Market brief 09/04/2025

VIETNAM STOCK MARKET

1,094.30

1D -3.40%

YTD -13.62%

192.58

1D -4.21%

YTD -15.32%

1,168.68

1D -2.41%

YTD -13.09%

84.41

1D -0.11%

YTD -11.20%

346.17

1D 0.00%

YTD 0.00%

35,171.68

1D 27.90%

YTD 93.99%

The market saw strong buying momentum, with the VN-Index fluctuating as it awaited the outcome of tariff negotiations. A sea of red dominated all sectors, with Oil & Gas and Basic Resources being the two sectors most negatively affected in terms of index contribution.

ETF & DERIVATIVES

20,640

1D -0.63%

YTD -12.10%

14,000

1D -2.10%

YTD -14.00%

15,980

1D -0.68%

YTD -4.31%

18,000

1D 0.00%

YTD -10.45%

21,300

1D 5.65%

YTD -3.62%

25,880

1D -4.33%

YTD -22.79%

16,200

1D -2.99%

YTD -9.60%

1,178

1D -0.04%

YTD 0.00%

1,174

1D -0.69%

YTD 0.00%

1,170

1D -1.91%

YTD 0.00%

1,175

1D -0.57%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

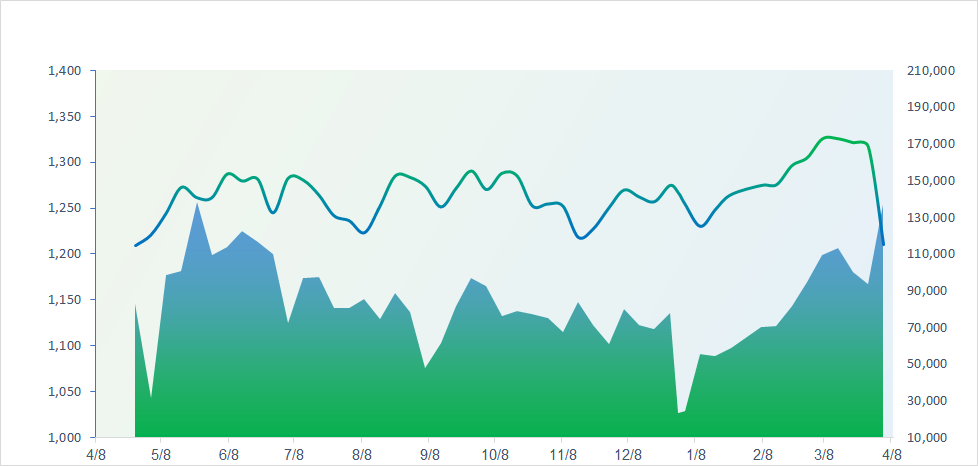

VNINDEX (12M)

GLOBAL MARKET

31,714.03

1D -3.93%

YTD -20.51%

3,186.81

1D 1.31%

YTD -4.92%

20,264.49

1D 0.68%

YTD 1.02%

2,293.70

1D -1.74%

YTD -4.41%

73,847.15

1D -0.46%

YTD -6.02%

3,393.70

1D -2.18%

YTD -10.40%

1,088.18

1D 1.26%

YTD -22.28%

60.07

1D -1.94%

YTD -19.97%

3,043.00

1D 2.04%

YTD 15.48%

As the deadline for the U.S. retaliatory tariffs approaches, stock indexes in Japan, South Korea, and Australia declined. Japan’s Nikkei 225 dropped 3.93% to 31,714 points, while South Korea’s Kospi fell 1.74% to 2,293.7 points. Chinese stock markets also opened lower but later reversed course and climbed. As a result, the Shanghai Composite rose 1.31% to 3,186.8, while the Hang Seng Index gained 0.68% to 20,264.5 points.

VIETNAM ECONOMY

4.18%

YTD (bps) 21

4.60%

2.53%

1D (bps) -1

YTD (bps) 5

2.92%

1D (bps) -2

YTD (bps) 7

2618200.00%

1D (%) 0.16%

YTD (%) 2.47%

2944352.00%

1D (%) 0.78%

YTD (%) 7.99%

359548.00%

1D (%) -0.12%

YTD (%) 0.97%

The domestic gold market witnessed a strong price rebound across most gold types compared to the trading session on April 8, reversing the downward trend from the previous day. Specifically, on April 9, the price of SJC gold bars increased significantly compared to the previous session at most surveyed retail outlets. The increase in both buying and selling prices ranged from 500,000 to 1 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank of Vietnam recently held a working session with the Acting Assistant Secretary of the U.S. Department of the Treasury;

- 343 projects in Ho Chi Minh City have had legal obstacles removed, expected to supply 216,000 apartments to the market;

- The Ministry of Justice proposes new authority for commune-level administrations, suggesting the removal of district-level governance;

- The U.S. reciprocal tariffs on goods from over 80 economies officially take effect;

- The White House officially announced: the U.S. will impose a 104% tariff on Chinese goods starting at noon today;

- The Kremlin confirms: Russia–U.S. negotiations will take place on April 10.

VN30

BANK

52,500

1D -5.91%

5D -18.98%

Buy Vol. 17,391,124

Sell Vol. 13,232,005

32,450

1D -3.13%

5D -16.15%

Buy Vol. 13,521,754

Sell Vol. 10,910,730

33,800

1D -6.11%

5D -19.43%

Buy Vol. 37,511,014

Sell Vol. 28,579,807

23,600

1D -1.46%

5D -15.41%

Buy Vol. 71,432,048

Sell Vol. 65,346,925

15,950

1D -1.85%

5D -16.71%

Buy Vol. 97,019,008

Sell Vol. 80,480,343

20,650

1D -1.20%

5D -15.20%

Buy Vol. 108,320,406

Sell Vol. 86,195,697

18,200

1D -5.94%

5D -18.93%

Buy Vol. 30,002,314

Sell Vol. 28,280,585

11,700

1D -1.68%

5D -17.89%

Buy Vol. 69,172,398

Sell Vol. 46,059,696

33,100

1D -4.89%

5D -15.67%

Buy Vol. 61,439,812

Sell Vol. 51,352,406

16,950

1D -2.59%

5D -15.04%

Buy Vol. 23,053,187

Sell Vol. 18,073,361

21,800

1D -1.58%

5D -15.99%

Buy Vol. 65,011,651

Sell Vol. 50,305,451

10,950

1D -2.67%

5D -12.75%

Buy Vol. 126,332,030

Sell Vol. 116,151,999

19,300

1D 1.58%

5D 0.52%

Buy Vol. 3,858,658

Sell Vol. 4,876,332

31,500

1D 0.96%

5D -4.83%

Buy Vol. 10,757,267

Sell Vol. 10,276,751

EIB: Eximbank has just released documents for the 2025 Annual General Meeting of Shareholders, highlighting several key goals, including a profit target of VND5,188 billion, up 23.8% compared to 2024.

OIL & GAS

50,800

1D -6.96%

5D -24.29%

Buy Vol. 4,318,570

Sell Vol. 3,845,199

30,950

1D -6.92%

5D -23.01%

Buy Vol. 4,339,455

Sell Vol. 3,974,340

Global oil prices have continued to decline sharply, with a drop of nearly 8% over the past two sessions.

VINGROUP

57,000

1D 3.45%

5D -5.63%

Buy Vol. 22,544,796

Sell Vol. 21,625,271

48,500

1D 3.19%

5D -8.49%

Buy Vol. 26,191,326

Sell Vol. 22,142,055

18,000

1D 2.86%

5D -10.67%

Buy Vol. 40,227,668

Sell Vol. 41,812,777

VinGroup stocks surged strongly despite the VN-Index continuing to plunge, contributing around 3.5 points to help support the market in today’s trading session.

FOOD & BEVERAGE

52,000

1D -4.59%

5D -14.05%

Buy Vol. 21,471,764

Sell Vol. 14,595,475

50,300

1D -6.85%

5D -23.79%

Buy Vol. 15,996,889

Sell Vol. 26,722,952

44,100

1D 3.52%

5D -10.55%

Buy Vol. 7,310,446

Sell Vol. 4,878,375

SAB: Foreign investors recorded a net buy of over VND35 billion in SAB across two consecutive sessions.

OTHERS

56,800

1D -6.89%

5D -24.87%

Buy Vol. 131,146

Sell Vol. 4,826,668

39,100

1D -6.90%

5D -24.95%

Buy Vol. 3,199,633

Sell Vol. 3,460,186

79,100

1D -4.24%

5D -16.74%

Buy Vol. 1,101,427

Sell Vol. 1,498,941

105,300

1D 0.19%

5D -13.69%

Buy Vol. 33,193,963

Sell Vol. 25,016,140

46,250

1D -5.90%

5D -21.34%

Buy Vol. 30,785,392

Sell Vol. 26,356,388

23,950

1D -6.99%

5D -24.92%

Buy Vol. 461,306

Sell Vol. 15,943,927

20,600

1D -6.79%

5D -22.12%

Buy Vol. 93,312,117

Sell Vol. 113,347,037

21,300

1D -6.99%

5D -21.83%

Buy Vol. 90,286,771

Sell Vol. 144,426,487

MWG: In its AGM documents, MWG sets a 2025 business target with projected net revenue of VND150,000 billion and post-tax profit of VND4,850 billion, up 12% and 30% respectively compared to the estimated results for 2024. Regarding profit distribution, the Board of Directors proposes a 10% cash dividend. Additionally, the Board suggests a plan to buy back up to 10 million MWG shares as treasury stock.

Market by numbers

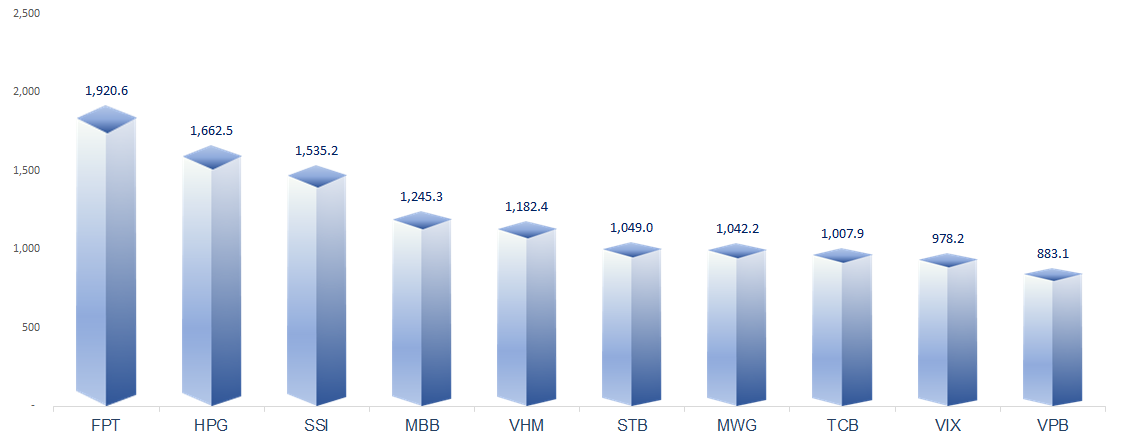

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

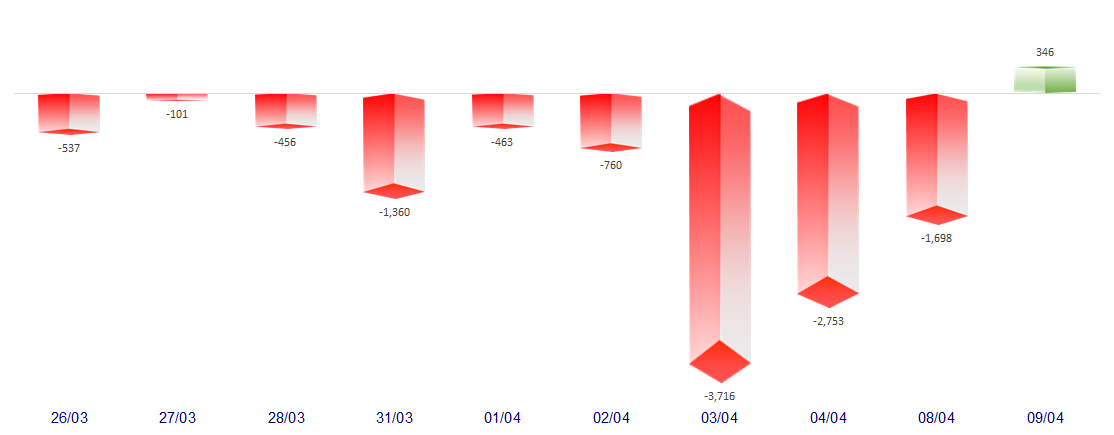

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

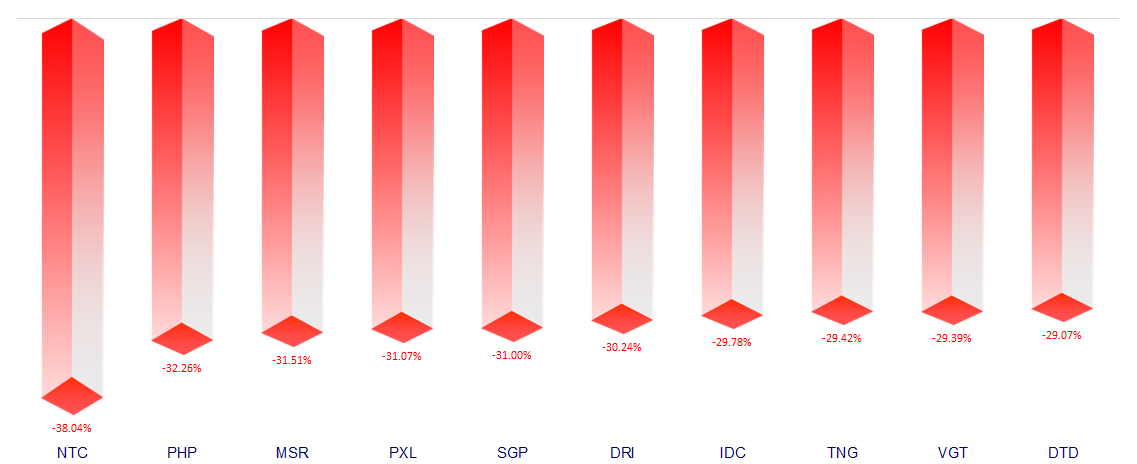

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.