Market brief 16/07/2025

VIETNAM STOCK MARKET

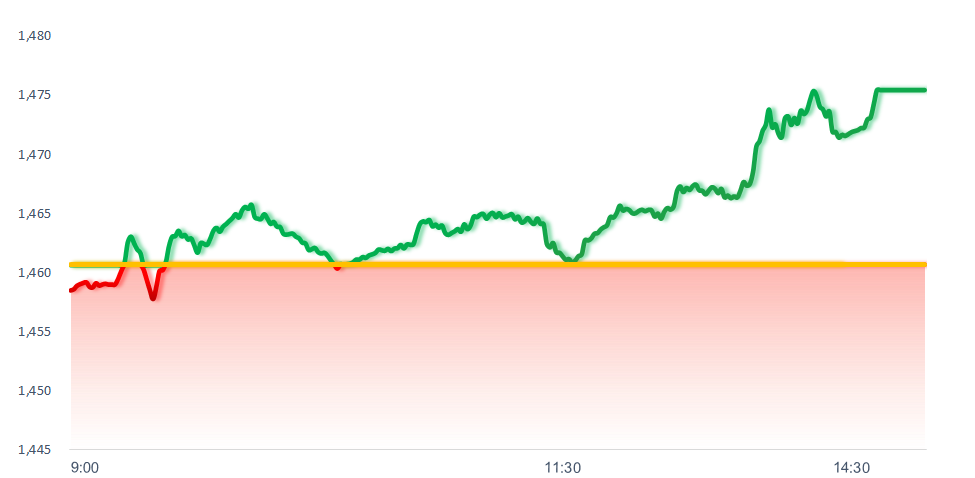

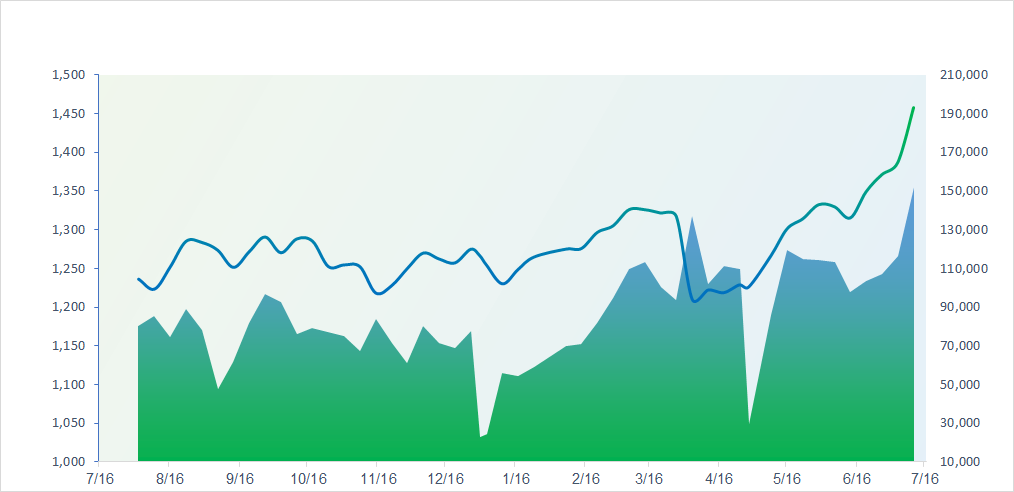

1,475.47

1D 1.01%

YTD 16.47%

242.35

1D 0.84%

YTD 6.56%

1,614.42

1D 1.29%

YTD 20.05%

103.08

1D 0.05%

YTD 8.44%

311.97

1D 0.00%

YTD 0.00%

36,271.00

1D -5.93%

YTD 100.05%

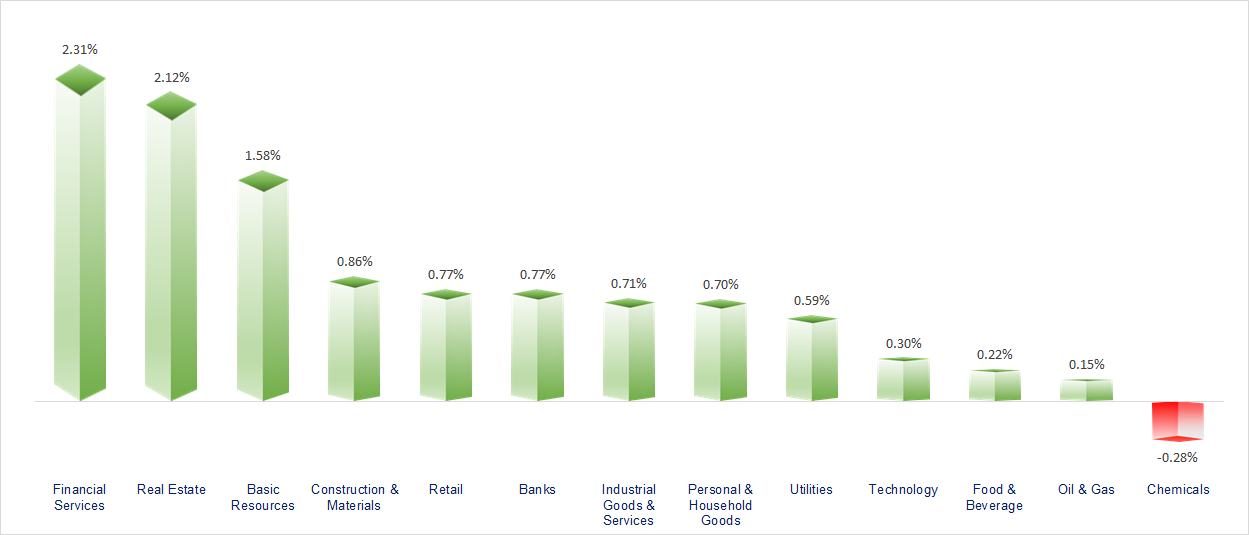

VN-Index surged back above 1,470 points as Q2 earnings reports begin to emerge. Most sectors posted gains today, with Securities and Real Estate standing out as the top performers.

ETF & DERIVATIVES

27,970

1D 0.83%

YTD 19.12%

19,480

1D 0.41%

YTD 19.66%

19,400

1D 0.21%

YTD 16.17%

21,920

1D 3.15%

YTD 9.05%

26,600

1D 2.31%

YTD 20.36%

35,100

1D -0.28%

YTD 4.71%

20,230

1D 2.85%

YTD 12.89%

1,618

1D 1.51%

YTD 0.00%

1,602

1D 1.10%

YTD 0.00%

1,593

1D 0.95%

YTD 0.00%

1,591

1D 1.00%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,663.40

1D -0.04%

YTD -0.58%

3,503.78

1D -0.03%

YTD 4.54%

24,517.76

1D -0.29%

YTD 22.23%

3,186.38

1D -0.90%

YTD 32.79%

82,732.39

1D 0.20%

YTD 5.29%

4,129.62

1D 0.24%

YTD 9.03%

1,157.47

1D -0.30%

YTD -17.34%

68.44

1D -0.39%

YTD -8.81%

3,340.00

1D 0.45%

YTD 26.75%

Asian stock markets mostly declined today, with trade negotiations remaining in the spotlight. Japan’s Nikkei 225 index traded weakly amid rising U.S. Treasury yields, which pushed the USD higher against the Yen. Yesterday, President Trump announced a deal with Indonesia, under which Indonesia will not impose any tariffs on U.S. exports, while the U.S. will apply a 19% tariff on Indonesian exports.

VIETNAM ECONOMY

5.24%

1D (bps) 44

YTD (bps) 127

4.60%

2.83%

1D (bps) -3

YTD (bps) 36

3.20%

1D (bps) 5

YTD (bps) 36

26,330

1D (%) 0.08%

YTD (%) 3.05%

31,138

1D (%) -0.46%

YTD (%) 14.20%

3,699

1D (%) -0.13%

YTD (%) 3.88%

SJC gold prices at major retailers fell sharply from midday July 15, marking the first drop below 121 million VND/tael in recent sessions.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: Aim for GDP growth of 8.3–8.5% in 2025;

- U.S. President Donald Trump: “Trade deal with Vietnam is fairly well established";

- President of Vietnam: Vietnam is committed to institutional reforms and investor protection;

- President Trump: Plans to impose new tariffs on semiconductors and pharmaceuticals;

- The U.S. launches an investigation into trade practices with Brazil;

- UK inflation rises to highest since January 2024, renewing focus on BoE rate cuts.

VN30

BANK

61,800

1D 0.65%

5D 0.49%

Buy Vol. 66,985,838

Sell Vol. 66,134,468

38,400

1D 0.79%

5D 0.52%

Buy Vol. 17,113,935

Sell Vol. 9,832,848

44,950

1D 1.81%

5D -0.11%

Buy Vol. 9,472,459

Sell Vol. 8,526,239

35,250

1D 1.29%

5D 1.00%

Buy Vol. 38,629,262

Sell Vol. 35,546,784

20,850

1D 0.48%

5D 3.99%

Buy Vol. 58,732,977

Sell Vol. 50,200,249

26,700

1D 0.38%

5D 0.38%

Buy Vol. 37,490,119

Sell Vol. 29,282,476

24,250

1D 0.41%

5D 0.21%

Buy Vol. 28,115,895

Sell Vol. 27,397,151

14,900

1D 1.02%

5D 0.00%

Buy Vol. 37,884,236

Sell Vol. 40,034,822

47,800

1D 0.21%

5D 0.00%

Buy Vol. 15,831,871

Sell Vol. 16,823,797

19,300

1D -0.26%

5D 0.78%

Buy Vol. 23,977,012

Sell Vol. 20,009,808

22,450

1D 0.00%

5D 0.00%

Buy Vol. 24,840,908

Sell Vol. 20,047,741

14,250

1D 1.06%

5D 1.79%

Buy Vol. 109,228,887

Sell Vol. 119,065,304

19,400

1D 0.52%

5D 1.57%

Buy Vol. 2,987,387

Sell Vol. 3,109,204

33,800

1D 0.90%

5D 1.96%

Buy Vol. 5,152,259

Sell Vol. 6,013,136

TPB: Tien Phong Commercial Joint Stock Bank (TPBank) recently revealed its preliminary business results for the first half of the year, with pre-tax profit expected to exceed VND4,100 billion, up more than 12% year-over-year. Credit growth reached nearly 11.7%, focusing primarily on retail, controlled real estate lending, and consumer finance – segments known for generating high net interest margins.

OIL & GAS

67,400

1D -0.44%

5D -0.88%

Buy Vol. 807,150

Sell Vol. 1,121,606

37,250

1D -0.13%

5D -0.53%

Buy Vol. 2,819,034

Sell Vol. 2,590,741

Global oil prices continued to fall by 1% after U.S. President Donald Trump issued a 50-day ultimatum for Russia to end the conflict in Ukraine.

VINGROUP

117,400

1D 5.20%

5D 23.58%

Buy Vol. 5,699,130

Sell Vol. 5,004,380

88,000

1D 0.69%

5D 7.58%

Buy Vol. 7,339,643

Sell Vol. 7,578,424

28,800

1D 2.31%

5D 7.46%

Buy Vol. 9,728,542

Sell Vol. 10,183,675

VIC: VinSpeed, the railway development company owned by billionaire Pham Nhat Vuong, has increased its charter capital from VND6,000 billion to VND15,000 billion.

FOOD & BEVERAGE

60,100

1D 0.00%

5D -0.17%

Buy Vol. 8,382,313

Sell Vol. 8,919,696

75,000

1D 0.67%

5D -1.06%

Buy Vol. 11,124,284

Sell Vol. 9,856,294

48,000

1D -0.10%

5D 0.73%

Buy Vol. 2,531,542

Sell Vol. 2,864,740

SAB: Foreign investors reversed to a net selling position on SAB shares, offloading more than VND10 billion in today’s session.

OTHERS

67,100

1D 0.15%

5D -2.19%

Buy Vol. 608,781

Sell Vol. 687,936

54,400

1D 1.12%

5D 0.93%

Buy Vol. 649,160

Sell Vol. 660,653

96,000

1D -1.54%

5D 2.13%

Buy Vol. 3,232,765

Sell Vol. 3,013,382

126,300

1D 0.24%

5D 2.85%

Buy Vol. 8,095,322

Sell Vol. 8,702,330

70,000

1D 1.01%

5D 3.40%

Buy Vol. 10,924,945

Sell Vol. 9,959,416

29,850

1D -0.83%

5D 0.00%

Buy Vol. 5,697,117

Sell Vol. 6,488,111

31,600

1D 3.61%

5D 10.68%

Buy Vol. 82,043,121

Sell Vol. 80,129,249

26,100

1D 2.35%

5D 5.45%

Buy Vol. 106,668,742

Sell Vol. 77,724,762

HPG: In Q2/2025, Hoa Phat Group recorded more than VND36 trillion in revenue and VND4,300 billion in post-tax profit. For the first six months of the year, total revenue reached VND74 trillion, with VND7,600 billion in post-tax profit, up 5% and 23%, respectively, compared to the same period last year. With these results, the Group has fulfilled 44% of its 2025 revenue target and 51% of its profit target, which are VND170 trillion in revenue and VND15 trillion in post-tax profit for the full year.

Market by numbers

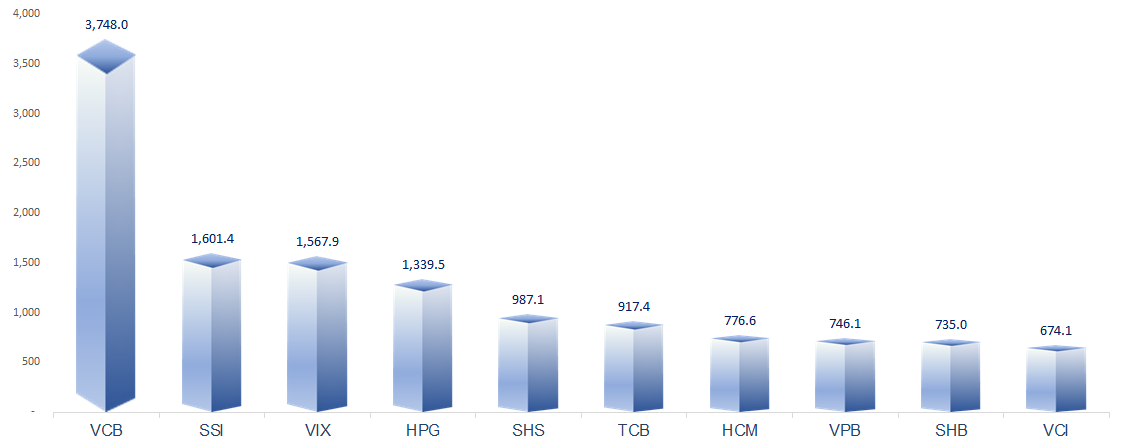

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

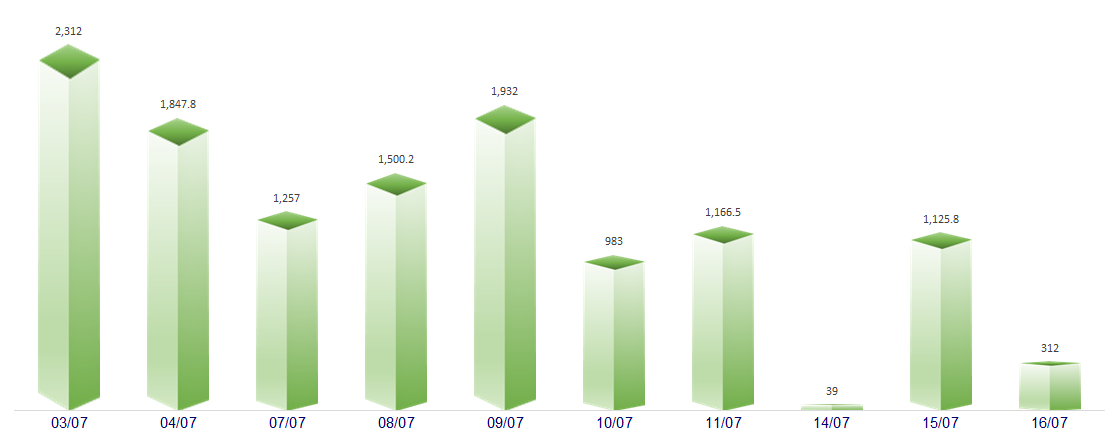

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

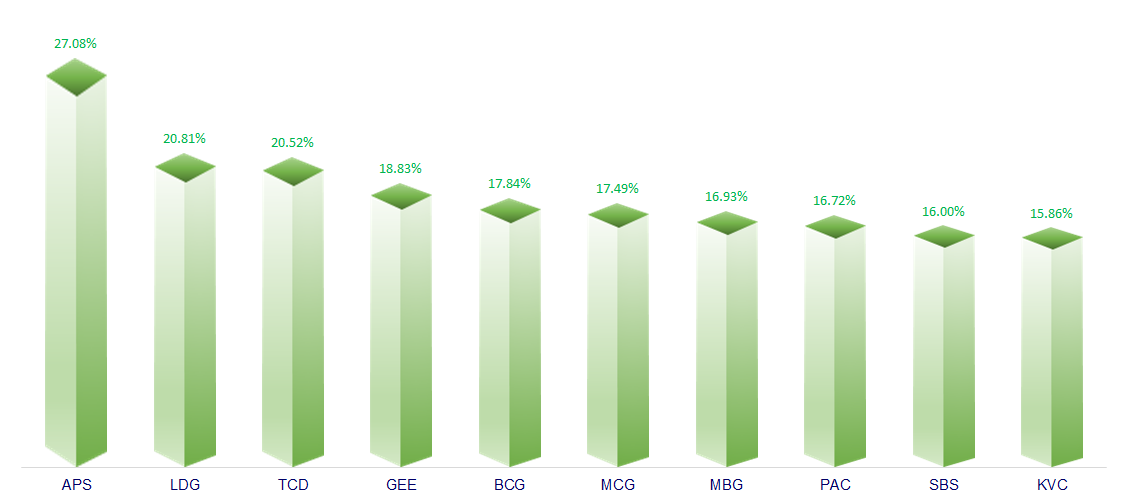

TOP INCREASES 3 CONSECUTIVE SESSIONS

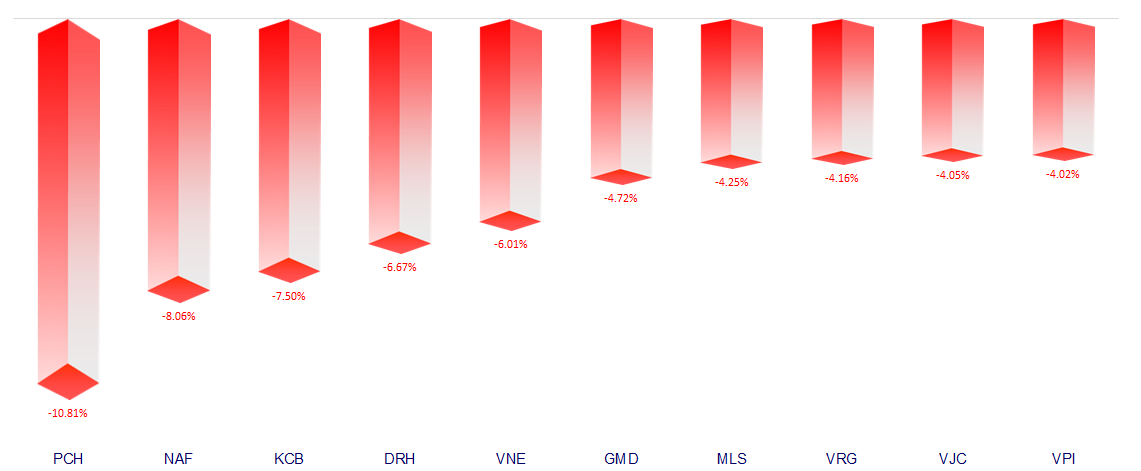

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.