Market brief 22/08/2025

VIETNAM STOCK MARKET

1,645.47

1D -2.52%

YTD 29.89%

272.48

1D -4.19%

YTD 19.81%

1,814.02

1D -3.25%

YTD 34.90%

109.26

1D -1.19%

YTD 14.94%

-1,541.52

1D 0.00%

YTD 0.00%

68,696.00

1D 21.41%

YTD 278.89%

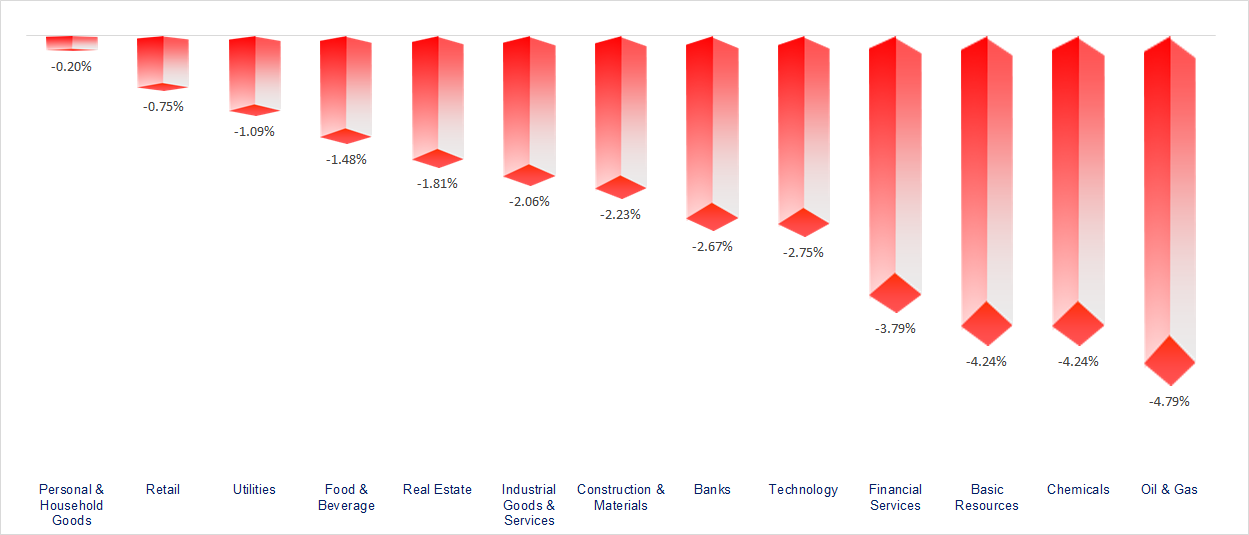

VN-Index experienced a sharp correction, dropping more than 40 points as capital fled the market. All sectors declined, with Oil & Gas, Chemicals, and Securities suffering the steepest losses.

ETF & DERIVATIVES

32,150

1D -1.62%

YTD 36.93%

22,200

1D -2.12%

YTD 36.36%

22,800

1D -2.31%

YTD 36.53%

28,000

1D -1.75%

YTD 39.30%

34,100

1D -4.08%

YTD 54.30%

39,000

1D -3.11%

YTD 16.35%

24,900

1D -1.97%

YTD 38.95%

1,803

1D -3.98%

YTD 0.00%

1,805

1D -3.19%

YTD 0.00%

1,795

1D -2.94%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

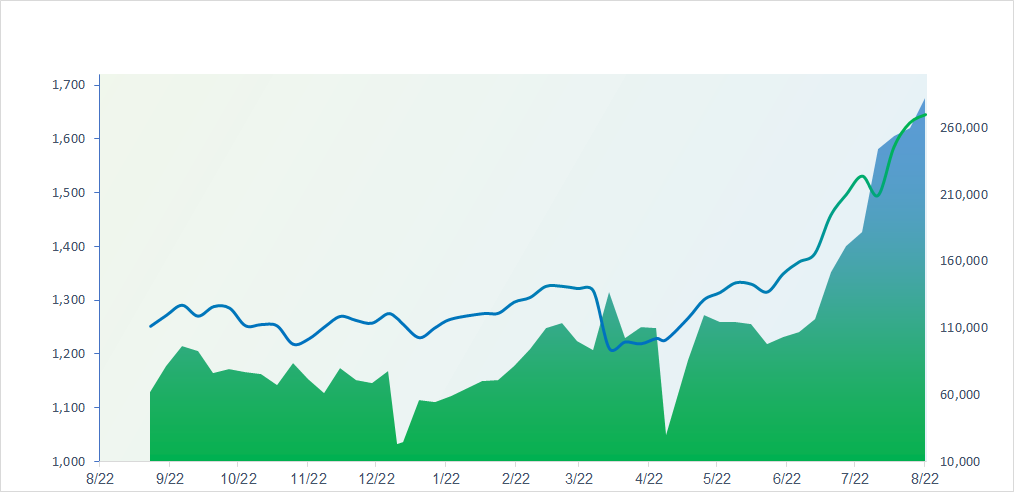

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

42,633.29

1D 0.05%

YTD 6.86%

3,825.76

1D 1.45%

YTD 14.14%

25,339.14

1D 0.93%

YTD 26.32%

3,168.73

1D 0.86%

YTD 32.06%

81,327.84

1D -0.82%

YTD 3.50%

4,253.02

1D 0.52%

YTD 12.29%

1,253.39

1D 0.69%

YTD -10.49%

67.51

1D -0.24%

YTD -10.05%

3,330.00

1D -0.26%

YTD 26.37%

Asian stock markets mostly gained today. China’s Shanghai Composite rose more than 1.45% to 3,825.76 points. Japan’s Nikkei 225 edged up 0.05% to 42,633.29 points, supported by easing core inflation in July, which cooled to 3.1%.

VIETNAM ECONOMY

4.96%

1D (bps) 40

YTD (bps) 99

4.60%

3.00%

1D (bps) 6

YTD (bps) 52

3.35%

1D (bps) -2

YTD (bps) 50

26,550

1D (%) 0.05%

YTD (%) 3.91%

31,372

1D (%) -0.74%

YTD (%) 15.06%

3,733

1D (%) -0.23%

YTD (%) 4.82%

The State Bank of Vietnam continued net injecting liquidity, pumping over VND 53.2 trillion into the market through open market operations in today’s session.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposal to raise regional minimum wages starting January 1, 2026;

- Toll collection to begin on 13 new expressways, expected to generate nearly VND 2,500 billion per year;

- State Bank of Vietnam injects over VND 53 trillion via OMO channel, USD exchange rate hits regulatory ceiling;

- U.S. cuts tariffs on EU cars, semiconductors, and wood products to 15%;

- Fed Chair to speak tonight — investors should watch for 4 key points;

- Eurozone sees rise in new orders for the first time since May 2024.

VN30

BANK

64,600

1D 0.62%

5D 0.47%

Buy Vol. 35,403,282

Sell Vol. 30,464,331

43,250

1D 2.25%

5D 5.49%

Buy Vol. 35,688,610

Sell Vol. 34,639,344

50,900

1D -1.74%

5D 3.88%

Buy Vol. 37,253,129

Sell Vol. 32,681,444

39,000

1D -6.14%

5D 3.72%

Buy Vol. 77,865,191

Sell Vol. 85,719,206

35,950

1D -6.99%

5D 15.59%

Buy Vol. 85,696,917

Sell Vol. 108,802,584

26,900

1D -4.61%

5D -4.78%

Buy Vol. 120,778,286

Sell Vol. 97,233,841

32,350

1D -2.71%

5D 4.35%

Buy Vol. 44,133,007

Sell Vol. 44,640,092

21,600

1D -2.04%

5D 10.77%

Buy Vol. 126,368,884

Sell Vol. 115,189,191

55,500

1D -3.98%

5D 2.97%

Buy Vol. 30,871,057

Sell Vol. 31,274,514

23,600

1D 0.85%

5D 15.97%

Buy Vol. 86,664,523

Sell Vol. 91,590,962

27,850

1D -5.43%

5D 4.90%

Buy Vol. 57,610,581

Sell Vol. 66,085,671

17,250

1D -6.76%

5D -6.52%

Buy Vol. 246,978,572

Sell Vol. 268,599,149

22,100

1D -4.33%

5D 7.02%

Buy Vol. 7,829,071

Sell Vol. 7,527,930

47,000

1D -2.89%

5D 20.51%

Buy Vol. 9,244,497

Sell Vol. 8,935,424

MSB: September 8 will be the ex-dividend date for receiving stock dividends at a 20% ratio.

OIL & GAS

68,000

1D -1.88%

5D -2.44%

Buy Vol. 2,070,975

Sell Vol. 2,468,838

35,950

1D -2.57%

5D -6.62%

Buy Vol. 5,850,118

Sell Vol. 5,054,618

Global oil rebounded 1% after several losing sessions, as Russia–Ukraine negotiations stalled and U.S. consumption demand exceeded forecasts.

VINGROUP

124,100

1D -0.72%

5D 4.99%

Buy Vol. 6,936,438

Sell Vol. 7,851,771

98,100

1D -1.70%

5D 4.36%

Buy Vol. 8,485,878

Sell Vol. 8,495,177

30,000

1D -1.32%

5D -0.99%

Buy Vol. 14,104,719

Sell Vol. 13,742,588

Despite a sharp market correction today, especially among large-cap stocks, the Vingroup group’s shares held firm with losses capped under 2%, and at times even turned green.

FOOD & BEVERAGE

58,700

1D -2.33%

5D -3.77%

Buy Vol. 11,039,787

Sell Vol. 10,936,862

81,000

1D -3.91%

5D -2.53%

Buy Vol. 26,014,838

Sell Vol. 26,884,998

45,800

1D -1.72%

5D -3.58%

Buy Vol. 2,923,444

Sell Vol. 2,912,925

VNM: Vinamilk faced its sixth consecutive net selling session by foreign investors, with today’s net outflow reaching nearly VND 100 billion.

OTHERS

66,500

1D -4.86%

5D -5.27%

Buy Vol. 772,799

Sell Vol. 1,194,366

98,800

1D 2.17%

5D -4.63%

Buy Vol. 8,007,125

Sell Vol. 5,162,954

140,000

1D -3.98%

5D -3.85%

Buy Vol. 4,338,709

Sell Vol. 4,409,134

99,000

1D -2.65%

5D -2.37%

Buy Vol. 10,482,975

Sell Vol. 15,276,019

70,300

1D -0.99%

5D -0.28%

Buy Vol. 16,590,249

Sell Vol. 15,495,632

29,500

1D -6.94%

5D -6.05%

Buy Vol. 11,864,890

Sell Vol. 14,234,538

35,750

1D -3.51%

5D -2.19%

Buy Vol. 97,041,393

Sell Vol. 90,240,438

26,000

1D -5.11%

5D -7.14%

Buy Vol. 215,952,245

Sell Vol. 246,642,546

FPT: Long Chau pharmacy chain, under FPT, signed a strategic partnership with OMRON Healthcare, Japan’s leading medical equipment brand.

Market by numbers

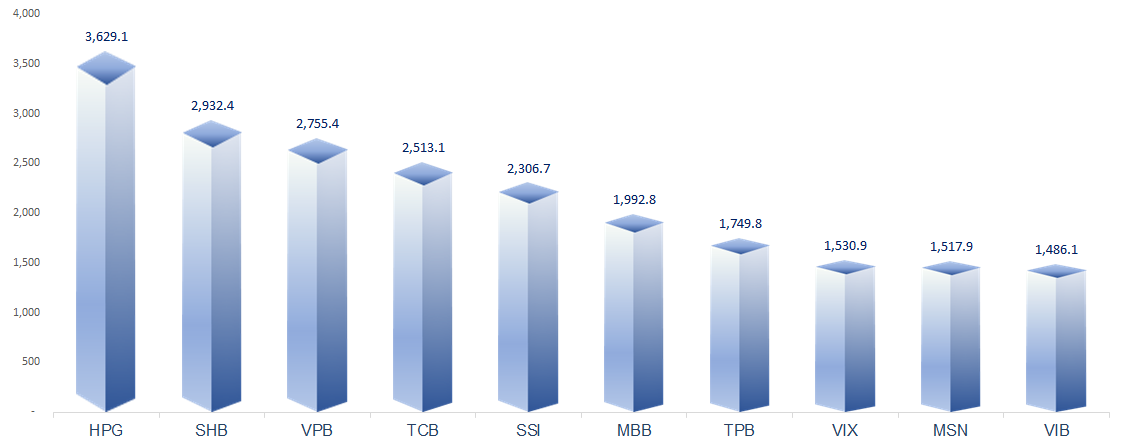

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

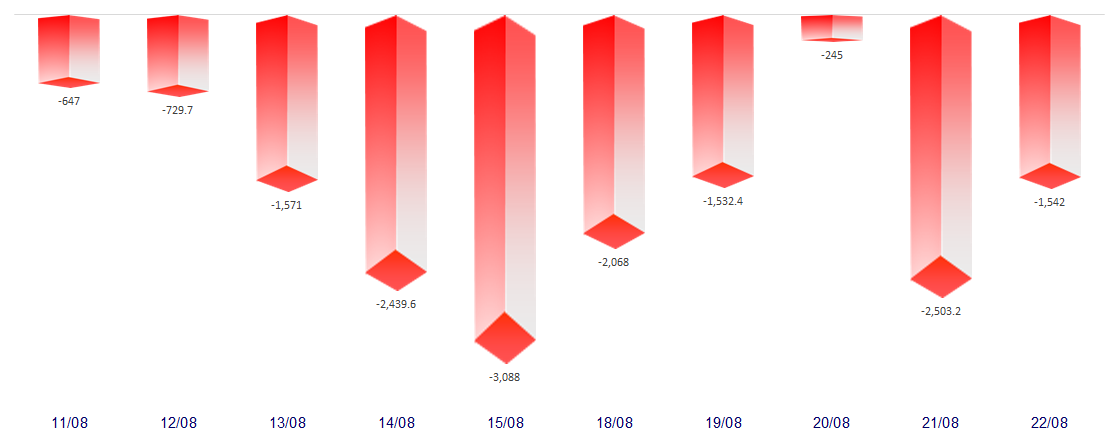

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

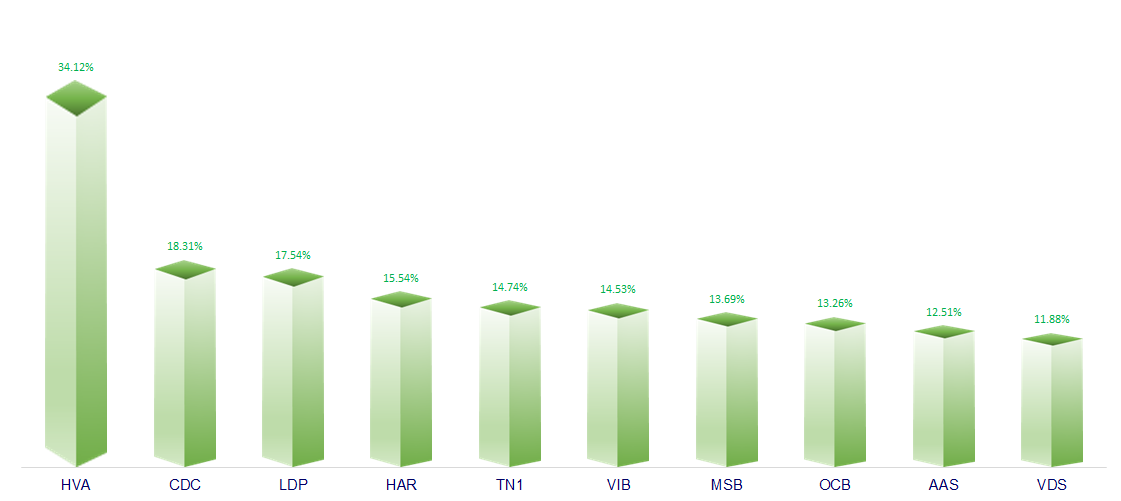

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.