Market brief 02/10/2025

VIETNAM STOCK MARKET

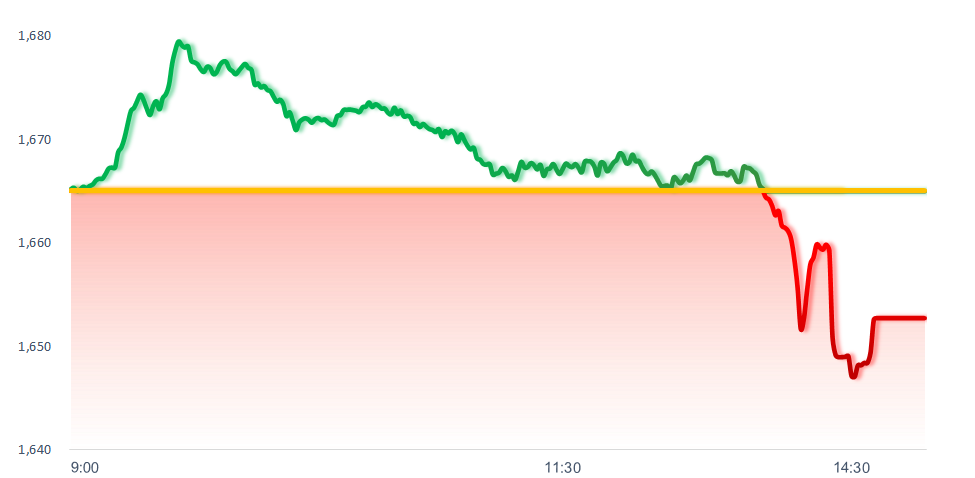

1,652.71

1D -0.74%

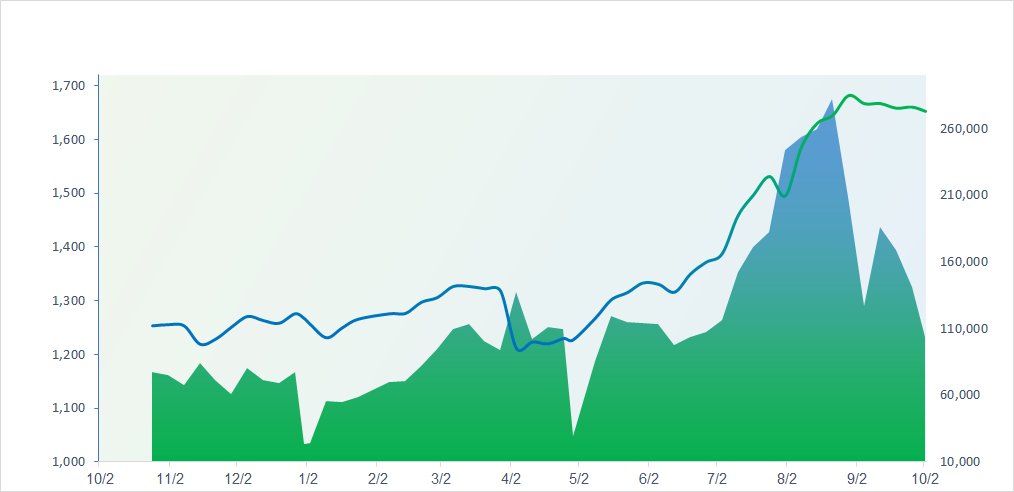

YTD 30.47%

269.55

1D -1.34%

YTD 18.52%

1,859.80

1D -0.58%

YTD 38.30%

109.79

1D 0.00%

YTD 15.50%

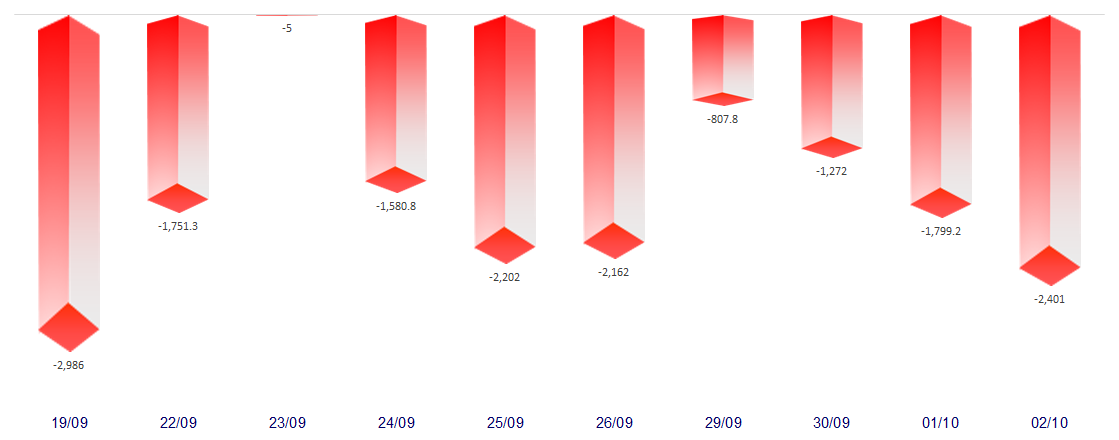

-2,400.59

1D 0.00%

YTD 0.00%

24,543.00

1D 5.67%

YTD 35.37%

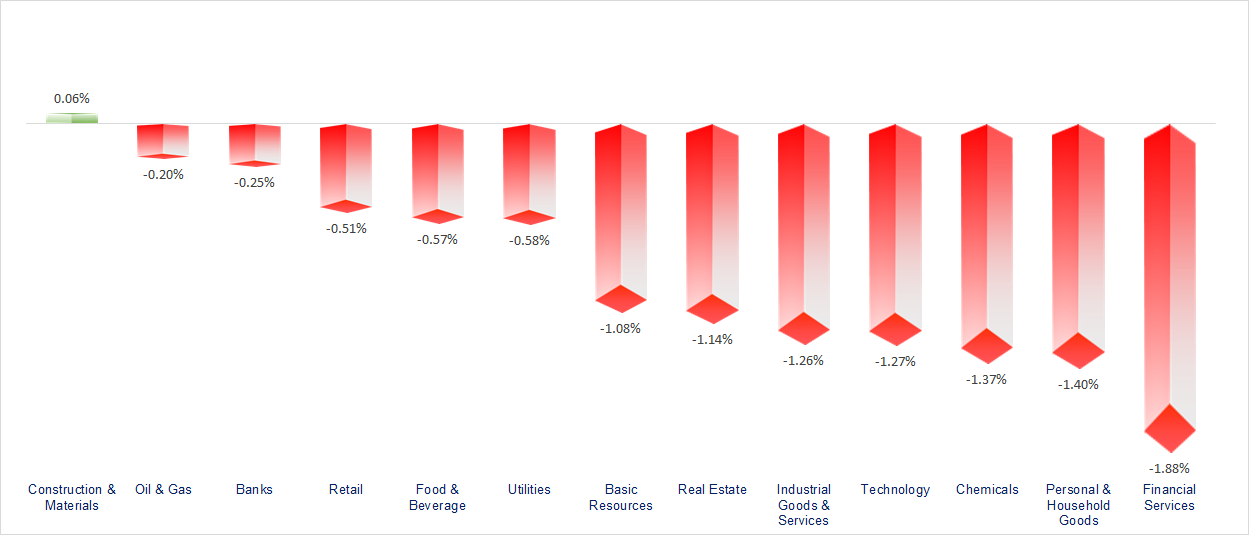

VN-Index broke below its 20-day moving average (MA20) as liquidity dried up and foreign investors recorded strong net selling of more than 2,400 billion VND. Most sectors declined today, with the most notable weakness coming from Securities, Chemicals, and Technology stocks.

ETF & DERIVATIVES

32,800

1D -0.61%

YTD 39.69%

22,610

1D -0.31%

YTD 38.88%

23,600

1D -1.63%

YTD 41.32%

28,140

1D 0.50%

YTD 40.00%

33,450

1D 0.15%

YTD 51.36%

38,410

1D 0.03%

YTD 14.59%

24,870

1D -0.20%

YTD 38.78%

1,853

1D -0.60%

YTD 0.00%

1,851

1D -0.60%

YTD 0.00%

1,848

1D -0.54%

YTD 0.00%

1,829

1D -0.50%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

44,936.73

1D 0.87%

YTD 12.64%

3,882.78

1D 0.00%

YTD 15.84%

27,287.12

1D 1.61%

YTD 36.03%

3,549.21

1D 2.70%

YTD 47.92%

80,983.31

1D 0.00%

YTD 3.07%

4,395.21

1D 1.67%

YTD 16.04%

1,288.29

1D 1.04%

YTD -7.99%

64.94

1D -0.63%

YTD -13.47%

3,882.00

1D 0.42%

YTD 47.32%

Across Asian markets, trading was broadly positive. The Kospi in South Korea led the gains with a 2.7% surge, setting a new all-time high. The rally was fueled by major names such as Samsung Electronics and SK Hynix, which jumped after news of their collaboration with OpenAI to supply chips. Notably, South Korea’s September CPI rose 2.1% year-on-year, slightly higher than expectations.

VIETNAM ECONOMY

4.40%

1D (bps) -16

YTD (bps) 43

4.60%

3.17%

1D (bps) -2

YTD (bps) 69

3.49%

1D (bps) -3

YTD (bps) 64

26,435

1D (%) -0.04%

YTD (%) 3.46%

31,743

1D (%) -0.25%

YTD (%) 16.42%

3,766

1D (%) -0.08%

YTD (%) 5.76%

On the domestic front, the Ministries of Industry & Trade and Finance adjusted retail fuel prices. Gasoline products only saw minor increases, while Diesel 0.05s and kerosene rose sharply by nearly 380 VND/liter.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Strive to increase state budget revenue in 2025 by at least 25% compared to the estimate;

- Deputy Prime Minister Bui Thanh Son chaired a meeting to review the progress of key energy projects;

- ADB slightly raised its forecast for Vietnam’s 2025 GDP growth;

- China and Malaysia are in talks over a rare earth processing project;

- The European Commission is preparing to significantly increase tariffs on imported steel;

- The labor market is under pressure on multiple fronts; even if the Fed cuts interest rates, it may not be enough to turn the situation around.

VN30

BANK

62,100

1D -0.48%

5D -1.43%

Buy Vol. 5,826,662

Sell Vol. 7,398,349

40,100

1D 0.12%

5D -1.96%

Buy Vol. 4,587,689

Sell Vol. 7,122,166

51,500

1D 0.00%

5D 2.39%

Buy Vol. 13,488,642

Sell Vol. 15,876,894

38,850

1D 0.78%

5D 2.52%

Buy Vol. 22,930,641

Sell Vol. 36,241,310

30,150

1D -2.43%

5D -2.58%

Buy Vol. 42,782,717

Sell Vol. 55,183,797

26,800

1D 1.52%

5D 0.94%

Buy Vol. 93,689,010

Sell Vol. 81,114,462

30,850

1D -0.16%

5D -0.48%

Buy Vol. 18,529,800

Sell Vol. 23,922,786

18,800

1D -2.59%

5D -3.09%

Buy Vol. 17,464,582

Sell Vol. 26,891,218

58,700

1D -1.84%

5D 3.16%

Buy Vol. 15,371,908

Sell Vol. 17,561,054

19,700

1D -1.99%

5D -1.99%

Buy Vol. 16,097,045

Sell Vol. 19,820,496

25,750

1D -0.19%

5D 0.39%

Buy Vol. 18,530,938

Sell Vol. 22,297,420

17,000

1D 0.29%

5D -2.02%

Buy Vol. 109,268,871

Sell Vol. 131,610,827

19,300

1D -0.52%

5D -0.77%

Buy Vol. 3,936,860

Sell Vol. 4,211,936

51,600

1D 1.18%

5D 7.61%

Buy Vol. 6,782,449

Sell Vol. 5,683,177

CTG (VietinBank): The Board of Directors of VietinBank has approved a resolution to pay a cash dividend for 2024. The record date for shareholders will be October 15, 2025, with a payout ratio of 4.5% (equivalent to 450 VND/share). The payment date is scheduled for November 17, 2025. With nearly 5.37 billion shares outstanding, VietinBank is expected to spend more than VND2,400 billion on this dividend distribution.

OIL & GAS

60,300

1D -0.50%

5D -2.58%

Buy Vol. 782,656

Sell Vol. 1,013,703

34,000

1D -0.44%

5D -3.00%

Buy Vol. 2,135,941

Sell Vol. 1,900,882

Brent are falling for the fourth consecutive session as concerns over the U.S. government shutdown raise fears about the global economy.

VINGROUP

171,000

1D 0.59%

5D 8.23%

Buy Vol. 3,874,400

Sell Vol. 3,611,052

98,600

1D -2.57%

5D -0.90%

Buy Vol. 9,250,254

Sell Vol. 9,162,305

31,750

1D -4.22%

5D 7.99%

Buy Vol. 10,559,686

Sell Vol. 12,757,668

VIC: The company has approved a plan to issue corporate bonds worth VND3,500 billion. These will be non-convertible, non-warrant, asset-backed bonds with a maximum maturity of 24 months.

FOOD & BEVERAGE

61,200

1D -1.45%

5D -0.49%

Buy Vol. 6,489,758

Sell Vol. 7,413,263

81,500

1D 0.25%

5D -0.85%

Buy Vol. 6,482,912

Sell Vol. 6,518,076

45,400

1D 0.22%

5D -0.98%

Buy Vol. 1,547,774

Sell Vol. 1,331,475

MSN: The stock faced its ninth straight net selling session by foreign investors, with today’s net outflow exceeding VND45 billion.

OTHERS

66,200

1D -1.05%

5D -1.78%

Buy Vol. 293,968

Sell Vol. 450,589

91,800

1D -0.43%

5D -4.87%

Buy Vol. 1,511,364

Sell Vol. 1,287,020

128,700

1D 0.55%

5D -5.30%

Buy Vol. 3,556,370

Sell Vol. 3,331,006

92,100

1D -1.39%

5D -6.02%

Buy Vol. 14,628,138

Sell Vol. 13,668,886

77,100

1D -0.77%

5D -2.41%

Buy Vol. 7,404,087

Sell Vol. 9,206,871

27,300

1D -1.97%

5D -5.21%

Buy Vol. 3,384,988

Sell Vol. 2,751,985

37,850

1D -1.94%

5D -2.95%

Buy Vol. 29,759,037

Sell Vol. 41,143,654

28,100

1D -0.71%

5D -2.43%

Buy Vol. 50,964,893

Sell Vol. 61,585,684

HPG: The European Commission is expected to announce on October 7 a new safeguard measure for the steel industry, which will replace the current safeguard clause set to expire in 2026.

Market by numbers

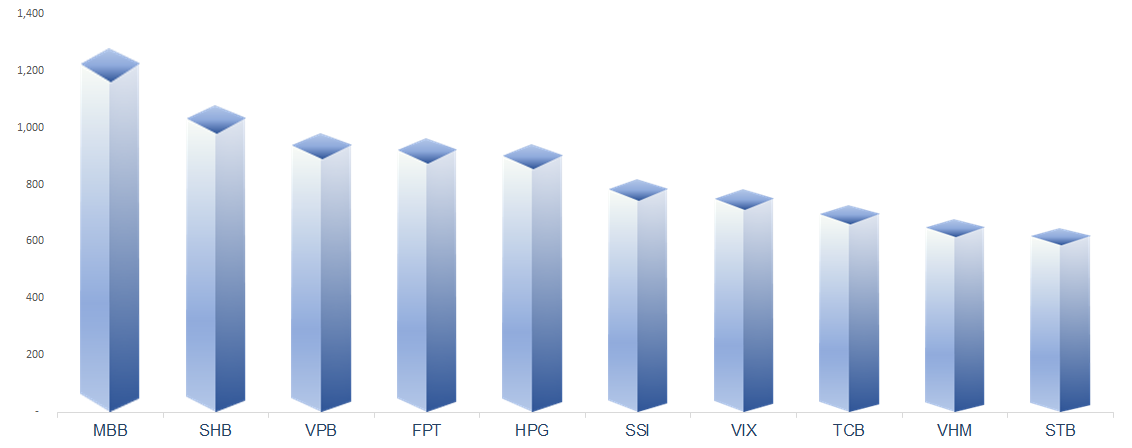

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

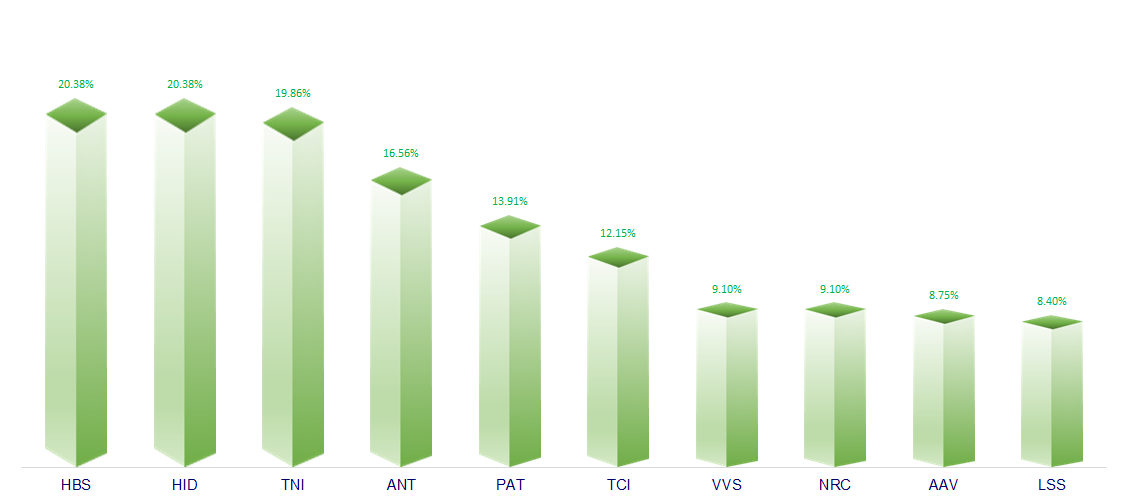

TOP INCREASES 3 CONSECUTIVE SESSIONS

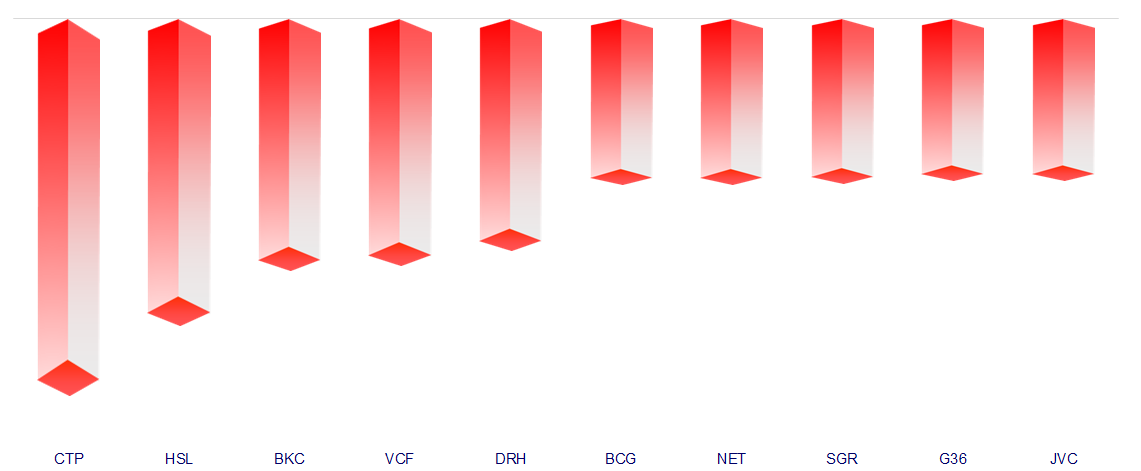

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.