Market brief 08/09/2025

VIETNAM STOCK MARKET

1,624.53

1D -2.55%

YTD 28.24%

271.57

1D -3.24%

YTD 19.41%

1,807.22

1D -2.07%

YTD 34.39%

110.12

1D -1.52%

YTD 15.84%

954.53

1D 0.00%

YTD 0.00%

58,204.00

1D 6.98%

YTD 221.02%

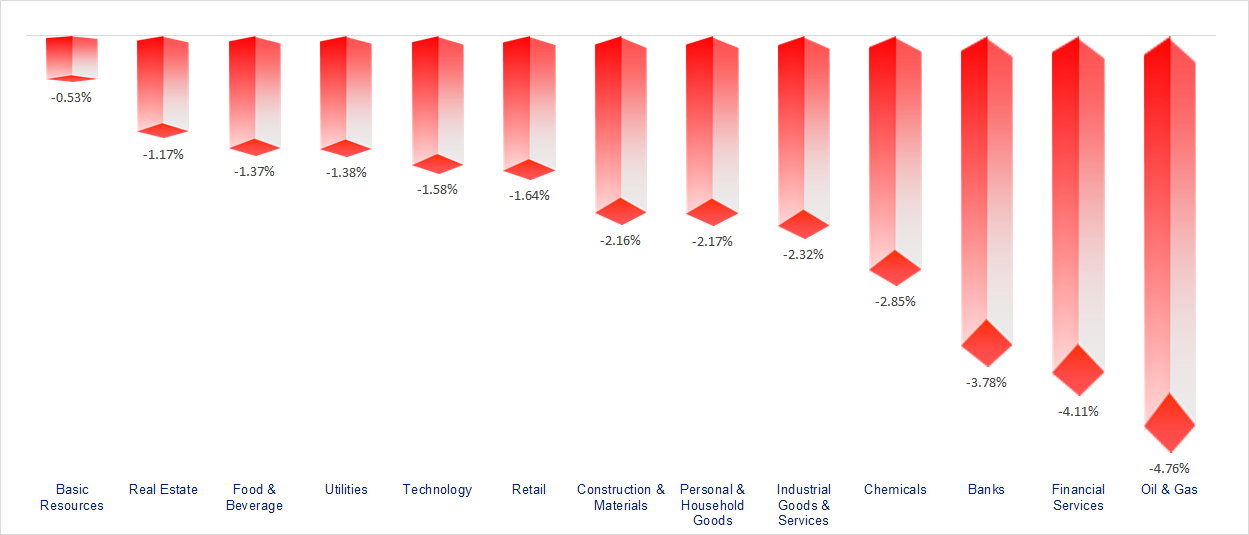

VN-Index unexpectedly plunged more than 30 points in just the last 20 minutes of trading. Most sectors closed lower today, with Oil & Gas, Securities, Banking, and Chemicals among the hardest hit.

ETF & DERIVATIVES

32,280

1D -1.88%

YTD 37.48%

22,050

1D -1.56%

YTD 35.44%

23,000

1D -2.91%

YTD 37.72%

27,700

1D -2.40%

YTD 37.81%

33,700

1D -2.77%

YTD 52.49%

39,400

1D -1.75%

YTD 17.54%

24,400

1D -2.44%

YTD 36.16%

1,798

1D -2.81%

YTD 0.00%

1,800

1D -2.44%

YTD 0.00%

1,785

1D -2.46%

YTD 0.00%

1,780

1D -2.48%

YTD 0.00%

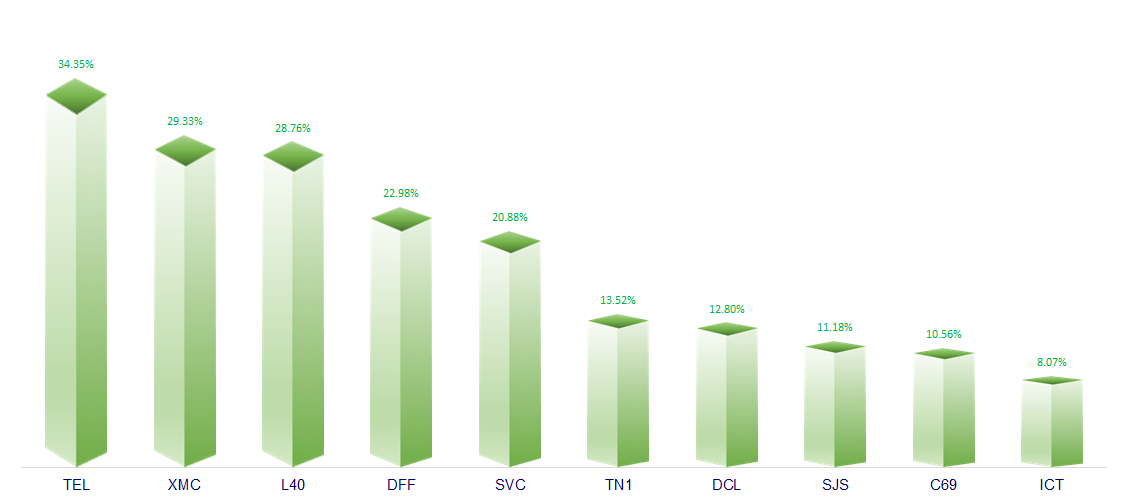

CHANGE IN PRICE BY SECTOR

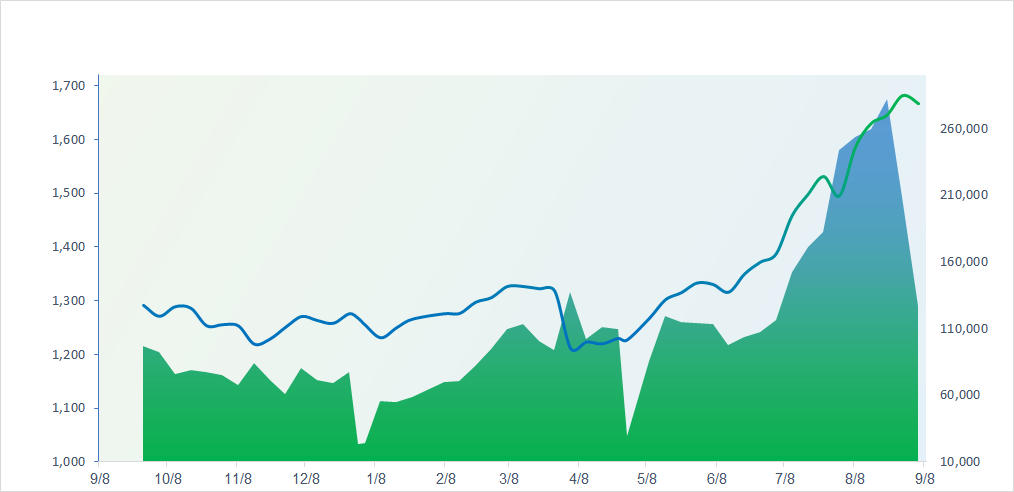

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

43,643.81

1D 1.45%

YTD 9.40%

3,826.84

1D 0.38%

YTD 14.17%

25,633.91

1D 0.85%

YTD 27.79%

3,219.59

1D 0.45%

YTD 34.18%

80,787.30

1D 0.09%

YTD 2.82%

4,308.52

1D 0.03%

YTD 13.75%

1,266.11

1D 0.10%

YTD -9.58%

66.77

1D 1.94%

YTD -11.03%

3,618.00

1D 0.87%

YTD 37.30%

Asian stock markets were awash in green as investors bet on a Fed rate cut in the upcoming meeting. Japan’s Nikkei 225 surged more than 1.4% to 43,643.81 points following Prime Minister Shigeru Ishiba’s announcement of his resignation late last week.

VIETNAM ECONOMY

4.50%

1D (bps) 50

YTD (bps) 53

4.60%

3.12%

1D (bps) -2

YTD (bps) 65

3.61%

1D (bps) 11

YTD (bps) 77

26,497

1D (%) -0.05%

YTD (%) 3.70%

31,711

1D (%) 0.48%

YTD (%) 16.30%

3,759

1D (%) 0.13%

YTD (%) 5.57%

Vietnam’s domestic gold market reversed after several sessions of sharp gains, as the Prime Minister ordered strict action against market manipulation. SJC gold bars fell sharply by 800,000 VND/tael, retreating to VND 135 million, while 24K and 18K gold jewelry and rings largely held steady, remaining near record highs.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister orders a reduction of at least 30% in administrative procedures;

- Guidelines issued for fiscal and monetary policy management to achieve 2025 economic growth of 8.3–8.5%;

- Gradual elimination of monopolies in the electricity market;

- Treasury Secretary Scott Bessent: U.S. will have to repay massive sums if Trump’s tariffs are struck down;

- China’s exports to the U.S. fall 33%, with overall growth hitting a six-month low;

- Sea freight rates plunge, with China–U.S. routes down 68% from their June peak.

VN30

BANK

65,300

1D -3.26%

5D -4.81%

Buy Vol. 15,886,936

Sell Vol. 17,260,451

40,650

1D -3.10%

5D -5.13%

Buy Vol. 13,596,728

Sell Vol. 12,917,845

49,500

1D -1.59%

5D -3.51%

Buy Vol. 19,311,523

Sell Vol. 19,785,261

38,000

1D -3.80%

5D -4.04%

Buy Vol. 41,312,348

Sell Vol. 49,601,500

31,200

1D -6.87%

5D -10.86%

Buy Vol. 84,098,437

Sell Vol. 83,339,143

26,700

1D -2.55%

5D -3.78%

Buy Vol. 113,894,031

Sell Vol. 85,472,297

30,900

1D -4.33%

5D -7.62%

Buy Vol. 38,684,031

Sell Vol. 38,374,979

19,350

1D -6.07%

5D -7.42%

Buy Vol. 72,716,091

Sell Vol. 77,496,613

54,000

1D -3.57%

5D -2.88%

Buy Vol. 20,430,872

Sell Vol. 22,757,877

21,000

1D -5.62%

5D -7.08%

Buy Vol. 35,962,569

Sell Vol. 38,621,701

26,550

1D -2.21%

5D -4.50%

Buy Vol. 42,868,387

Sell Vol. 43,289,467

17,250

1D -4.17%

5D -8.24%

Buy Vol. 226,149,158

Sell Vol. 217,513,109

19,950

1D -5.00%

5D -6.78%

Buy Vol. 5,935,723

Sell Vol. 5,666,029

42,800

1D -3.71%

5D -4.89%

Buy Vol. 5,115,644

Sell Vol. 5,054,894

At the regular Government meeting on September 6, Deputy Governor of the State Bank of Vietnam (SBV) Doan Thai Son said that by the end of August, outstanding credit had reached VND 17.14 quadrillion, an increase of 11.08% compared to the end of last year. If calculated for the whole year, credit growth would be about 20.19%, the highest in many years, while normally it is only around 14.5%. According to him, this leads to two consequences. First, banks will have to boost capital mobilization, which could push deposit rates higher, and as a result, lending rates would also rise. Second, strong credit growth means more money in circulation, which could create long-term inflation pressure. He also said that core inflation has recently remained above 3%. This is a worrying figure, because normally, the 3% level is already considered a warning signal for policy management.

OIL & GAS

62,600

1D -1.88%

5D -1.88%

Buy Vol. 1,729,341

Sell Vol. 2,147,287

35,500

1D -3.01%

5D -1.66%

Buy Vol. 3,861,737

Sell Vol. 4,306,652

Brent rose more than 1 USD/barrel on expectations that the U.S. will impose additional sanctions on Russian crude amid escalating Ukraine tensions.

VINGROUP

125,000

1D 0.00%

5D -2.57%

Buy Vol. 2,950,564

Sell Vol. 3,717,798

100,000

1D 0.00%

5D -4.31%

Buy Vol. 5,464,950

Sell Vol. 5,815,700

30,300

1D 0.00%

5D -0.33%

Buy Vol. 6,469,025

Sell Vol. 6,894,955

VIC: Vingroup has begun work on its VND 41 trillion mega-urban project in Bac Ninh. The group has completed listing procedures, detailed 1/500 planning consultations.

FOOD & BEVERAGE

60,600

1D -0.49%

5D 0.50%

Buy Vol. 12,312,119

Sell Vol. 10,425,772

81,000

1D -2.41%

5D -2.41%

Buy Vol. 19,827,319

Sell Vol. 20,688,042

46,800

1D -1.06%

5D 0.54%

Buy Vol. 1,379,696

Sell Vol. 1,948,033

VNM: Foreign investors extended their buying streak in Vinamilk to a fourth straight session, with total net inflows reaching VND 155 billion over this period.

OTHERS

66,900

1D -1.18%

5D -0.15%

Buy Vol. 553,746

Sell Vol. 737,968

96,200

1D -1.74%

5D -2.04%

Buy Vol. 3,146,457

Sell Vol. 3,408,266

141,900

1D -0.07%

5D -1.80%

Buy Vol. 3,072,164

Sell Vol. 3,251,363

101,900

1D -1.45%

5D 0.30%

Buy Vol. 20,728,343

Sell Vol. 19,807,334

74,000

1D -1.33%

5D -5.13%

Buy Vol. 26,410,802

Sell Vol. 22,741,107

28,800

1D -3.36%

5D -0.86%

Buy Vol. 6,640,775

Sell Vol. 7,646,352

40,200

1D -0.74%

5D -4.74%

Buy Vol. 123,936,130

Sell Vol. 93,616,637

28,900

1D 0.35%

5D 5.09%

Buy Vol. 226,944,006

Sell Vol. 196,838,704

HPG: Unofficial sources indicate that Hoa Phat Group has raised construction steel coil prices by 100,000 VND/ton, effective today.

Market by numbers

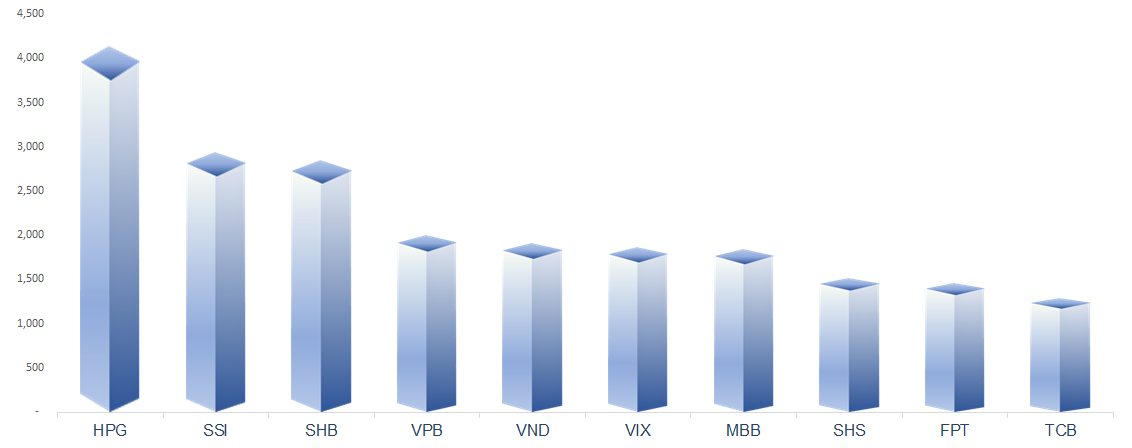

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

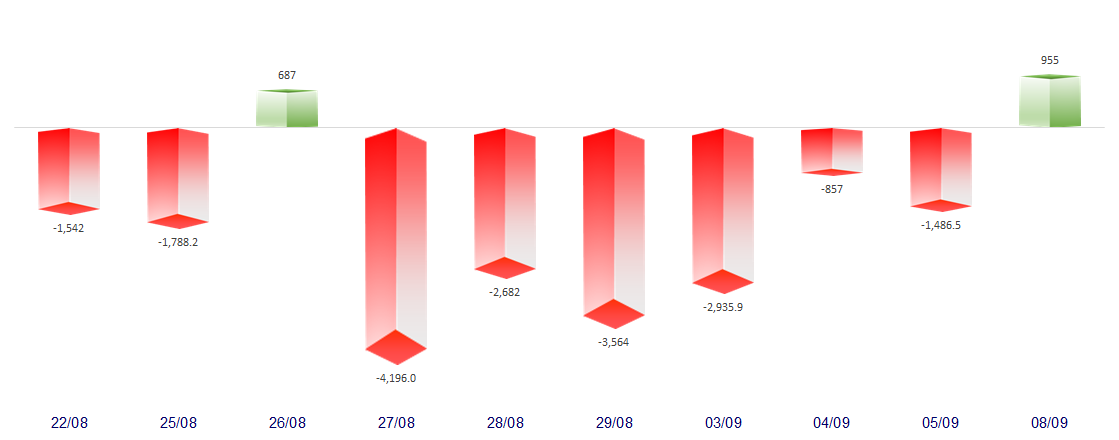

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.