Market brief 10/04/2025

VIETNAM STOCK MARKET

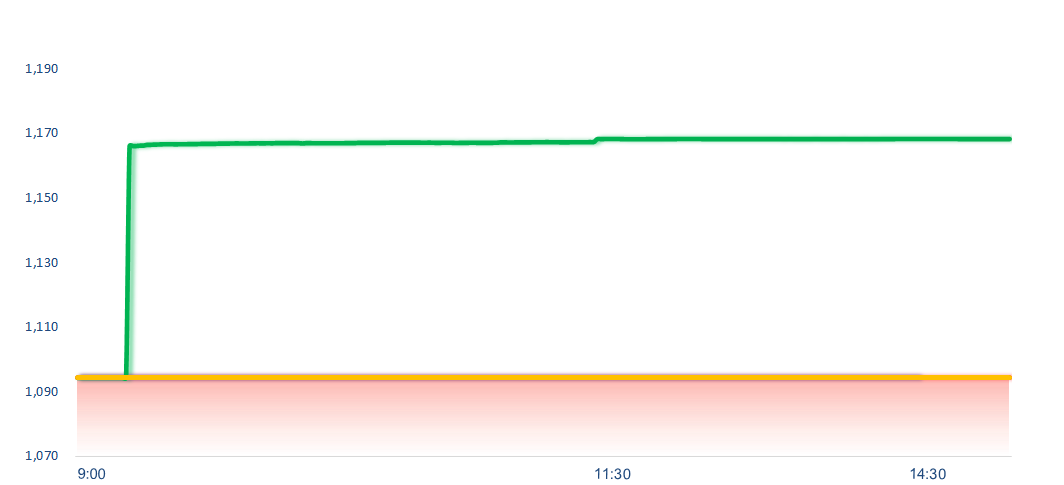

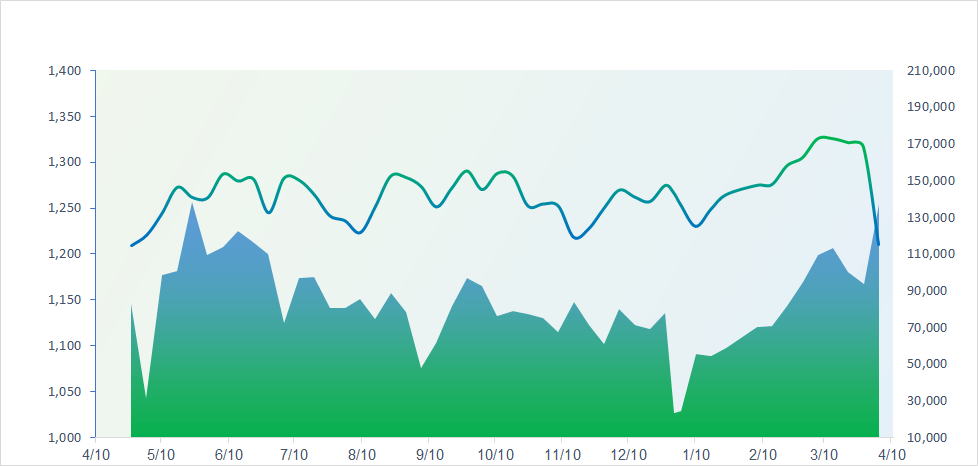

1,168.34

1D 6.77%

YTD -7.77%

208.32

1D 8.17%

YTD -8.40%

1,249.29

1D 6.90%

YTD -7.10%

92.84

1D 9.99%

YTD -2.34%

-1,000.70

1D 0.00%

YTD 0.00%

8,047.32

1D -77.12%

YTD -55.62%

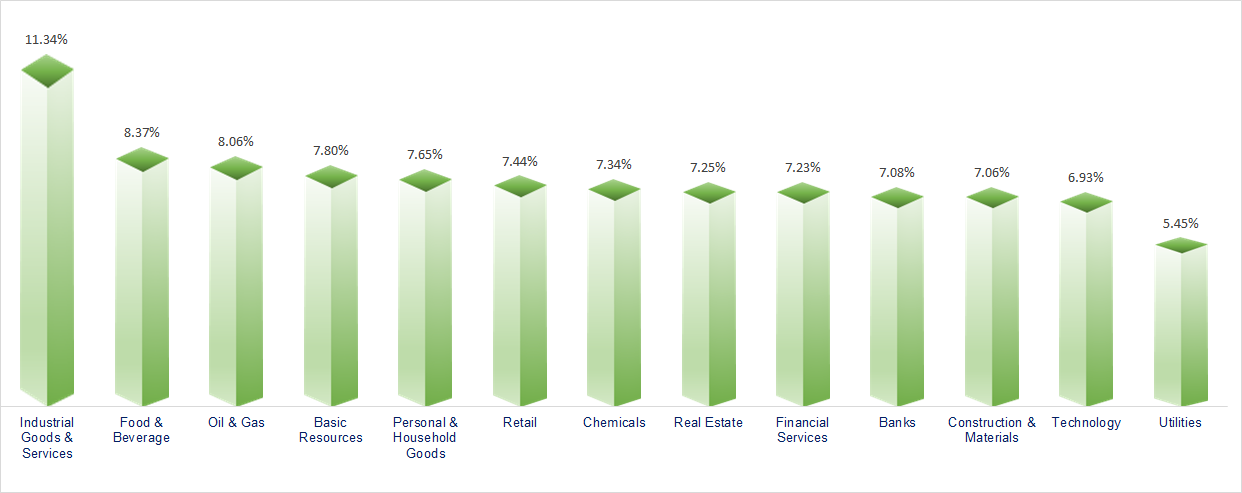

VN-Index made a dramatic reversal, with nearly the entire market shifting from floor-limit losses to ceiling-limit gains. A sea of "purple" — the color indicating limit-up — blanketed all sectors. Industrial Goods & Services and Food & Beverage were the two strongest-performing sectors in terms of index gains.

ETF & DERIVATIVES

22,080

1D 6.98%

YTD -5.96%

14,980

1D 7.00%

YTD -7.99%

17,090

1D 6.95%

YTD 2.34%

19,260

1D 7.00%

YTD -4.18%

22,790

1D 7.00%

YTD 3.12%

27,690

1D 6.99%

YTD -17.39%

17,330

1D 6.98%

YTD -3.29%

1,260

1D 6.99%

YTD 0.00%

1,256

1D 6.99%

YTD 0.00%

1,252

1D 7.00%

YTD 0.00%

1,257

1D 7.00%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

34,609.00

1D 9.13%

YTD -13.25%

3,223.64

1D 1.16%

YTD -3.82%

20,681.78

1D 2.06%

YTD 3.10%

2,445.06

1D 6.60%

YTD 1.90%

73,847.15

1D 0.00%

YTD -6.02%

3,577.84

1D 5.43%

YTD -5.54%

1,137.64

1D 4.55%

YTD -18.75%

63.60

1D 4.09%

YTD -15.26%

3,110.00

1D 0.91%

YTD 18.02%

Following President Trump's decision to temporarily suspend the imposition of tariffs, Asian stock markets rallied as investors anticipated the move would ease pressure from trade tensions. Japan’s Nikkei 225 surged by 9.13% to 34,609 points. South Korea’s Kospi also jumped 6.6% to 2,445.1 points. Chinese stock markets continued their upward momentum, with the Shanghai Composite rising 1.16% to 3,223.6 points. Meanwhile, the Hang Seng Index climbed 2.06% to 20,681.8 points.

VIETNAM ECONOMY

4.07%

1D (bps) -11

YTD (bps) 10

4.60%

2.47%

1D (bps) -6

YTD (bps) -1

2.97%

1D (bps) 5

YTD (bps) 12

2597000.00%

1D (%) -0.81%

YTD (%) 1.64%

2917876.00%

1D (%) -0.90%

YTD (%) 7.02%

356800.00%

1D (%) -0.76%

YTD (%) 0.20%

Domestic gold prices continued to surge today, with gold rings hitting a historic peak of 104 million VND/tael, while SJC gold bars set a new record at 103.9 million VND/tael. In contrast, during today’s (April 10) price adjustment session, gasoline prices were sharply reduced after three consecutive hikes. RON 95 gasoline dropped by 1,710 VND/liter, bringing it close to the 19,000 VND/liter.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- General Secretary To Lam: Policy to reorganize into 34 provinces and cities, reducing 50% of commune-level units;

- ASEAN Economic Ministers approve joint statement on U.S. tariff policy;

- Adjustment of a VND25,000 billion airport project planned by the Mobile Police Command and constructed by Sun Group;

- Apple faces difficulty relocating production to the U.S. as iPhone prices could rise to USD3,500;

- The Chinese yuan has depreciated for six consecutive days amid the trade conflict with the U.S;

- FED: The U.S. economy faces risks of slowdown and high inflation.

VN30

BANK

56,100

1D 6.86%

5D -6.97%

Buy Vol. 30,754,109

Sell Vol. 175,351

34,700

1D 6.93%

5D -3.61%

Buy Vol. 18,445,716

Sell Vol. 636,561

36,150

1D 6.95%

5D -7.43%

Buy Vol. 68,081,049

Sell Vol. 2,908,401

25,250

1D 6.99%

5D -2.70%

Buy Vol. 167,571,561

Sell Vol. 1,243,616

17,050

1D 6.90%

5D -4.48%

Buy Vol. 50,951,208

Sell Vol. 1,667,054

22,050

1D 6.78%

5D -2.65%

Buy Vol. 231,568,505

Sell Vol. 1,693,323

19,450

1D 6.87%

5D -6.94%

Buy Vol. 46,652,923

Sell Vol. 232,507

12,500

1D 6.84%

5D -6.02%

Buy Vol. 53,231,173

Sell Vol. 1,279,664

35,400

1D 6.95%

5D -3.15%

Buy Vol. 75,382,777

Sell Vol. 231,926

18,100

1D 6.78%

5D -2.69%

Buy Vol. 32,633,326

Sell Vol. 646,526

23,300

1D 6.88%

5D -3.52%

Buy Vol. 100,611,767

Sell Vol. 998,409

11,700

1D 6.85%

5D 0.00%

Buy Vol. 149,737,256

Sell Vol. 18,932,429

20,650

1D 6.99%

5D 10.43%

Buy Vol. 3,519,429

Sell Vol. 2,696,010

33,700

1D 6.98%

5D 9.42%

Buy Vol. 14,407,048

Sell Vol. 475,851

EIB: Eximbank has just released documents for the 2025 Annual General Meeting of Shareholders, highlighting several key goals, including a profit target of VND5,188 billion, up 23.8% compared to 2024.

OIL & GAS

54,300

1D 6.89%

5D -13.12%

Buy Vol. 8,781,043

Sell Vol. 57,969

33,100

1D 6.95%

5D -11.50%

Buy Vol. 7,457,980

Sell Vol. 41,725

Global oil prices have continued to decline sharply, with a drop of nearly 8% over the past two sessions.

VINGROUP

60,900

1D 6.84%

5D 8.36%

Buy Vol. 25,657,401

Sell Vol. 3,810,300

51,800

1D 6.80%

5D 5.07%

Buy Vol. 26,950,075

Sell Vol. 755,433

19,250

1D 6.94%

5D 2.67%

Buy Vol. 24,837,376

Sell Vol. 1,893,392

VinGroup stocks surged strongly despite the VN-Index continuing to plunge, contributing around 3.5 points to help support the market in today’s trading session.

FOOD & BEVERAGE

55,600

1D 6.92%

5D -1.59%

Buy Vol. 18,955,217

Sell Vol. 1,515,755

53,800

1D 6.96%

5D -12.38%

Buy Vol. 19,815,903

Sell Vol. 492,414

47,150

1D 6.92%

5D 2.84%

Buy Vol. 5,661,121

Sell Vol. 598,972

SAB: Foreign investors recorded a net buy of over VND35 billion in SAB across two consecutive sessions.

OTHERS

60,700

1D 6.87%

5D -13.78%

Buy Vol. 1,894,207

Sell Vol. 159,589

41,800

1D 6.91%

5D -13.81%

Buy Vol. 3,744,090

Sell Vol. 56,829

84,600

1D 6.95%

5D -4.30%

Buy Vol. 779,990

Sell Vol. 21,982

112,600

1D 6.93%

5D -0.79%

Buy Vol. 44,793,974

Sell Vol. 1,009,422

49,450

1D 6.92%

5D -9.60%

Buy Vol. 45,970,284

Sell Vol. 412,041

25,600

1D 6.89%

5D -13.80%

Buy Vol. 7,442,450

Sell Vol. 2,524,160

22,000

1D 6.80%

5D -10.57%

Buy Vol. 167,088,637

Sell Vol. 5,223,676

22,750

1D 6.81%

5D -10.26%

Buy Vol. 242,752,223

Sell Vol. 3,066,909

MWG: In its AGM documents, MWG sets a 2025 business target with projected net revenue of VND150,000 billion and post-tax profit of VND4,850 billion, up 12% and 30% respectively compared to the estimated results for 2024. Regarding profit distribution, the Board of Directors proposes a 10% cash dividend. Additionally, the Board suggests a plan to buy back up to 10 million MWG shares as treasury stock.

Market by numbers

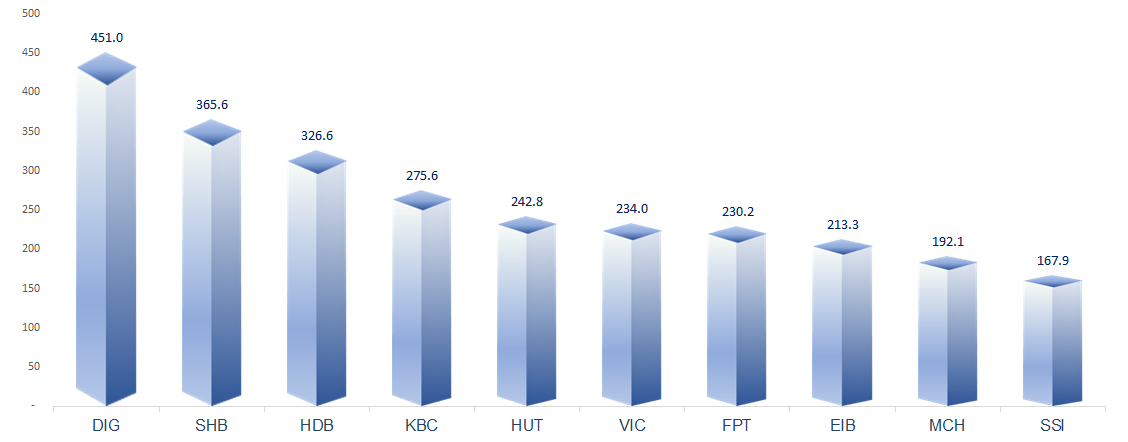

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

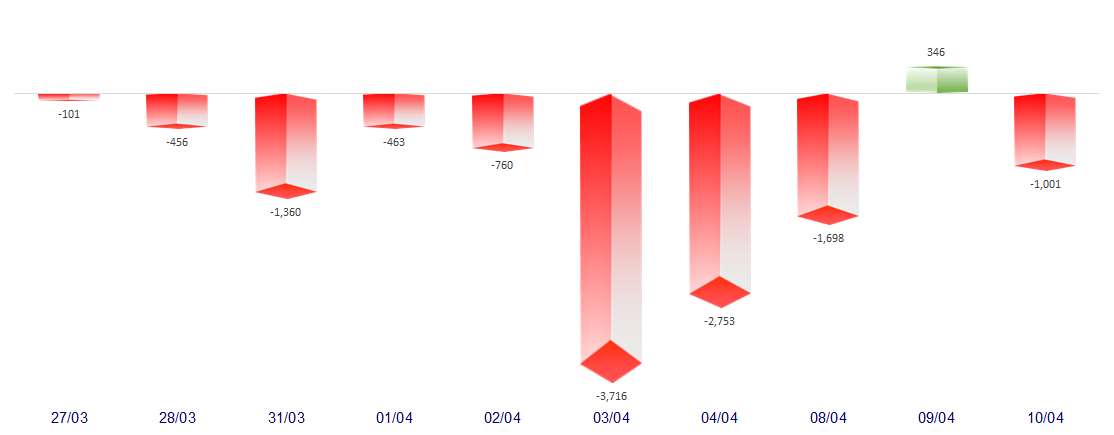

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

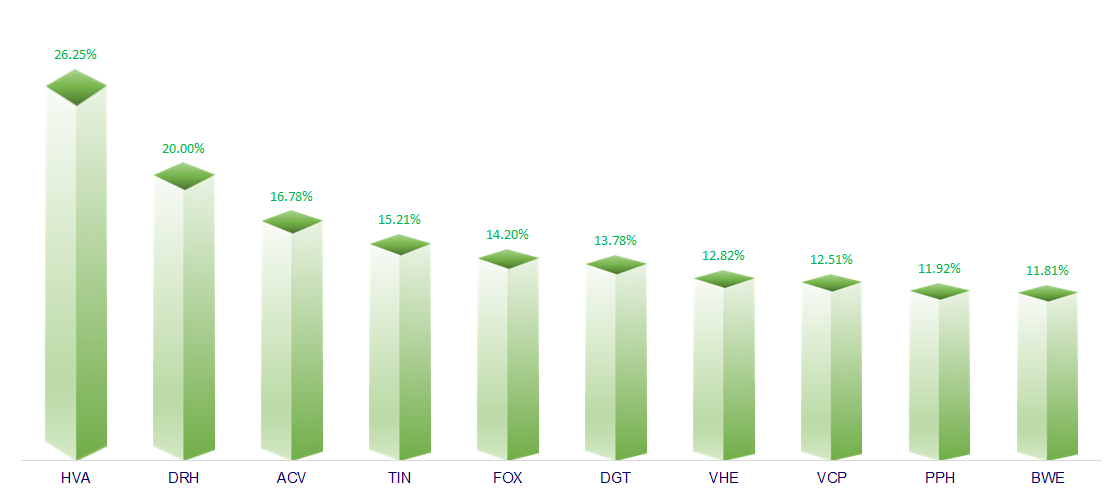

TOP INCREASES 3 CONSECUTIVE SESSIONS

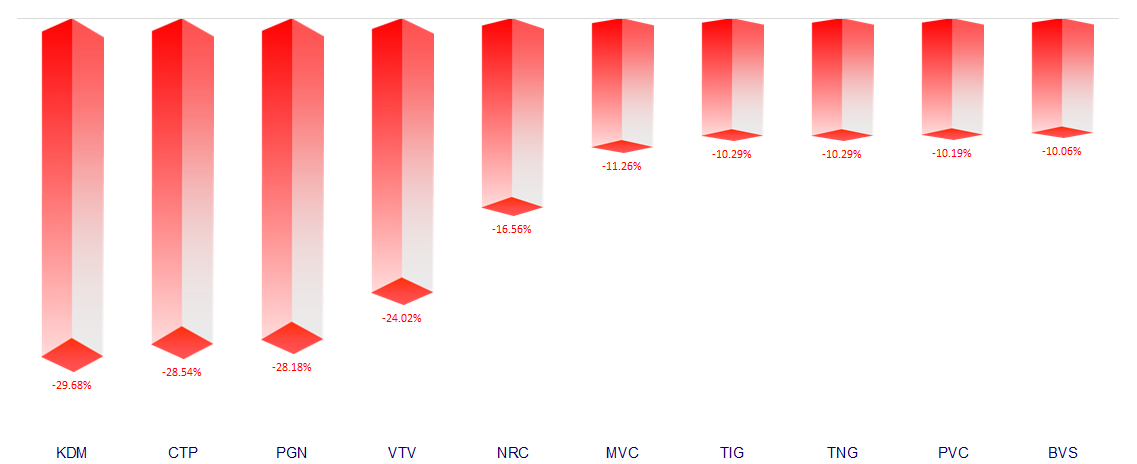

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.