Market brief 01/08/2025

VIETNAM STOCK MARKET

1,495.21

1D -0.49%

YTD 18.03%

264.93

1D -0.53%

YTD 16.49%

1,614.11

1D -0.07%

YTD 20.03%

106.46

1D 0.63%

YTD 11.99%

-2,488.46

1D 0.00%

YTD 0.00%

46,541.00

1D -5.02%

YTD 156.70%

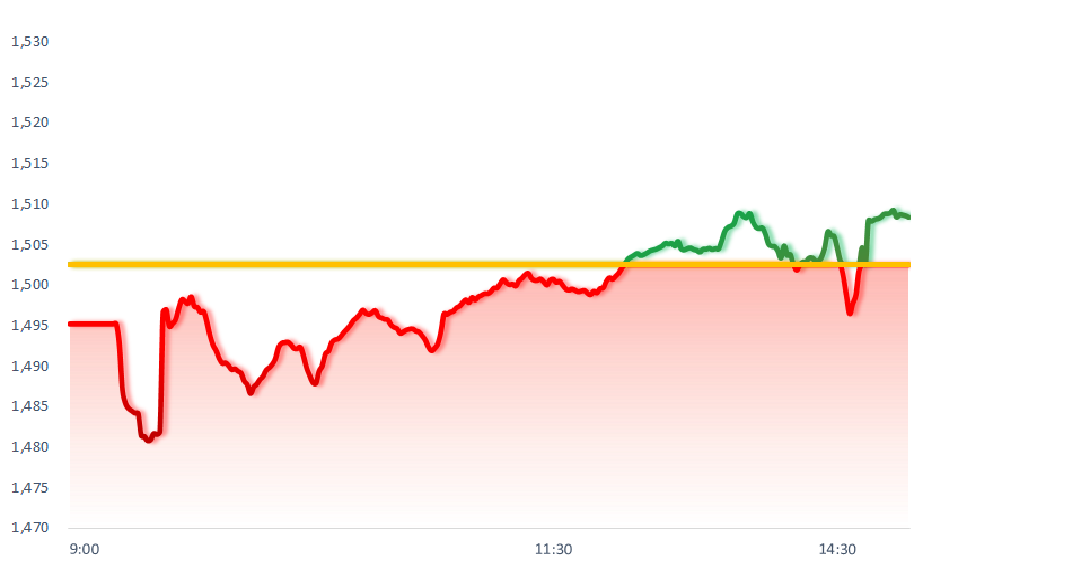

The VNIndex maintained its correction trend but the decline has narrowed. Bluechip stocks continued to be sold off heavily, especially under pressure from foreign investors. On the contrary, cash flow is still pouring into midcap stocks.

ETF & DERIVATIVES

28,300

1D -0.67%

YTD 20.53%

19,500

1D -0.66%

YTD 19.78%

20,780

1D 0.87%

YTD 24.43%

24,180

1D -0.45%

YTD 20.30%

28,160

1D -0.64%

YTD 27.42%

34,900

1D -0.29%

YTD 4.12%

21,600

1D -0.28%

YTD 20.54%

1,615

1D 0.48%

YTD 0.00%

1,600

1D 0.07%

YTD 0.00%

1,606

1D 0.19%

YTD 0.00%

1,603

1D -0.06%

YTD 0.00%

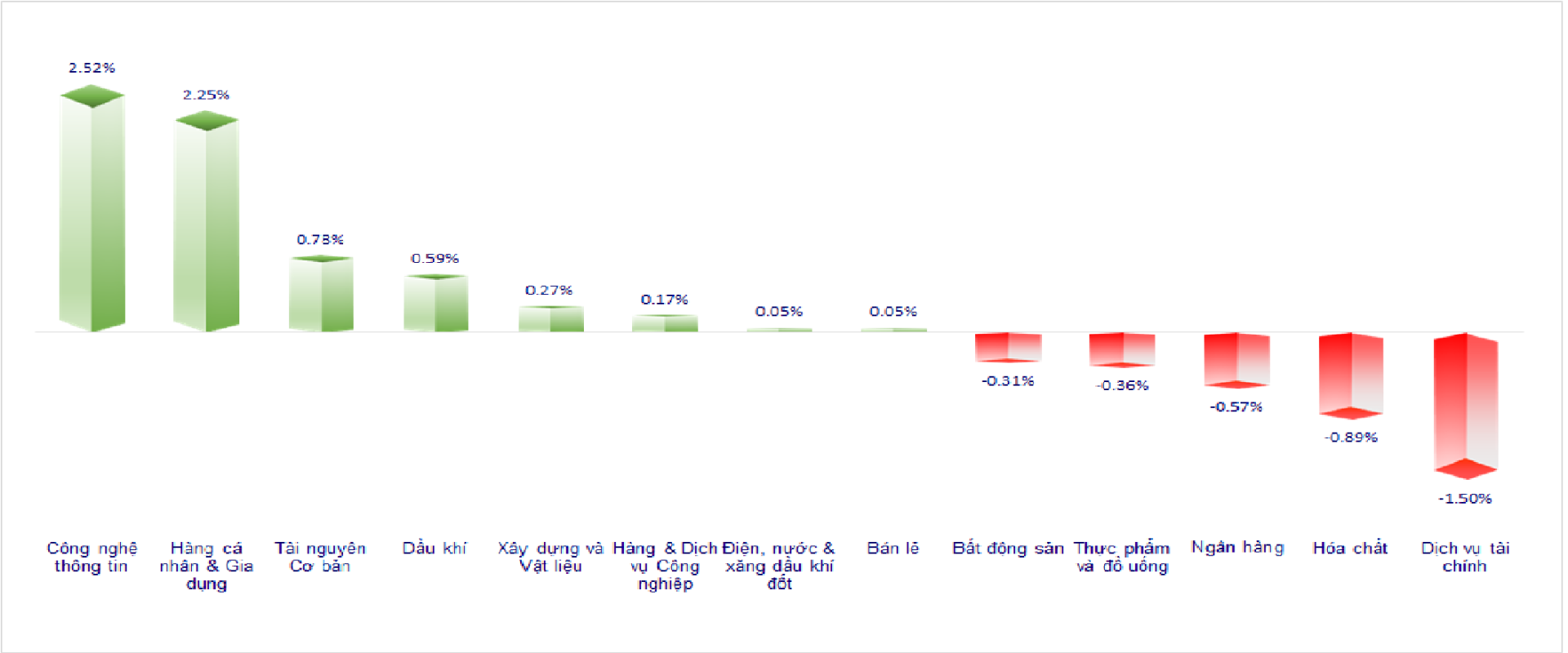

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

40,799.60

1D -0.66%

YTD 2.27%

3,559.95

1D -0.37%

YTD 6.21%

24,507.81

1D -1.07%

YTD 22.18%

3,119.41

1D -3.88%

YTD 30.00%

80,800.06

1D -0.80%

YTD 2.83%

4,153.83

1D -0.48%

YTD 9.67%

1,218.33

1D -2.13%

YTD -12.99%

71.48

1D -0.47%

YTD -4.76%

3,294.00

1D 0.09%

YTD 25.01%

Asian stocks were in the red as US President Donald Trump formally imposed reciprocal tariffs. South Korea's Kospi fell more than 3.8% on the finance ministry's new proposal to increase both corporate income and investment taxes.

VIETNAM ECONOMY

5.40%

1D (bps) 202

YTD (bps) 143

4.60%

2.92%

1D (bps) -1

YTD (bps) 44

3.08%

1D (bps) -22

YTD (bps) 23

26,400

1D (%) 0.08%

YTD (%) 3.32%

30,730

1D (%) -0.08%

YTD (%) 12.70%

3,685

1D (%) -0.43%

YTD (%) 3.48%

DXY increased sharply on signs of rising inflation and market anxiety ahead of the tariff agreement deadline. Domestically, USD buying and selling prices were adjusted slightly downward by banks in the context of the central exchange rate continuing to increase.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- PMI in July reached 52.4 points, the number of new orders increased after 4 months;

- More than 8.2 million F88 shares priced at VND634,900/share officially traded on UPCoM from August 8;

- New information from the Ministry of Finance on real estate and securities taxes;

- Nikkei Asia: China stops granting investment licenses to the US amid trade war;

- The White House sends mixed signals about the trade deal with China;

- Apple exceeds profit forecast thanks to strong iPhone sales.

VN30

BANK

60,200

1D 0.00%

5D -2.90%

Buy Vol. 9,491,840

Sell Vol. 7,773,509

37,200

1D -1.72%

5D -4.25%

Buy Vol. 10,612,681

Sell Vol. 11,354,358

44,300

1D -3.49%

5D -2.85%

Buy Vol. 20,774,659

Sell Vol. 22,166,523

34,100

1D 0.29%

5D -3.13%

Buy Vol. 38,959,297

Sell Vol. 34,642,635

25,800

1D 0.00%

5D 7.28%

Buy Vol. 88,087,837

Sell Vol. 79,284,687

27,150

1D -1.09%

5D -4.57%

Buy Vol. 43,775,809

Sell Vol. 38,154,932

27,000

1D 2.08%

5D -4.42%

Buy Vol. 35,418,774

Sell Vol. 31,577,497

15,700

1D 0.00%

5D 0.64%

Buy Vol. 38,093,809

Sell Vol. 39,707,677

49,400

1D -1.10%

5D 1.23%

Buy Vol. 18,982,351

Sell Vol. 23,902,486

19,000

1D -2.06%

5D 3.26%

Buy Vol. 46,548,061

Sell Vol. 41,554,671

23,000

1D 0.00%

5D -2.54%

Buy Vol. 19,921,348

Sell Vol. 19,099,240

17,400

1D 1.16%

5D 15.61%

Buy Vol. 186,768,332

Sell Vol. 192,370,003

19,600

1D 0.51%

5D -5.31%

Buy Vol. 5,777,155

Sell Vol. 6,163,037

34,500

1D 0.88%

5D -2.13%

Buy Vol. 6,088,862

Sell Vol. 4,519,689

ABB: Banks have announced their financial reports for the second quarter, with most of them reporting year-on-year profit growth. ABBank is the bank with the highest profit growth, with pre-tax profit in the second quarter reaching VND1,257 billion, 3.2 times higher than the same period; accumulated profit for the first 6 months reached VND1,672 billion, 2.8 times higher than the same period.

OIL & GAS

67,600

1D -0.15%

5D -1.60%

Buy Vol. 1,410,912

Sell Vol. 1,732,045

35,800

1D -1.24%

5D -6.04%

Buy Vol. 5,492,130

Sell Vol. 6,335,158

PLX: Petrolimex reported a profit of 1,368 billion in Q2/2025, up 6.3% over the same period last year.

VINGROUP

104,000

1D -1.42%

5D -8.85%

Buy Vol. 6,603,211

Sell Vol. 5,323,906

89,900

1D -0.11%

5D -4.06%

Buy Vol. 12,406,084

Sell Vol. 11,452,457

28,450

1D 1.25%

5D -3.56%

Buy Vol. 4,699,797

Sell Vol. 4,720,667

VHM: Vinhomes and SAMTY held the topping out ceremony of 4 towers of The Opus One, expected to be handed over from the first quarter of 2026.

FOOD & BEVERAGE

60,000

1D -1.96%

5D -5.06%

Buy Vol. 7,979,655

Sell Vol. 8,724,841

72,500

1D 0.00%

5D -4.35%

Buy Vol. 10,961,406

Sell Vol. 8,964,785

47,950

1D 0.63%

5D -2.34%

Buy Vol. 1,789,351

Sell Vol. 2,168,913

MSN: Masan Consumer (MCH) recorded Q2/2025 revenue of VND6,276 billion, down 15% yoy, but had a bright spot in the export segment thanks to increased presence in the Asian market.

OTHERS

69,900

1D -2.51%

5D 0.14%

Buy Vol. 1,056,553

Sell Vol. 1,894,225

50,000

1D 1.52%

5D -3.85%

Buy Vol. 1,390,026

Sell Vol. 1,289,071

119,000

1D -1.82%

5D -2.38%

Buy Vol. 9,638,497

Sell Vol. 9,810,402

107,000

1D 2.88%

5D -3.34%

Buy Vol. 22,336,567

Sell Vol. 14,806,854

65,200

1D -0.15%

5D -6.99%

Buy Vol. 17,759,464

Sell Vol. 13,774,251

29,700

1D -1.33%

5D -4.81%

Buy Vol. 5,818,728

Sell Vol. 7,381,683

33,200

1D -2.92%

5D -2.35%

Buy Vol. 80,620,664

Sell Vol. 84,457,810

25,150

1D 0.80%

5D -3.45%

Buy Vol. 103,056,641

Sell Vol. 76,750,992

BVH: Bao Viet Group announced its business results for the first half of 2025 with consolidated profit after tax in the second quarter reaching VND705 billion, up 60.7% over the same period last year. Accumulated profit after tax in the first 6 months of the year reached VND1,392 billion, up 31.5%.

Market by numbers

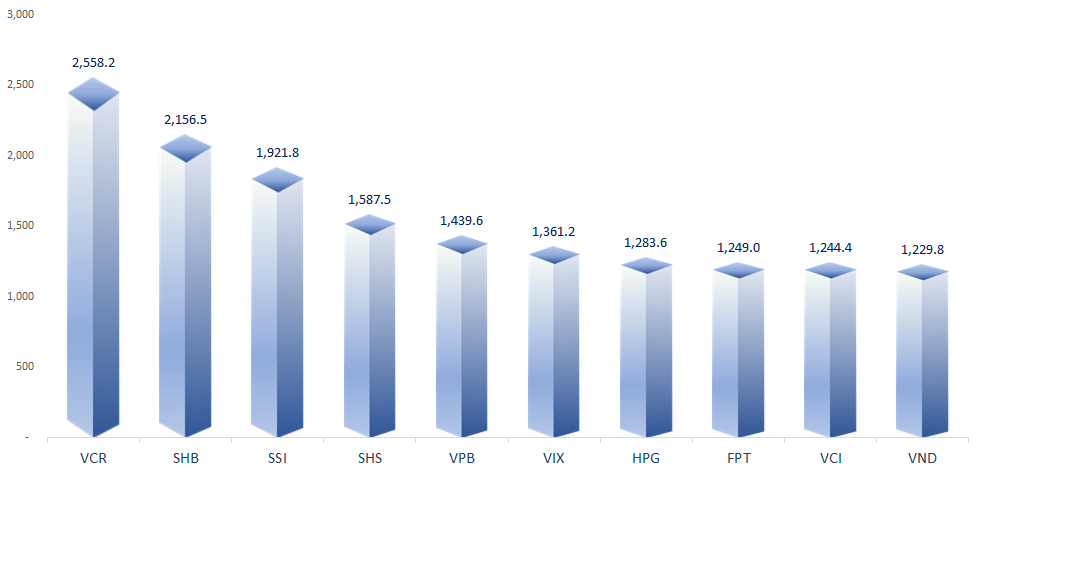

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

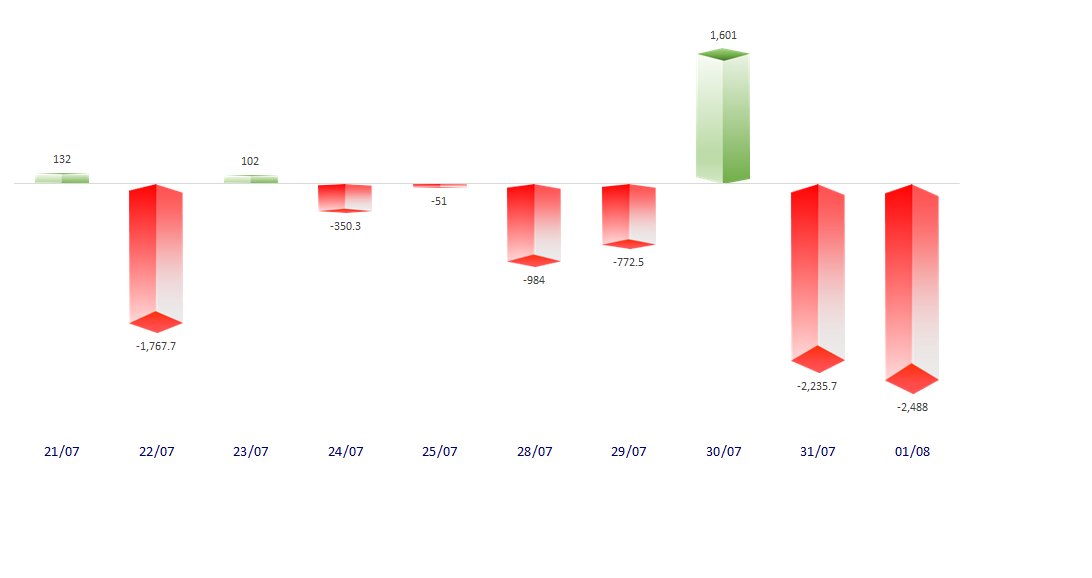

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

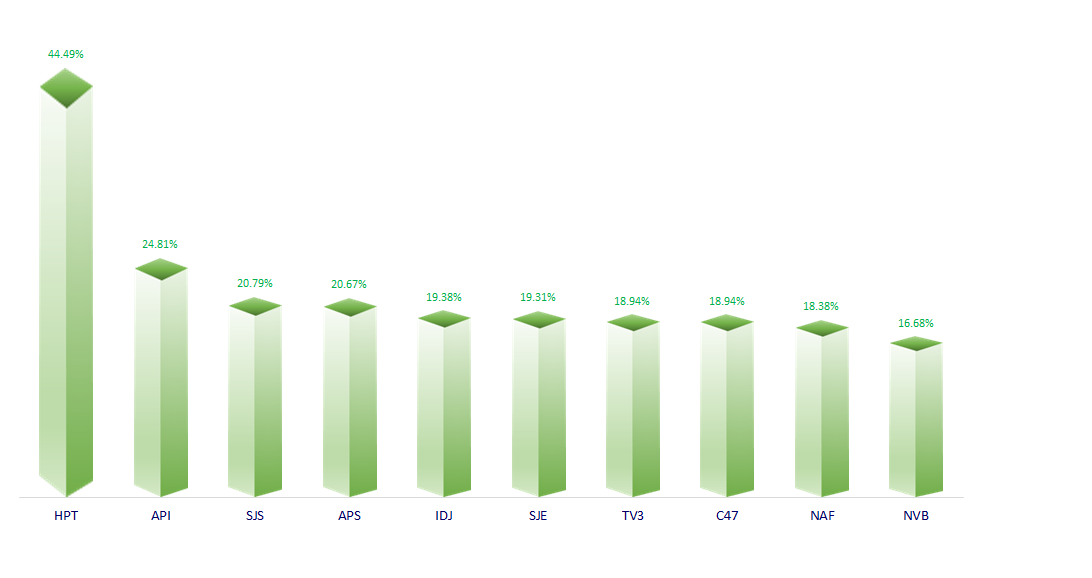

TOP INCREASES 3 CONSECUTIVE SESSIONS

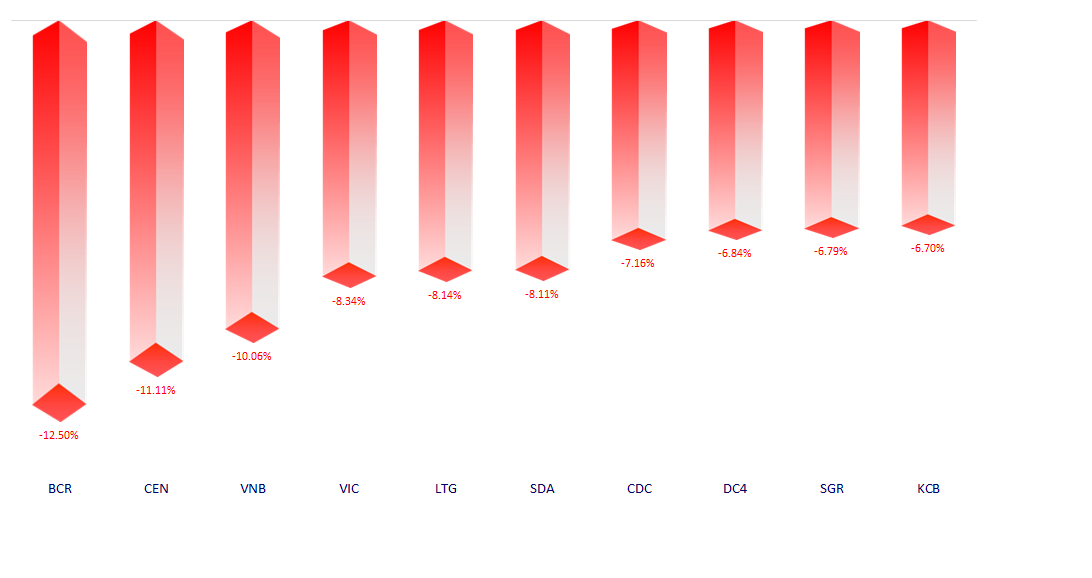

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.