Market brief 08/05/2025

VIETNAM STOCK MARKET

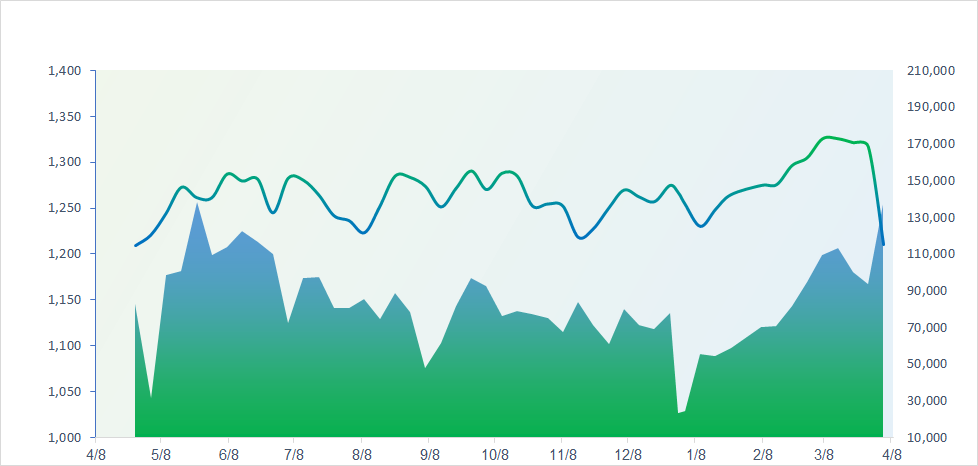

1132.79

1D -6.43%

YTD -10.58%

201.04

1D -7.34%

YTD -11.60%

1,197.51

1D -6.48%

YTD -10.95%

84.5

1D -7.28%

YTD -11.11%

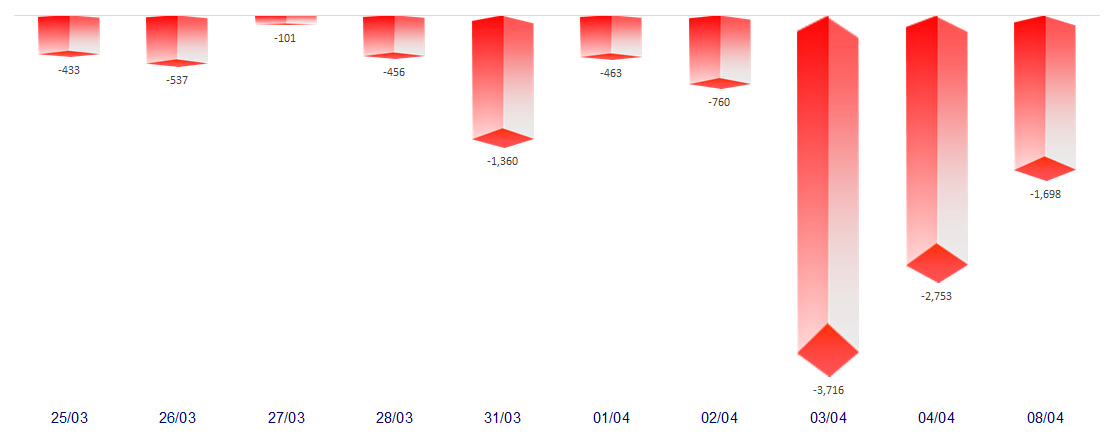

-1,697.69

1D 0.00%

YTD 0.00%

27,500.28

1D -38.95%

YTD 51.68%

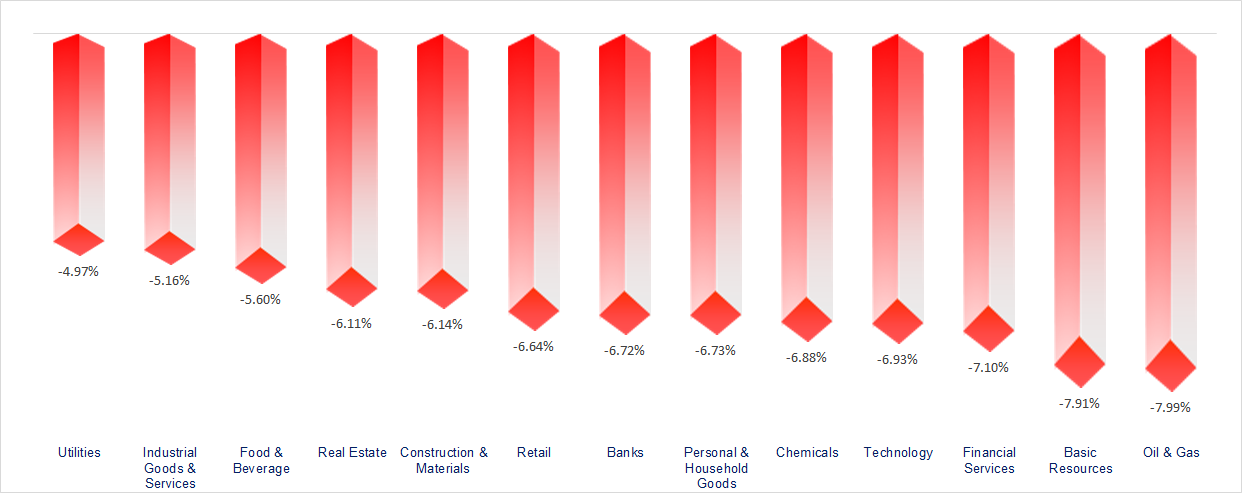

433 stocks hit the floor, VN-Index nears 1.5-year low. A sea of red swept across all sectors, with Oil & Gas, Resources, and Financial Services being the most negatively affected groups in today’s session.

ETF & DERIVATIVES

20,770

1D -6.99%

YTD -11.54%

14,300

1D -6.96%

YTD -12.16%

16,090

1D -6.99%

YTD -3.65%

18,000

1D -4.76%

YTD -10.45%

20,160

1D -6.97%

YTD -8.78%

27,050

1D -6.98%

YTD -19.30%

16,700

1D -1.76%

YTD -6.81%

1,179

1D -6.99%

YTD 0.00%

1,182

1D -6.99%

YTD 0.00%

1,193

1D -7.00%

YTD 0.00%

1,182

1D -7.00%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

33,012.58

1D 6.03%

YTD -17.25%

3,145.55

1D 1.58%

YTD -6.15%

20,127.68

1D 1.52%

YTD 0.34%

2,334.23

1D 0.26%

YTD -2.72%

74,188.68

1D 1.44%

YTD -5.58%

3,469.48

1D -2.01%

YTD -8.40%

1,074.59

1D -4.50%

YTD -23.26%

64.32

1D 0.28%

YTD -14.30%

3,004.00

1D 0.74%

YTD 14.00%

Stock markets across the Asia-Pacific region recorded gains today, marking the first rebound after a sharp downturn triggered by U.S. President Donald Trump’s tariff policies and his threats to impose even higher tariffs on China. In Japan, the Nikkei 225 surged 6.03% to close at 33,012.58, while South Korea’s Kospi inched up 0.26% to 2,334.23. After China unexpectedly adjusted the reference rate of the yuan amid escalating tensions with the U.S.—and with speculation rising over a possible devaluation—the Shanghai Composite Index rose 1.58% to 3,145.55. Meanwhile, Hong Kong’s Hang Seng Index climbed 1.58% to 20,127.68.

VIETNAM ECONOMY

4.18%

1D (bps) 12

YTD (bps) 21

4.60%

2.54%

1D (bps) 2

YTD (bps) 6

2.94%

1D (bps) -1

YTD (bps) 9

2614000.00%

1D (%) 0.69%

YTD (%) 2.31%

2921500.00%

1D (%) 0.37%

YTD (%) 7.15%

359987.00%

1D (%) 0.07%

YTD (%) 1.09%

Survey on the free market shows that the USD price continues to rise by about 20–50 VND compared to yesterday. Currently, the buying price is commonly around 26,100 VND/USD, and the selling price is approximately 26,200 VND/USD. At commercial banks, the USD rate also surged to a record high today. Specifically, at Vietcombank, the USD is now listed at 25,760–26,120 VND/USD, up 160 VND compared to the end of last week.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Banks injected nearly VND615 trillion into the economy in Q1, with total system-wide credit outstanding reaching a new record high;

- The U.S. tariff policy puts pressure on exchange rates, but SBV is committed to timely liquidity injection to support interest rate reductions;

- Vietnam's longest expressway, worth VND146.99 trillion, officially extends to Đat Mui, invested by the Ministry of National Defense;

- President Donald Trump maintains tariffs but aims to enter negotiations with other countries;

- Apple has chartered five planes full of iPhones back to the U.S., hoping to stabilize prices for a few months;

- China declares it will "fight back to the end" after Trump threatens an additional 50% tariff.

VN30

BANK

55,800

1D -7.00%

5D -13.49%

Buy Vol. 9,699,780

Sell Vol. 10,188,647

33,500

1D -6.94%

5D -14.10%

Buy Vol. 7,201,973

Sell Vol. 9,250,687

36,000

1D -6.98%

5D -13.98%

Buy Vol. 27,944,759

Sell Vol. 35,386,006

23,950

1D -6.81%

5D -14.31%

Buy Vol. 38,126,274

Sell Vol. 59,524,521

16,250

1D -6.88%

5D -15.14%

Buy Vol. 28,413,095

Sell Vol. 57,509,377

20,900

1D -6.90%

5D -15.04%

Buy Vol. 71,339,463

Sell Vol. 110,343,724

19,350

1D -6.97%

5D -13.81%

Buy Vol. 20,506,332

Sell Vol. 26,823,491

11,900

1D -6.67%

5D -16.78%

Buy Vol. 45,121,636

Sell Vol. 53,781,748

34,800

1D -6.95%

5D -12.34%

Buy Vol. 66,244,606

Sell Vol. 77,678,565

17,400

1D -6.95%

5D -13.00%

Buy Vol. 12,618,555

Sell Vol. 22,874,262

22,150

1D -6.93%

5D -14.97%

Buy Vol. 50,033,581

Sell Vol. 59,013,734

11,250

1D -6.64%

5D -9.64%

Buy Vol. 89,578,634

Sell Vol. 147,452,948

19,000

1D -1.04%

5D -2.81%

Buy Vol. 2,129,801

Sell Vol. 3,881,675

31,200

1D -5.31%

5D -6.59%

Buy Vol. 7,518,980

Sell Vol. 6,855,368

ACB: ACB targets a pre-tax profit of VND23,000 billion in 2025, up 9.5% compared to its 2024 performance. The bank also approved a dividend payout plan totaling 25%, including 10% in cash and 15% in shares.

OIL & GAS

54,600

1D -6.98%

5D -19.11%

Buy Vol. 3,152,305

Sell Vol. 4,167,259

33,250

1D -6.86%

5D -17.49%

Buy Vol. 2,395,468

Sell Vol. 3,837,578

Global oil prices have continued to decline by over 2% since the trading session on April 4.

VINGROUP

55,100

1D -5.49%

5D -7.71%

Buy Vol. 16,284,439

Sell Vol. 20,855,978

47,000

1D -6.56%

5D -11.32%

Buy Vol. 27,199,344

Sell Vol. 33,383,680

17,500

1D -6.91%

5D -12.50%

Buy Vol. 24,630,555

Sell Vol. 34,323,825

VIC: Vingroup is preparing to break ground on an industrial park project in Ha Tinh. The project covers nearly 1,000 hectares with a total investment of over VND13,276 billion, including VND1,991 billion in investor capital.

FOOD & BEVERAGE

54,500

1D -6.84%

5D -10.36%

Buy Vol. 17,370,767

Sell Vol. 19,956,921

54,000

1D -6.90%

5D -18.43%

Buy Vol. 6,389,263

Sell Vol. 15,995,059

42,600

1D -1.73%

5D -13.68%

Buy Vol. 6,279,932

Sell Vol. 6,772,994

VNM: Foreign investors returned to net selling VNM, with a total value of VND165 billion in today's session.

OTHERS

61,000

1D -6.87%

5D -19.63%

Buy Vol. 217,550

Sell Vol. 2,552,503

42,000

1D -6.98%

5D -20.30%

Buy Vol. 1,293,578

Sell Vol. 3,059,217

82,600

1D -4.29%

5D -13.24%

Buy Vol. 785,249

Sell Vol. 1,337,459

105,100

1D -6.99%

5D -12.78%

Buy Vol. 21,532,902

Sell Vol. 25,908,276

49,150

1D -6.91%

5D -16.13%

Buy Vol. 12,723,170

Sell Vol. 21,912,799

25,750

1D -6.87%

5D -19.15%

Buy Vol. 463,988

Sell Vol. 15,799,750

22,100

1D -6.95%

5D -15.16%

Buy Vol. 36,553,372

Sell Vol. 73,312,494

22,900

1D -6.91%

5D -15.19%

Buy Vol. 38,483,184

Sell Vol. 104,369,646

HPG: Previously, Hoa Phat approved a 2024 dividend payout plan at a rate of 20% (5% in cash and 15% in shares). However, there are now rumors suggesting that Hòa Phát may cancel the cash dividend portion.

Market by numbers

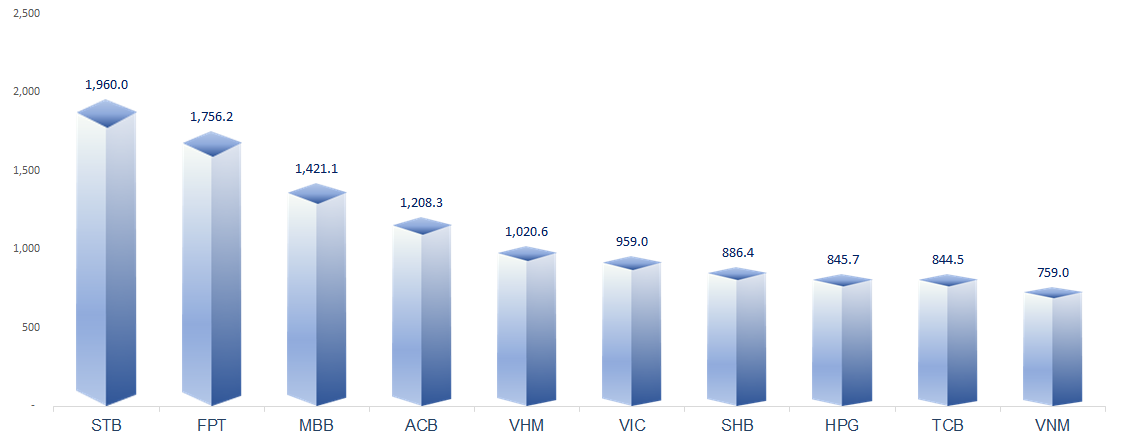

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

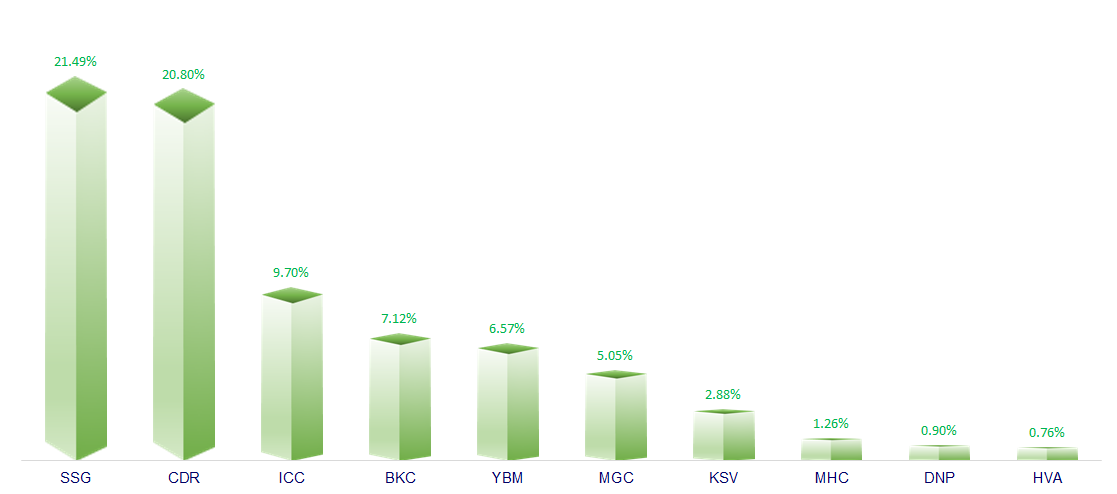

TOP INCREASES 3 CONSECUTIVE SESSIONS

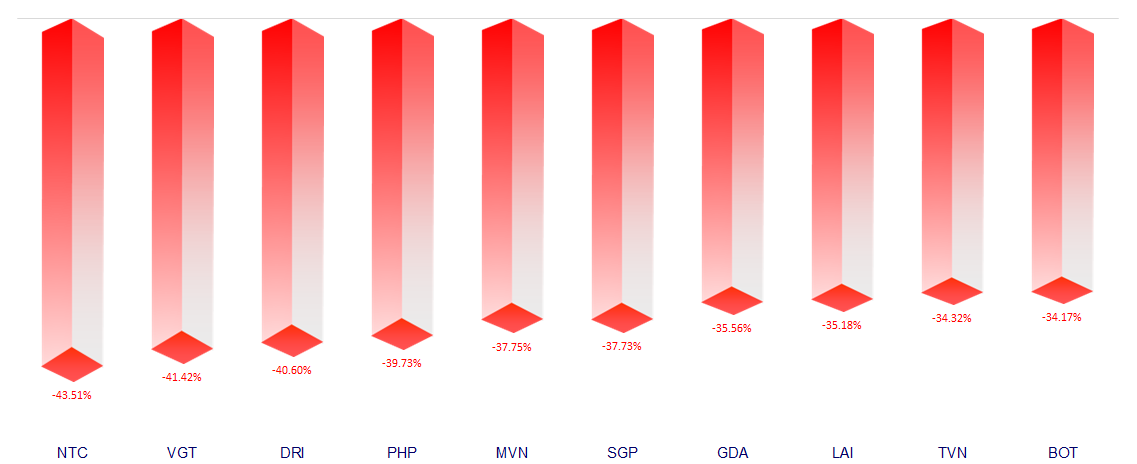

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.