Market brief 23/07/2025

VIETNAM STOCK MARKET

1,512.31

1D 0.18%

YTD 19.38%

249.33

1D 0.60%

YTD 9.63%

1,653.01

1D -0.18%

YTD 22.92%

104.80

1D 0.75%

YTD 10.25%

102.13

1D 0.00%

YTD 0.00%

42,169.00

1D 12.44%

YTD 132.58%

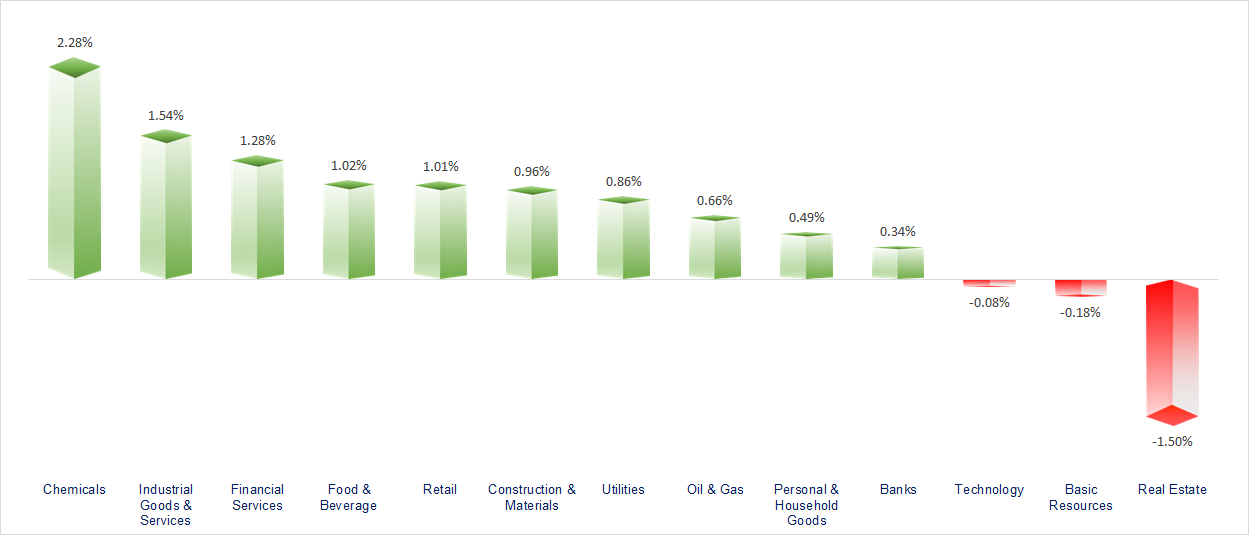

VN-Index experienced a highly emotional trading session with liquidity exceeding USD 1.6 billion. Most sectors saw strong gains, with Chemicals and Securities standing out as the top performers.

ETF & DERIVATIVES

28,900

1D 0.17%

YTD 23.08%

20,070

1D 0.90%

YTD 23.28%

20,650

1D 1.37%

YTD 23.65%

23,600

1D 0.17%

YTD 17.41%

27,460

1D 0.59%

YTD 24.25%

35,350

1D 0.14%

YTD 5.46%

21,180

1D 1.58%

YTD 18.19%

1,653

1D -0.12%

YTD 0.00%

1,631

1D 0.03%

YTD 0.00%

1,647

1D 0.07%

YTD 0.00%

1,634

1D -0.09%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

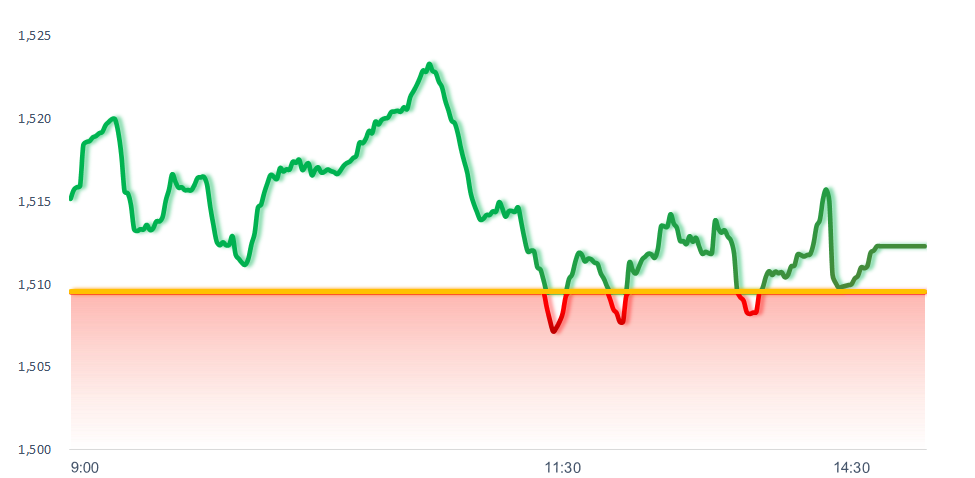

INTRADAY VNINDEX

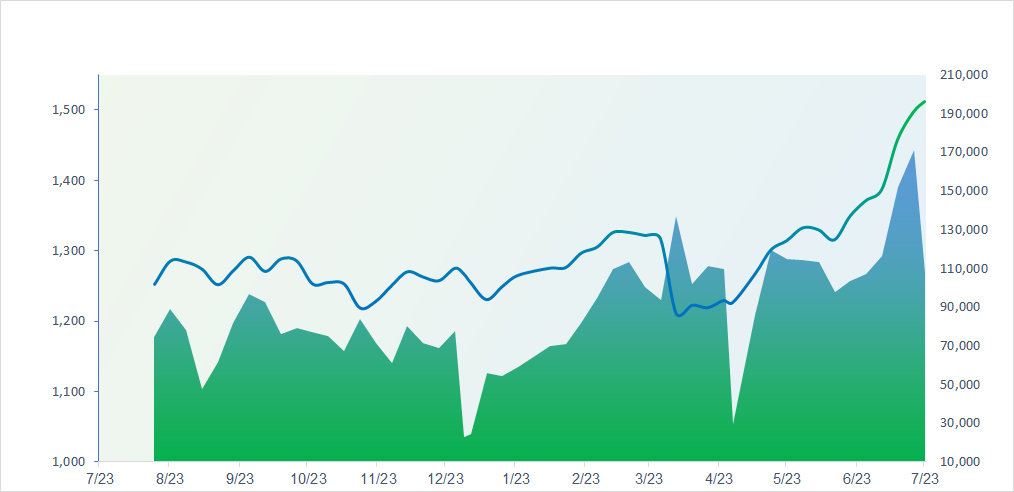

VNINDEX (12M)

GLOBAL MARKET

41,171.32

1D 3.51%

YTD 3.20%

3,582.30

1D 0.01%

YTD 6.88%

25,538.07

1D 1.62%

YTD 27.31%

3,183.77

1D 0.44%

YTD 32.69%

82,726.64

1D 0.64%

YTD 5.28%

4,231.28

1D 0.55%

YTD 11.71%

1,219.62

1D 2.34%

YTD -12.90%

68.10

1D -0.71%

YTD -9.26%

3,423.00

1D -0.25%

YTD 29.90%

Asian stock markets were awash in green today. Notably, the Nikkei 225 surged more than 3.5% following positive news that Japan would only face a 15% reciprocal tariff from the U.S., rather than the previously expected 25%. Both the Hang Seng and Shanghai Composite indexes also posted gains, despite data showing China’s outstanding real estate loans reached a two-year high of over CNY53.3 trillion (approximately USD7.43 trillion) at the end of June, marking a 0.4% increase year over year.

VIETNAM ECONOMY

5.34%

1D (bps) 26

YTD (bps) 137

4.60%

2.81%

1D (bps) 1

YTD (bps) 34

3.23%

1D (bps) -3

YTD (bps) 38

26,320

1D (%) 0.00%

YTD (%) 3.01%

31,482

1D (%) 0.44%

YTD (%) 15.46%

3,702

1D (%) -0.04%

YTD (%) 3.95%

Japan's 10-year government bond yield also jumped over 5% during the session, reaching 1.59% — the highest level in the past 15 years.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- ADB forecasts Vietnam’s GDP growth at 6.3% for 2025;

- Official: Gia Binh has overtaken Noi Bai to become the largest airport in northern Vietnam;

- No other wage benefits will be reduced when the minimum wage is increased;

- President Trump announces a trade agreement with the Philippines, including a 19% tariff;

- Trump declares a 15% reciprocal tariff on Japan;

- Iran admits its nuclear facilities were “seriously damaged” by U.S. strikes.

VN30

BANK

62,100

1D -0.16%

5D 0.49%

Buy Vol. 8,382,506

Sell Vol. 8,743,936

38,700

1D -0.51%

5D 0.78%

Buy Vol. 10,509,953

Sell Vol. 13,217,749

45,650

1D 0.11%

5D 1.56%

Buy Vol. 8,627,832

Sell Vol. 10,089,205

35,000

1D -0.99%

5D -0.71%

Buy Vol. 40,653,890

Sell Vol. 41,523,074

23,350

1D 3.78%

5D 11.99%

Buy Vol. 110,518,387

Sell Vol. 100,680,085

27,400

1D 0.92%

5D 2.62%

Buy Vol. 53,247,915

Sell Vol. 39,377,185

26,500

1D 4.13%

5D 9.28%

Buy Vol. 46,121,313

Sell Vol. 45,138,924

15,400

1D 0.65%

5D 3.36%

Buy Vol. 49,853,333

Sell Vol. 57,055,918

48,700

1D -1.62%

5D 1.88%

Buy Vol. 20,626,887

Sell Vol. 22,418,578

17,800

1D 2.30%

5D 5.14%

Buy Vol. 37,151,231

Sell Vol. 29,646,136

23,000

1D 0.44%

5D 2.45%

Buy Vol. 24,395,419

Sell Vol. 25,416,306

14,650

1D 0.34%

5D 2.81%

Buy Vol. 120,979,070

Sell Vol. 171,819,721

19,850

1D -0.75%

5D 2.32%

Buy Vol. 28,804,165

Sell Vol. 28,536,132

35,250

1D -1.81%

5D 4.29%

Buy Vol. 6,314,338

Sell Vol. 6,413,095

SHB: Saigon – Hanoi Commercial Joint Stock Bank has approved a plan to increase its charter capital by issuing dividends in shares for existing shareholders from 2024 profits. According to the plan, SHB will issue up to nearly 528.5 million shares, equivalent to 13% of the total outstanding shares. These newly issued shares will not be subject to transfer restrictions.

OIL & GAS

69,000

1D 1.62%

5D 2.37%

Buy Vol. 2,534,328

Sell Vol. 2,803,042

37,250

1D 0.27%

5D 0.00%

Buy Vol. 3,759,826

Sell Vol. 3,490,502

PLX: Starting from August 1, 2025, Petrolimex will pilot the sale of E10 biofuel at 36 petrol stations in Ho Chi Minh City.

VINGROUP

115,000

1D -2.13%

5D -2.04%

Buy Vol. 4,498,375

Sell Vol. 5,241,699

92,200

1D -3.46%

5D 4.77%

Buy Vol. 5,785,215

Sell Vol. 7,152,349

29,250

1D -2.50%

5D 1.56%

Buy Vol. 5,977,122

Sell Vol. 7,585,188

VHM: Vinhomes may begin infrastructure construction for the Tan Trao Industrial Park (Hai Phong), phase 1, with a total investment of over VND4,000 billion, starting in Q1/2026.

FOOD & BEVERAGE

61,700

1D 2.49%

5D 2.66%

Buy Vol. 15,313,268

Sell Vol. 12,746,035

77,300

1D -0.51%

5D 3.07%

Buy Vol. 10,832,067

Sell Vol. 12,839,918

48,600

1D 1.67%

5D 1.25%

Buy Vol. 5,418,810

Sell Vol. 4,234,152

VNM: Vinamilk unexpectedly saw a net buying session by foreign investors, totaling over VND100 billion today.

OTHERS

69,200

1D 1.47%

5D 3.13%

Buy Vol. 1,400,540

Sell Vol. 1,639,786

52,400

1D -0.19%

5D -3.68%

Buy Vol. 713,181

Sell Vol. 805,501

108,800

1D 6.98%

5D 13.33%

Buy Vol. 7,066,837

Sell Vol. 1,982,771

111,800

1D -0.27%

5D 1.79%

Buy Vol. 7,056,350

Sell Vol. 7,738,712

70,500

1D 0.14%

5D 0.71%

Buy Vol. 16,191,237

Sell Vol. 14,831,105

31,050

1D 1.97%

5D 4.02%

Buy Vol. 10,994,030

Sell Vol. 10,708,980

32,250

1D 0.78%

5D 2.06%

Buy Vol. 58,207,598

Sell Vol. 70,106,137

26,400

1D -0.19%

5D 1.15%

Buy Vol. 68,147,434

Sell Vol. 77,562,755

GVR: Rubber prices in China have increased by more than 12% since the end of May.

Market by numbers

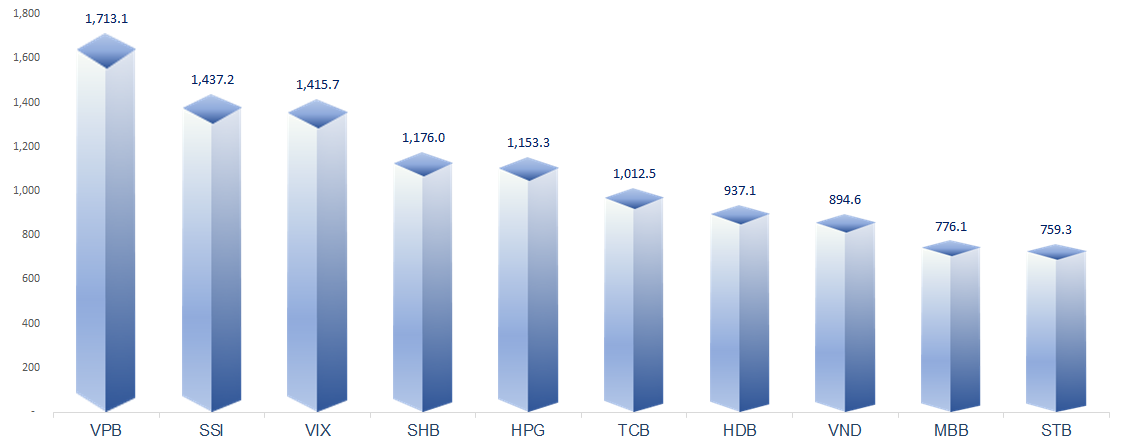

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

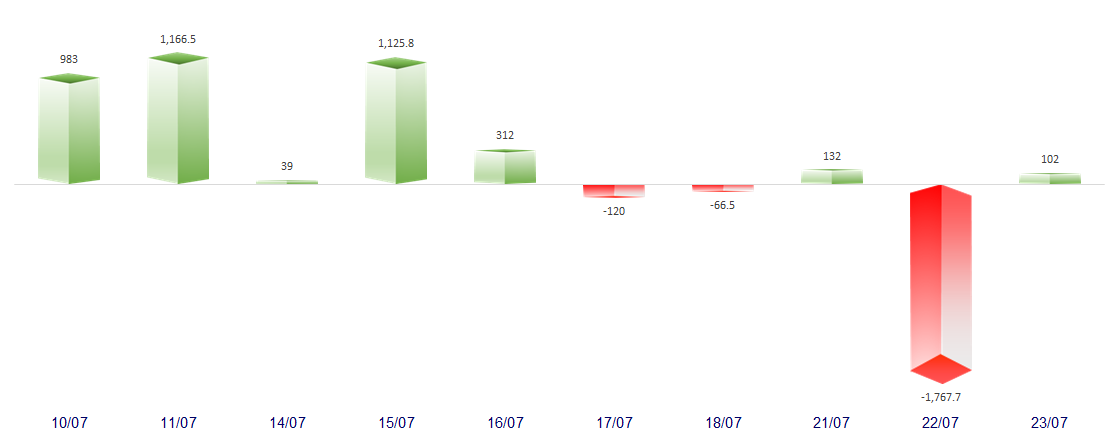

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

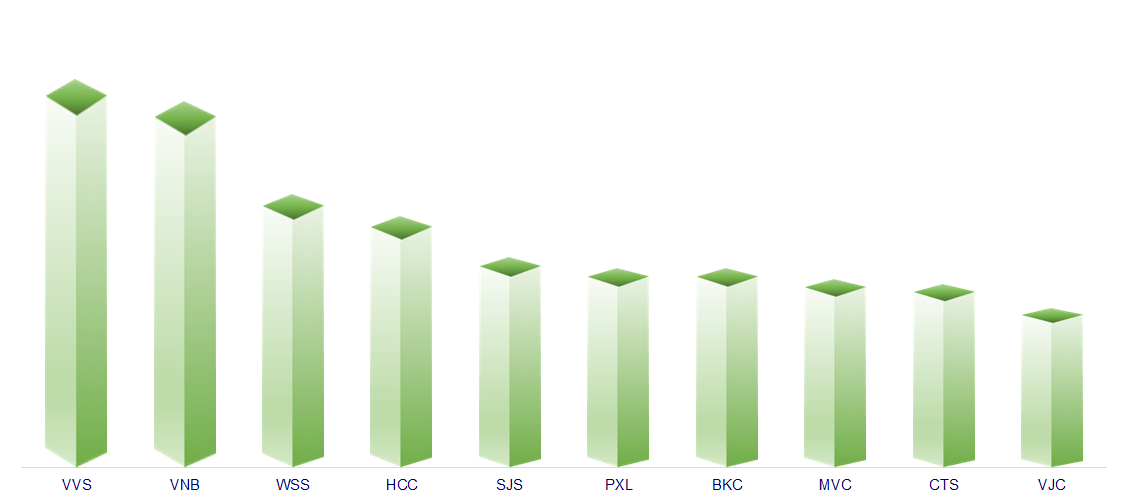

TOP INCREASES 3 CONSECUTIVE SESSIONS

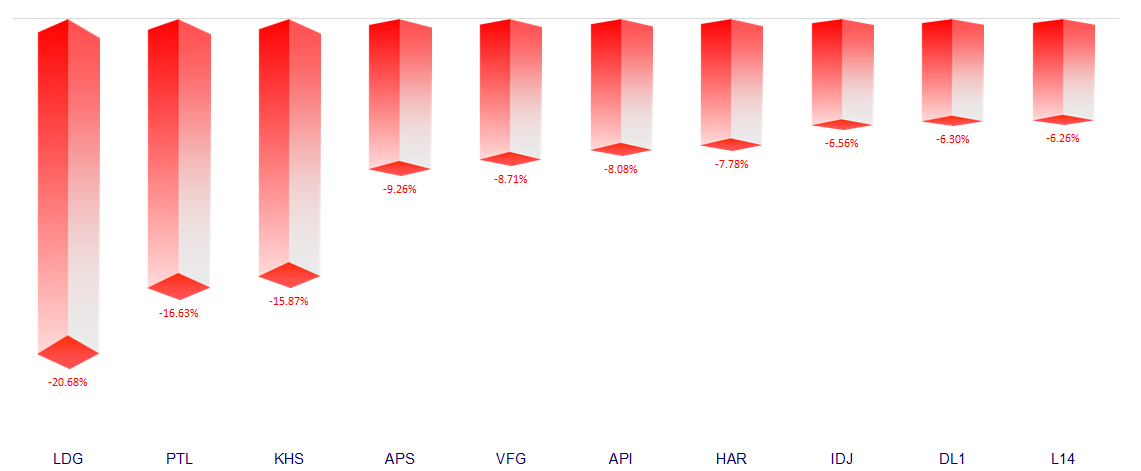

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.