Morning brief 17/09/2025

GLOBAL MARKET

45,757.90

1D -0.28%

YTD 7.55%

6,606.79

1D -0.13%

YTD 12.33%

22,333.96

1D -0.07%

YTD 15.66%

16.36

1D 4.27%

9,195.66

1D -0.88%

YTD 12.51%

23,329.24

1D -1.77%

YTD 17.18%

7,818.22

1D -1.00%

YTD 5.93%

68.47

1D 1.56%

YTD -8.77%

3,689.00

1D -0.16%

YTD 40.00%

On September 16, U.S. stocks edged lower as investors took profits ahead of the highly anticipated interest rate decision from the Federal Reserve (Fed). The two-day Fed meeting, which began on September 16, is expected to deliver the first rate cut since December 2024. According to the CME FedWatch tool, markets are currently pricing in a 100% probability that the Fed will cut rates by at least 0.25%. What investors are watching closely is the central bank’s forward guidance on interest rates for the remainder of the year, and whether policymakers anticipate one or two more cuts before the end of 2025.

VIETNAM ECONOMY

4.49%

1D (bps) 26

YTD (bps) 52

4.60%

3.09%

YTD (bps) 62

3.55%

1D (bps) -5

YTD (bps) 71

26,468

1D (%) -0.03%

YTD (%) 3.59%

31,825

1D (%) 0.29%

YTD (%) 16.72%

3,765

1D (%) 0.06%

YTD (%) 5.73%

According to Reuters, Vietnam’s Finance Minister said yesterday that he is “fairly confident” about the country’s stock market being upgraded to “emerging market” status by global index provider FTSE Russell, with confirmation expected next month. “I myself am quite confident about the upgrade,” Minister Nguyễn Văn Thắng told Reuters at a conference in London, where he also met with representatives from FTSE Russell and the London Stock Exchange.

VIETNAM STOCK MARKET

1,680.90

1D -0.24%

YTD 32.69%

278.98

1D -0.61%

YTD 22.67%

1,875.39

1D -0.07%

YTD 39.46%

111.32

1D 0.78%

YTD 17.10%

-115.91

44,433.00

1D 4.73%

YTD 145.07%

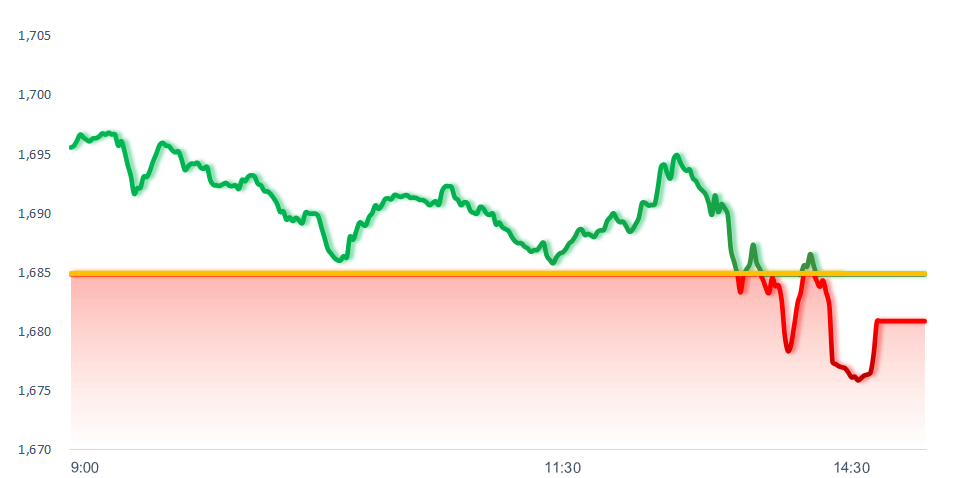

VN-Index fell sharply in the afternoon session despite opening with a gap up of more than 10 points. Proprietary trading desks of securities companies recorded a net sell of VND 453 billion on September 16, focusing mainly on MWG (VND 81 billion), VNM (VND 62 billion), HPG (VND 60 billion), and VIC (VND 56 billion). In contrast, they net bought VIB (VND 109 billion) and PLX (VND 18 billion).

INTRADAY

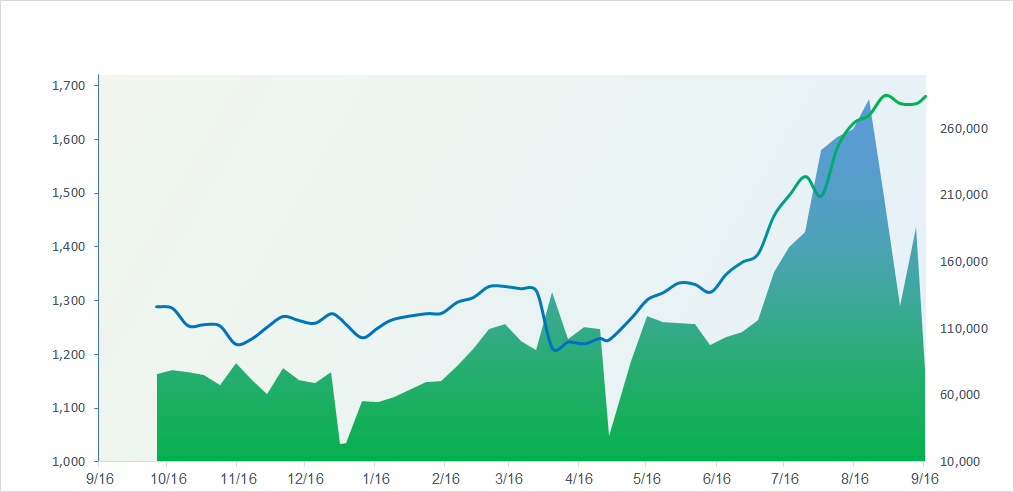

VN30 (12M)

SELECTED NEWS

- Proposal on tax levels for priority projects at the international financial center;

- Deputy Prime Minister Ho Duc Phoc issues urgent directives to the State Bank of Vietnam on managing the gold market;

- Proposal to establish a "Silicon Valley" in Ho Chi Minh City;

- 100,000 troops take part in a joint Belarus–Russia military exercise;

- Donald Trump confirms that a U.S. investor has acquired TikTok;

- EU postpones Russia sanctions package under pressure from the U.S.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.