Vol. 49,087,049

Sell Vol. 45,956,351

FPT: FPT Corporation has just announced its business results for the first two months of 2025, with revenue reaching VND10,438 billion and pre-tax profit at VND1,885 billion, increasing by 16.4% and 20.3% year-over-year, respectively. Net profit attributable to parent company shareholders rose by 21.1% to VND1,378 billion.

Market by numbers

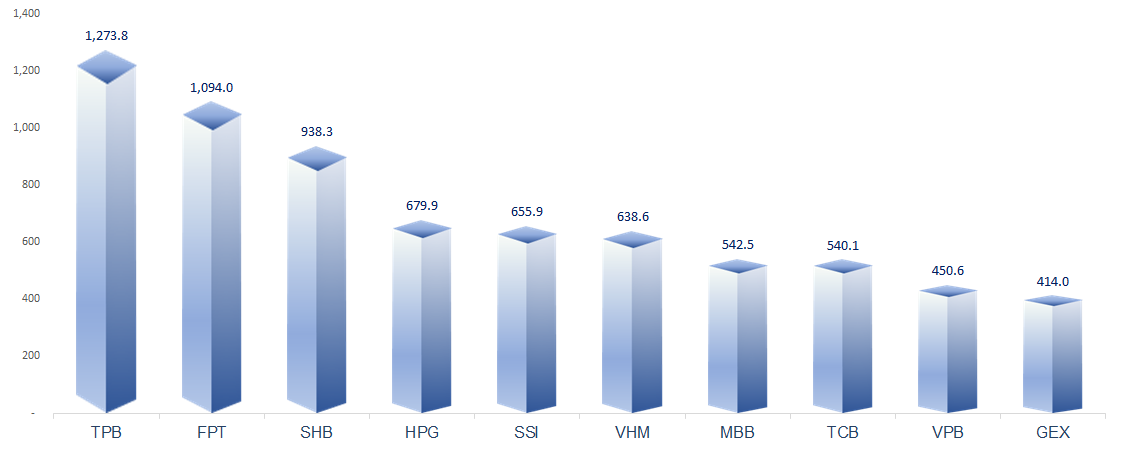

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

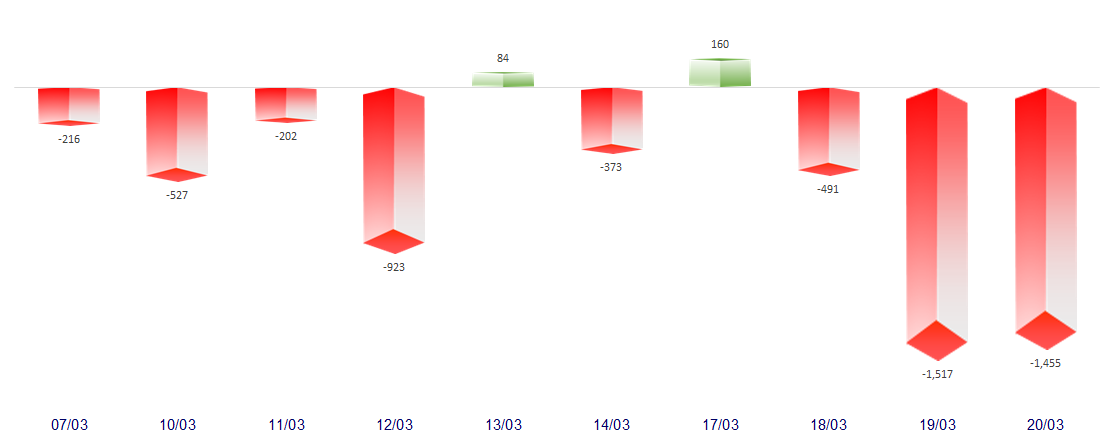

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

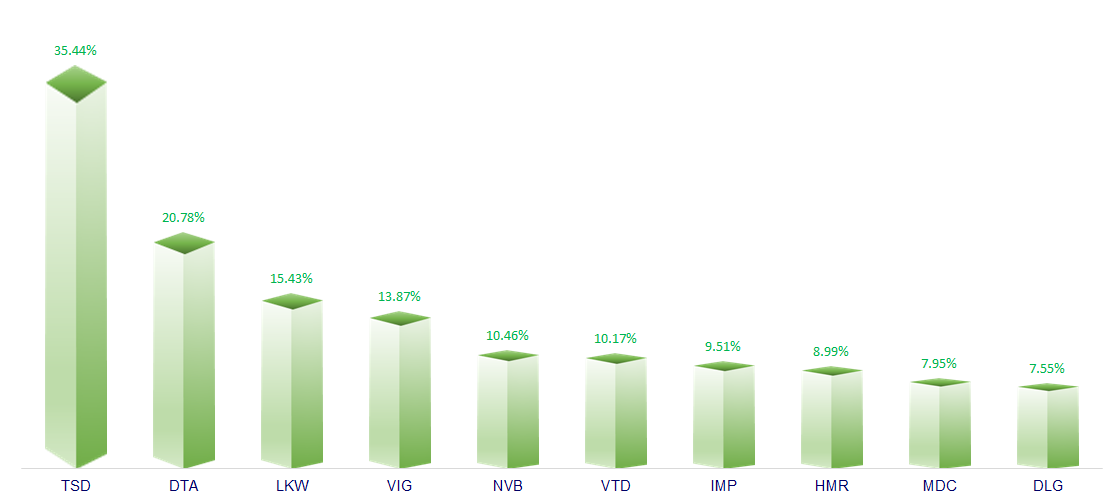

TOP INCREASES 3 CONSECUTIVE SESSIONS

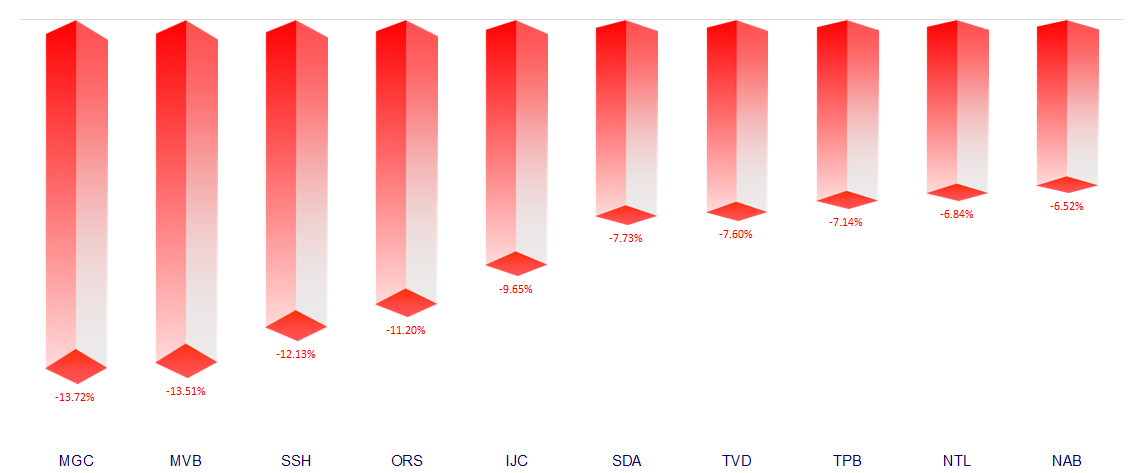

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.