Market brief 30/09/2025

VIETNAM STOCK MARKET

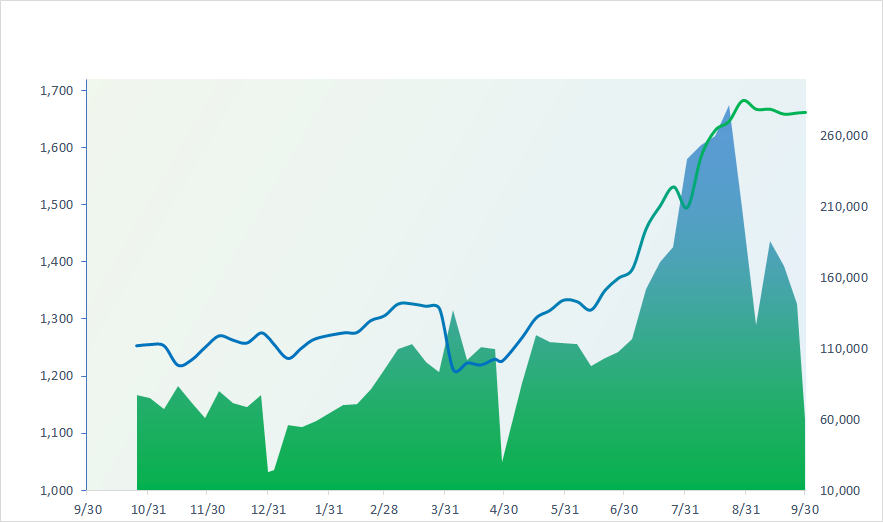

1,661.70

1D -0.29%

YTD 31.18%

273.16

1D -0.72%

YTD 20.11%

1,863.13

1D 0.05%

YTD 38.55%

109.46

1D 0.16%

YTD 15.15%

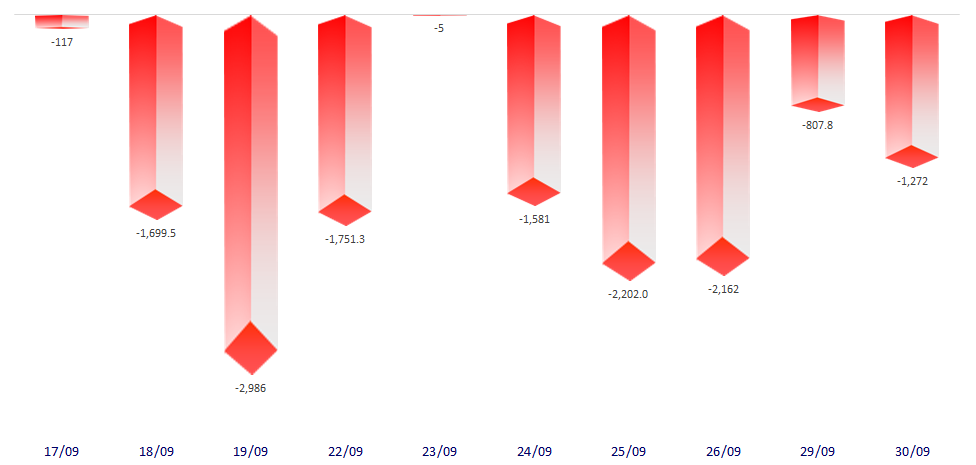

-1,271.69

1D 0.00%

YTD 0.00%

35,626.56

1D 21.51%

YTD 96.50%

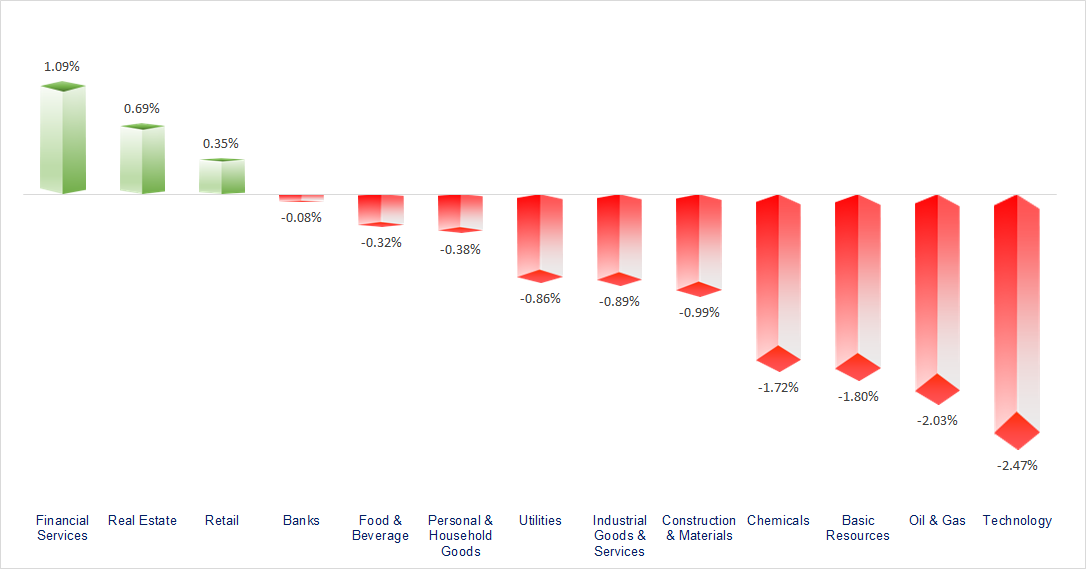

VN-Index pulled back more than 15 points after a sharp decline in early afternoon trading, with an unexpected rebound in stocks from the Securities sector. The Vin group was the most positively performing sector in the market today, followed by the Securities and Retail sectors. In contrast, the Technology, Oil & Gas, Resources, and Chemicals sectors showed quite negative movements.

ETF & DERIVATIVES

33,090

1D 0.88%

YTD 40.93%

22,790

1D 0.62%

YTD 39.99%

23,340

1D -0.47%

YTD 39.76%

28,030

1D 0.50%

YTD 39.45%

33,400

1D -0.30%

YTD 51.13%

38,280

1D -0.85%

YTD 14.20%

24,820

1D -0.28%

YTD 38.50%

1,854

1D -0.04%

YTD 0.00%

1,854

1D 0.14%

YTD 0.00%

1,847

1D -0.20%

YTD 0.00%

1,830

1D 0.04%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

44,932.63

1D -0.25%

YTD 12.63%

3,882.78

1D 0.52%

YTD 15.84%

26,855.56

1D 0.87%

YTD 33.88%

3,424.60

1D -0.19%

YTD 42.72%

80,267.62

1D -0.12%

YTD 2.15%

4,300.16

1D 0.71%

YTD 13.53%

1,274.17

1D -1.08%

YTD -9.00%

66.50

1D -0.31%

YTD -11.39%

3,809.72

1D -0.87%

YTD 44.58%

Asian stock markets showed mixed performances today as investors weighed the risk of a U.S. government shutdown, which could delay the release of employment data that is currently in focus. Specifically, U.S. Vice President JD Vance stated that the risk of a government shutdown seems imminent after budget negotiations between President Donald Trump and Democratic lawmakers made little progress.

VIETNAM ECONOMY

4.94%

1D (bps) 121

YTD (bps) 97

4.60%

3.17%

YTD (bps) 70

3.49%

YTD (bps) 64

26,446

1D (%) -0.02%

YTD (%) 3.50%

31,777

1D (%) 0.13%

YTD (%) 16.54%

3,771

1D (%) 0.25%

YTD (%) 5.90%

The domestic gold market continues to boom across all segments. SJC gold bars surged to a historic record of 137.3 million VND/tael, while plain gold rings and 24K jewelry also rose by up to 2.2 million VND/tael, simultaneously setting new price peaks.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Construction started on the nearly VND4,000 billion An Biên - Rạch Giá coastal bridge;

- The Prime Minister urges progress on the nearly 8.4 billion USD railway connecting with China;

- The Prime Minister requests GE Vernova (USA) to expand investment in power sources and grids in Vietnam;

- Trump imposes a 10% tariff on wood and 25% on furniture starting October 14;

- Trump’s ‘deputy’: ‘The U.S. government is about to shut down’;

- Lowy Institute: China uses ‘economic influence card’ to strengthen its role in Cambodia, outpacing the U.S. by 60%.

VN30

BANK

62,000

1D -0.96%

5D -0.32%

Buy Vol. 7,682,308

Sell Vol. 7,642,145

40,000

1D -0.74%

5D -2.08%

Buy Vol. 5,863,899

Sell Vol. 7,044,235

50,800

1D -0.39%

5D 1.60%

Buy Vol. 10,916,004

Sell Vol. 11,411,215

37,850

1D 0.26%

5D 3.61%

Buy Vol. 16,568,005

Sell Vol. 22,417,356

31,100

1D 0.00%

5D 4.01%

Buy Vol. 47,966,357

Sell Vol. 46,871,461

26,200

1D 0.19%

5D -0.57%

Buy Vol. 62,232,575

Sell Vol. 33,937,725

31,000

1D 0.32%

5D 8.01%

Buy Vol. 20,239,682

Sell Vol. 22,652,232

18,850

1D 0.00%

5D -1.82%

Buy Vol. 22,042,936

Sell Vol. 24,201,573

56,900

1D 0.53%

5D 2.71%

Buy Vol. 18,145,658

Sell Vol. 18,083,015

19,900

1D 0.76%

5D 0.25%

Buy Vol. 17,488,753

Sell Vol. 15,520,579

25,500

1D -0.39%

5D 0.59%

Buy Vol. 17,763,244

Sell Vol. 18,044,290

16,900

1D 0.60%

5D -0.59%

Buy Vol. 234,843,671

Sell Vol. 155,804,839

19,300

1D -1.03%

5D 0.00%

Buy Vol. 3,291,208

Sell Vol. 3,625,797

49,500

1D 3.56%

5D 6.34%

Buy Vol. 6,467,696

Sell Vol. 4,916,543

After four consecutive weeks of net liquidity withdrawal, the State Bank of Vietnam switched to net liquidity injection of VND29,312 billion into the banking system during the week of September 22–26. As of the end of last week, the outstanding amount of OMO (Open Market Operations) had increased to over VND168,852 billion, corresponding to the amount the State Bank is currently supporting the system with.

OIL & GAS

60,400

1D -1.79%

5D -1.95%

Buy Vol. 1,373,525

Sell Vol. 1,535,998

34,200

1D -1.58%

5D -1.58%

Buy Vol. 2,834,118

Sell Vol. 2,627,703

Brent crude oil prices reversed, adjusting down more than 0.8% today to 66.5 USD/barrel.

VINGROUP

174,900

1D 1.22%

5D 17.23%

Buy Vol. 5,823,060

Sell Vol. 7,036,706

103,000

1D 1.08%

5D 4.36%

Buy Vol. 7,990,597

Sell Vol. 7,511,556

32,100

1D 7.00%

5D 13.43%

Buy Vol. 28,729,488

Sell Vol. 18,809,866

VRE: Price hit the ceiling after news of a massive dividend payout of VND4,500 billion.

FOOD & BEVERAGE

60,000

1D -0.50%

5D -2.60%

Buy Vol. 5,612,379

Sell Vol. 6,350,585

81,000

1D -0.98%

5D -1.10%

Buy Vol. 10,313,639

Sell Vol. 10,112,777

45,200

1D -0.66%

5D -1.31%

Buy Vol. 1,264,014

Sell Vol. 1,261,735

VNM: Foreign investors continued to net sell approximately VND23 billion worth of Vinamilk shares today.

OTHERS

66,900

1D -0.45%

5D 0.30%

Buy Vol. 449,169

Sell Vol. 554,085

91,800

1D -2.34%

5D -4.38%

Buy Vol. 3,289,984

Sell Vol. 2,566,692

129,600

1D -0.08%

5D -2.56%

Buy Vol. 2,318,301

Sell Vol. 2,197,981

93,000

1D -2.62%

5D -5.10%

Buy Vol. 20,667,136

Sell Vol. 18,990,844

77,700

1D 0.91%

5D -0.13%

Buy Vol. 13,427,428

Sell Vol. 12,616,114

27,700

1D -1.95%

5D -1.42%

Buy Vol. 4,053,187

Sell Vol. 3,066,723

38,550

1D 2.66%

5D 0.33%

Buy Vol. 60,028,004

Sell Vol. 54,322,474

28,150

1D -1.57%

5D -1.75%

Buy Vol. 82,464,481

Sell Vol. 86,729,034

FPT: FPT Group has officially been recognized by Hewlett Packard Enterprise (HPE) as achieving Platinum partner status—the highest rank in HPE’s global partner system—for its subsidiary FPT IS.

Market by numbers

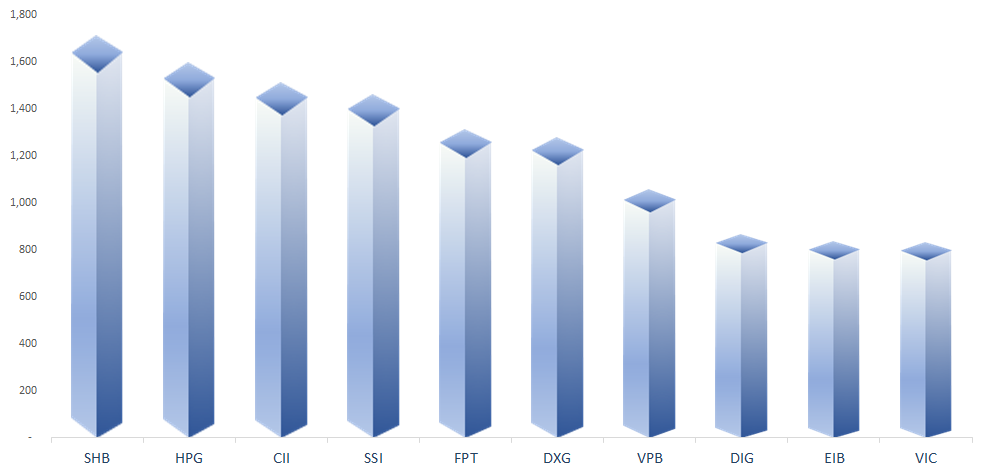

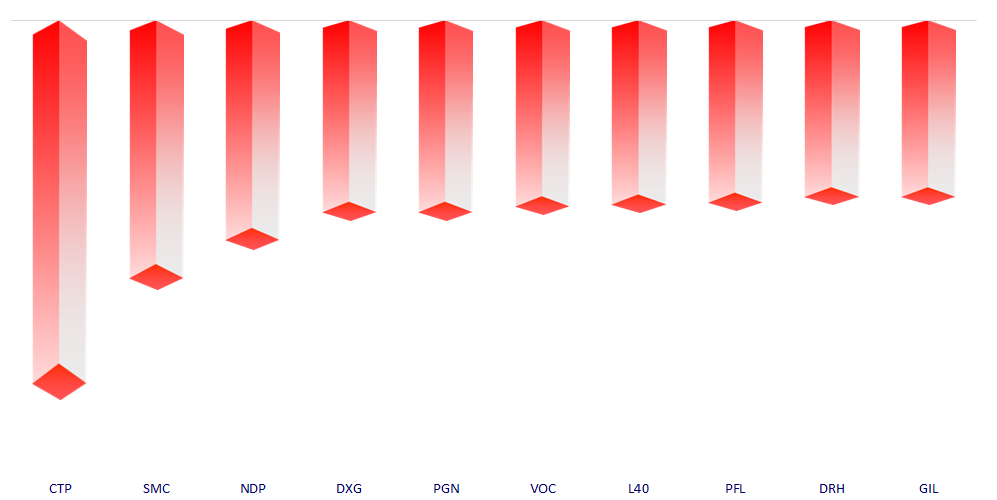

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.