Market brief 28/04/2025

VIETNAM STOCK MARKET

1,226.80

1D -0.20%

YTD -3.16%

211.45

1D -0.13%

YTD -7.03%

1,312.32

1D -0.37%

YTD -2.41%

92.25

1D -0.02%

YTD -2.96%

-9.47

1D 0.00%

YTD 0.00%

15,409.91

1D -29.53%

YTD -15.01%

VNIndex traded tepidly ahead of the holiday break. Securities and Retail were the most positive sectors today. In contrast, Technology, Chemicals, and Industrial Real Estate experienced lackluster performance.

ETF & DERIVATIVES

22,850

1D 0.22%

YTD -2.68%

15,800

1D 0.13%

YTD -2.95%

16,140

1D 0.25%

YTD -3.35%

19,400

1D -0.41%

YTD -3.48%

21,640

1D -0.18%

YTD -2.08%

29,410

1D 1.13%

YTD -12.26%

17,180

1D 0.00%

YTD -4.13%

1,312

1D 0.01%

YTD 0.00%

1,315

1D 0.30%

YTD 0.00%

1,316

1D 0.11%

YTD 0.00%

1,316

1D -0.20%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

35,839.99

1D 0.38%

YTD -10.16%

3,288.42

1D -0.20%

YTD -1.89%

21,971.96

1D -0.04%

YTD 9.54%

2,548.86

1D 0.10%

YTD 6.23%

80,196.13

1D 1.24%

YTD 2.06%

3,811.80

1D -0.31%

YTD 0.64%

1,159.53

1D 0.05%

YTD -17.19%

65.55

1D -0.49%

YTD -12.66%

3,292.06

1D -0.06%

YTD 24.93%

Asian stock markets showed mixed movements today. Japan’s Nikkei 225 index rose by 0.38%, mainly driven by gains in Toyota shares following news that the company might buy back its key parts supplier, Toyota Industries, at a valuation of USD42 billion. Conversely, Hong Kong and Chinese stock markets remained weak amid rising U.S.–China trade tensions.

VIETNAM ECONOMY

2.50%

1D (bps) 7

YTD (bps) -147

4.60%

2.47%

1D (bps) -1

YTD (bps) -1

2.99%

1D (bps) 1

YTD (bps) 14

2617000.00%

1D (%) -0.10%

YTD (%) 2.42%

3032377.00%

1D (%) -0.12%

YTD (%) 11.21%

361921.00%

1D (%) -0.05%

YTD (%) 1.63%

Today (April 28), the State Bank of Vietnam announced the central exchange rate at 24,960 VND/USD, up VND12 compared to the last quoted level at the end of last week. With a corridor of 5%, commercial banks are allowed to trade USD within the range of 23,712 – 26,208 VND/USD. USD exchange rates at commercial banks showed mixed movements, with a downward trend dominating.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Japan allocates approximately USD20 billion to support a major initiative in Vietnam;

- Official groundbreaking for Phase 2 of a VND25,500 billion expressway project;

- Top 10 provinces attracting FDI in Q1/2025: Bac Ninh leads, closely followed by Hanoi and Ho Chi Minh City;

- As U.S. tariffs begin to bite, many factories in China are being forced to shut down;

- Former President Trump states that TSMC has no choice but to invest USD100 billion in the U.S.;

- China asserts there are no ongoing tariff negotiations with the U.S.

VN30

BANK

57,500

1D 0.00%

5D -1.20%

Buy Vol. 3,445,128

Sell Vol. 3,139,513

34,550

1D -1.29%

5D -1.99%

Buy Vol. 6,425,688

Sell Vol. 6,692,581

36,850

1D -0.81%

5D -1.07%

Buy Vol. 11,648,240

Sell Vol. 10,561,703

26,000

1D 0.19%

5D 0.97%

Buy Vol. 24,217,001

Sell Vol. 23,668,157

16,550

1D 0.30%

5D -0.90%

Buy Vol. 23,766,597

Sell Vol. 19,387,409

23,700

1D 0.64%

5D 3.27%

Buy Vol. 42,856,855

Sell Vol. 53,734,972

21,500

1D 1.18%

5D 5.39%

Buy Vol. 15,749,575

Sell Vol. 11,277,200

13,500

1D 0.75%

5D -0.37%

Buy Vol. 19,936,504

Sell Vol. 21,080,145

39,250

1D 0.26%

5D -2.97%

Buy Vol. 17,386,287

Sell Vol. 17,611,363

17,350

1D 0.00%

5D -1.70%

Buy Vol. 4,873,901

Sell Vol. 5,253,072

23,950

1D 0.21%

5D -0.62%

Buy Vol. 11,378,547

Sell Vol. 9,518,328

12,700

1D -0.78%

5D -3.79%

Buy Vol. 92,854,520

Sell Vol. 113,444,852

18,600

1D 2.76%

5D -2.36%

Buy Vol. 3,664,483

Sell Vol. 2,502,655

32,800

1D 1.55%

5D -0.76%

Buy Vol. 4,964,104

Sell Vol. 3,081,101

SSB: Southeast Asia Commercial Joint Stock Bank (SSB) plans to expand its business operations by proposing the acquisition of ASEAN Securities Corporation (ASEAN SC), while also posting an impressive 189% year-on-year profit growth in Q1/2025 compared to Q1/2024.

OIL & GAS

58,400

1D -0.17%

5D 0.52%

Buy Vol. 546,185

Sell Vol. 1,429,021

33,800

1D -1.31%

5D 0.00%

Buy Vol. 1,160,113

Sell Vol. 1,410,499

At 5:00 PM today, Brent crude oil prices fell by more than 0.3%, settling at 65.5 USD/barrel.

VINGROUP

68,000

1D 1.49%

5D 10.57%

Buy Vol. 9,845,626

Sell Vol. 14,608,151

58,500

1D -6.10%

5D 6.36%

Buy Vol. 9,665,223

Sell Vol. 14,356,393

23,100

1D 1.32%

5D 13.24%

Buy Vol. 27,719,276

Sell Vol. 30,094,264

VRE: Vincom Retail (VRE) announced its Q1/2025 financial results with a profit of VND1,177 billion, marking the second-highest in its history and representing a 9% increase year-on-year.

FOOD & BEVERAGE

57,500

1D -1.37%

5D 1.41%

Buy Vol. 4,492,981

Sell Vol. 6,994,038

62,500

1D 0.81%

5D 7.57%

Buy Vol. 6,352,251

Sell Vol. 9,285,939

51,200

1D 3.43%

5D 8.70%

Buy Vol. 3,783,978

Sell Vol. 3,315,556

VNM: Vinamilk (VNM) is set to break ground on a new VND2,100 billion dairy plant in Q2/2025.

OTHERS

55,700

1D -0.18%

5D 0.91%

Buy Vol. 856,155

Sell Vol. 977,984

46,000

1D -0.22%

5D 4.55%

Buy Vol. 515,355

Sell Vol. 598,734

89,100

1D -2.09%

5D 6.07%

Buy Vol. 1,033,101

Sell Vol. 806,528

109,500

1D -2.58%

5D -1.97%

Buy Vol. 7,064,477

Sell Vol. 7,676,496

60,900

1D 0.66%

5D 9.53%

Buy Vol. 12,398,745

Sell Vol. 23,173,714

23,500

1D -1.26%

5D -0.84%

Buy Vol. 4,821,254

Sell Vol. 6,478,600

23,050

1D 1.10%

5D 0.66%

Buy Vol. 27,699,715

Sell Vol. 29,308,723

25,650

1D -0.19%

5D 2.81%

Buy Vol. 22,780,686

Sell Vol. 27,979,365

FPT: FPT Corporation partners with a leading American chip design company, aiming to transform Da Nang into "Silicon Bay.

Market by numbers

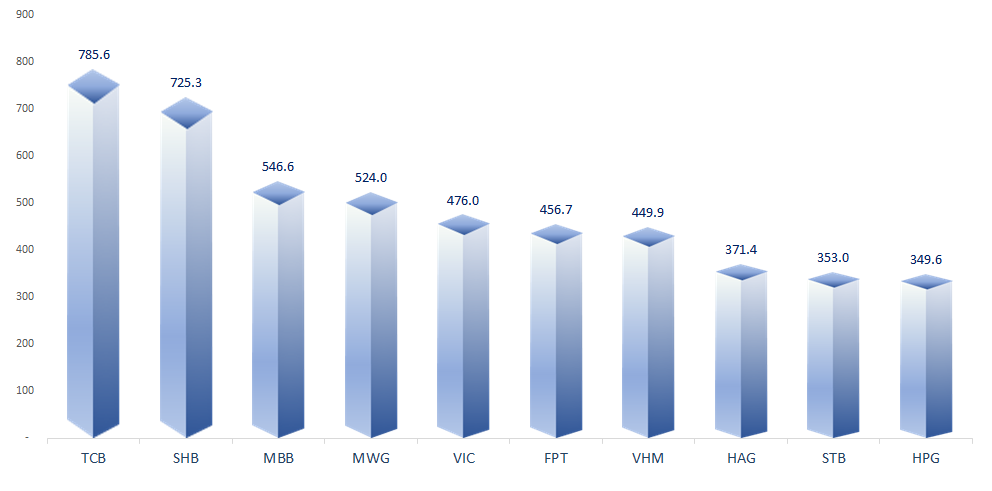

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

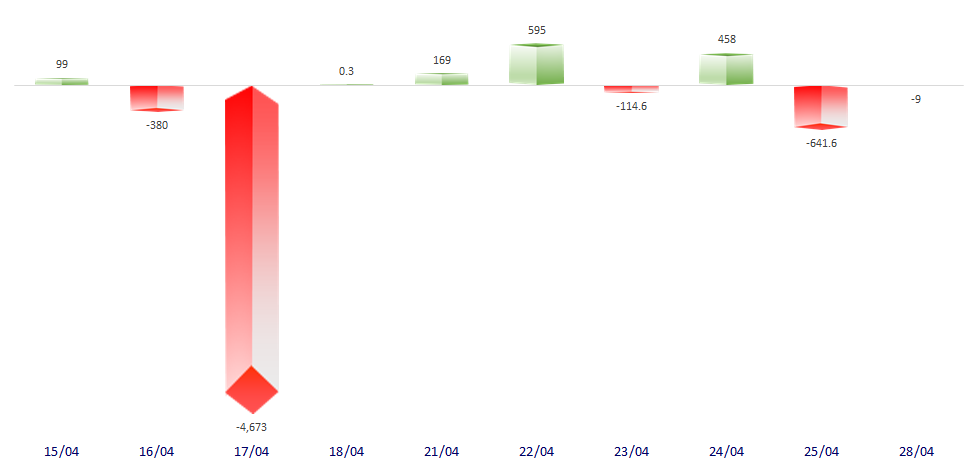

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.