Market brief 26/08/2025

VIETNAM STOCK MARKET

1,667.63

1D 3.32%

YTD 31.64%

275.79

1D 3.45%

YTD 21.26%

1,849.05

1D 3.70%

YTD 37.50%

108.84

1D 0.24%

YTD 14.50%

686.93

1D 0.00%

YTD 0.00%

42,641.00

1D -7.41%

YTD 135.18%

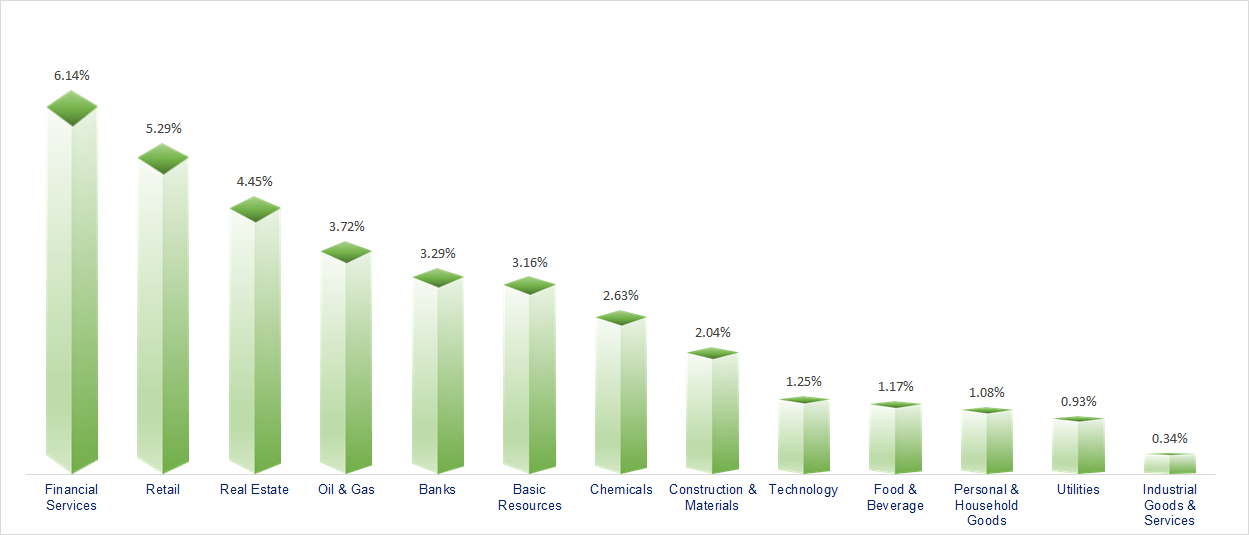

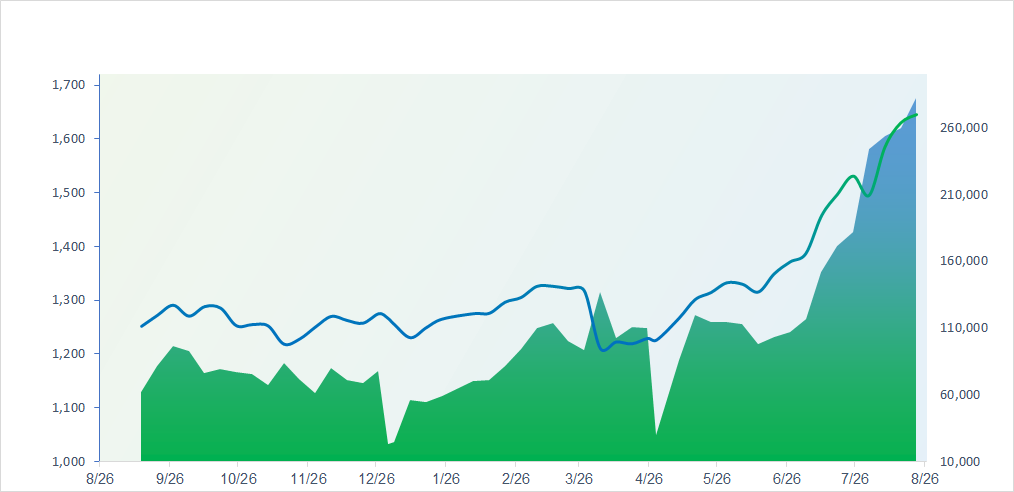

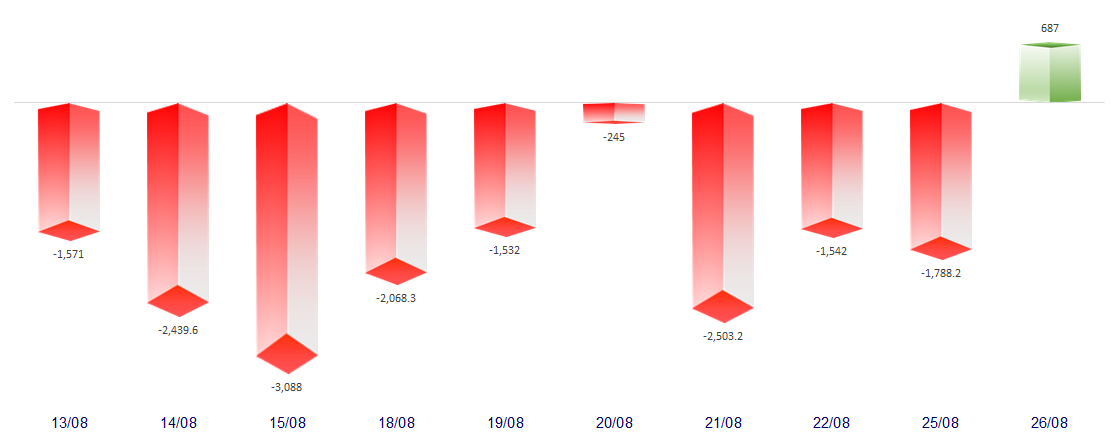

VN-Index rebounded strongly, gaining more than 50 points as foreign investors returned with net purchases of nearly VND700 billion. Almost all sectors advanced today, with Securities, Retail, and Real Estate leading the gains.

ETF & DERIVATIVES

32,440

1D 2.17%

YTD 38.16%

22,410

1D 3.37%

YTD 37.65%

23,200

1D 2.20%

YTD 38.92%

27,970

1D 3.55%

YTD 39.15%

34,300

1D 4.29%

YTD 55.20%

39,950

1D 6.11%

YTD 19.18%

25,000

1D 2.46%

YTD 39.51%

1,845

1D 3.94%

YTD 0.00%

1,852

1D 3.87%

YTD 0.00%

1,835

1D 3.50%

YTD 0.00%

1,828

1D 3.50%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

42,394.40

1D -0.97%

YTD 6.27%

3,868.38

1D -0.39%

YTD 15.41%

25,524.92

1D -1.18%

YTD 27.25%

3,179.36

1D -0.95%

YTD 32.50%

80,821.61

1D -1.02%

YTD 2.86%

4,243.71

1D -0.30%

YTD 12.04%

1,251.17

1D -0.91%

YTD -10.64%

67.19

1D -1.51%

YTD -10.47%

3,370.00

1D 0.12%

YTD 27.89%

Asian stock markets sank deep into the red following a series of tariff-related statements from President Trump and his dismissal of Fed Governor Lisa Cook. Hong Kong’s Hang Seng Index posted the steepest drop, down more than 1.1% to 25,524.92 points, followed by Japan’s Nikkei 225, which slid nearly 1% to 42,394.40 points. Notably, President Trump warned of imposing a “200% or similar” tariff on China if the country bans rare earth exports.

VIETNAM ECONOMY

4.00%

1D (bps) -92

YTD (bps) 3

4.60%

3.05%

1D (bps) 9

YTD (bps) 57

3.41%

1D (bps) -2

YTD (bps) 56

26,530

1D (%) 0.19%

YTD (%) 3.83%

31,403

1D (%) -0.46%

YTD (%) 15.17%

3,739

1D (%) 0.29%

YTD (%) 4.99%

The State Bank of Vietnam (SBV) announced the central exchange rate at 25,291 – 25,273 VND/USD, down VND18. This followed a VND7 decrease in the previous trading session.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Official removal of the monopoly on gold bar production;

- Proposal to write off tax debts in multiple cases;

- Prime Minister orders improved efficiency in the management and use of public assets;

- Russia and China expand cooperation;

- Several countries suspend postal services to the U.S.;

- Ukraine seeks to raise USD1 billion per month to purchase U.S. weapons.

VN30

BANK

64,600

1D 1.57%

5D 0.62%

Buy Vol. 14,311,116

Sell Vol. 12,428,232

41,800

1D 1.95%

5D 2.33%

Buy Vol. 19,025,477

Sell Vol. 15,909,334

51,200

1D 4.28%

5D 3.23%

Buy Vol. 16,585,269

Sell Vol. 13,597,387

39,350

1D 4.79%

5D 0.38%

Buy Vol. 52,222,970

Sell Vol. 48,904,650

34,300

1D 2.39%

5D 0.29%

Buy Vol. 99,315,941

Sell Vol. 84,402,322

27,550

1D 5.15%

5D -2.30%

Buy Vol. 75,325,099

Sell Vol. 56,746,668

32,300

1D 3.19%

5D -0.62%

Buy Vol. 20,919,559

Sell Vol. 17,970,827

20,950

1D 4.23%

5D -1.41%

Buy Vol. 91,917,614

Sell Vol. 73,255,506

55,000

1D 3.77%

5D 3.38%

Buy Vol. 26,415,211

Sell Vol. 22,818,851

22,750

1D 3.64%

5D 10.98%

Buy Vol. 39,564,674

Sell Vol. 40,435,821

27,350

1D 4.39%

5D -3.87%

Buy Vol. 35,406,420

Sell Vol. 32,603,382

17,400

1D 6.75%

5D -5.95%

Buy Vol. 187,651,100

Sell Vol. 111,506,850

21,800

1D 5.06%

5D 5.31%

Buy Vol. 4,645,869

Sell Vol. 4,193,872

45,500

1D 1.11%

5D 6.31%

Buy Vol. 7,362,888

Sell Vol. 5,827,277

On August 25, S&P Global Ratings announced upgrades to the long-term credit ratings of three Vietnamese banks: Vietcombank (VCB) from BB to BB+, Techcombank (TCB) from BB- to BB, and Eximbank (EIB) from B+ to BB-. At the same time, S&P affirmed their short-term ratings at B.

OIL & GAS

69,500

1D 1.16%

5D -0.57%

Buy Vol. 1,314,845

Sell Vol. 1,715,594

36,350

1D 1.39%

5D -5.22%

Buy Vol. 3,486,447

Sell Vol. 2,887,457

Brent fell more than 1% after a 2% gain in the previous session, as investors grew concerned about potential disruptions to fuel supplies from Russia.

VINGROUP

135,500

1D 3.44%

5D 14.64%

Buy Vol. 4,121,564

Sell Vol. 4,694,491

105,200

1D 6.91%

5D 12.03%

Buy Vol. 10,308,283

Sell Vol. 7,512,605

31,300

1D 4.33%

5D 4.51%

Buy Vol. 14,185,463

Sell Vol. 13,211,662

VIC: Ho Chi Minh City has proposed that Vingroup advance funds for land clearance of 325 hectares for the metro line connecting Can Gio.

FOOD & BEVERAGE

59,700

1D 1.70%

5D -1.32%

Buy Vol. 9,033,334

Sell Vol. 4,746,607

81,100

1D 2.01%

5D -4.59%

Buy Vol. 17,397,886

Sell Vol. 13,342,977

45,900

1D 0.66%

5D -2.65%

Buy Vol. 1,909,446

Sell Vol. 1,404,097

VNM: Foreign investors returned as net buyers of over VND26 billion in Vinamilk after seven consecutive net selling sessions.

OTHERS

69,000

1D 6.15%

5D -2.13%

Buy Vol. 796,941

Sell Vol. 564,637

99,000

1D 2.06%

5D -3.13%

Buy Vol. 3,661,758

Sell Vol. 2,821,281

144,000

1D 1.05%

5D -1.37%

Buy Vol. 2,983,629

Sell Vol. 2,791,210

100,000

1D 1.21%

5D -0.30%

Buy Vol. 10,992,311

Sell Vol. 9,705,357

73,600

1D 6.98%

5D 8.24%

Buy Vol. 25,796,306

Sell Vol. 20,065,760

29,200

1D 2.82%

5D -7.74%

Buy Vol. 6,678,638

Sell Vol. 5,673,569

39,200

1D 6.96%

5D 6.67%

Buy Vol. 156,487,943

Sell Vol. 120,167,010

27,200

1D 4.82%

5D -3.37%

Buy Vol. 96,008,693

Sell Vol. 76,796,945

HPG: Despite a strong rebound of 4.8% today, HPG remained under heavy selling pressure from foreign investors, with net outflows reaching VND114 billion. This marked the sixth straight session of foreign net selling in HPG, with a cumulative value of over VND2,350 billion.

Market by numbers

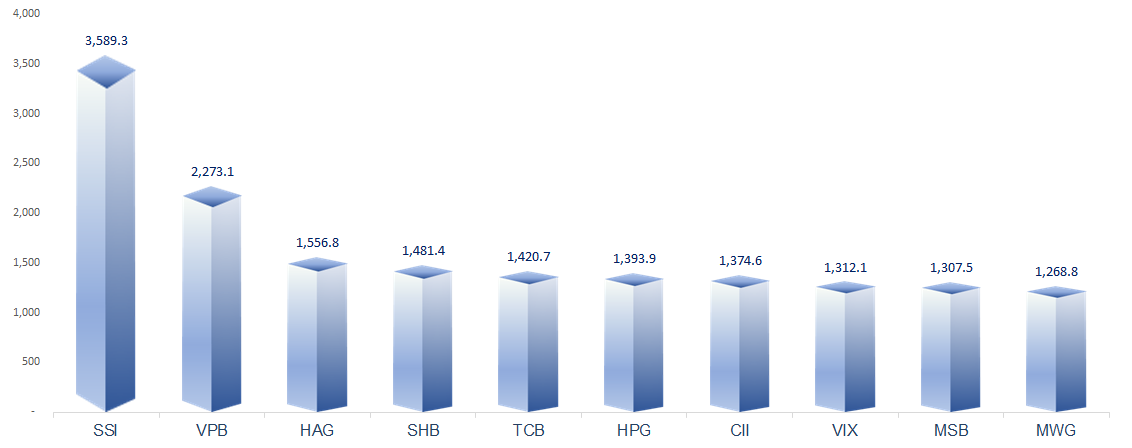

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

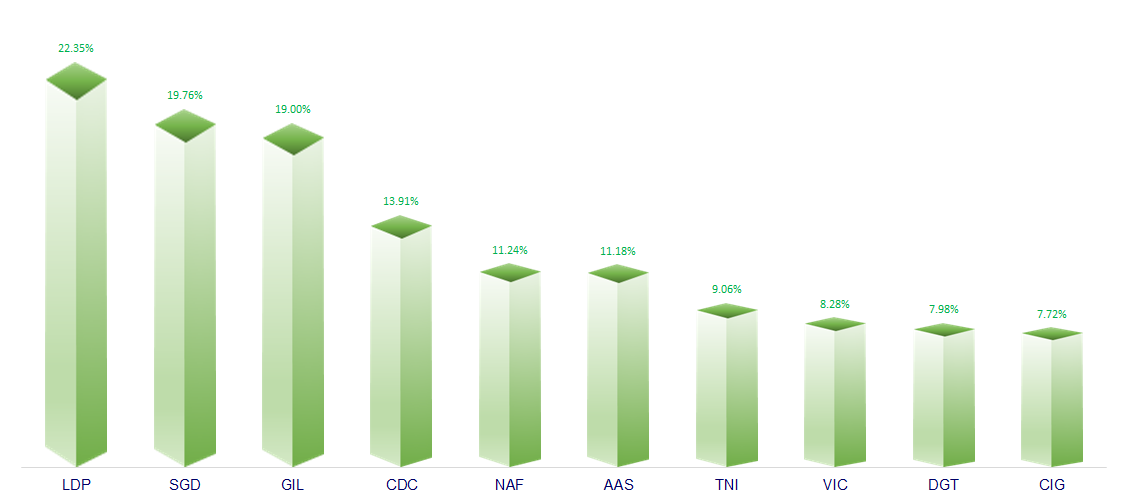

TOP INCREASES 3 CONSECUTIVE SESSIONS

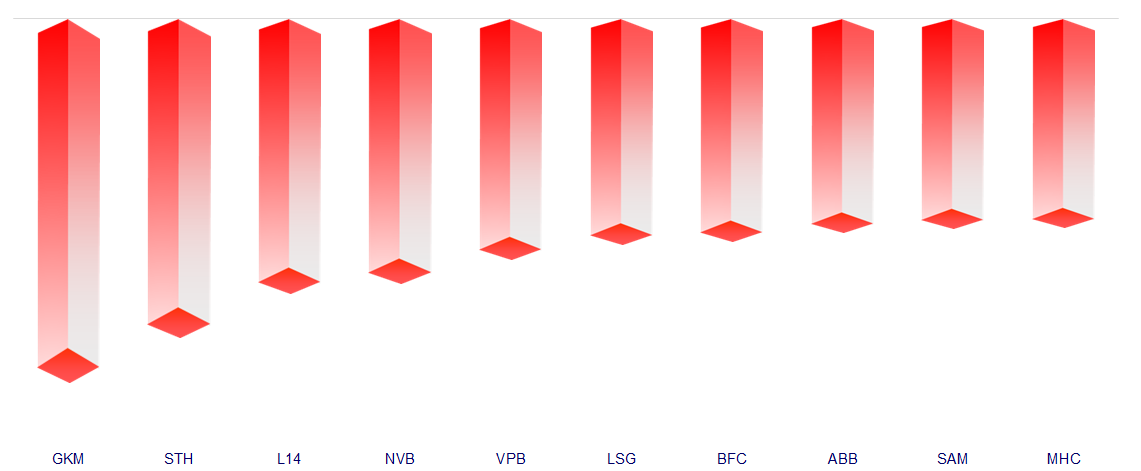

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.