Market brief 19/09/2025

VIETNAM STOCK MARKET

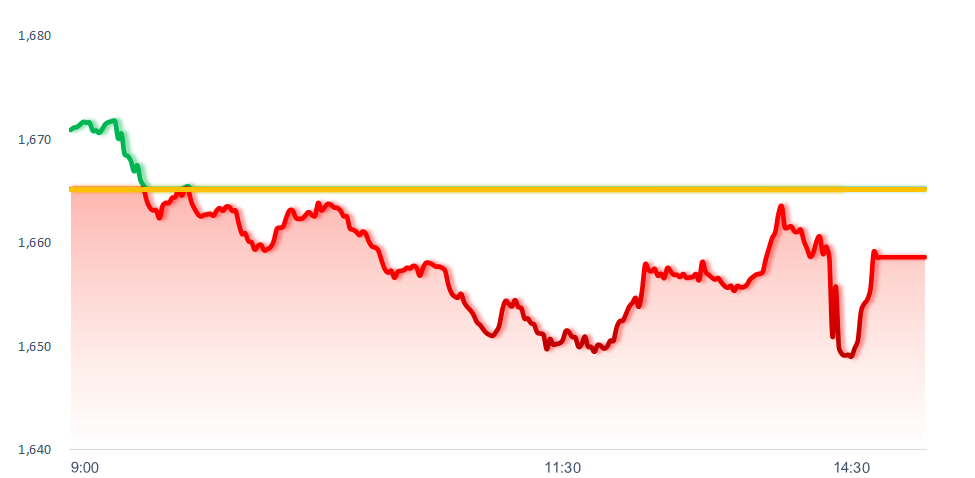

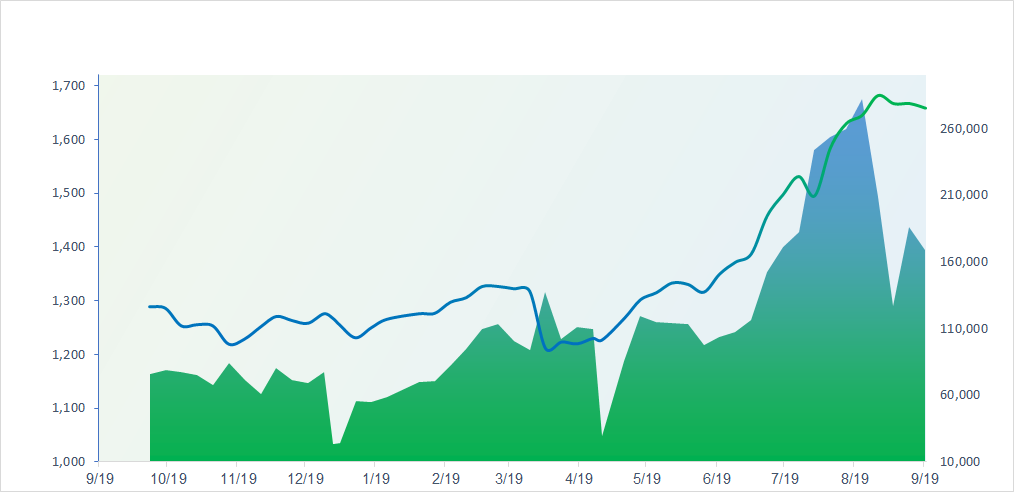

1,658.62

1D -0.39%

YTD 30.93%

276.24

1D -0.25%

YTD 21.46%

1,859.53

1D -0.12%

YTD 38.28%

111.01

1D -0.08%

YTD 16.78%

-2,985.90

1D 0.00%

YTD 0.00%

31,145.00

1D 1.60%

YTD 71.78%

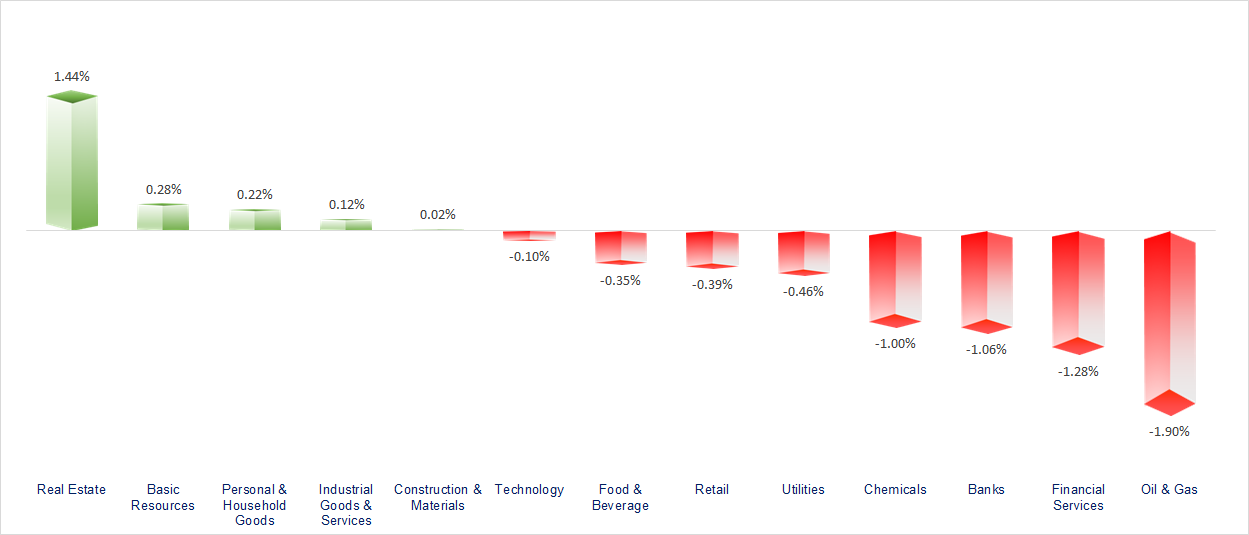

VN-Index unexpectedly rebounded by more than 17 points as VIC shares surged during the ATC session. Real Estate and Resources were the most positive sectors of the day, while Securities, Oil & Gas, and Banking stocks performed rather weakly.

ETF & DERIVATIVES

32,990

1D 0.27%

YTD 40.50%

22,720

1D 0.40%

YTD 39.56%

23,370

1D -0.89%

YTD 39.94%

28,490

1D 0.32%

YTD 41.74%

33,000

1D -0.60%

YTD 49.32%

40,350

1D -0.12%

YTD 20.38%

24,880

1D -0.28%

YTD 38.84%

1,848

1D -0.10%

YTD 0.00%

1,848

1D -0.94%

YTD 0.00%

1,845

1D 0.30%

YTD 0.00%

1,828

1D 0.08%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

45,045.81

1D -0.57%

YTD 12.91%

3,820.09

1D -0.30%

YTD 13.97%

26,545.10

1D 0.00%

YTD 32.34%

3,445.24

1D 0.67%

YTD 43.58%

82,673.47

1D -0.41%

YTD 5.22%

4,318.74

1D 0.14%

YTD 14.02%

1,294.32

1D -0.21%

YTD -7.56%

66.97

1D -0.70%

YTD -10.77%

3,657.45

1D 0.36%

YTD 38.80%

Asian stock markets mostly declined in today’s session. Notably, Japan’s Nikkei 225 closed down nearly 0.6% at 45,045.81 points after hitting a fresh morning peak, as the Bank of Japan kept its policy rate unchanged at 0.5%.

VIETNAM ECONOMY

3.92%

1D (bps) -28

YTD (bps) -5

4.60%

3.07%

1D (bps) -10

YTD (bps) 59

3.30%

1D (bps) -20

YTD (bps) 45

26,445

1D (%) 0.00%

YTD (%) 3.50%

31,860

1D (%) -0.29%

YTD (%) 16.85%

3,769

1D (%) 0.01%

YTD (%) 5.83%

Vietnam’s domestic gold market continued to cool down. Plain rings and jewelry fell by another 500,000 VND/tael, while SJC gold bars held steady at 132 million VND/tael following the previous adjustment.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Public investment disbursement has reached 100%, which could help GDP grow by an additional 2%;

- The French Ambassador highlighted three factors that could make Vietnam a major financial hub in Southeast Asia;

- There is a proposal to designate Hanoi and Ho Chi Minh City as “special-class” urban areas, while four other cities would be classified as “first-class”;

- The Bank of Japan has kept interest rates unchanged and plans to gradually sell off its holdings of ETFs and J-REITs;

- The Bank of England has also kept interest rates unchanged;

- Chinese investors are moving away from gold and shifting into stocks.

VN30

BANK

63,000

1D -1.41%

5D -4.26%

Buy Vol. 11,343,075

Sell Vol. 11,192,533

39,800

1D -2.45%

5D -2.81%

Buy Vol. 12,075,006

Sell Vol. 9,709,240

51,200

1D 0.00%

5D 1.59%

Buy Vol. 13,835,800

Sell Vol. 12,564,148

38,400

1D -1.03%

5D -0.52%

Buy Vol. 21,614,793

Sell Vol. 26,856,759

30,400

1D -1.30%

5D -3.80%

Buy Vol. 54,799,862

Sell Vol. 39,405,246

26,650

1D -0.56%

5D 0.19%

Buy Vol. 38,928,173

Sell Vol. 26,226,329

30,200

1D -1.63%

5D -4.13%

Buy Vol. 23,539,654

Sell Vol. 22,388,817

18,600

1D -1.33%

5D -4.62%

Buy Vol. 26,268,830

Sell Vol. 18,179,748

55,200

1D -3.16%

5D -0.36%

Buy Vol. 27,620,564

Sell Vol. 29,304,297

20,300

1D -1.22%

5D -4.47%

Buy Vol. 18,239,949

Sell Vol. 15,002,034

25,350

1D -0.78%

5D -3.61%

Buy Vol. 28,946,710

Sell Vol. 24,456,762

17,750

1D -0.56%

5D 1.14%

Buy Vol. 133,693,186

Sell Vol. 132,877,991

19,600

1D -2.00%

5D -0.25%

Buy Vol. 11,529,405

Sell Vol. 11,716,148

46,500

1D 2.42%

5D 5.44%

Buy Vol. 4,968,519

Sell Vol. 4,779,446

TCB: Techcom Securities (TCBS) has successfully issued 231.15 million shares, raising its charter capital from VND20,802 billion to over VND23,113 billion, and bringing total shareholders’ equity to more than VND41,000 billion (excluding retained earnings from Q3). The IPO drew far more interest than expected, with total investor subscriptions exceeding 575.16 million shares — 2.5 times the offering. Based on this, TCBS announced an allocation ratio (pro-rata) of 40.188%.

OIL & GAS

62,500

1D -0.79%

5D 0.00%

Buy Vol. 1,118,265

Sell Vol. 1,469,686

35,350

1D -0.70%

5D -0.70%

Buy Vol. 3,516,556

Sell Vol. 3,257,506

Brent crude oil prices fell 0.7% today as investors grew concerned about the U.S. economic outlook.

VINGROUP

153,200

1D 5.66%

5D 11.18%

Buy Vol. 10,840,406

Sell Vol. 6,863,620

101,700

1D -1.74%

5D -3.60%

Buy Vol. 14,825,689

Sell Vol. 10,721,161

29,450

1D -2.48%

5D -4.23%

Buy Vol. 10,692,476

Sell Vol. 11,026,725

VIC: Vingroup has signed a memorandum of understanding to develop a renewable energy project in Indonesia.

FOOD & BEVERAGE

62,000

1D -2.52%

5D -1.90%

Buy Vol. 8,410,086

Sell Vol. 9,253,367

83,900

1D -0.12%

5D -2.44%

Buy Vol. 13,224,087

Sell Vol. 22,319,346

46,000

1D -1.71%

5D -1.39%

Buy Vol. 2,152,093

Sell Vol. 2,229,395

MSN: Subsidiary VCF will finalize the list of shareholders entitled to receive the 2024 cash dividend. The payout ratio is 480%, meaning shareholders will receive 48,000 VND/share, with payment scheduled for October 8, 2025.

OTHERS

68,900

1D -0.43%

5D 2.99%

Buy Vol. 431,191

Sell Vol. 717,685

96,700

1D -2.13%

5D -0.82%

Buy Vol. 4,739,292

Sell Vol. 3,133,828

137,200

1D -1.86%

5D -6.03%

Buy Vol. 2,626,615

Sell Vol. 3,102,140

103,000

1D 0.00%

5D 1.38%

Buy Vol. 32,326,837

Sell Vol. 45,140,697

78,600

1D 0.13%

5D -0.51%

Buy Vol. 8,223,630

Sell Vol. 7,223,539

28,600

1D -0.69%

5D -2.56%

Buy Vol. 2,334,348

Sell Vol. 2,891,092

40,350

1D -1.10%

5D -3.70%

Buy Vol. 48,981,567

Sell Vol. 41,864,051

29,250

1D 0.34%

5D -2.50%

Buy Vol. 88,194,548

Sell Vol. 89,230,003

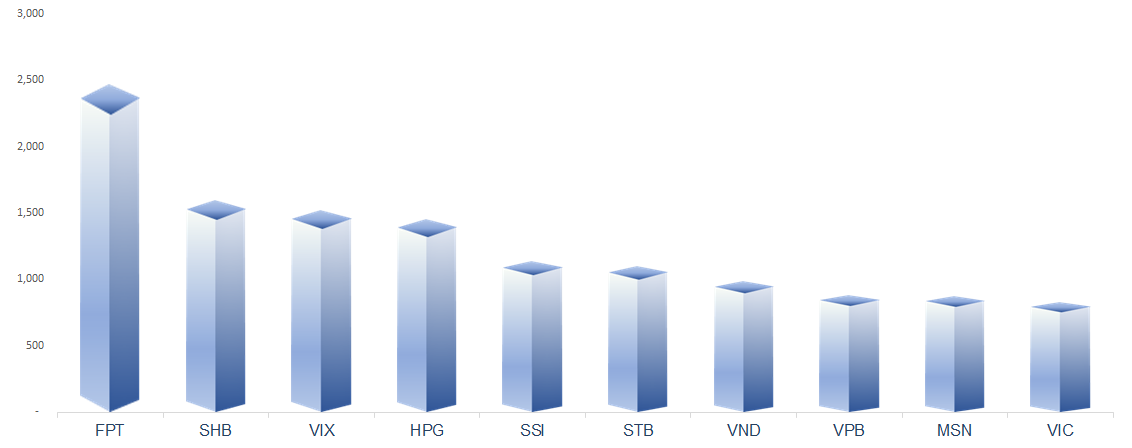

FPT: FPT has announced a strategic investment in Daythree Digital Berhad, a leading Malaysian firm in business process and systems management. The deal, made through FPT’s Malaysian subsidiary, gives it a 10% stake, making FPT the company’s first foreign investor.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

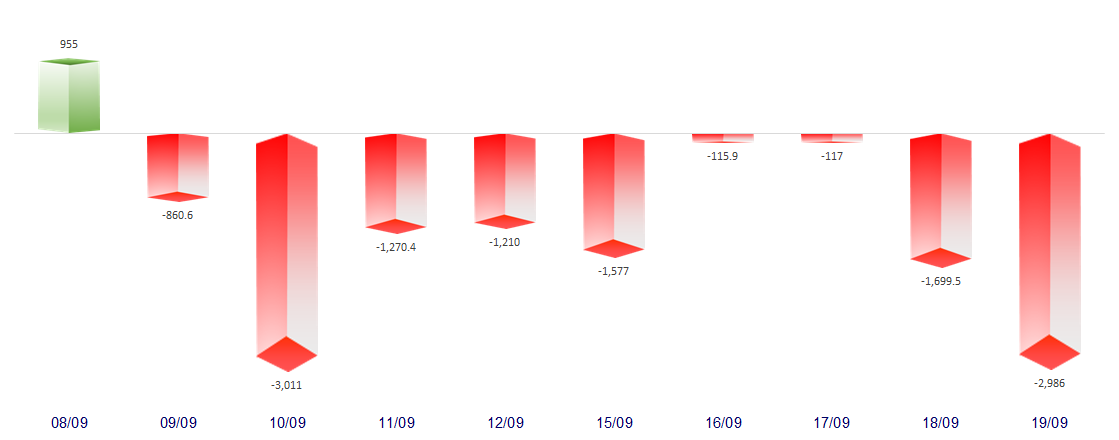

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

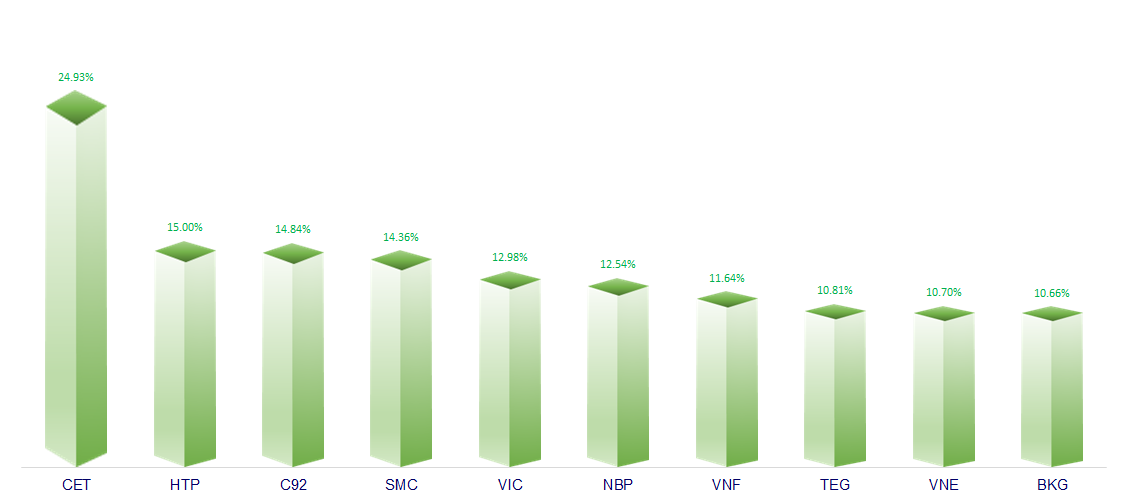

TOP INCREASES 3 CONSECUTIVE SESSIONS

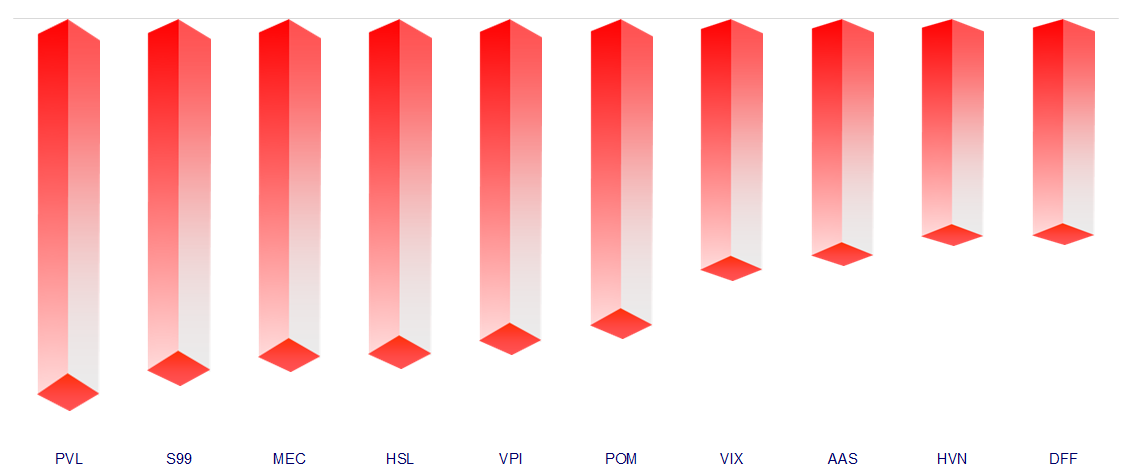

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.