Market brief 25/04/2025

VIETNAM STOCK MARKET

1,223.35

1D 1.02%

YTD -3.43%

211.07

1D -0.18%

YTD -7.19%

1,311.66

1D 0.66%

YTD -2.46%

91.83

1D 0.40%

YTD -3.40%

458.22

1D 0.00%

YTD 0.00%

19,312.78

1D -6.31%

YTD 6.52%

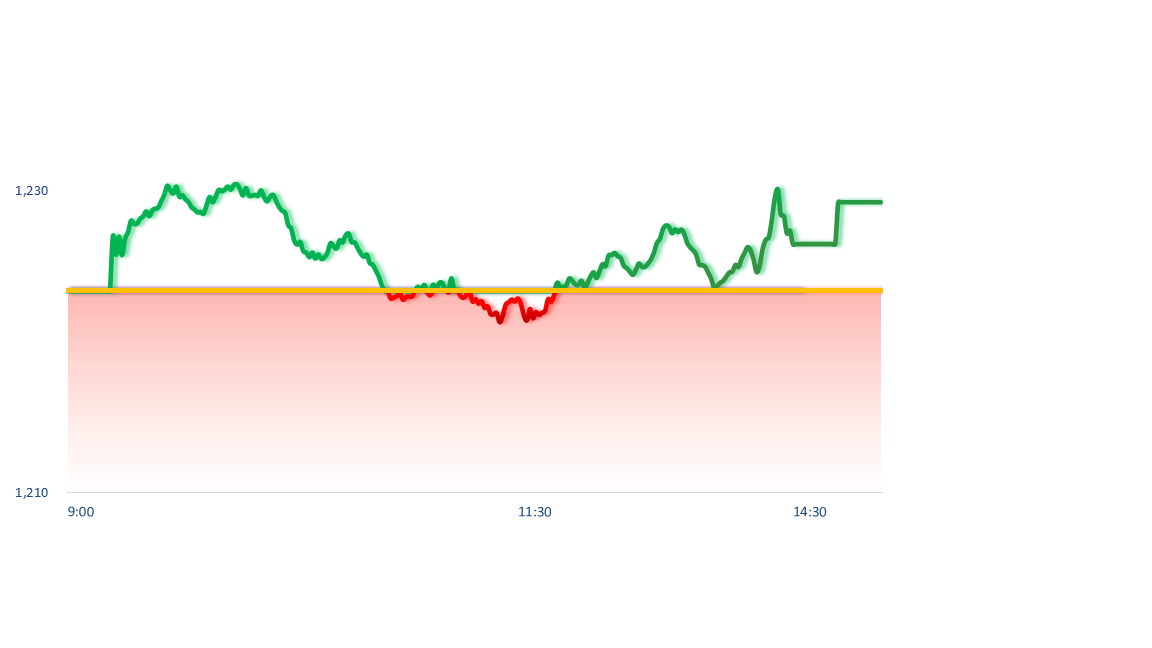

The VN-Index recorded a strong gain as investor caution gradually eased. Real Estate, Information Technology, and Oil & Gas were the most positive sectors today, while Banking was the only sector to decline.

ETF & DERIVATIVES

22,650

1D 0.22%

YTD -3.53%

15,740

1D 0.32%

YTD -3.32%

16,150

1D 0.81%

YTD -3.29%

19,210

1D 0.00%

YTD -4.43%

21,770

1D 1.16%

YTD -1.49%

28,730

1D 1.45%

YTD -14.29%

17,100

1D 0.35%

YTD -4.58%

1,307

1D 0.46%

YTD 0.00%

1,303

1D 0.46%

YTD 0.00%

1,310

1D 0.26%

YTD 0.00%

1,313

1D 0.31%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

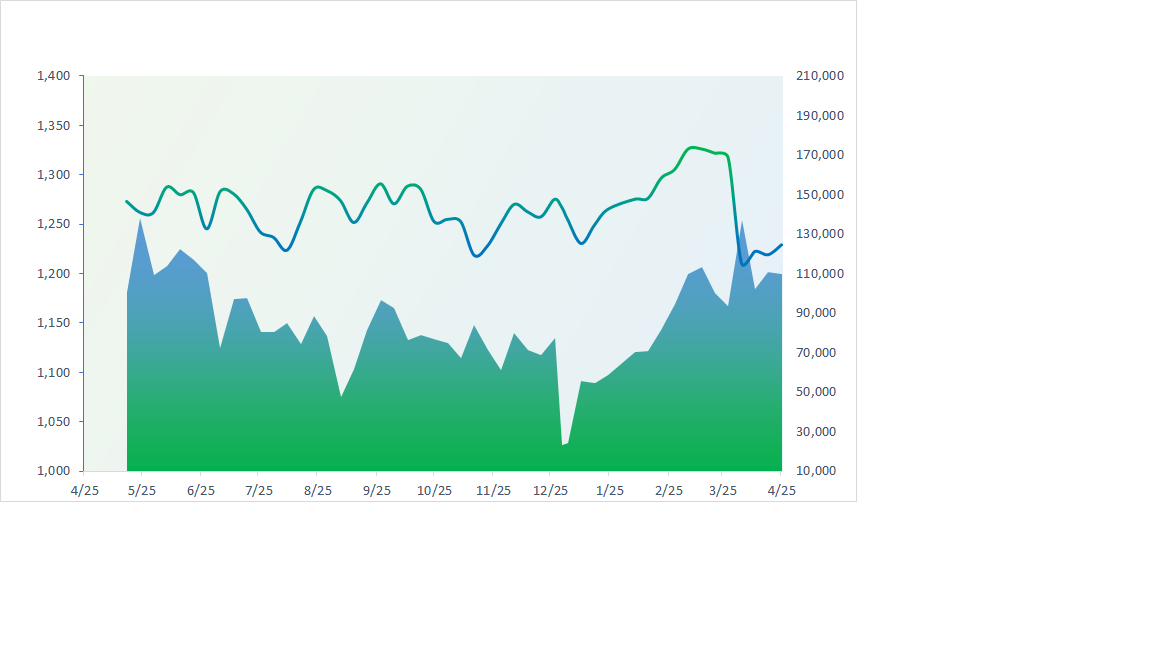

VNINDEX (12M)

GLOBAL MARKET

35,039.15

1D 0.49%

YTD -12.17%

3,297.29

1D 0.03%

YTD -1.63%

21,909.76

1D -0.74%

YTD 9.23%

2,522.33

1D -0.13%

YTD 5.12%

79,801.43

1D -0.29%

YTD 1.56%

3,831.93

1D -0.04%

YTD 1.17%

1,146.86

1D -0.43%

YTD -18.09%

65.70

1D 0.89%

YTD -12.47%

3,330.00

1D 1.28%

YTD 26.37%

Asian markets saw mixed movements today. The Nikkei 225 rose nearly 0.5% thanks to progress in trade negotiations with the U.S., while Kospi declined 0.13% as GDP fell 0.2% quarter-on-quarter and 0.1% year-on-year. Hang Seng Index also dropped 0.7% after China denied reports of trade talks with the U.S.

VIETNAM ECONOMY

3.33%

1D (bps) -64

YTD (bps) -64

4.60%

2.54%

1D (bps) -2

YTD (bps) 6

2.92%

1D (bps) -10

YTD (bps) 7

2617400.00%

1D (%) 0.13%

YTD (%) 2.44%

3031768.00%

1D (%) -0.70%

YTD (%) 11.19%

362701.00%

1D (%) 0.09%

YTD (%) 1.85%

Domestic gold prices on April 24 recorded notable fluctuations. SJC gold bars continued to stay high at around VND121 million/tael at major retailers, while 24K and 18K gold jewelry prices moved in different directions across various brands.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- VAT reduction is expected to continue in the last 6 months of 2025 and throughout 2026;

- Vietnam’s economy is projected to reach USD1.1 trillion by 2035;

- The Ministry of Industry and Trade will transfer state ownership representation of 3 joint-stock companies to SCIC;

- The USD surged after hitting a nearly 3-year low: Two remarks by Mr. Trump provided relief to investors;

- The U.S. Treasury Secretary stated that a trade war with China is unsustainable;

- If Mr. Trump delists Chinese companies, the U.S. may also suffer consequences.

VN30

BANK

58,200

1D 0.34%

5D 0.17%

Buy Vol. 3,423,141

Sell Vol. 4,418,500

35,450

1D 0.28%

5D -1.12%

Buy Vol. 4,722,942

Sell Vol. 4,968,312

37,400

1D 0.27%

5D 0.40%

Buy Vol. 13,273,622

Sell Vol. 14,381,412

25,750

1D -1.34%

5D -0.96%

Buy Vol. 17,096,553

Sell Vol. 22,679,494

16,650

1D -0.30%

5D 0.60%

Buy Vol. 31,034,061

Sell Vol. 30,776,851

23,250

1D -0.64%

5D 1.09%

Buy Vol. 41,405,314

Sell Vol. 41,008,636

21,250

1D 4.42%

5D 2.66%

Buy Vol. 20,372,306

Sell Vol. 21,072,845

13,450

1D -0.37%

5D 2.67%

Buy Vol. 16,590,867

Sell Vol. 19,358,703

40,200

1D 0.00%

5D 4.96%

Buy Vol. 26,202,126

Sell Vol. 25,011,354

17,650

1D 0.00%

5D 1.94%

Buy Vol. 4,772,425

Sell Vol. 6,342,712

24,150

1D -1.83%

5D -0.62%

Buy Vol. 15,759,767

Sell Vol. 14,764,812

12,900

1D -0.77%

5D 7.05%

Buy Vol. 173,396,139

Sell Vol. 184,259,202

18,600

1D 0.54%

5D -3.88%

Buy Vol. 3,507,828

Sell Vol. 3,495,025

33,000

1D -0.90%

5D -1.79%

Buy Vol. 4,645,801

Sell Vol. 4,332,141

TPB: TPBank recently held its Annual General Meeting, setting a 2025 profit target of VND9,000 billion, up 18% from 2024. Management also reported Q1 profit of VND2,000 billion, an increase of 15% year-on-year.

OIL & GAS

57,500

1D 0.00%

5D -1.03%

Buy Vol. 959,861

Sell Vol. 1,515,623

33,650

1D 0.60%

5D -0.59%

Buy Vol. 1,693,649

Sell Vol. 1,783,348

Gasoline prices reversed upward in the April 24 adjustment session after two consecutive cuts. RON95 gasoline surpassed 19,000 VND/liter.

VINGROUP

62,700

1D 7.00%

5D -11.69%

Buy Vol. 18,369,693

Sell Vol. 13,064,446

61,200

1D 4.62%

5D 7.75%

Buy Vol. 19,226,794

Sell Vol. 18,875,041

22,800

1D 3.87%

5D 11.76%

Buy Vol. 30,915,002

Sell Vol. 29,179,591

VIC: Chairman Pham Nhat Vuong said Vinpearl’s listing will be completed in May. VinFast aims to sell 200,000 vehicles—equivalent to 40% market share—which would allow VinFast to break even in Vietnamese market.

FOOD & BEVERAGE

56,300

1D -0.18%

5D 0.54%

Buy Vol. 4,848,293

Sell Vol. 4,714,695

59,900

1D 0.50%

5D 4.54%

Buy Vol. 8,741,514

Sell Vol. 10,642,556

49,200

1D 1.23%

5D 4.68%

Buy Vol. 2,470,065

Sell Vol. 3,462,190

SAB: SAB targets revenue of over VND44.8 trillion and post-tax profit of VND4.84 trillion, representing growth of 9% and 8%. Special consumption tax on alcohol and beer has been proposed postponing the increase to 2027.

OTHERS

55,500

1D 0.91%

5D 3.74%

Buy Vol. 1,844,091

Sell Vol. 1,774,480

46,450

1D 5.57%

5D 2.43%

Buy Vol. 2,787,456

Sell Vol. 1,873,149

85,700

1D 0.00%

5D -2.61%

Buy Vol. 1,104,525

Sell Vol. 883,641

112,000

1D 1.45%

5D 2.38%

Buy Vol. 12,037,516

Sell Vol. 14,461,806

59,700

1D 1.53%

5D 5.11%

Buy Vol. 11,151,261

Sell Vol. 16,661,952

23,550

1D 1.73%

5D -2.69%

Buy Vol. 11,233,462

Sell Vol. 10,374,611

23,000

1D 1.10%

5D -0.43%

Buy Vol. 33,731,253

Sell Vol. 40,503,503

25,600

1D 0.20%

5D 0.39%

Buy Vol. 30,999,069

Sell Vol. 40,532,557

HPG: Foreign investors continued to net buy Hoa Phat shares strongly today, with a value exceeding VND152 billion.

Market by numbers

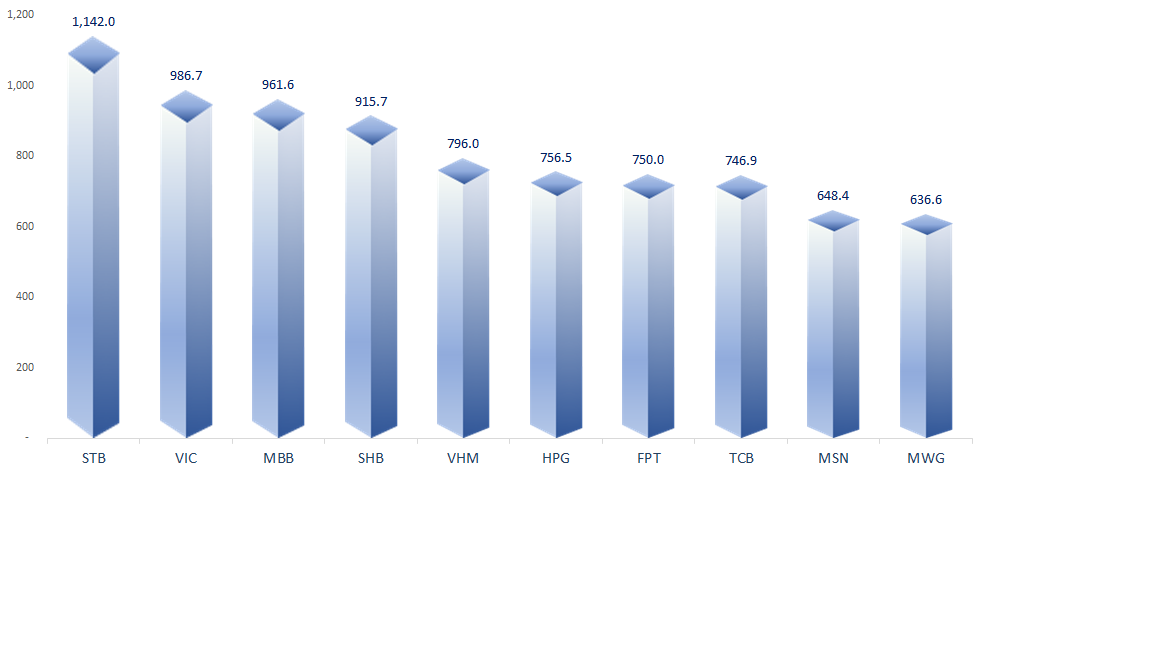

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

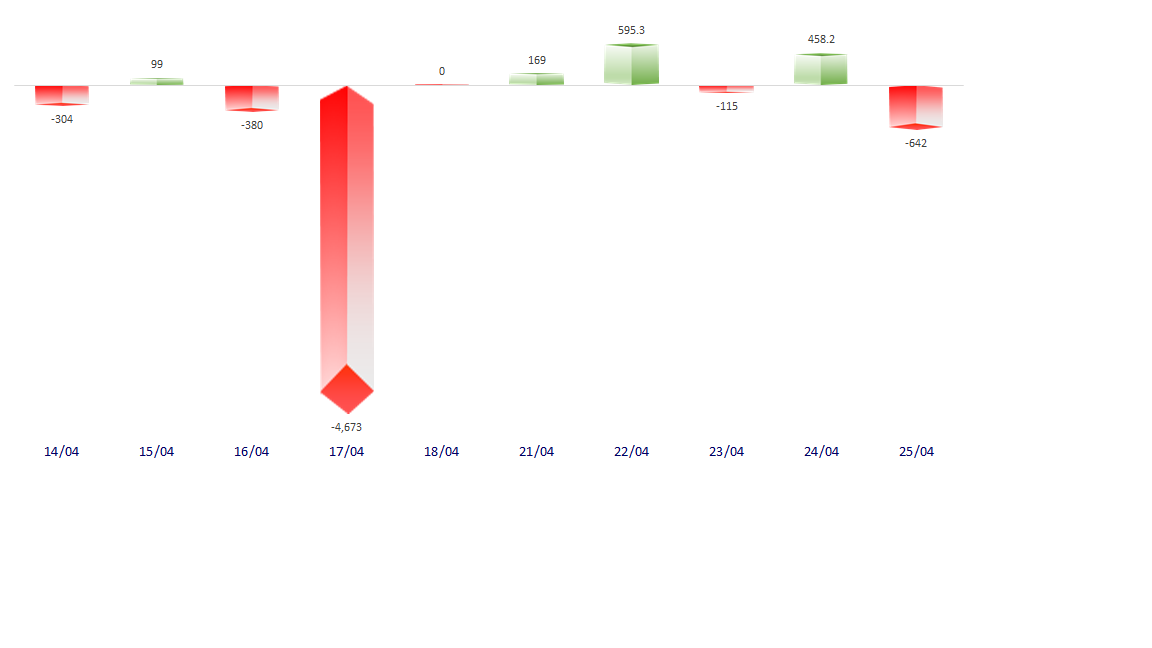

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

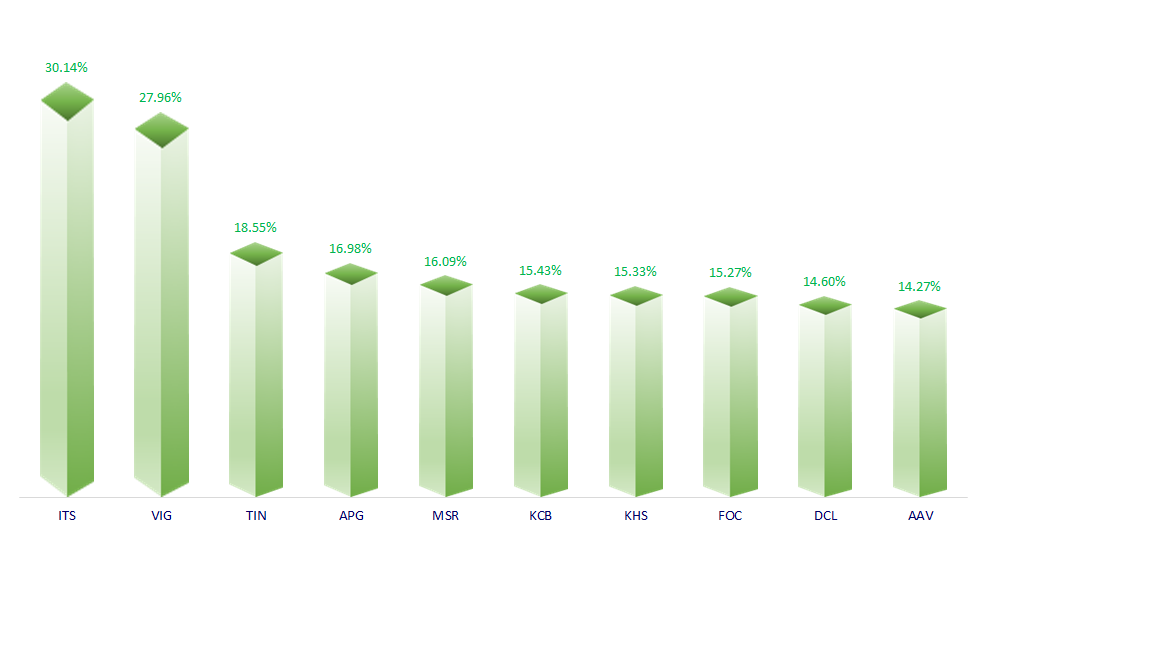

TOP INCREASES 3 CONSECUTIVE SESSIONS

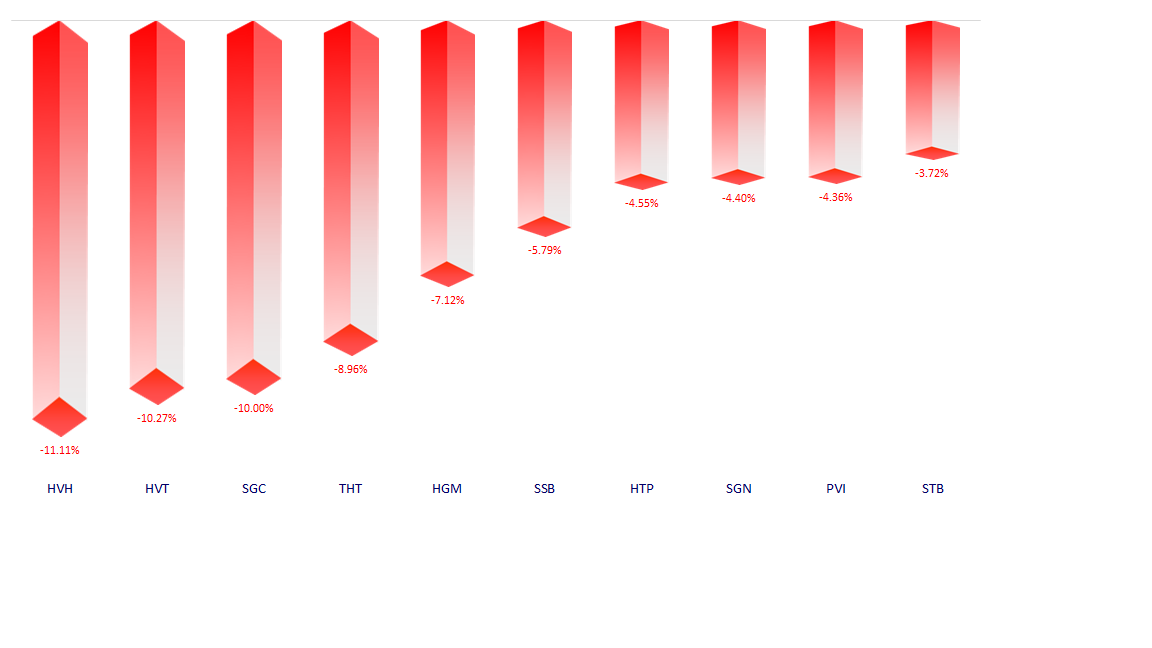

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.