Market brief 09/09/2025

VIETNAM STOCK MARKET

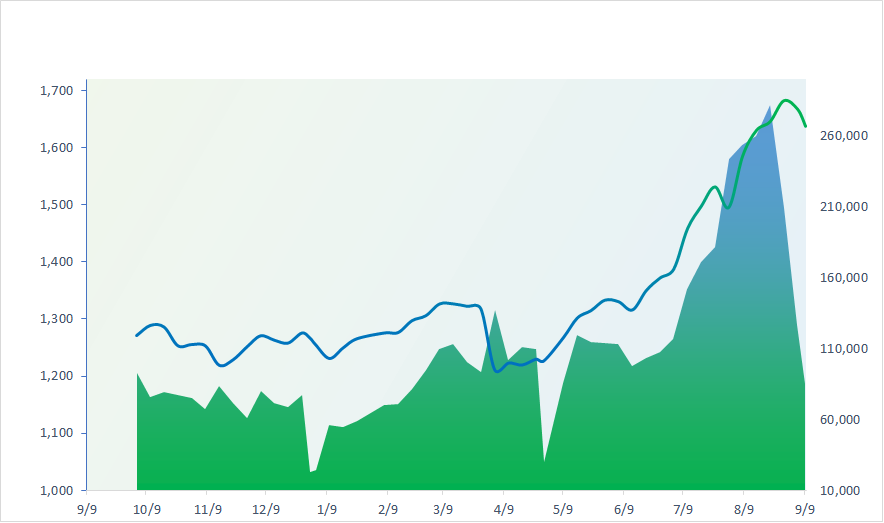

1,637.32

1D 0.79%

YTD 29.25%

274.82

1D 1.20%

YTD 20.84%

1,825.17

1D 0.99%

YTD 35.73%

109.89

1D -0.21%

YTD 15.60%

-860.61

1D 0.00%

YTD 0.00%

34,749.83

1D -40.30%

YTD 91.66%

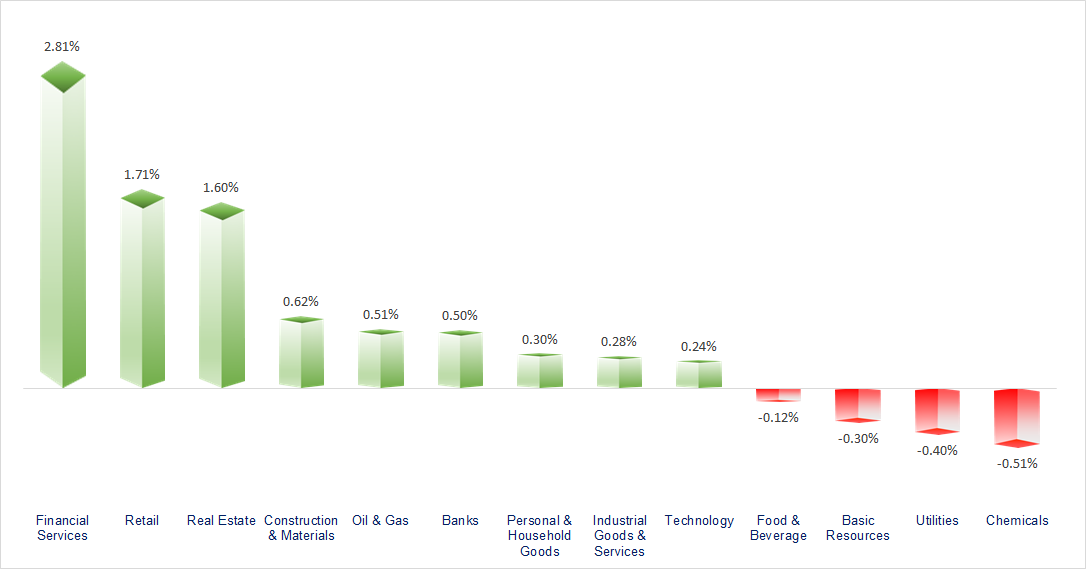

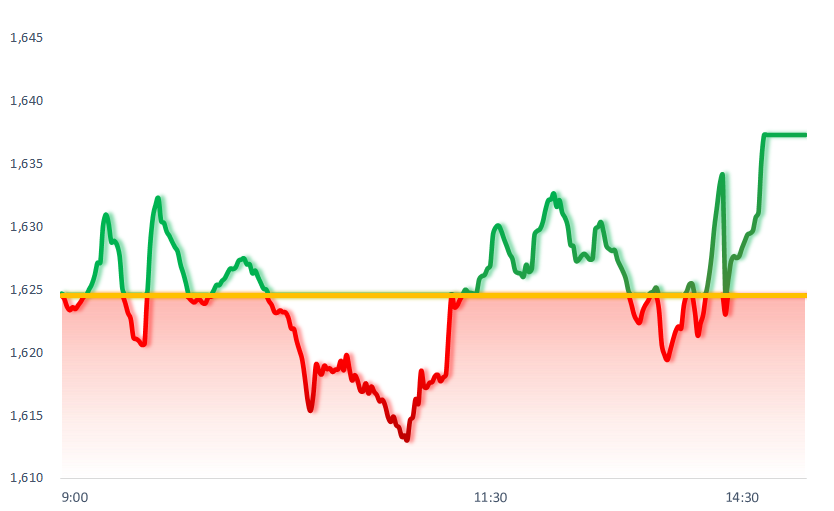

VN-Index unexpectedly rebounded at the end of the afternoon session thanks to a surge in Securities and Real Estate stocks. Most sectors reversed to close in the green today, with the most positive contributions coming from the Securities, Real Estate, and Retail groups. In contrast, the Chemicals and Resources sectors showed less favorable performance.

ETF & DERIVATIVES

32,280

1D 0.00%

YTD 37.48%

22,160

1D 0.50%

YTD 36.12%

23,300

1D 1.30%

YTD 39.52%

27,500

1D -0.72%

YTD 36.82%

32,630

1D -3.18%

YTD 47.65%

39,200

1D -0.51%

YTD 16.95%

24,310

1D -0.37%

YTD 35.66%

1,816

1D 1.01%

YTD 0.00%

1,825

1D 1.39%

YTD 0.00%

1,803

1D 1.00%

YTD 0.00%

1,797

1D 0.94%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

43,459.29

1D -0.42%

YTD 8.94%

3,807.29

1D -0.51%

YTD 13.59%

25,938.13

1D 1.19%

YTD 29.31%

3,260.05

1D 1.26%

YTD 35.86%

81,100.19

1D 0.39%

YTD 3.21%

4,297.57

1D -0.25%

YTD 13.46%

1,276.08

1D 0.79%

YTD -8.87%

66.47

1D 0.35%

YTD -11.43%

3,654.53

1D 0.65%

YTD 38.69%

Asian stock markets showed mixed movements today as investors anticipated that the Fed may cut interest rates next week. Specifically, Japan’s Nikkei 225 index fell by 0.4% to 43,459.29 points, Hong Kong’s Hang Seng index rose by 1.19% to 25,938.13 points, while China’s Shanghai Composite index dropped by 0.5% to 3,807.29 points.

VIETNAM ECONOMY

4.20%

1D (bps) -30

YTD (bps) 23

4.60%

3.12%

YTD (bps) 65

3.48%

1D (bps) -13

YTD (bps) 63

26,497

1D (%) 0.00%

YTD (%) 3.70%

31,848

1D (%) 0.43%

YTD (%) 16.80%

3,764

1D (%) 0.11%

YTD (%) 5.69%

Global gold prices hit a new record on September 9, fueled by investor expectations that the Fed will cut interest rates by 0.75 percentage points during the remainder of 2025. Domestically, SJC gold bars and gold rings reversed to rise, listed at 135.8 million VND/tael and 130.8 million VND/tael respectively.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Finance proposes raising the personal income tax deduction to 15.5 million VND/month;

- One of Vietnam’s economic indicators is expected to reach a new record before year-end;

- A two-part electricity pricing scheme will be applied to large consumers starting January 1, 2026;

- The Hungarian Prime Minister warns about the future of the European Union;

- The EU remains dependent on Russian energy for many years to come;

- Standard Chartered forecasts that the Fed will cut rates by 50 basis points next week.

VN30

BANK

64,900

1D -0.61%

5D -5.39%

Buy Vol. 10,471,448

Sell Vol. 11,452,233

40,650

1D 0.00%

5D -5.13%

Buy Vol. 8,171,851

Sell Vol. 8,323,454

49,600

1D 0.20%

5D -3.31%

Buy Vol. 11,877,706

Sell Vol. 11,663,226

38,500

1D 1.32%

5D -2.78%

Buy Vol. 40,507,045

Sell Vol. 36,368,119

32,400

1D 3.85%

5D -7.43%

Buy Vol. 81,001,769

Sell Vol. 52,266,805

26,650

1D -0.19%

5D -3.96%

Buy Vol. 66,609,251

Sell Vol. 44,207,379

31,550

1D 2.10%

5D -5.68%

Buy Vol. 24,994,131

Sell Vol. 19,543,788

19,450

1D 0.52%

5D -6.94%

Buy Vol. 44,197,856

Sell Vol. 33,121,758

54,200

1D 0.37%

5D -2.52%

Buy Vol. 12,857,402

Sell Vol. 9,449,215

21,050

1D 0.24%

5D -6.86%

Buy Vol. 19,702,400

Sell Vol. 14,956,511

26,550

1D 0.00%

5D -4.50%

Buy Vol. 23,750,224

Sell Vol. 23,078,146

17,600

1D 2.03%

5D -6.38%

Buy Vol. 162,896,677

Sell Vol. 139,036,762

19,650

1D -1.50%

5D -8.18%

Buy Vol. 4,357,413

Sell Vol. 3,943,194

42,300

1D -1.17%

5D -6.00%

Buy Vol. 5,345,450

Sell Vol. 4,558,263

ABB: An Binh Commercial Joint Stock Bank (ABB) has just released its post-audit financial statements, reporting an after-tax profit of VND1,151 billion, a decrease of VND184 billion (14%) compared to the previously self-reported figures. According to the bank, the decline was due to the auditor not recognizing unrealized revenue from foreign exchange revaluation gains that the bank had previously recorded as of June 30, 2025. ABBank stated that this income will instead be recognized on December 31, 2025.

OIL & GAS

62,100

1D -0.80%

5D -2.66%

Buy Vol. 1,972,112

Sell Vol. 1,812,814

35,450

1D -0.14%

5D -1.80%

Buy Vol. 3,367,600

Sell Vol. 2,714,529

As of 4:30 PM today, Brent crude oil rose by more than 0.6% to 66.46 USD/barrel.

VINGROUP

129,200

1D 3.36%

5D 0.70%

Buy Vol. 4,328,941

Sell Vol. 3,765,968

101,400

1D 1.40%

5D -2.97%

Buy Vol. 4,474,926

Sell Vol. 4,311,692

30,300

1D 0.00%

5D -0.33%

Buy Vol. 4,393,822

Sell Vol. 5,004,315

VIC: Over a month after inaugurating its automobile plant in Thoothukudi, India, VinFast has launched its first two electric SUV models, the VF 6 and VF 7, in the market.

FOOD & BEVERAGE

60,300

1D -0.50%

5D 0.00%

Buy Vol. 6,533,077

Sell Vol. 6,108,528

81,000

1D 0.00%

5D -2.41%

Buy Vol. 9,748,312

Sell Vol. 9,904,749

46,300

1D -1.07%

5D -0.54%

Buy Vol. 1,441,834

Sell Vol. 1,451,893

MSN: Foreign investors recorded a net sell-off of over VND17 billion in MSN shares today.

OTHERS

67,900

1D 1.49%

5D 1.34%

Buy Vol. 642,045

Sell Vol. 722,526

95,600

1D -0.62%

5D -2.65%

Buy Vol. 2,509,513

Sell Vol. 2,495,270

145,000

1D 2.18%

5D 0.35%

Buy Vol. 3,243,362

Sell Vol. 3,484,450

102,100

1D 0.20%

5D 0.49%

Buy Vol. 12,629,635

Sell Vol. 12,137,830

76,000

1D 2.70%

5D -2.56%

Buy Vol. 12,006,281

Sell Vol. 9,585,747

28,600

1D -0.69%

5D -1.55%

Buy Vol. 5,140,911

Sell Vol. 4,040,139

42,000

1D 4.48%

5D -0.47%

Buy Vol. 93,133,490

Sell Vol. 66,965,975

28,850

1D -0.17%

5D 4.91%

Buy Vol. 120,210,123

Sell Vol. 126,239,719

HPG: In August 2025, Hoa Phat Group’s liquid steel (crude steel) output reached 953,000 tons, averaging 31,800 tons/day, up 34% YoY compared to August 2024. For Q4/2025, the group projects a daily crude steel output of around 40,000 tons.

Market by numbers

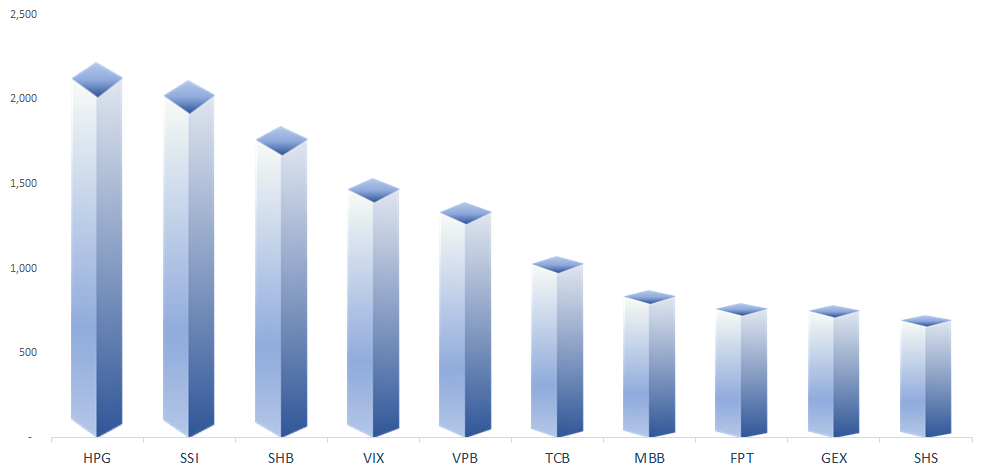

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

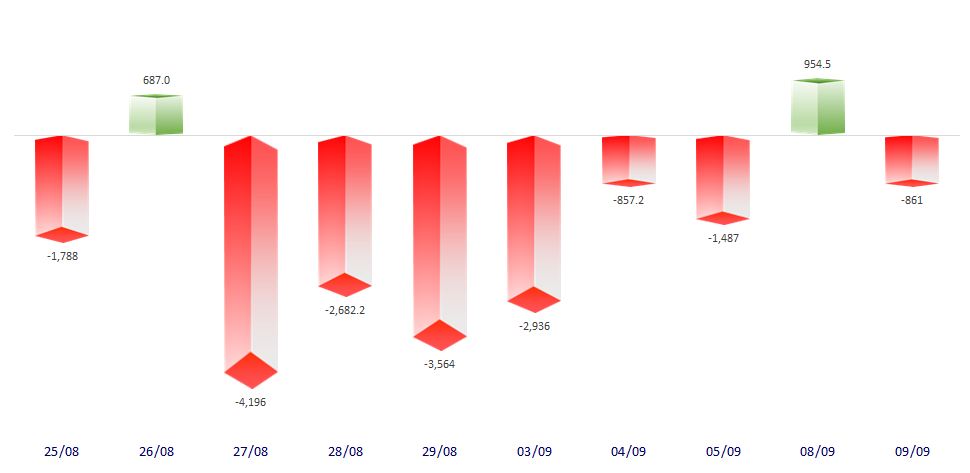

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

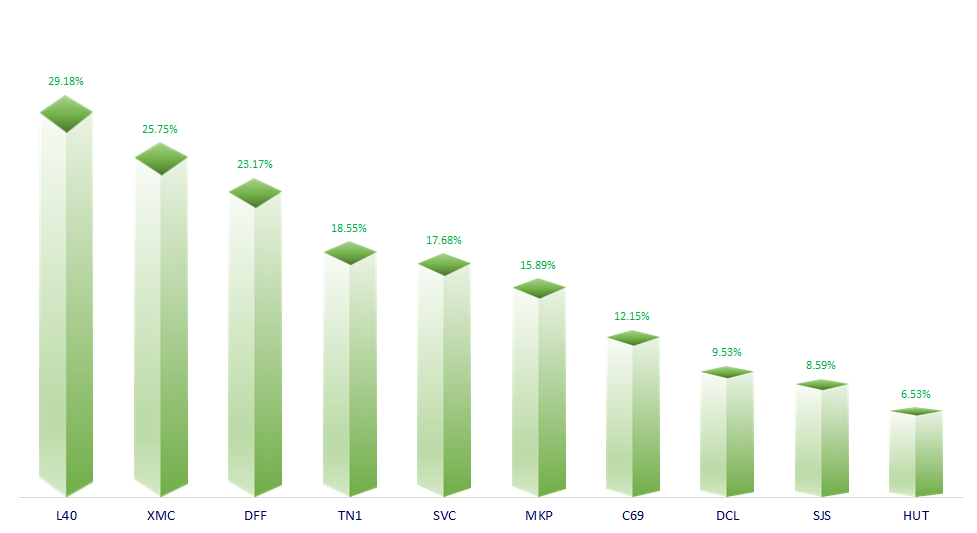

TOP INCREASES 3 CONSECUTIVE SESSIONS

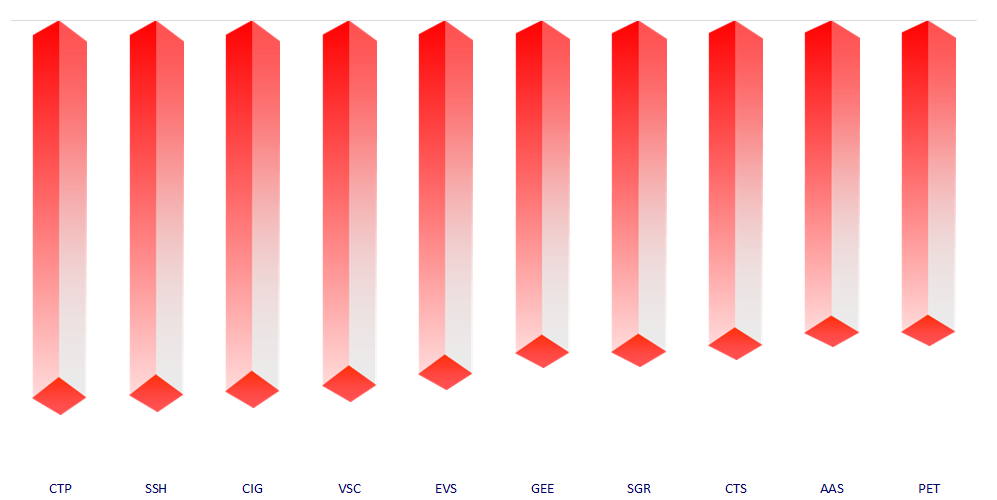

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.