Morning brief 05/08/2025

GLOBAL MARKET

44,173.64

1D 1.34%

YTD 3.83%

6,329.94

1D 1.47%

YTD 7.62%

21,053.58

1D 1.95%

YTD 9.02%

17.52

1D -14.03%

9,128.30

1D 0.66%

YTD 11.69%

23,757.69

1D 1.42%

YTD 19.33%

7,632.01

1D 1.14%

YTD 3.40%

68.83

1D -0.03%

YTD -8.29%

3,380.00

1D 0.66%

YTD 28.27%

On August 4, all three major U.S. stock indexes recorded their largest daily percentage gains since May 27, as buying demand emerged after the previous session’s sell-off and investors increased bets that the U.S. Federal Reserve (Fed) will cut interest rates in September due to weaker-than-expected employment data. According to CME FedWatch, the probability of a September rate cut is now around 84%. Investors expect at least two rate cuts of 0.25 percentage points each by the end of this year.

VIETNAM ECONOMY

5.30%

1D (bps) -10

YTD (bps) 133

4.60%

2.91%

1D (bps) -1

YTD (bps) 44

3.33%

1D (bps) 25

YTD (bps) 48

26,370

1D (%) -0.11%

YTD (%) 3.21%

31,056

1D (%) 1.06%

YTD (%) 13.90%

3,702

1D (%) 0.46%

YTD (%) 3.95%

Gold prices unexpectedly reversed course, climbing 0.66% to USD3,380/ounce, as both Europe and the U.S. released weaker-than-expected economic data. Specifically, the eurozone’s monthly investor confidence index, published by Sentix GmbH, fell by 3.7 points in August, well below the 4.5-point increase in July.

VIETNAM STOCK MARKET

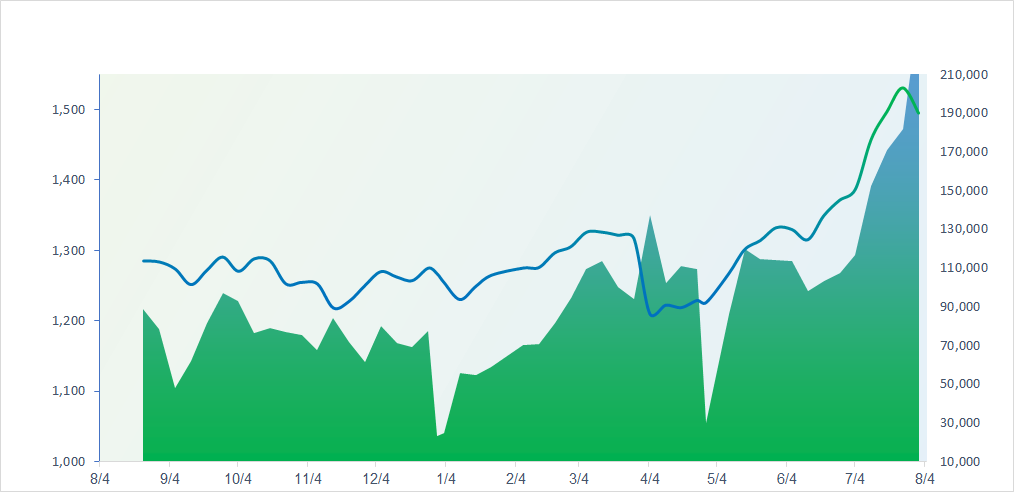

1,528.19

1D 2.21%

YTD 20.64%

268.34

1D 1.29%

YTD 17.99%

1,653.22

1D 2.42%

YTD 22.94%

107.16

1D 0.66%

YTD 12.73%

-10,100.66

46,966.00

1D 0.91%

YTD 159.04%

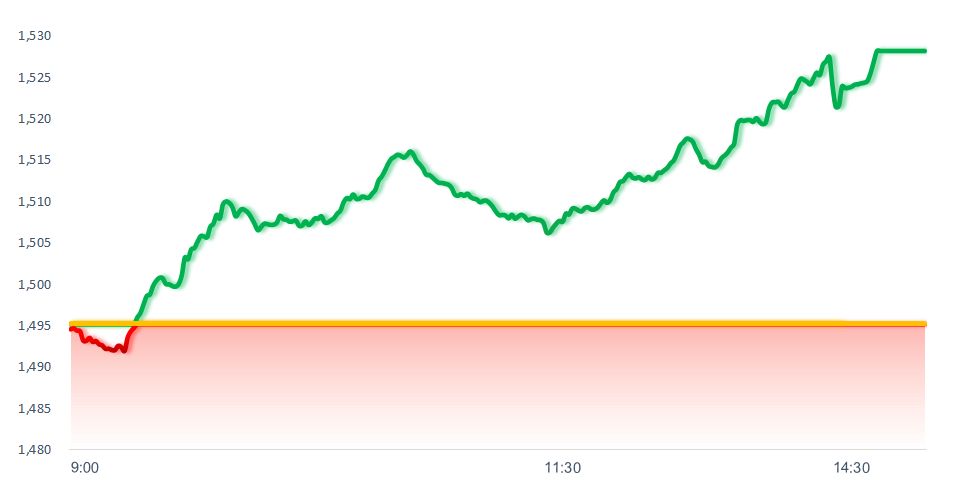

VN-Index rebounded by more than 30 points despite strong net foreign selling of over VND10,000 billion. Domestic proprietary traders turned to net selling of VND287 billion, with the biggest outflows in FPT (VND114 billion), BSR (VND111 billion), and DGC (VND97 billion). On the other hand, they recorded net buys in VHM (VND46 billion), VNM (VND33 billion), and MWG (VND31 billion).

INTRADAY

VN30 (12M)

SELECTED NEWS

- Positive negotiations are underway for investment cooperation in the Ninh Thuan nuclear power plant project;

- Cua Nam Ward responds to information about the ‘pilot ban on gasoline-powered vehicles’;

- The Prime Minister requests measurement of outcomes to better serve citizens and businesses;

- China injects USD15 billion, the U.S. responds with a 250% tariff — leaving one Southeast Asian country “caught in the middle”;

- 3,200 Boeing workers strike in the U.S. over unresolved wage agreements;

- OPEC+ works to regain its share of the oil market.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.