Market brief 28/05/2025

VIETNAM STOCK MARKET

1,341.87

1D 0.15%

YTD 5.93%

223.56

1D 0.80%

YTD -1.70%

1,432.19

1D 0.33%

YTD 6.50%

98.59

1D 0.46%

YTD 3.71%

-211.29

1D 0.00%

YTD 0.00%

24,990.32

1D -14.19%

YTD 37.83%

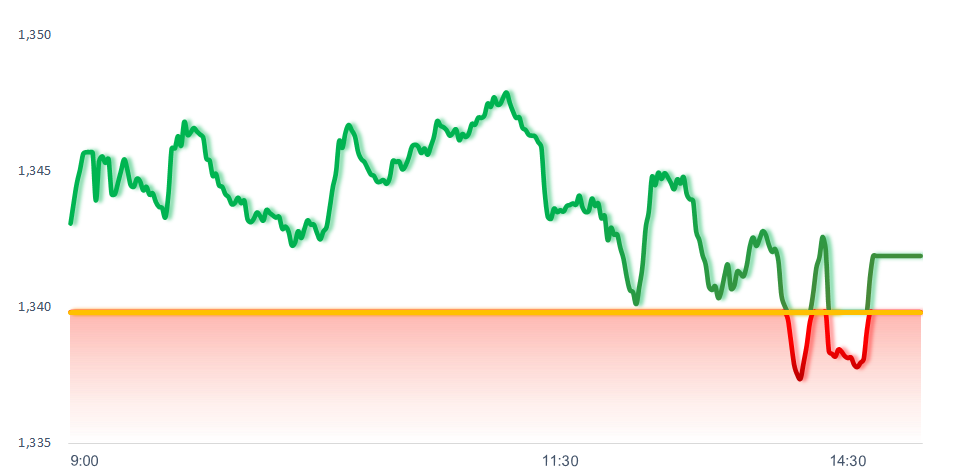

VN-Index has yet to surpass its previous peak despite strong support from Vingroup-related stocks. Oil & Gas and Real Estate were the two most positive sectors today. In contrast, Industrial Goods & Services and Construction sectors showed rather sluggish performance.

ETF & DERIVATIVES

24,700

1D -0.24%

YTD 5.20%

17,200

1D 0.58%

YTD 5.65%

16,900

1D 0.00%

YTD 1.20%

20,100

1D 0.25%

YTD 0.00%

24,150

1D 0.63%

YTD 9.28%

32,150

1D -0.43%

YTD -4.09%

18,200

1D 0.00%

YTD 1.56%

1,421

1D 0.40%

YTD 0.00%

1,419

1D 0.55%

YTD 0.00%

1,416

1D 0.27%

YTD 0.00%

1,422

1D 0.54%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

37,722.40

1D 0.00%

YTD -5.44%

3,339.93

1D -0.02%

YTD -0.35%

23,258.31

1D -0.53%

YTD 15.95%

2,670.15

1D 1.25%

YTD 11.28%

81,409.57

1D -0.18%

YTD 3.61%

3,911.93

1D 0.41%

YTD 3.28%

1,162.24

1D -0.10%

YTD -17.00%

63.99

1D -0.44%

YTD -14.74%

3,322.00

1D -0.07%

YTD 26.07%

Chinese stocks declined as investors grew concerned about deflation and weakening consumer spending, following disappointing earnings from e-commerce company PDD. Specifically, PDD’s Q1 profit dropped nearly 50%, with domestic revenue pressured by intense competition and weak demand. At the same time, its international business also faced headwinds due to escalating tariff tensions with the U.S.

VIETNAM ECONOMY

4.12%

1D (bps) -8

YTD (bps) 15

4.60%

2.55%

1D (bps) 1

YTD (bps) 7

3.01%

1D (bps) 19

YTD (bps) 17

26,140

1D (%) 0.15%

YTD (%) 2.31%

30,201

1D (%) -0.12%

YTD (%) 10.76%

3,667

1D (%) 0.17%

YTD (%) 2.99%

After two consecutive declines, the domestic gold market continued its sharp drop by midday on May 28 across most segments. SJC gold fell close to 118 million VND/tael, while plain gold rings and 24K jewelry also saw steep declines. Meanwhile, 18K gold jewelry only experienced a slight correction.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- North-South High-Speed Railway project worth over USD60 billion: Citizens could see travel costs reduced by up to 40%;

- U.S. congressional delegation visits Vietnam, expresses desire to boost bilateral cooperation;

- U.S. receives petition to launch an anti-dumping investigation into hardwood plywood from Vietnam;

- Trump advisor: U.S. may reduce tariffs to below 10% for nations that show goodwill;

- Economists warn of rising deflationary pressure in China;

- Ukraine fears a looming Russian offensive with 50,000 troops targeting Sumy.

VN30

BANK

56,800

1D 0.00%

5D -0.53%

Buy Vol. 11,305,136

Sell Vol. 11,894,852

36,500

1D 0.55%

5D 0.83%

Buy Vol. 6,822,375

Sell Vol. 8,828,764

39,550

1D -0.13%

5D 0.25%

Buy Vol. 7,944,880

Sell Vol. 12,211,054

30,500

1D -0.33%

5D -1.29%

Buy Vol. 28,244,884

Sell Vol. 28,775,524

18,000

1D -0.55%

5D -2.44%

Buy Vol. 24,854,654

Sell Vol. 27,674,970

24,600

1D -0.61%

5D -1.80%

Buy Vol. 26,107,146

Sell Vol. 32,564,167

22,250

1D -1.55%

5D -0.67%

Buy Vol. 18,036,708

Sell Vol. 21,806,353

13,350

1D 0.00%

5D -1.11%

Buy Vol. 18,679,343

Sell Vol. 23,757,435

41,050

1D -1.08%

5D -1.79%

Buy Vol. 12,054,326

Sell Vol. 14,147,727

18,450

1D -1.07%

5D 1.37%

Buy Vol. 6,314,712

Sell Vol. 11,419,509

21,400

1D -0.23%

5D -0.14%

Buy Vol. 20,254,913

Sell Vol. 15,309,084

13,800

1D 0.00%

5D 2.22%

Buy Vol. 86,979,826

Sell Vol. 115,378,020

18,600

1D 0.81%

5D -0.53%

Buy Vol. 3,219,795

Sell Vol. 2,787,949

31,950

1D -0.78%

5D -1.84%

Buy Vol. 4,320,191

Sell Vol. 4,379,083

VCB: On May 27, 2025, Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) and IDICO Corporation - JSC (IDICO) signed a comprehensive cooperation agreement. At the same time, they signed a credit contract worth VND4,000 billion to finance the Tan Phuoc 1 Industrial Park project in Tien Giang province.

OIL & GAS

64,100

1D 0.63%

5D 6.30%

Buy Vol. 1,657,692

Sell Vol. 2,154,489

35,500

1D 2.16%

5D 0.57%

Buy Vol. 2,798,470

Sell Vol. 3,382,128

GAS: GAS targets consolidated revenue and profit in 2025 at VND74,000 and 5,300 billion, respectively down 29% and 50% compared to the previous year.

VINGROUP

97,000

1D 2.65%

5D 3.74%

Buy Vol. 10,033,585

Sell Vol. 9,999,952

75,700

1D 1.88%

5D 12.48%

Buy Vol. 10,987,634

Sell Vol. 13,188,325

26,700

1D 5.53%

5D 3.69%

Buy Vol. 26,366,636

Sell Vol. 24,463,142

VIC: Vingroup has committed to guaranteeing up to VND5,000 billion worth of bond issuance for VinFast.

FOOD & BEVERAGE

55,200

1D -0.36%

5D -0.36%

Buy Vol. 6,511,209

Sell Vol. 6,231,792

63,900

1D -0.16%

5D 0.47%

Buy Vol. 6,981,397

Sell Vol. 9,227,658

49,450

1D 0.00%

5D -0.30%

Buy Vol. 1,251,796

Sell Vol. 1,268,495

VNM: Foreign investors continued to sell VNM heavily, with net outflows of over VND82 billion today.

OTHERS

61,500

1D -0.16%

5D 0.99%

Buy Vol. 729,148

Sell Vol. 908,126

52,400

1D -0.19%

5D 4.17%

Buy Vol. 736,545

Sell Vol. 1,054,315

88,000

1D -0.45%

5D -0.34%

Buy Vol. 864,674

Sell Vol. 1,094,857

118,400

1D -0.50%

5D 0.08%

Buy Vol. 7,119,178

Sell Vol. 8,072,530

64,400

1D 0.16%

5D 0.16%

Buy Vol. 14,210,258

Sell Vol. 19,387,088

29,650

1D 0.85%

5D 8.61%

Buy Vol. 8,127,773

Sell Vol. 11,158,734

23,700

1D 0.00%

5D 1.50%

Buy Vol. 43,712,344

Sell Vol. 52,330,540

25,600

1D 0.20%

5D -0.58%

Buy Vol. 30,921,020

Sell Vol. 37,502,099

MWG: In the first four months of 2025, Mobile World Investment Corporation opened 359 new stores, completing 32% of its annual revenue target.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

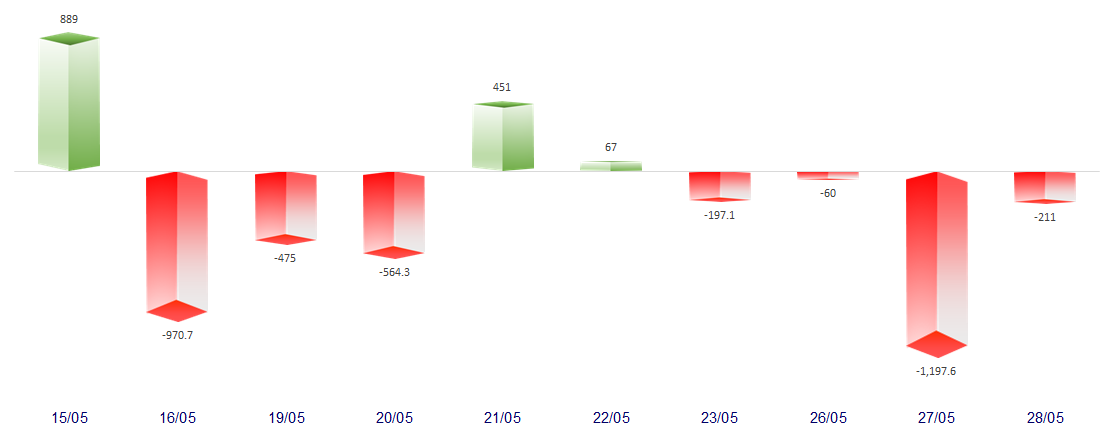

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

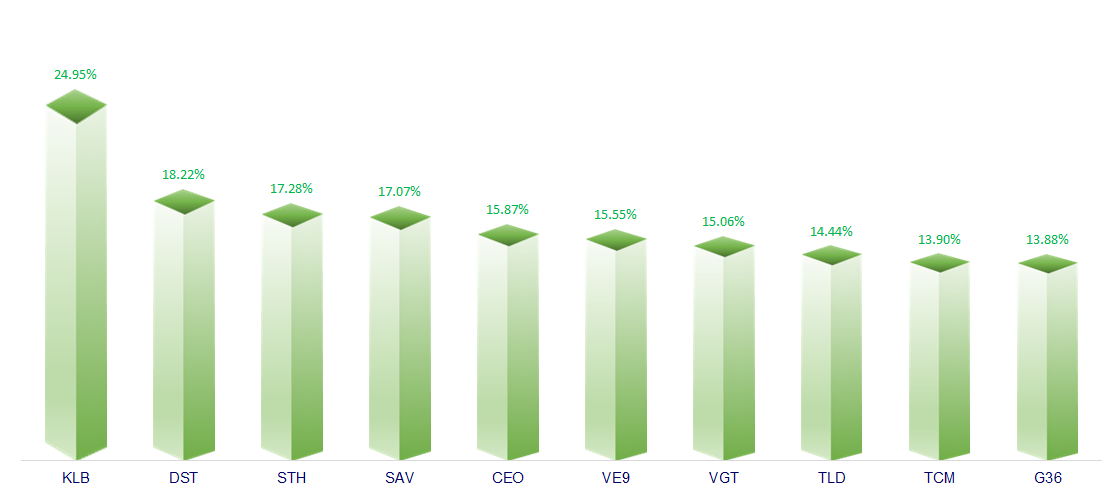

TOP INCREASES 3 CONSECUTIVE SESSIONS

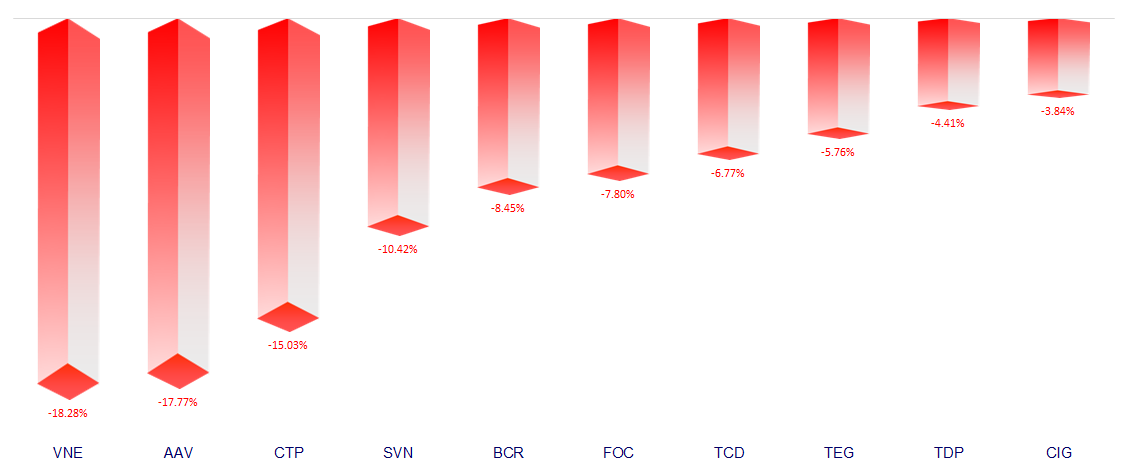

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.