Market brief 15/04/2025

VIETNAM STOCK MARKET

1,227.79

1D -1.10%

YTD -3.08%

210.24

1D -2.21%

YTD -7.56%

1,310.76

1D -1.14%

YTD -2.53%

91.03

1D -0.80%

YTD -4.24%

99.05

1D 0.00%

YTD 0.00%

26,083.72

1D -1.27%

YTD 43.86%

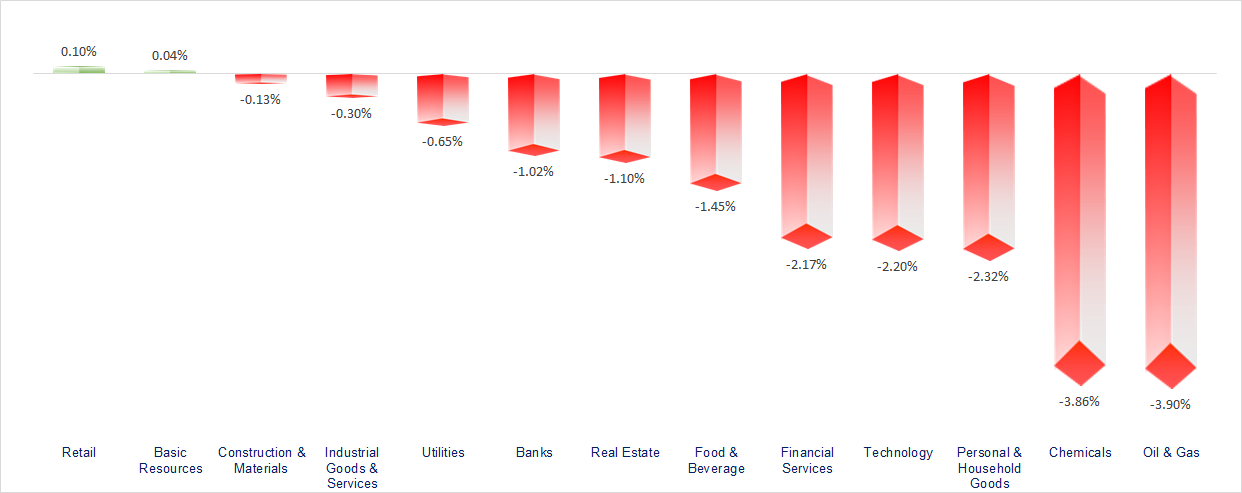

The market recorded its first correction session after four consecutive days of gains from the bottom. Basic resources and retail were among the few sectors that closed in positive territory. In contrast, Oil & gas and Chemicals were the worst-performing sectors of the day.

ETF & DERIVATIVES

22,800

1D -1.47%

YTD -2.90%

15,890

1D -0.25%

YTD -2.40%

16,470

1D 0.80%

YTD -1.38%

19,950

1D -1.97%

YTD -0.75%

21,790

1D -1.63%

YTD -1.40%

29,200

1D -0.34%

YTD -12.89%

17,200

1D -1.66%

YTD -4.02%

1,308

1D -0.71%

YTD 0.00%

1,308

1D -0.91%

YTD 0.00%

1,309

1D -0.98%

YTD 0.00%

1,317

1D -0.60%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

34,267.54

1D 0.84%

YTD -14.10%

3,267.66

1D 0.15%

YTD -2.51%

21,466.27

1D 0.23%

YTD 7.02%

2,477.41

1D 0.88%

YTD 3.25%

76,734.89

1D 2.10%

YTD -2.34%

3,624.72

1D 2.14%

YTD -4.30%

1,128.66

1D 0.00%

YTD -19.39%

64.24

1D -1.37%

YTD -14.41%

3,220.00

1D -0.10%

YTD 22.20%

Following Wall Street’s gains overnight, Asian stock markets also turned green ahead of China’s Q1 GDP announcement tomorrow. In Japan and South Korea, shares of major automakers such as Honda, Mazda, Toyota, and Suzuki surged between 3–5% after former U.S. President Donald Trump said yesterday afternoon that he was considering support measures for some car manufacturers.

VIETNAM ECONOMY

4.08%

1D (bps) -2

YTD (bps) 11

4.60%

2.52%

1D (bps) 4

YTD (bps) 4

2.99%

1D (bps) -2

YTD (bps) 14

2601000.00%

1D (%) 0.04%

YTD (%) 1.80%

3010803.00%

1D (%) -0.27%

YTD (%) 10.42%

358716.00%

1D (%) -0.04%

YTD (%) 0.73%

On April 15, the central exchange rate was listed by the State Bank of Vietnam at 24,891 VND/USD, up VND5 from the previous day. The USD selling price at commercial banks surpassed the 26,000 VND/USD mark this morning, while the EUR selling price reached 30,189 VND/EUR.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Resolution on administrative unit restructuring takes effect from April 15;

- Vietnam and China agree to establish a Railway Cooperation Committee;

- Vice Chairman of the National Assembly invites South Korean energy giants to invest in nuclear power in Vietnam;

- Chinese company unveils CUDA alternative software, challenging NVIDIA’s dominance in AI development;

- Trump poised for a historic victory;

- Fed Chair: Inflation is temporary; the central bank will cut interest rates regardless of tax levels.

VN30

BANK

60,000

1D 1.18%

5D 7.53%

Buy Vol. 8,667,597

Sell Vol. 10,303,092

36,500

1D -1.35%

5D 8.96%

Buy Vol. 5,462,357

Sell Vol. 6,252,351

37,750

1D -1.44%

5D 4.86%

Buy Vol. 19,519,615

Sell Vol. 18,984,001

26,000

1D -2.07%

5D 8.56%

Buy Vol. 39,551,130

Sell Vol. 35,208,866

16,900

1D -2.31%

5D 4.00%

Buy Vol. 37,026,483

Sell Vol. 35,069,026

23,000

1D -1.92%

5D 10.05%

Buy Vol. 53,762,885

Sell Vol. 55,777,535

20,550

1D -2.14%

5D 6.20%

Buy Vol. 21,103,863

Sell Vol. 19,994,545

12,800

1D -1.92%

5D 7.56%

Buy Vol. 24,253,811

Sell Vol. 28,174,410

38,450

1D 1.72%

5D 10.49%

Buy Vol. 32,296,882

Sell Vol. 27,981,775

18,450

1D -1.60%

5D 6.03%

Buy Vol. 10,425,199

Sell Vol. 12,475,017

24,100

1D -2.82%

5D 8.80%

Buy Vol. 25,485,603

Sell Vol. 22,755,129

11,900

1D -2.06%

5D 5.78%

Buy Vol. 102,186,061

Sell Vol. 135,541,405

18,600

1D -2.87%

5D -2.11%

Buy Vol. 3,346,600

Sell Vol. 3,318,791

33,150

1D -2.07%

5D 6.25%

Buy Vol. 7,643,498

Sell Vol. 7,196,735

VPB: VPBank aims to reach VND1.13 quadrillion in consolidated total assets by the end of 2025, representing a 23% increase compared to the end of 2024. If achieved, VPBank will become the next member of the "quadrillion-VND club", which is currently dominated by state-owned banks.

OIL & GAS

58,200

1D -1.69%

5D 6.59%

Buy Vol. 1,736,682

Sell Vol. 1,983,883

33,600

1D -3.59%

5D 1.05%

Buy Vol. 2,882,068

Sell Vol. 2,545,910

PLX: Petrolimex targets an 8% increase in output in 2025, with a profit plan of VND3,200 billion and an expected dividend payout of 10%.

VINGROUP

70,500

1D 1.29%

5D 27.95%

Buy Vol. 18,322,791

Sell Vol. 20,835,709

57,500

1D 0.52%

5D 22.34%

Buy Vol. 24,001,676

Sell Vol. 26,440,523

20,300

1D 0.00%

5D 16.00%

Buy Vol. 28,910,120

Sell Vol. 38,898,425

VIC: Vingroup has successfully raised VND7,000 billion through two private bond issuances.

FOOD & BEVERAGE

56,300

1D -1.05%

5D 3.30%

Buy Vol. 7,715,043

Sell Vol. 8,127,578

58,500

1D -2.50%

5D 8.33%

Buy Vol. 11,135,784

Sell Vol. 13,511,530

48,700

1D -1.62%

5D 14.32%

Buy Vol. 3,834,263

Sell Vol. 4,586,034

VNM: Foreign investors have returned to net selling, with a total value of VND137 billion over the past two sessions.

OTHERS

56,500

1D -6.61%

5D -7.38%

Buy Vol. 2,326,130

Sell Vol. 2,007,031

44,000

1D -1.35%

5D 4.76%

Buy Vol. 1,701,301

Sell Vol. 1,832,302

83,300

1D -2.57%

5D 0.85%

Buy Vol. 1,327,955

Sell Vol. 1,223,473

116,000

1D -2.11%

5D 10.37%

Buy Vol. 12,486,138

Sell Vol. 15,176,085

57,100

1D 0.88%

5D 16.17%

Buy Vol. 19,275,033

Sell Vol. 19,267,392

24,400

1D -6.87%

5D -5.24%

Buy Vol. 8,184,539

Sell Vol. 14,907,474

23,300

1D -3.32%

5D 5.43%

Buy Vol. 46,268,673

Sell Vol. 49,539,810

25,850

1D 1.97%

5D 12.88%

Buy Vol. 85,413,432

Sell Vol. 85,744,370

HPG: Hoa Phat Group has signed a memorandum of understanding with Phu Yen province to study investments in three strategic projects totaling over VND120,000 billion (nearly USD5 billion). The projects include: Hoa Tam Industrial Park (VND13,300 billion), Bai Goc Port (VND24,000 billion), and the Hoa Phat Steel Complex at Hoa Tam IP (VND86,000 billion).

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

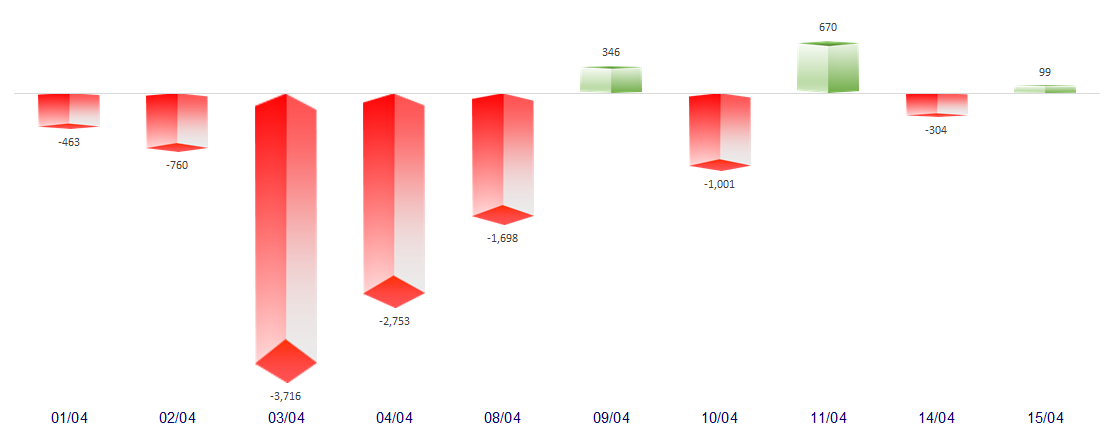

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

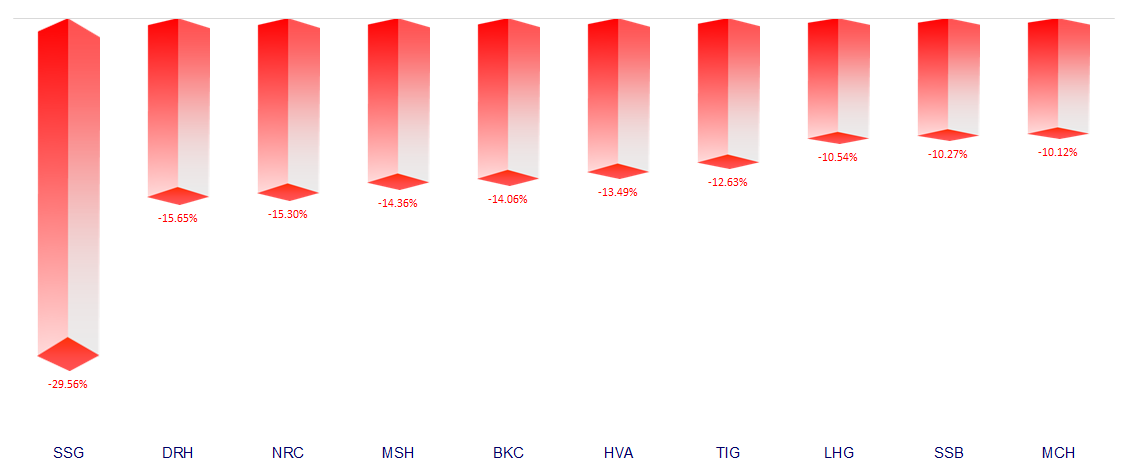

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.