Market brief 15/07/2025

VIETNAM STOCK MARKET

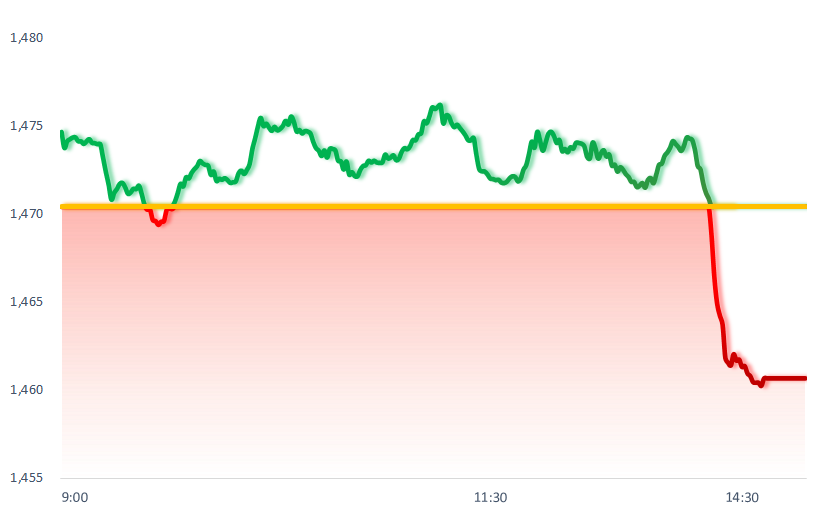

1,460.65

1D -0.66%

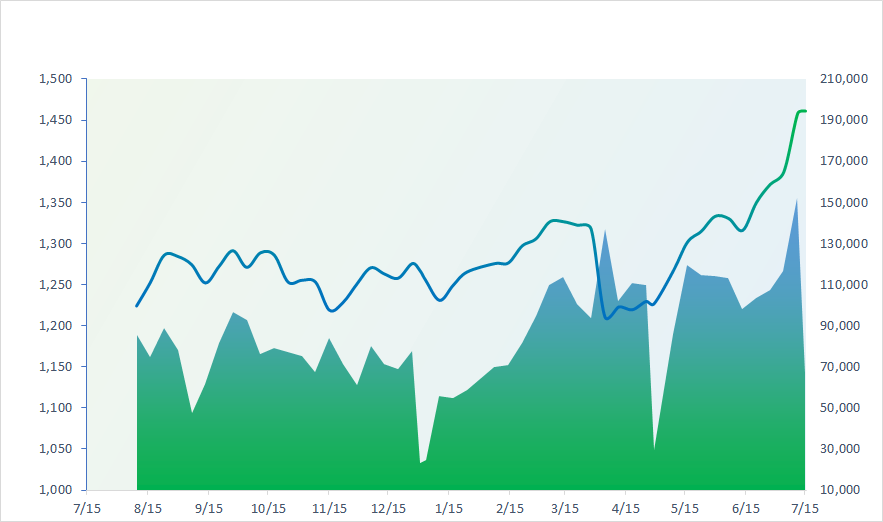

YTD 15.30%

240.33

1D 0.30%

YTD 5.67%

1,593.84

1D -0.74%

YTD 18.52%

103.03

1D 0.35%

YTD 8.38%

1,125.85

1D 0.00%

YTD 0.00%

38,556.13

1D 12.19%

YTD 112.65%

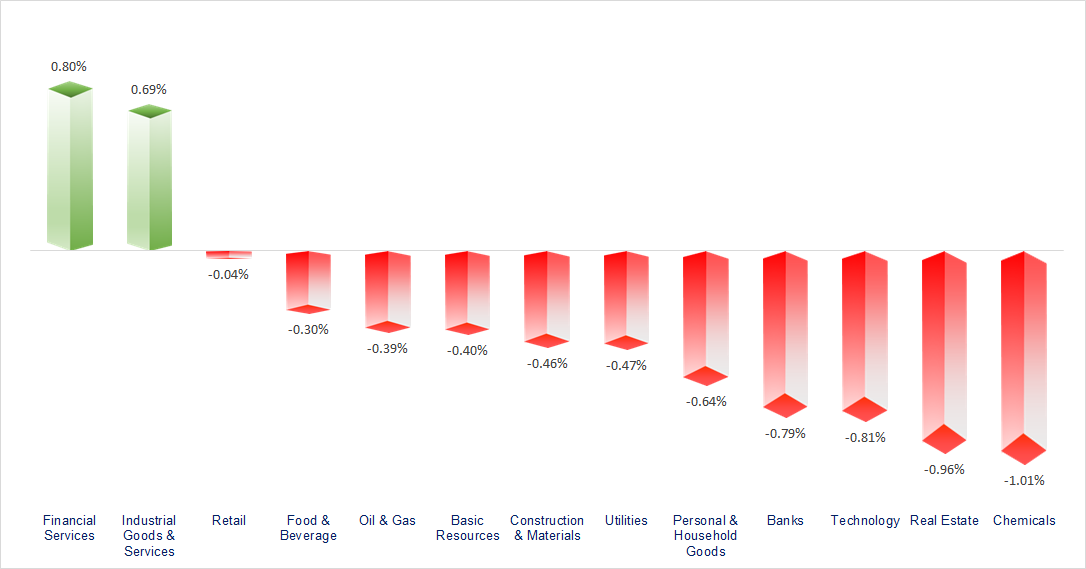

VN-Index recorded its first distribution session after a continuous gain of over 88 points. Most sectors declined today, except for Securities, Commodities, and Industrial Services, which showed positive performance.

ETF & DERIVATIVES

27,740

1D -0.22%

YTD 18.14%

19,400

1D 0.47%

YTD 19.16%

19,360

1D -0.56%

YTD 15.93%

21,250

1D -2.75%

YTD 5.72%

26,000

1D -1.14%

YTD 17.65%

35,200

1D 0.28%

YTD 5.01%

19,670

1D -2.14%

YTD 9.77%

1,594

1D -0.45%

YTD 0.00%

1,584

1D -0.12%

YTD 0.00%

1,578

1D -0.16%

YTD 0.00%

1,575

1D -0.24%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,678.02

1D 0.55%

YTD -0.54%

3,505.00

1D -0.42%

YTD 4.57%

24,590.12

1D 1.60%

YTD 22.59%

3,215.28

1D 0.41%

YTD 34.00%

82,628.44

1D 0.46%

YTD 5.16%

4,119.82

1D 0.26%

YTD 8.77%

1,161.01

1D 1.55%

YTD -17.08%

68.90

1D -0.30%

YTD -8.19%

3,372.85

1D 0.74%

YTD 28.00%

Asian stock markets mainly rose on July 15, as trade negotiations remained in the spotlight during a week packed with key U.S. inflation data and bank earnings announcements. Notably, the Hang Seng Index increased by 1.6% thanks to a broad rally in chip stocks following news of access to Nvidia’s H20 chips. Another highlight was China’s Q2/2025 GDP growth of 5.2%, exceeding analyst expectations despite weak domestic demand and trade tensions with the U.S.

VIETNAM ECONOMY

4.80%

1D (bps) 7

YTD (bps) 83

4.60%

2.86%

1D (bps) -1

YTD (bps) 38

3.16%

1D (bps) -4

YTD (bps) 31

26,310

1D (%) 0.08%

YTD (%) 2.97%

31,283

1D (%) 0.02%

YTD (%) 14.73%

3,704

1D (%) 0.12%

YTD (%) 4.02%

Bitcoin plunged below USD117,000 as traders took profits after a sharp rally that previously pushed the world's most valuable cryptocurrency above USD123,000.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam's VND36,000 billion power plant project is said to have “the world’s largest and most modern efficiency;

- Long An Port sets a target of reaching 20 million tons of cargo by 2030;

- Hanoi is studying support and buyback policies for 450,000 gasoline motorbikes within Ring Road No.1;

- Good news for Nvidia: The U.S. gives the green light for the company to sell chips to China;

- The U.S. imposes a 17% anti-dumping tax on tomatoes from Mexico;

- U.S. tariffs and their economic toll on Europe.

VN30

BANK

61,400

1D -1.60%

5D 4.07%

Buy Vol. 8,951,166

Sell Vol. 11,847,095

38,100

1D -1.42%

5D 1.60%

Buy Vol. 8,262,792

Sell Vol. 11,934,961

44,150

1D -0.34%

5D -0.56%

Buy Vol. 10,219,339

Sell Vol. 11,254,606

34,800

1D -0.85%

5D -1.42%

Buy Vol. 32,398,415

Sell Vol. 39,164,271

20,750

1D -1.19%

5D 5.87%

Buy Vol. 82,747,108

Sell Vol. 76,550,198

26,600

1D -0.75%

5D 0.76%

Buy Vol. 36,796,668

Sell Vol. 34,055,468

24,150

1D -1.02%

5D 2.77%

Buy Vol. 62,831,316

Sell Vol. 57,595,483

14,750

1D -1.01%

5D 5.36%

Buy Vol. 29,880,959

Sell Vol. 51,318,437

47,700

1D -0.52%

5D 0.10%

Buy Vol. 14,621,821

Sell Vol. 16,098,637

19,350

1D -0.26%

5D 2.93%

Buy Vol. 32,290,397

Sell Vol. 26,632,463

22,450

1D -1.10%

5D 0.90%

Buy Vol. 21,399,439

Sell Vol. 24,142,409

14,100

1D -0.35%

5D -0.35%

Buy Vol. 145,577,417

Sell Vol. 146,160,747

19,300

1D 0.26%

5D 2.12%

Buy Vol. 4,585,074

Sell Vol. 4,462,273

33,500

1D 1.98%

5D -0.59%

Buy Vol. 9,586,405

Sell Vol. 7,801,347

VPB: In Hanoi, Vietnam Prosperity Joint Stock Commercial Bank (VPBank) and LOTTE C&F Vietnam Co., Ltd. (LOTTE C&F) recently marked a new milestone in their sustainable partnership with the launch of a consumer finance product – LOTTE FLEX.

OIL & GAS

67,700

1D -0.73%

5D 0.00%

Buy Vol. 1,182,884

Sell Vol. 1,716,894

37,300

1D -0.53%

5D 0.00%

Buy Vol. 2,217,238

Sell Vol. 2,576,727

As of 4:30 PM today, Brent crude oil price dropped by over 0.4% to 68.9 USD/barrel

VINGROUP

111,600

1D -1.24%

5D 19.61%

Buy Vol. 4,981,365

Sell Vol. 5,165,667

87,400

1D -1.58%

5D 10.35%

Buy Vol. 6,487,847

Sell Vol. 6,686,419

28,150

1D -1.75%

5D 9.11%

Buy Vol. 6,731,158

Sell Vol. 8,239,989

VIC: On July 15, Vingroup officially opened the Royal Bridge, directly connecting the Vinhomes Royal Island project to downtown Hai Phong.

FOOD & BEVERAGE

60,100

1D -0.33%

5D 1.86%

Buy Vol. 9,609,629

Sell Vol. 12,476,842

74,500

1D -1.06%

5D -1.46%

Buy Vol. 11,434,179

Sell Vol. 12,684,836

48,050

1D 0.10%

5D 2.56%

Buy Vol. 3,615,702

Sell Vol. 4,406,774

VNM: Foreign investors net bought over VND43 billion of Vinamilk shares today.

OTHERS

67,000

1D -2.19%

5D -0.74%

Buy Vol. 645,091

Sell Vol. 1,025,797

53,800

1D -0.19%

5D -0.19%

Buy Vol. 902,415

Sell Vol. 1,201,536

97,500

1D -1.52%

5D 2.63%

Buy Vol. 2,198,311

Sell Vol. 2,709,870

126,000

1D -0.87%

5D 1.20%

Buy Vol. 7,717,054

Sell Vol. 9,425,673

69,300

1D 0.43%

5D 3.13%

Buy Vol. 15,219,817

Sell Vol. 17,440,543

30,100

1D -1.79%

5D 0.33%

Buy Vol. 5,191,360

Sell Vol. 6,775,628

30,500

1D 2.52%

5D 12.75%

Buy Vol. 87,282,746

Sell Vol. 89,381,328

25,500

1D -0.97%

5D 3.24%

Buy Vol. 72,676,199

Sell Vol. 82,333,656

FPT: FPT Corporation announced a plan to issue bonus shares from its equity capital. The ex-rights date will be July 21. With a 20:3 bonus share ratio (~15%), the tech group plans to issue nearly 222.2 million bonus shares to its shareholders. The shares will not be restricted in transfer, and issuance is expected to be completed no later than Q3/2025.

Market by numbers

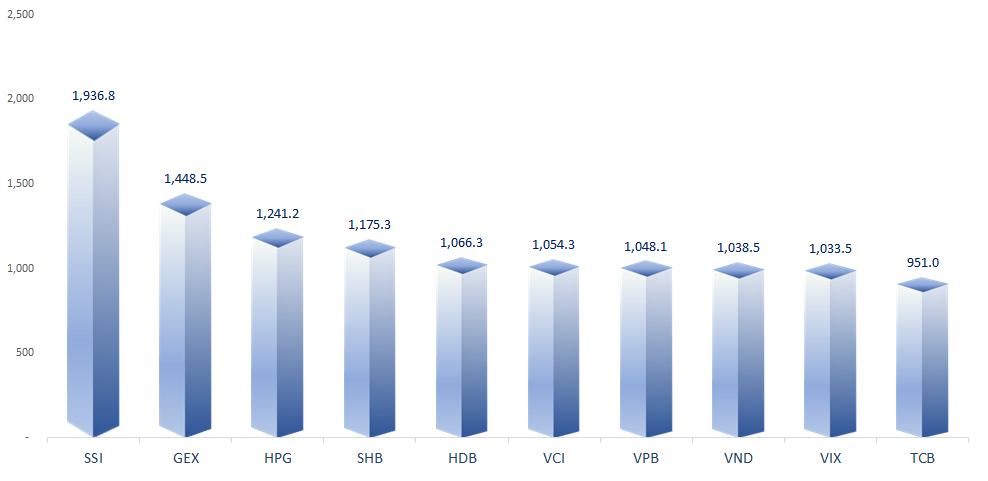

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

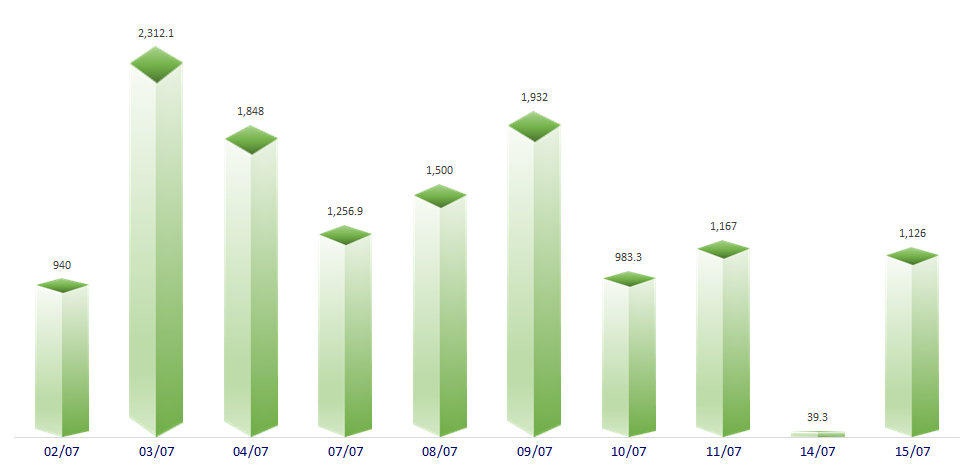

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

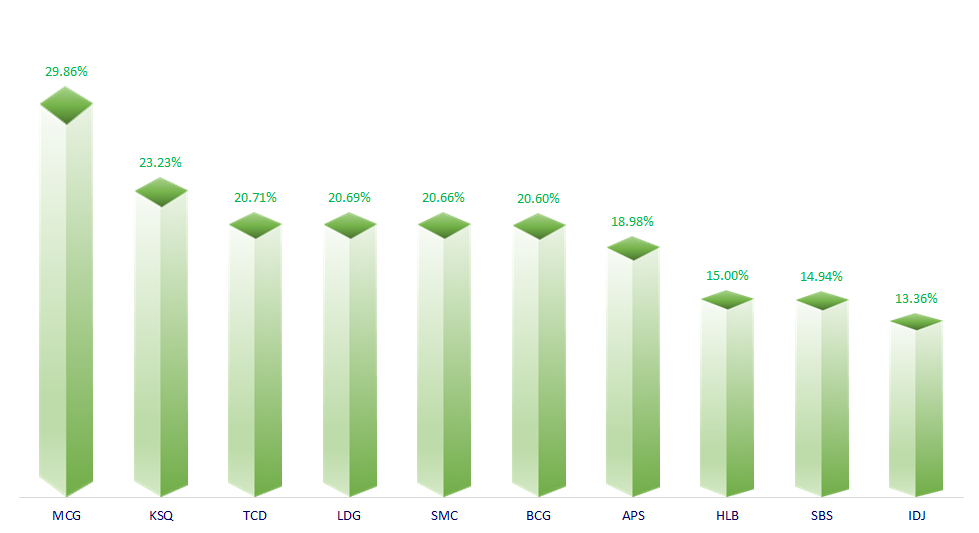

TOP INCREASES 3 CONSECUTIVE SESSIONS

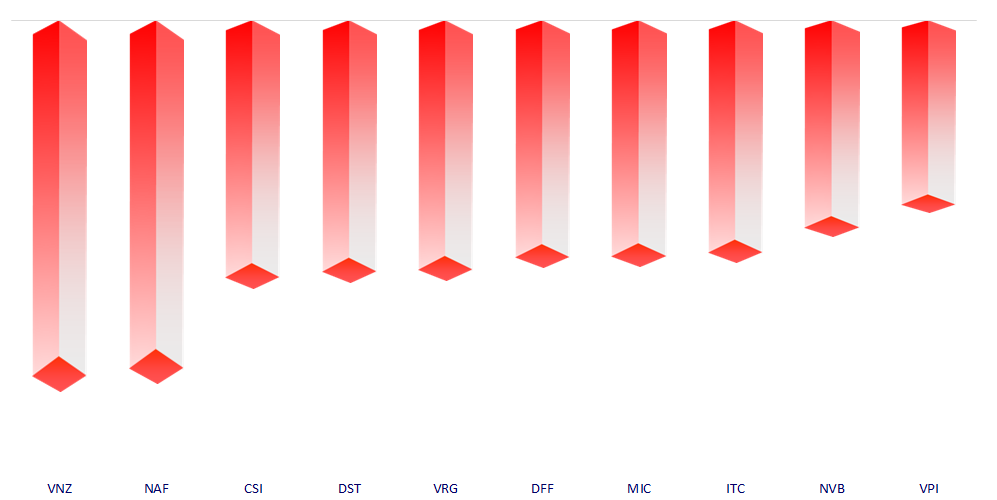

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.