Market brief 22/09/2025

VIETNAM STOCK MARKET

1,634.45

1D -1.46%

YTD 29.02%

274.23

1D -0.73%

YTD 20.58%

1,819.60

1D -2.15%

YTD 35.31%

110.15

1D -0.77%

YTD 15.87%

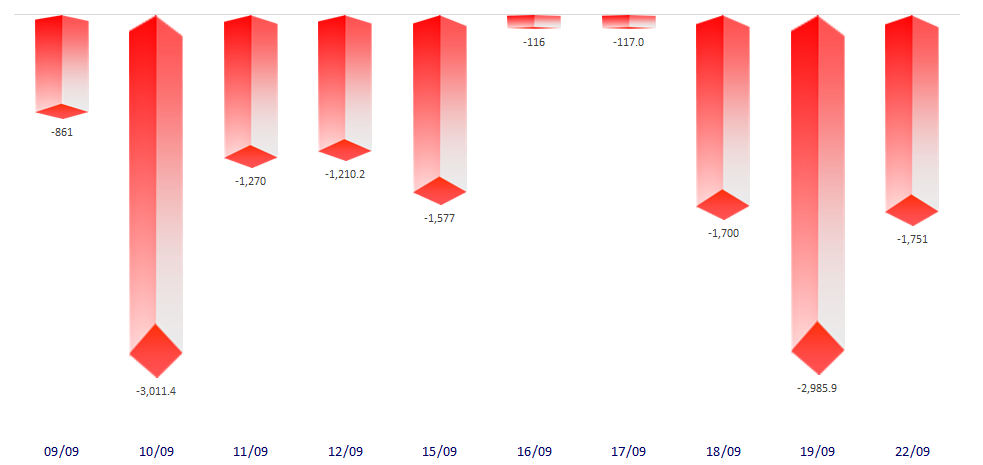

-1,751.33

1D 0.00%

YTD 0.00%

38,920.04

1D 24.96%

YTD 114.66%

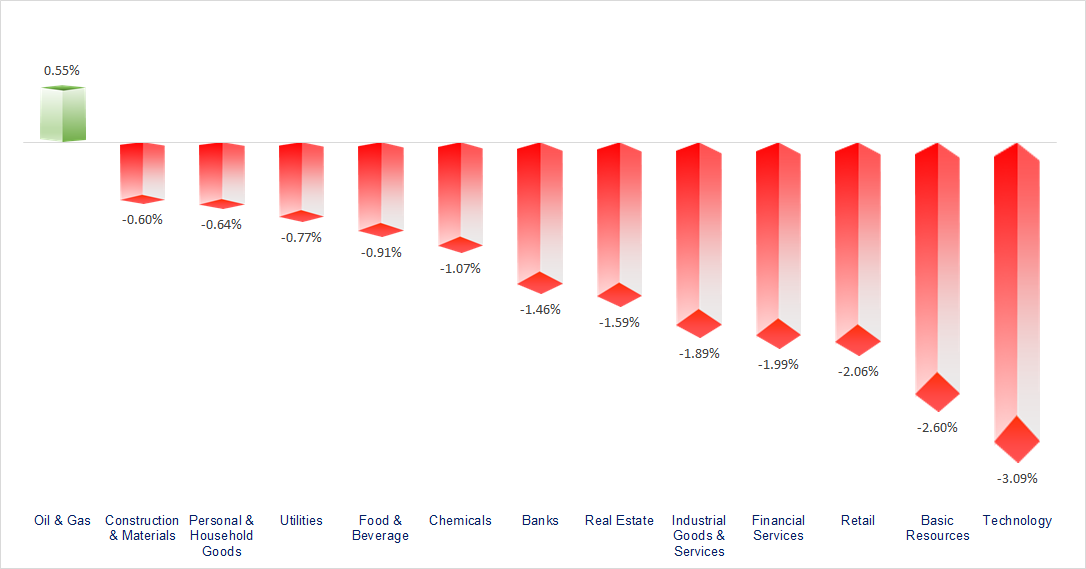

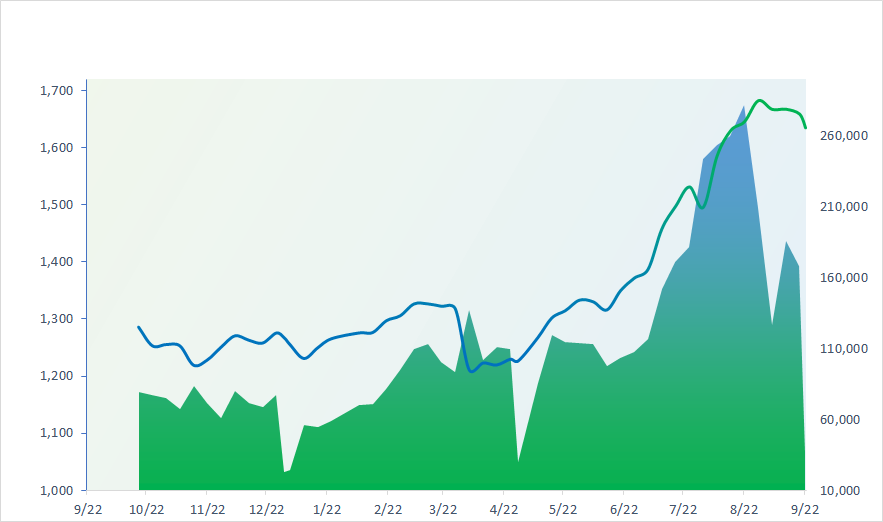

VN-Index experienced a sharp decline, mainly due to heavy selling pressure from Vingroup-related stocks. Most sectors closed lower today, with the most negative performances coming from Technology, Banking, and Securities.

ETF & DERIVATIVES

32,200

1D -2.39%

YTD 37.14%

22,090

1D -2.77%

YTD 35.69%

23,460

1D 0.39%

YTD 40.48%

27,800

1D -2.42%

YTD 38.31%

32,400

1D -1.82%

YTD 46.61%

38,700

1D -4.09%

YTD 15.45%

24,400

1D -1.93%

YTD 36.16%

1,815

1D -1.79%

YTD 0.00%

1,809

1D -2.11%

YTD 0.00%

1,811

1D -1.88%

YTD 0.00%

1,800

1D -1.53%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

45,493.66

1D 0.99%

YTD 14.03%

3,828.58

1D 0.22%

YTD 14.23%

26,344.14

1D -0.76%

YTD 31.33%

3,468.65

1D 0.68%

YTD 44.56%

82,160.00

1D -0.56%

YTD 4.56%

4,297.37

1D -0.12%

YTD 13.46%

1,282.54

1D -0.79%

YTD -8.40%

67.02

1D 0.00%

YTD -10.70%

3,692.91

1D 0.00%

YTD 40.15%

Asian stock markets mostly gained today, led by Japan and South Korea. The Tokyo stock market took the lead after the Bank of Japan announced it would gradually sell its large ETF holdings, rather than conducting a sudden sell-off as previously feared. This decision helped ease investor sentiment following the sell-off shock on September 19. South Korea's stock market also surged, hitting a new record on September 22, thanks to strong capital inflows into technology stocks like Samsung Electronics.

VIETNAM ECONOMY

3.88%

1D (bps) -4

YTD (bps) -9

4.60%

3.15%

1D (bps) 9

YTD (bps) 67

3.50%

1D (bps) 20

YTD (bps) 66

26,448

1D (%) 0.01%

YTD (%) 3.51%

31,873

1D (%) 0.04%

YTD (%) 16.90%

3,773

1D (%) 0.13%

YTD (%) 5.97%

As of the end of last week, the amount of outstanding OMO (Open Market Operations) declined to VND139.54 trillion, down from a record high of VND225.43 trillion recorded at the end of July. Notably, the State Bank of Vietnam net withdrew more than VND9,195 billion from the market via the open market channel. This marks the fourth consecutive week of net liquidity withdrawal by the central bank.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi proposes reducing the length and increasing the investment capital of the Tran Hung Dao Bridge project;

- The President of Vietnam urges Boeing to invest soon in a component manufacturing plant and aircraft maintenance center in Vietnam;

- The project is expected to generate 1.5 billion USD/year for the Vietnamese economy once it restarts;

- Demand for U.S. corporate bonds rises strongly;

- India expected to weather tariff storm well, thanks to two unique advantages lacking in many major exporting nations;

- The Bank of Japan unexpectedly announces it will sell ETFs.

VN30

BANK

62,000

1D -1.59%

5D -5.78%

Buy Vol. 10,412,403

Sell Vol. 8,849,066

41,000

1D 3.02%

5D -2.84%

Buy Vol. 11,587,664

Sell Vol. 17,172,643

49,300

1D -3.71%

5D -4.46%

Buy Vol. 16,363,959

Sell Vol. 17,832,910

37,500

1D -2.34%

5D -3.85%

Buy Vol. 37,990,788

Sell Vol. 34,709,916

29,500

1D -2.96%

5D -6.50%

Buy Vol. 85,599,431

Sell Vol. 68,344,377

26,150

1D -1.88%

5D -2.61%

Buy Vol. 49,674,833

Sell Vol. 37,789,743

29,000

1D -3.97%

5D -7.20%

Buy Vol. 23,636,906

Sell Vol. 28,000,264

19,000

1D 2.15%

5D -4.04%

Buy Vol. 32,283,370

Sell Vol. 42,664,027

54,800

1D -0.72%

5D -2.14%

Buy Vol. 15,943,794

Sell Vol. 16,290,146

19,750

1D -2.71%

5D -7.93%

Buy Vol. 23,863,374

Sell Vol. 21,149,405

25,150

1D -0.79%

5D -4.73%

Buy Vol. 29,518,340

Sell Vol. 27,265,322

17,400

1D -1.97%

5D -2.25%

Buy Vol. 121,852,910

Sell Vol. 119,054,296

19,300

1D -1.53%

5D -2.77%

Buy Vol. 22,638,463

Sell Vol. 22,136,268

46,500

1D 0.00%

5D 4.38%

Buy Vol. 3,364,870

Sell Vol. 3,406,876

TPB: Tien Phong Commercial Joint Stock Bank (TPBank) has submitted a report to the Hanoi Stock Exchange (HNX) regarding its bond issuance results. On September 12, 2025, TPBank successfully issued 1,500 bonds under code TPB12533, each with a par value of VND100 million, equivalent to a total issuance value of VND150 billion. With a 10-year term, the bonds are expected to mature on September 12, 2035.

OIL & GAS

61,800

1D -1.12%

5D -2.22%

Buy Vol. 1,397,928

Sell Vol. 1,659,980

34,850

1D -1.41%

5D -2.52%

Buy Vol. 2,906,245

Sell Vol. 2,785,732

GAS: PV GAS has received approval to invest in the North Central LNG Terminal project worth VND26.7 trillion in Ha Tinh province.

VINGROUP

148,800

1D -2.87%

5D 7.98%

Buy Vol. 9,024,731

Sell Vol. 10,441,511

99,500

1D -2.16%

5D -4.78%

Buy Vol. 13,505,179

Sell Vol. 13,500,416

28,800

1D -2.21%

5D -6.04%

Buy Vol. 8,081,852

Sell Vol. 8,496,652

VIC: Vietnam Exhibition Fair Center JSC (VEF) has proposed a cash dividend advance plan at a rate of 330% (equivalent to 33,000 VND/share).

FOOD & BEVERAGE

61,400

1D -0.97%

5D -2.69%

Buy Vol. 7,839,168

Sell Vol. 8,894,313

81,900

1D -2.38%

5D -7.46%

Buy Vol. 16,515,014

Sell Vol. 18,291,496

45,700

1D -0.65%

5D -2.14%

Buy Vol. 2,742,255

Sell Vol. 2,249,045

MSN: Today, foreign investors recorded a net sale of over VND57 billion in Masan shares.

OTHERS

67,700

1D -1.74%

5D -1.60%

Buy Vol. 579,587

Sell Vol. 1,022,145

96,000

1D -0.72%

5D -3.52%

Buy Vol. 3,872,934

Sell Vol. 3,013,569

135,500

1D -1.24%

5D -6.94%

Buy Vol. 3,300,995

Sell Vol. 3,276,487

99,700

1D -3.20%

5D -2.16%

Buy Vol. 25,335,503

Sell Vol. 26,100,457

76,500

1D -2.67%

5D -3.77%

Buy Vol. 12,504,125

Sell Vol. 11,452,192

28,300

1D -1.05%

5D -5.19%

Buy Vol. 2,612,438

Sell Vol. 3,180,395

39,300

1D -2.60%

5D -6.87%

Buy Vol. 71,217,045

Sell Vol. 60,887,335

28,400

1D -2.91%

5D -6.43%

Buy Vol. 93,368,093

Sell Vol. 106,754,038

On September 10, the Trade Remedies Authority received a request to investigate the circumvention of anti-dumping measures on hot-rolled coil (HRC) steel products with widths greater than 1,880 mm and less than 2,300 mm originating from China, submitted by a representative of the domestic manufacturing industry.

Market by numbers

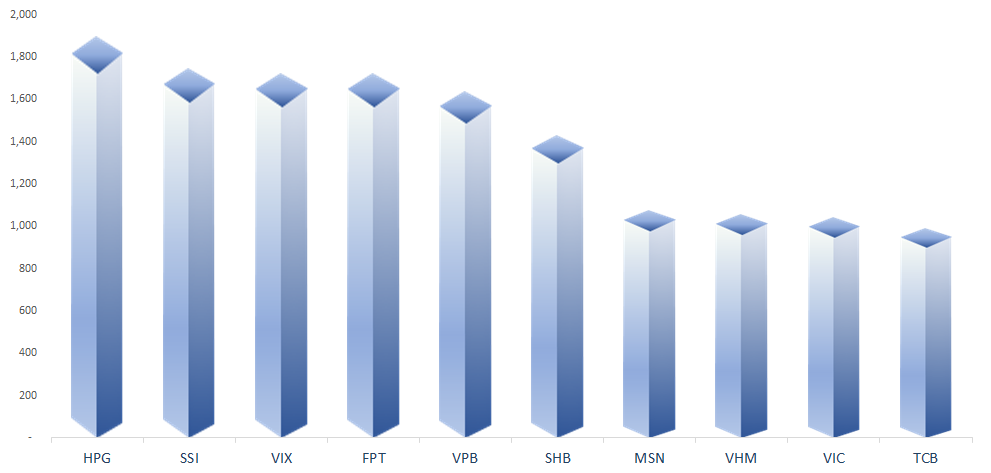

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

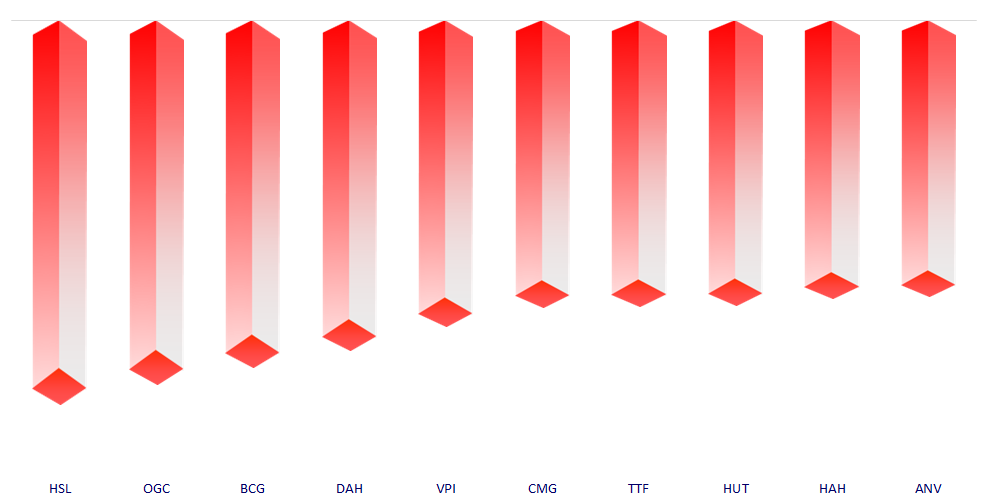

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.