Market brief 31/07/2025

VIETNAM STOCK MARKET

1,502.52

1D -0.34%

YTD 18.61%

266.34

1D 1.85%

YTD 17.11%

1,615.23

1D -0.95%

YTD 20.11%

105.79

1D 0.65%

YTD 11.29%

-2,235.69

1D 0.00%

YTD 0.00%

48,998.65

1D 4.64%

YTD 170.25%

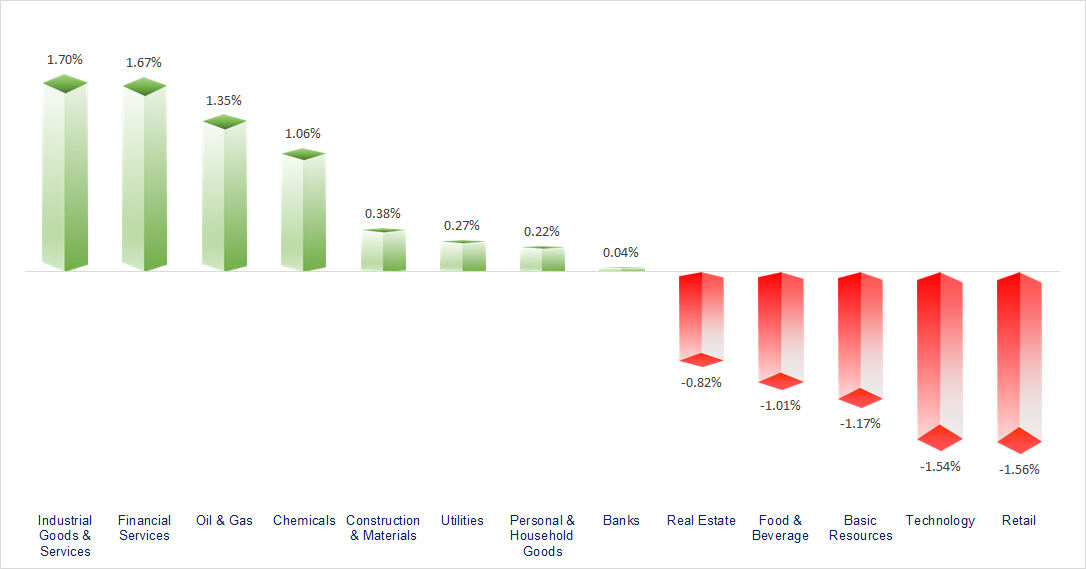

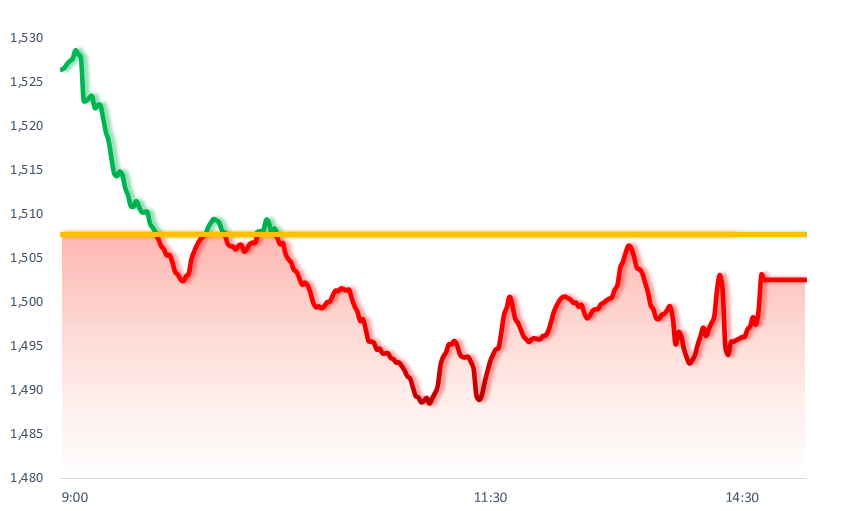

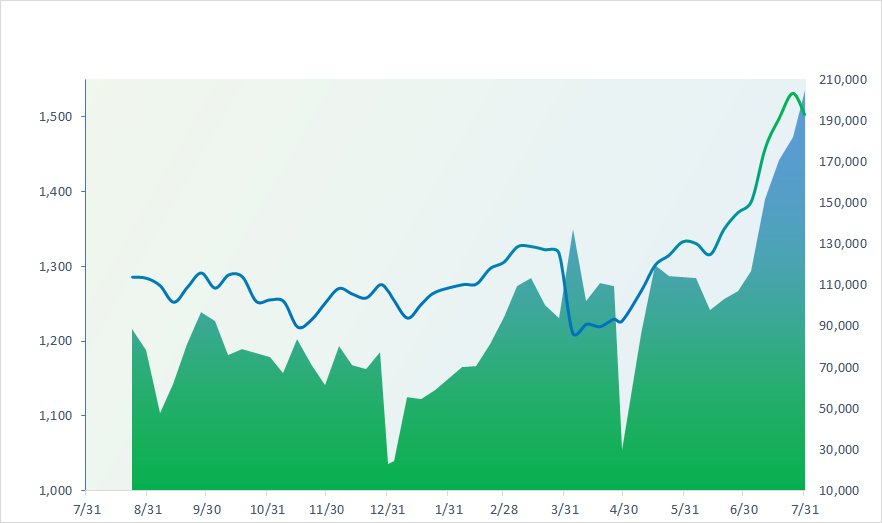

VN-Index mostly traded in the red today as foreign investors net sold over VND2,000 billion. The Securities, Industrial Parks, Commodities, and Industrial Services sectors showed the most positive performance during the session. In contrast, the Vingroup group, Retail, Telecommunications, and Steel sectors experienced rather negative movements.

ETF & DERIVATIVES

28,490

1D -1.04%

YTD 21.34%

19,630

1D -1.06%

YTD 20.58%

20,600

1D -1.39%

YTD 23.35%

24,290

1D 0.00%

YTD 20.85%

28,340

1D 1.21%

YTD 28.24%

35,000

1D 0.43%

YTD 4.42%

21,660

1D 0.42%

YTD 20.87%

1,607

1D -0.99%

YTD 0.00%

1,599

1D -1.06%

YTD 0.00%

1,603

1D -0.58%

YTD 0.00%

1,604

1D -0.98%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

41,069.82

1D 1.02%

YTD 2.95%

3,573.21

1D -1.18%

YTD 6.61%

24,773.33

1D -1.60%

YTD 23.50%

3,245.44

1D -0.28%

YTD 35.26%

81,453.00

1D -0.04%

YTD 3.66%

4,173.77

1D -1.08%

YTD 10.20%

1,244.89

1D 0.06%

YTD -11.09%

71.83

1D -0.88%

YTD -4.29%

3,358.31

1D 0.63%

YTD 27.45%

Asian stock markets traded mixed today following the above-mentioned U.S. tariff decision. Notably, Japan’s Nikkei 225 surged into positive territory after the Bank of Japan decided to maintain its benchmark interest rate at 0.5% for the fourth consecutive time. This decision also caused the Japanese Yen to reverse and appreciate, while the 10-year government bond yield rose to 1.56%.

VIETNAM ECONOMY

3.38%

1D (bps) -30

YTD (bps) -59

4.60%

2.93%

1D (bps) 2

YTD (bps) 45

3.30%

1D (bps) 5

YTD (bps) 45

26,380

1D (%) -0.08%

YTD (%) 3.24%

30,754

1D (%) -1.10%

YTD (%) 12.79%

3,701

1D (%) -0.29%

YTD (%) 3.93%

Today, the Ministry of Industry and Trade and the Ministry of Finance adjusted fuel prices. Most gasoline types saw an increase of around 100 VND/liter, while only diesel 0.05S dropped by 61 VND/liter.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank of Vietnam announced an increase in the 2025 credit growth target;

- A business plans to invest VND3,560 billion in Tay Ninh province;

- Gia Binh airport planning adjusted to over 1,900 hectares, becoming the largest in the North;

- Minister Lutnick announced two more Southeast Asian countries reached agreements with the U.S.;

- President Trump declared he will not extend the August 1st deadline;

- BOJ continues to keep interest rates unchanged.

VN30

BANK

60,200

1D -1.15%

5D -3.06%

Buy Vol. 9,088,826

Sell Vol. 10,985,606

37,850

1D -0.66%

5D -2.57%

Buy Vol. 9,807,306

Sell Vol. 13,104,450

45,900

1D -0.65%

5D 0.44%

Buy Vol. 25,892,406

Sell Vol. 30,182,806

34,000

1D -1.45%

5D -3.00%

Buy Vol. 43,949,994

Sell Vol. 42,944,074

25,800

1D 2.18%

5D 9.79%

Buy Vol. 92,120,714

Sell Vol. 96,404,778

27,450

1D 0.18%

5D -3.35%

Buy Vol. 49,135,389

Sell Vol. 42,151,176

26,450

1D -0.75%

5D -4.17%

Buy Vol. 45,440,368

Sell Vol. 42,446,853

15,700

1D -1.26%

5D 0.64%

Buy Vol. 39,292,455

Sell Vol. 40,609,599

49,950

1D 1.32%

5D 1.94%

Buy Vol. 26,481,555

Sell Vol. 27,637,614

19,400

1D 0.26%

5D 5.72%

Buy Vol. 31,848,904

Sell Vol. 33,032,277

23,000

1D 0.00%

5D -0.86%

Buy Vol. 22,677,868

Sell Vol. 17,591,177

17,200

1D 6.83%

5D 14.29%

Buy Vol. 280,161,986

Sell Vol. 230,356,097

19,500

1D 1.30%

5D -2.26%

Buy Vol. 5,018,755

Sell Vol. 4,214,655

34,200

1D 0.00%

5D -3.66%

Buy Vol. 8,115,199

Sell Vol. 6,977,797

Vietnam Joint Stock Commercial Bank for Industry and Trade (CTG) reported Q2/2025 financial results with pre-tax profit of VND12,097 billion, up 79.2% year-over-year; post-tax profit reached VND9,752 billion, up 80.3%. For the first half of the year, the bank recorded pre-tax profit of VND18,920 billion, a 46% increase compared to the same period last year. With this result, VietinBank ranked second in the banking sector in terms of profitability.

OIL & GAS

67,700

1D -0.29%

5D -2.03%

Buy Vol. 1,464,155

Sell Vol. 2,234,901

36,250

1D -0.14%

5D -4.86%

Buy Vol. 3,520,478

Sell Vol. 3,669,072

GAS: Q2/2025 post-tax profit reached VND4,808 billion, growing over 40% year-on-year.

VINGROUP

105,500

1D -3.65%

5D -9.05%

Buy Vol. 8,723,795

Sell Vol. 7,662,895

90,000

1D -1.64%

5D -2.17%

Buy Vol. 10,134,689

Sell Vol. 10,791,095

28,100

1D 0.00%

5D -5.70%

Buy Vol. 9,227,967

Sell Vol. 8,065,765

VIC: Q2/2025 post-tax profit tripled compared to the same period last year, reaching VND2,265 billion, mainly thanks to recognizing over VND18,000 billion in other income.

FOOD & BEVERAGE

61,200

1D -2.70%

5D -3.92%

Buy Vol. 15,722,821

Sell Vol. 17,756,865

72,500

1D -0.68%

5D -4.61%

Buy Vol. 14,776,866

Sell Vol. 13,005,625

47,650

1D 0.11%

5D -2.76%

Buy Vol. 2,929,232

Sell Vol. 2,647,084

VNM: Q2/2025 post-tax profit was VND2,488 billion, down around 8% year-on-year.

OTHERS

71,700

1D 3.91%

5D 2.58%

Buy Vol. 2,530,383

Sell Vol. 2,873,569

49,250

1D -0.61%

5D -5.65%

Buy Vol. 1,801,867

Sell Vol. 1,841,214

121,200

1D 2.11%

5D 6.32%

Buy Vol. 4,983,135

Sell Vol. 4,291,716

104,000

1D -1.98%

5D -6.39%

Buy Vol. 14,984,303

Sell Vol. 11,977,103

65,300

1D -2.68%

5D -6.04%

Buy Vol. 24,307,194

Sell Vol. 20,801,122

30,100

1D 2.03%

5D -4.90%

Buy Vol. 8,526,128

Sell Vol. 10,001,318

34,200

1D 0.88%

5D 6.88%

Buy Vol. 71,929,687

Sell Vol. 71,647,851

24,950

1D -1.77%

5D -4.04%

Buy Vol. 133,682,447

Sell Vol. 120,451,639

BCM: Gross profit growth combined with cost-cutting measures helped Becamex report Q2/2025 profit of over VND1,466 billion, 4 times higher than Q2/2024.

Market by numbers

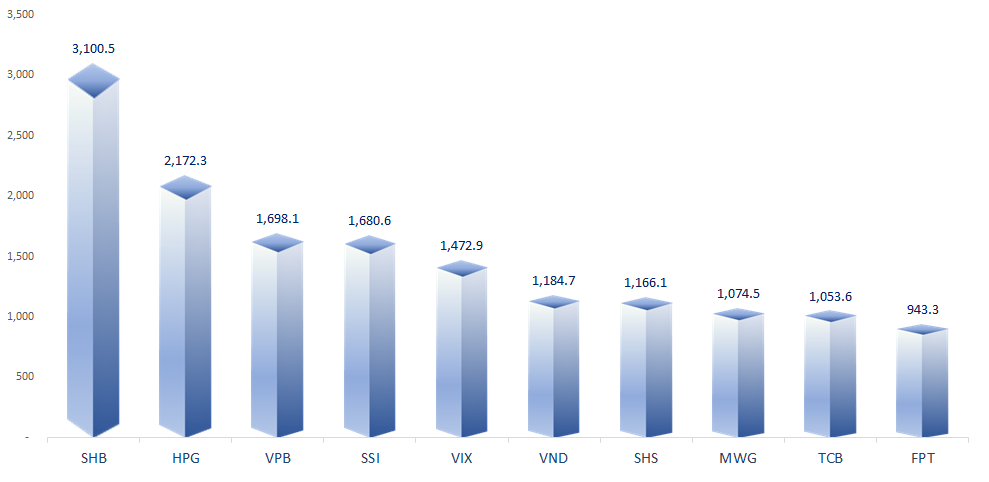

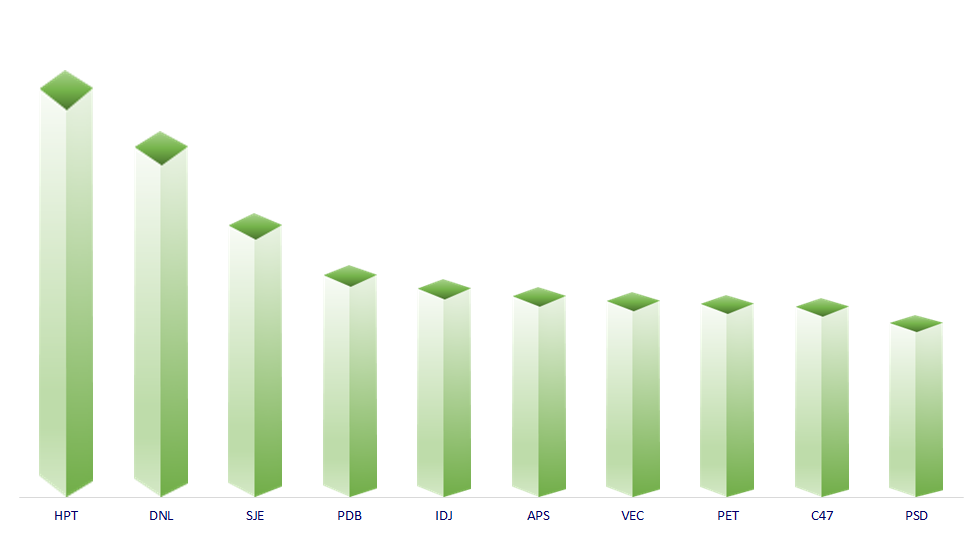

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

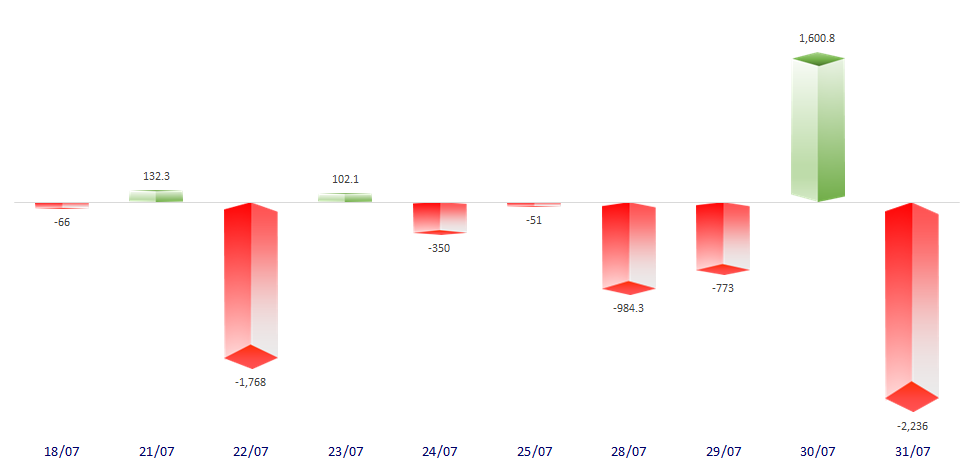

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

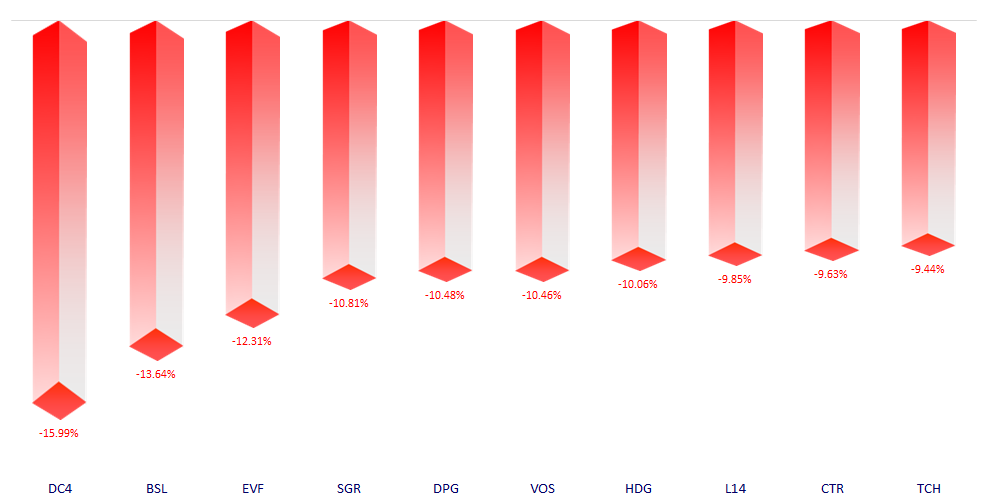

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.