Market brief 11/04/2025

VIETNAM STOCK MARKET

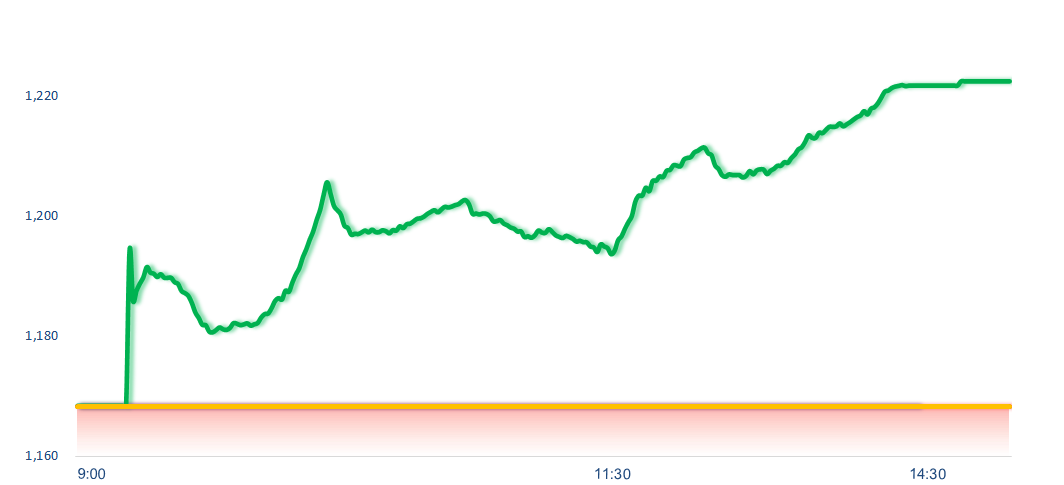

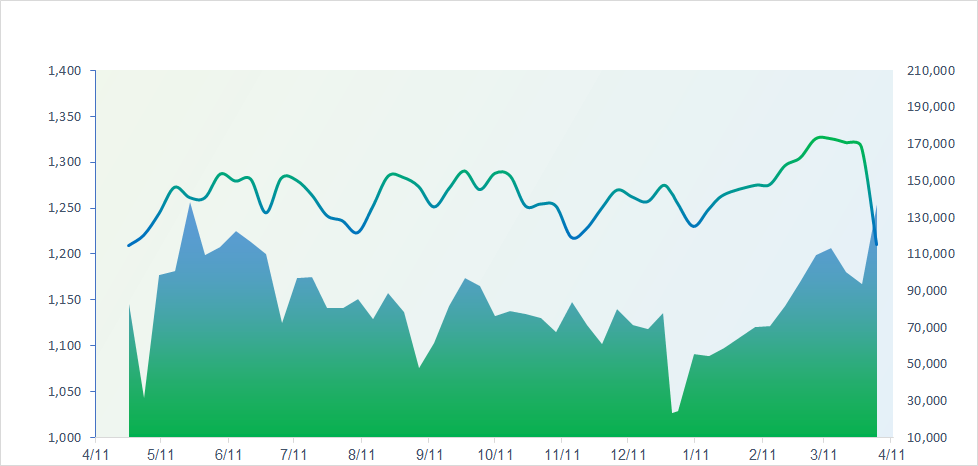

1,222.46

1D 4.63%

YTD -3.50%

213.34

1D 2.41%

YTD -6.20%

1,309.94

1D 4.85%

YTD -2.59%

93.25

1D 0.44%

YTD -1.90%

669.78

1D 0.00%

YTD 0.00%

41,553.62

1D 416.37%

YTD 129.19%

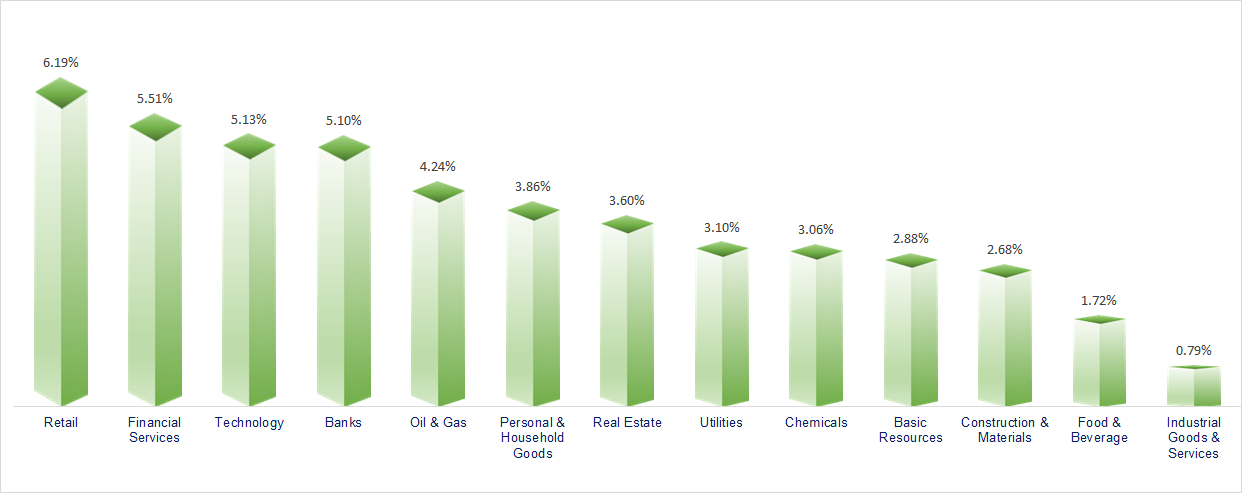

VN-Index continued to rise strongly despite intense fluctuations. Most sectors recorded positive gains in today’s trading session. Retail, Financial Services, and Banking were the sectors with the strongest increases in terms of index performance.

ETF & DERIVATIVES

22,800

1D 3.26%

YTD -2.90%

15,760

1D 5.21%

YTD -3.19%

16,100

1D -5.79%

YTD -3.59%

20,480

1D 6.33%

YTD 1.89%

22,000

1D -3.47%

YTD -0.45%

29,100

1D 5.09%

YTD -13.19%

17,520

1D 1.10%

YTD -2.23%

1,307

1D 3.70%

YTD 0.00%

1,310

1D 4.30%

YTD 0.00%

1,312

1D 4.77%

YTD 0.00%

1,315

1D 4.59%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

33,585.58

1D -2.96%

YTD -15.81%

3,238.23

1D 0.45%

YTD -3.39%

20,914.69

1D 1.13%

YTD 4.27%

2,432.72

1D -0.50%

YTD 1.38%

75,157.26

1D 1.77%

YTD -4.35%

3,512.54

1D -1.83%

YTD -7.26%

1,128.66

1D -0.79%

YTD -19.39%

63.00

1D -3.61%

YTD -16.06%

3,220.00

1D -0.30%

YTD 22.20%

Stock markets across the Asia-Pacific region saw mixed movements in today’s trading session, following Wall Street’s renewed sell-off as escalating trade tensions between the world’s two largest economies, the U.S. and China, fueled investor risk aversion. In Japan, the Nikkei 225 dropped 2.96% today after surging 9.1% on April 10. Meanwhile, South Korea’s Kospi also slipped 0.5%. In Hong Kong, the Hang Seng Index edged up 1.13%, while mainland China’s Shanghai Composite rose slightly by 0.45%.

VIETNAM ECONOMY

4.08%

1D (bps) 1

YTD (bps) 11

4.60%

2.54%

1D (bps) 7

YTD (bps) 6

2.95%

1D (bps) -2

YTD (bps) 10

2592000.00%

1D (%) -0.19%

YTD (%) 1.44%

2977569.00%

1D (%) 2.05%

YTD (%) 9.20%

356999.00%

1D (%) 0.06%

YTD (%) 0.25%

The domestic gold market on April 11 continued to record strong gains, extending the record-setting trend from the previous session. Notably, the price of SJC gold bars surpassed 106 million VND/tael – the highest level ever recorded.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SBV may lower its policy interest rate to COVID-era lows if the economic situation worsens, with the exchange rate forecast to rise to 27,200 USD/VND;

- New information has emerged regarding the “super project” – a railway costing over VND200 trillion connecting to China;

- General Secretary and Chinese President Xi Jinping will make a state visit to Vietnam from April 14 to 15;

- Former U.S. President Donald Trump expresses desire to reach a trade agreement with China;

- China declares it will not concede and announces a 125% tariff on U.S. goods;

- Russia and the U.S. release results of a 5-hour-long meeting held in Turkey.

VN30

BANK

59,800

1D 6.60%

5D -0.33%

Buy Vol. 14,683,507

Sell Vol. 13,910,677

36,750

1D 5.91%

5D 2.08%

Buy Vol. 13,944,676

Sell Vol. 13,406,802

38,400

1D 6.22%

5D -0.78%

Buy Vol. 38,167,921

Sell Vol. 35,326,054

26,600

1D 5.35%

5D 3.50%

Buy Vol. 75,865,093

Sell Vol. 88,717,526

17,450

1D 2.35%

5D 0.00%

Buy Vol. 123,199,496

Sell Vol. 115,217,647

23,450

1D 6.35%

5D 4.45%

Buy Vol. 148,706,624

Sell Vol. 134,560,946

20,700

1D 6.43%

5D -0.48%

Buy Vol. 27,823,611

Sell Vol. 23,901,690

13,200

1D 5.60%

5D 3.53%

Buy Vol. 58,096,185

Sell Vol. 45,989,388

37,850

1D 6.92%

5D 1.20%

Buy Vol. 70,908,022

Sell Vol. 66,159,514

18,650

1D 3.04%

5D -0.27%

Buy Vol. 27,760,279

Sell Vol. 27,869,786

24,850

1D 6.65%

5D 4.41%

Buy Vol. 56,110,068

Sell Vol. 60,470,892

12,150

1D 3.85%

5D 0.83%

Buy Vol. 180,825,183

Sell Vol. 226,682,063

20,000

1D -3.15%

5D 4.17%

Buy Vol. 4,420,546

Sell Vol. 4,727,978

34,200

1D 1.48%

5D 3.79%

Buy Vol. 13,943,344

Sell Vol. 14,470,346

TPB: Tien Phong Commercial Joint Stock Bank (TPBank) has just announced its Q1/2025 business results, reporting a pre-tax profit of over VND2,100 billion, equivalent to approximately 26% of its full-year profit target. Compared to the same period in 2024, this profit represents an increase of more than 15%.

OIL & GAS

58,100

1D 7.00%

5D -1.02%

Buy Vol. 4,900,987

Sell Vol. 3,002,694

35,350

1D 6.80%

5D -0.98%

Buy Vol. 5,714,714

Sell Vol. 5,561,832

Global oil prices have sharply reversed, dropping 4% due to escalating tensions between the U.S. and China.

VINGROUP

65,100

1D 6.90%

5D 11.66%

Buy Vol. 23,213,791

Sell Vol. 19,975,538

53,500

1D 3.28%

5D 6.36%

Buy Vol. 19,285,787

Sell Vol. 27,123,555

19,400

1D 0.78%

5D 3.19%

Buy Vol. 23,762,765

Sell Vol. 33,147,978

VIC: Vingroup issued VND7,000 billion worth of bonds via private placement, including two tranches: VND3,000 billion with a maximum term of 25 months and VND4,000 billion with a maximum term of 38 months.

FOOD & BEVERAGE

57,500

1D 3.42%

5D -1.71%

Buy Vol. 16,992,707

Sell Vol. 18,335,232

57,100

1D 6.13%

5D -1.55%

Buy Vol. 23,534,060

Sell Vol. 23,158,040

49,000

1D 3.92%

5D 13.03%

Buy Vol. 6,261,250

Sell Vol. 7,819,360

MSN: Masan will seek shareholders’ approval to remove the provision limiting foreign ownership to a maximum of 49% of its charter capital.

OTHERS

59,700

1D -1.65%

5D -8.85%

Buy Vol. 5,199,657

Sell Vol. 5,709,924

44,000

1D 5.26%

5D -2.55%

Buy Vol. 2,328,366

Sell Vol. 2,249,576

85,400

1D 0.95%

5D -1.04%

Buy Vol. 1,388,647

Sell Vol. 1,868,245

118,500

1D 5.24%

5D 4.87%

Buy Vol. 30,294,705

Sell Vol. 34,868,248

52,900

1D 6.98%

5D 0.19%

Buy Vol. 28,518,408

Sell Vol. 17,328,932

26,000

1D 1.56%

5D -5.97%

Buy Vol. 18,951,732

Sell Vol. 19,540,563

23,450

1D 6.59%

5D -1.26%

Buy Vol. 107,683,032

Sell Vol. 108,646,050

24,300

1D 6.81%

5D -1.22%

Buy Vol. 152,742,286

Sell Vol. 95,648,803

HPG: Hoa Phat Group is preparing to install production lines for railway steel and automotive tire bead wire with an annual capacity of 500,000 tons, following a contract signing with Primetals Technologies, a supplier of casting and rolling steel equipment.

Market by numbers

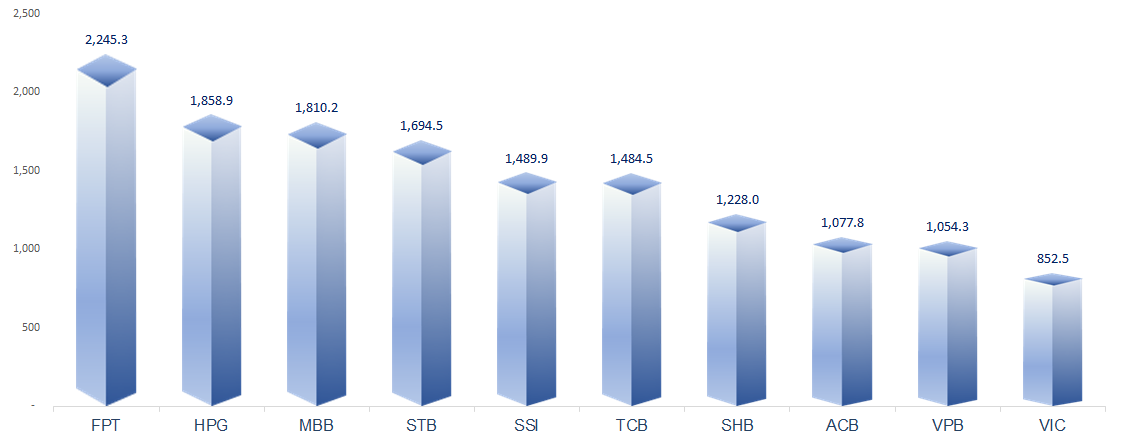

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

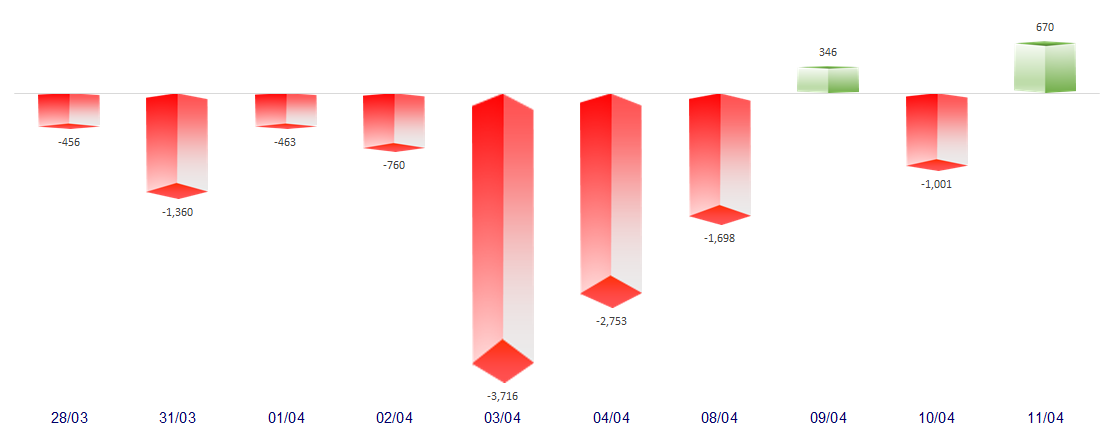

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

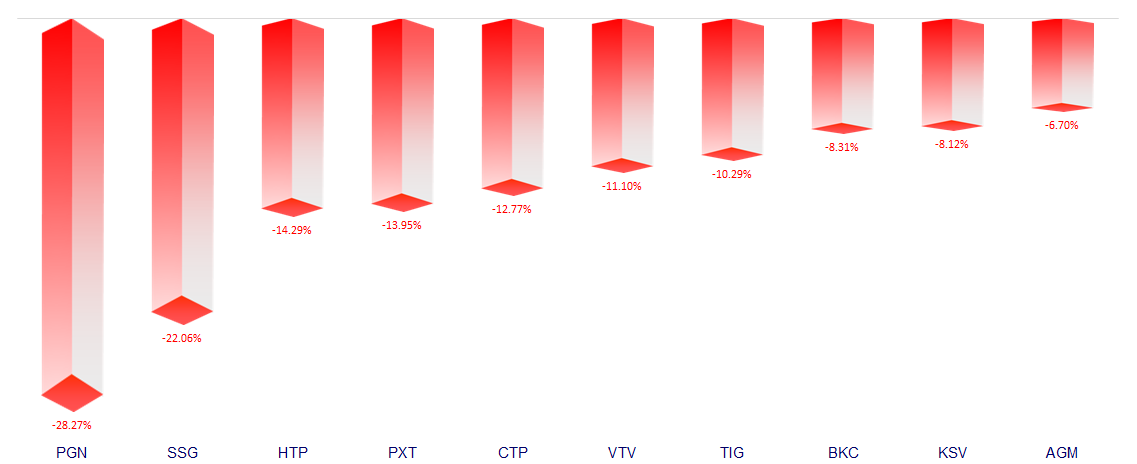

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.