Market brief 21/03/2024

VIETNAM STOCK MARKET

1,321.88

1D -0.15%

YTD 4.35%

245.82

1D 0.02%

YTD 8.09%

1,378.27

1D -0.05%

YTD 2.49%

99.32

1D 0.16%

YTD 4.48%

-1,015.52

1D 0.00%

YTD 0.00%

18,185.61

1D 0.30%

YTD 0.30%

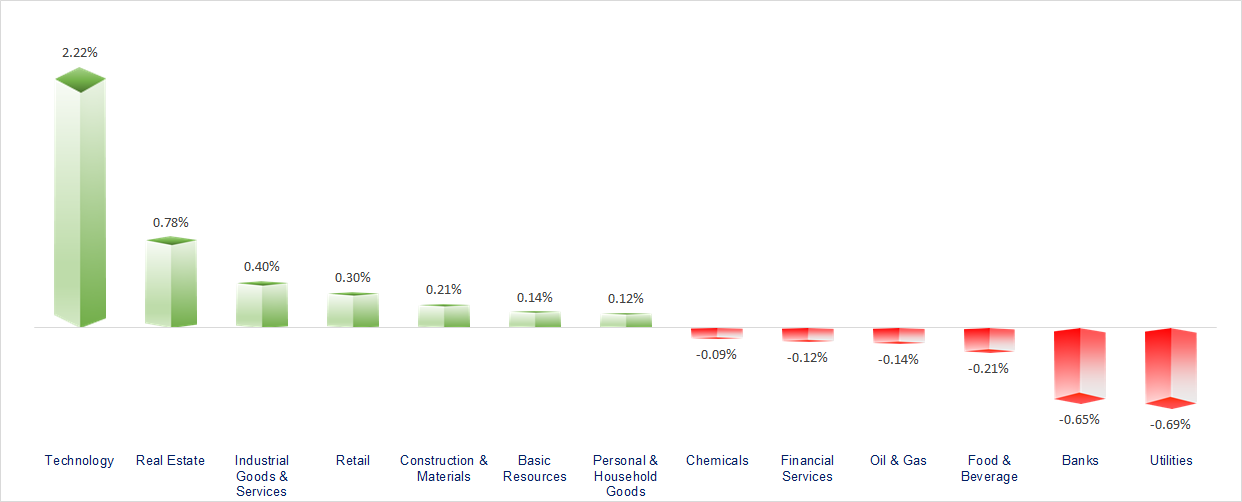

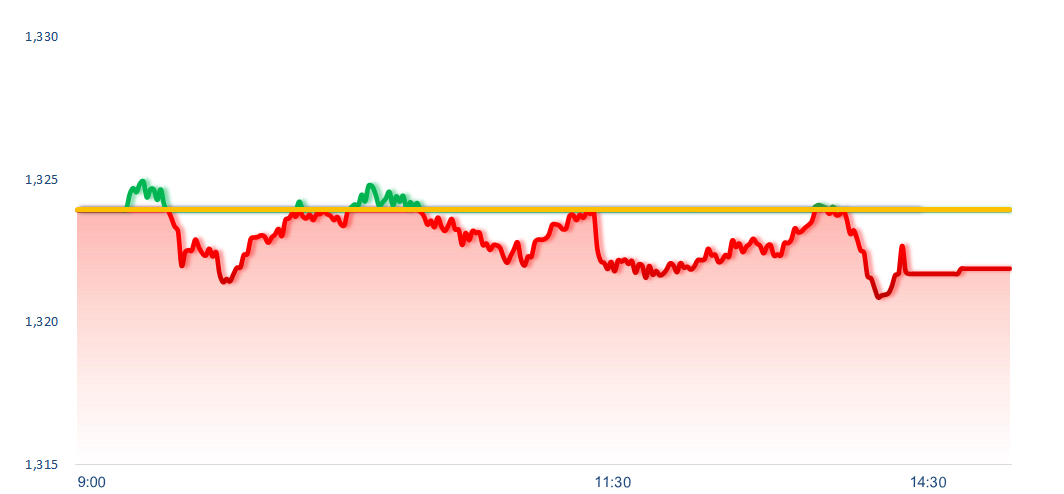

VN-Index fluctuated within a narrow range during the rebalancing session of several ETFs, with liquidity reaching nearly VND17,000 billion. Technology and Telecommunications were the most positive sectors today, while Utilities, Banking, and Insurance had a negative impact on the market.

ETF & DERIVATIVES

24,040

1D -0.25%

YTD 2.39%

16,660

1D 0.36%

YTD 2.33%

17,060

1D 0.00%

YTD 2.16%

20,550

1D 0.29%

YTD 2.24%

23,300

1D -0.38%

YTD 5.43%

32,480

1D 0.50%

YTD -3.10%

18,340

1D -0.05%

YTD 2.34%

1,374

1D 0.08%

YTD 0.00%

1,373

1D -0.47%

YTD 0.00%

1,368

1D -0.21%

YTD 0.00%

1,371

1D 0.00%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

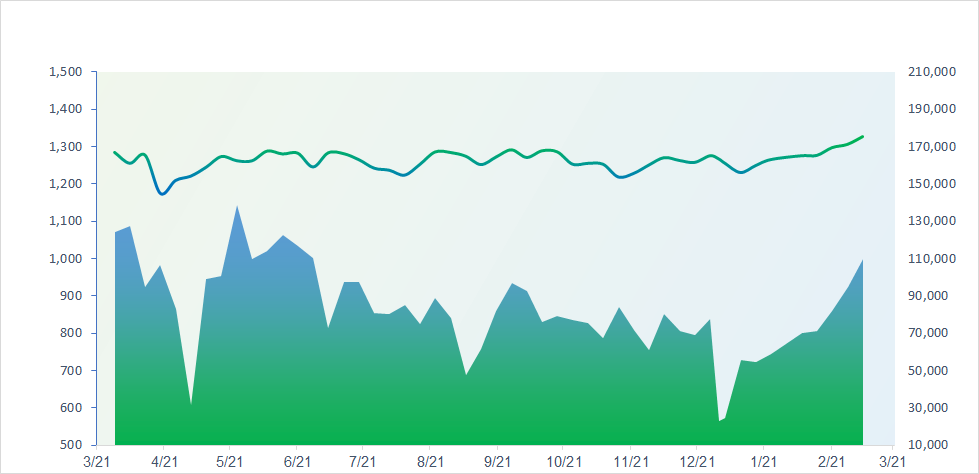

VNINDEX (12M)

GLOBAL MARKET

37,677.06

1D -0.19%

YTD -5.56%

3,364.83

1D -1.29%

YTD 0.39%

23,689.73

1D -2.19%

YTD 18.10%

2,643.13

1D 0.23%

YTD 10.15%

76,881.94

1D 0.70%

YTD -2.15%

3,926.46

1D -0.10%

YTD 3.67%

1,186.61

1D 0.41%

YTD -15.25%

71.29

1D -0.61%

YTD -5.02%

3,032.86

1D -0.39%

YTD 15.10%

Asian markets mostly declined in today's session, led by the Hang Seng, which dropped over 2%. Notably, Japan's February inflation came in at 3.7%, 0.3% lower than the 4% recorded in January.

VIETNAM ECONOMY

4.22%

1D (bps) 18

YTD (bps) 25

4.60%

2.51%

1D (bps) 4

YTD (bps) 4

2.92%

1D (bps) -2

YTD (bps) 8

2576000.00%

1D (%) 0.08%

YTD (%) 0.82%

2848126.00%

1D (%) -0.64%

YTD (%) 4.46%

358560.00%

1D (%) -0.12%

YTD (%) 0.69%

This morning (March 21), the central exchange rate of VND to USD announced by the State Bank of Vietnam was 24,807 VND/USD, up VND17. Commercial banks also adjusted their USD exchange rates upward. Specifically, Vietcombank quoted 25,350 - 25,740 VND/USD, up VND30 VND for both bid and ask sides compared to yesterday’s session.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Official groundbreaking of an international port project worth nearly VND2,300 billion;

- Vietnam ranks among the top 30 fastest-growing trade nations;

- Proposal for Hanoi residents to enter a lottery to purchase gasoline-powered vehicles;

- Russian Security Council Secretary visits North Korea to meet with Chairman Kim Jong Un;

- Ukraine attacks a key Russian gas pipeline;

- The flood of Chinese goods wipes out millions of jobs worldwide, with Indonesia as a prime example.

VN30

BANK

66,000

1D -1.20%

5D 0.00%

Buy Vol. 3,111,720

Sell Vol. 2,992,623

39,450

1D -0.88%

5D -2.35%

Buy Vol. 4,601,846

Sell Vol. 4,593,436

41,650

1D 0.12%

5D -1.54%

Buy Vol. 14,053,984

Sell Vol. 11,453,253

27,350

1D -0.36%

5D 0.18%

Buy Vol. 15,277,866

Sell Vol. 13,630,490

19,500

1D -0.51%

5D -0.51%

Buy Vol. 21,330,795

Sell Vol. 18,849,833

24,300

1D 0.21%

5D 0.00%

Buy Vol. 32,189,975

Sell Vol. 33,703,291

23,000

1D -0.43%

5D -0.86%

Buy Vol. 13,376,370

Sell Vol. 13,927,366

14,750

1D -2.96%

5D -8.39%

Buy Vol. 75,729,856

Sell Vol. 67,252,979

38,650

1D -0.64%

5D -0.51%

Buy Vol. 11,634,752

Sell Vol. 12,286,942

20,300

1D -0.49%

5D -0.25%

Buy Vol. 11,208,370

Sell Vol. 11,736,958

26,100

1D -0.57%

5D 0.38%

Buy Vol. 8,818,436

Sell Vol. 10,808,101

11,750

1D 0.00%

5D 9.81%

Buy Vol. 121,111,872

Sell Vol. 162,340,639

19,850

1D 0.00%

5D 0.25%

Buy Vol. 2,471,067

Sell Vol. 3,392,055

34,800

1D -2.11%

5D -0.43%

Buy Vol. 5,578,692

Sell Vol. 5,723,594

TPB: Tien Phong Commercial Joint Stock Bank (TPB) has announced that it has received the resignation letter from Mr. Do Anh Tu – Vice Chairman of the Board of Directors. Accordingly, on March 18, 2025, Mr. Do Anh Tu submitted his resignation as a member of TPBank's Board of Directors for personal reasons.

OIL & GAS

67,700

1D -1.31%

5D 0.00%

Buy Vol. 1,850,396

Sell Vol. 2,447,628

41,300

1D 0.00%

5D -0.24%

Buy Vol. 3,081,255

Sell Vol. 2,383,336

GAS: HoSE reminded PV Gas to disclose its Board resolution on time to protect shareholders' rights.

VINGROUP

53,000

1D 2.91%

5D 1.53%

Buy Vol. 17,071,507

Sell Vol. 10,512,348

48,250

1D 1.90%

5D 0.73%

Buy Vol. 31,980,203

Sell Vol. 21,207,169

18,450

1D 0.27%

5D -1.60%

Buy Vol. 15,642,352

Sell Vol. 20,582,806

VIC: Vingroup has announced a funding of VND1,000 billion to support the implementation of the National Emergency Medical Services Project for the 2025-2030 period.

FOOD & BEVERAGE

61,300

1D -0.81%

5D -1.29%

Buy Vol. 5,812,071

Sell Vol. 6,112,979

67,900

1D -0.73%

5D -4.50%

Buy Vol. 6,115,956

Sell Vol. 6,486,359

50,300

1D -0.59%

5D -2.52%

Buy Vol. 2,185,140

Sell Vol. 2,399,496

VNM: Foreign investors continued to net sell over VND44 billion worth of VNM shares today.

OTHERS

78,700

1D -1.01%

5D -0.38%

Buy Vol. 748,728

Sell Vol. 949,410

52,500

1D -0.94%

5D -2.05%

Buy Vol. 715,631

Sell Vol. 988,059

96,600

1D 0.42%

5D -2.03%

Buy Vol. 950,840

Sell Vol. 932,968

128,000

1D 2.40%

5D -2.59%

Buy Vol. 12,227,219

Sell Vol. 12,303,969

60,300

1D 0.50%

5D -1.95%

Buy Vol. 5,275,316

Sell Vol. 6,488,618

34,550

1D 0.14%

5D 3.75%

Buy Vol. 6,041,994

Sell Vol. 9,906,182

26,600

1D 0.19%

5D -1.30%

Buy Vol. 37,570,094

Sell Vol. 43,491,354

27,150

1D 0.00%

5D -1.45%

Buy Vol. 40,781,157

Sell Vol. 38,014,914

FPT: FPT Telecom Joint Stock Company (FOX) has released documents for its 2025 Annual General Meeting of Shareholders, scheduled for April 10. The Board of Directors plans to propose a 2025 business target with revenue of VND19,900 billion and pre-tax profit of VND4,200 billion, representing increases of 13% and 17.1% year-over-year, respectively. The 2025 dividend will not be lower than 2,000 VND/share.

Market by numbers

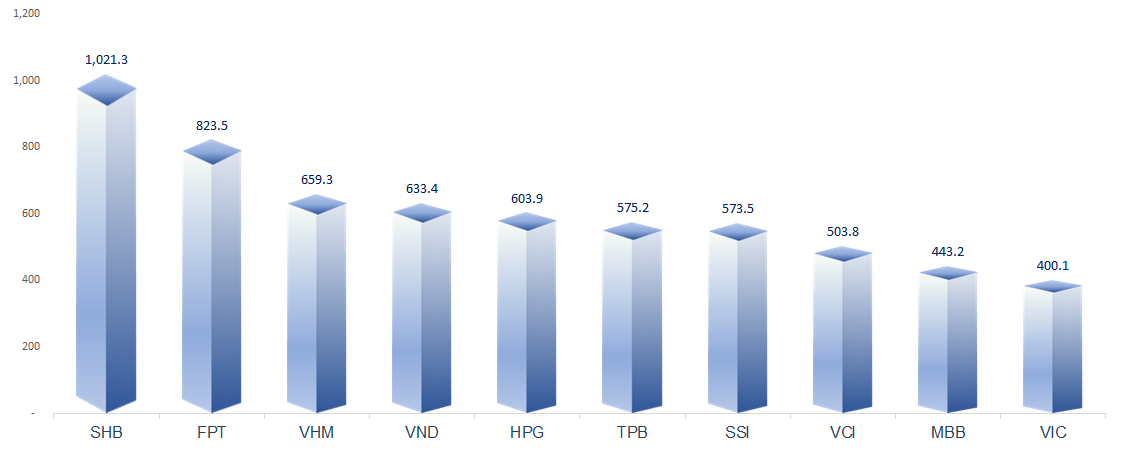

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

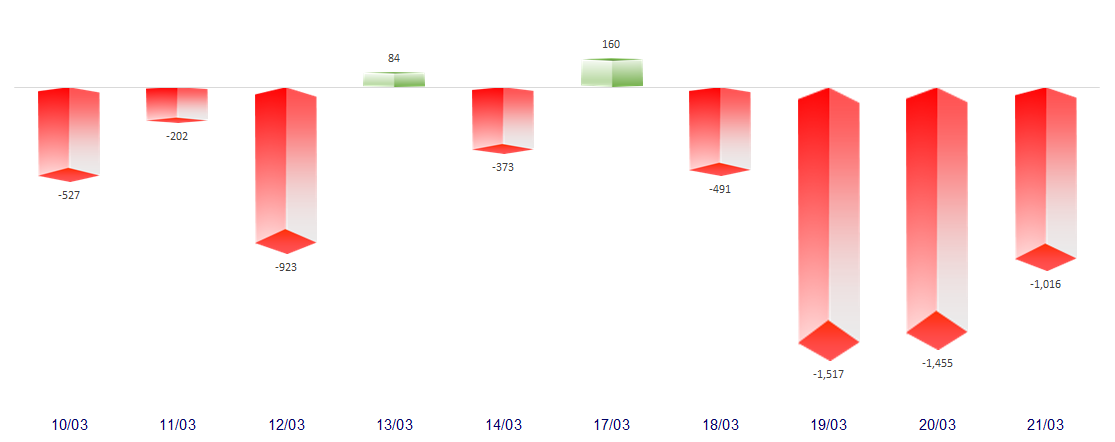

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

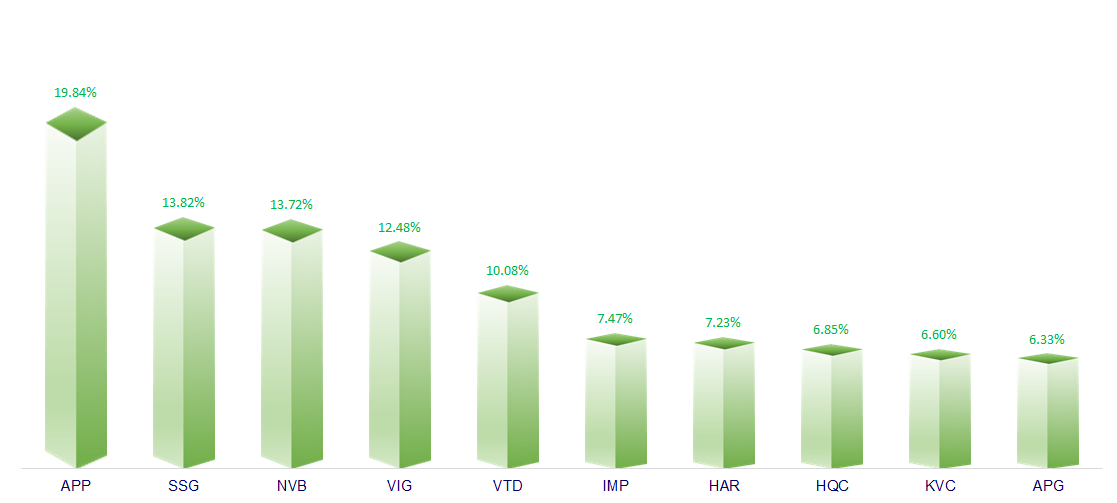

TOP INCREASES 3 CONSECUTIVE SESSIONS

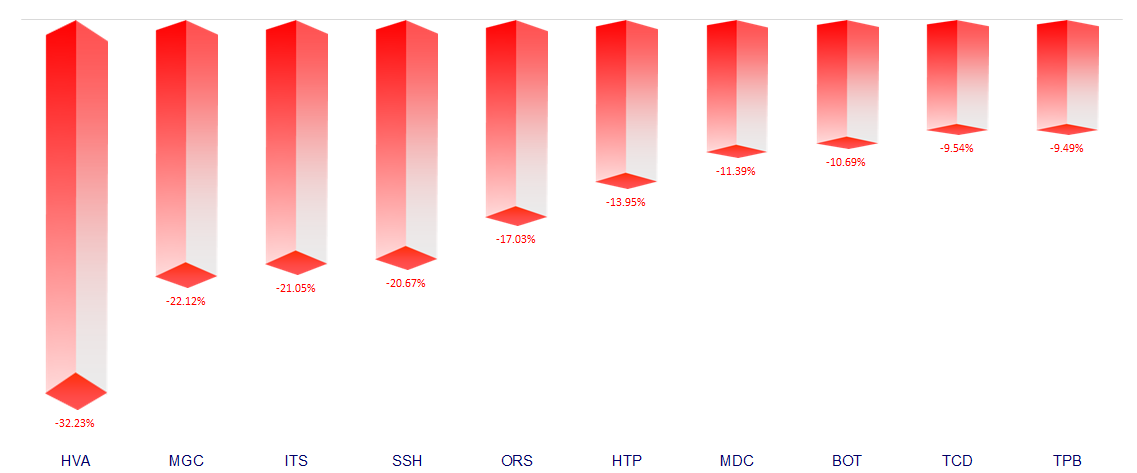

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.