Market brief 03/10/2025

VIETNAM STOCK MARKET

1,645.82

1D -0.42%

YTD 29.92%

265.75

1D -1.41%

YTD 16.85%

1,859.51

1D -0.02%

YTD 38.28%

109.02

1D -0.70%

YTD 14.69%

-1,315.96

1D 0.00%

YTD 0.00%

27,113.83

1D 10.47%

YTD 49.55%

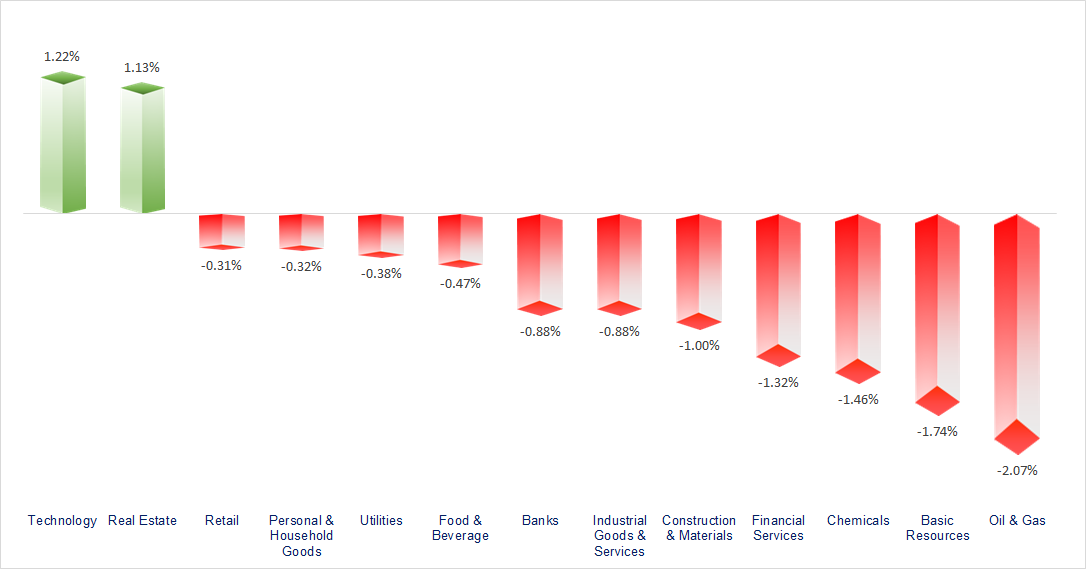

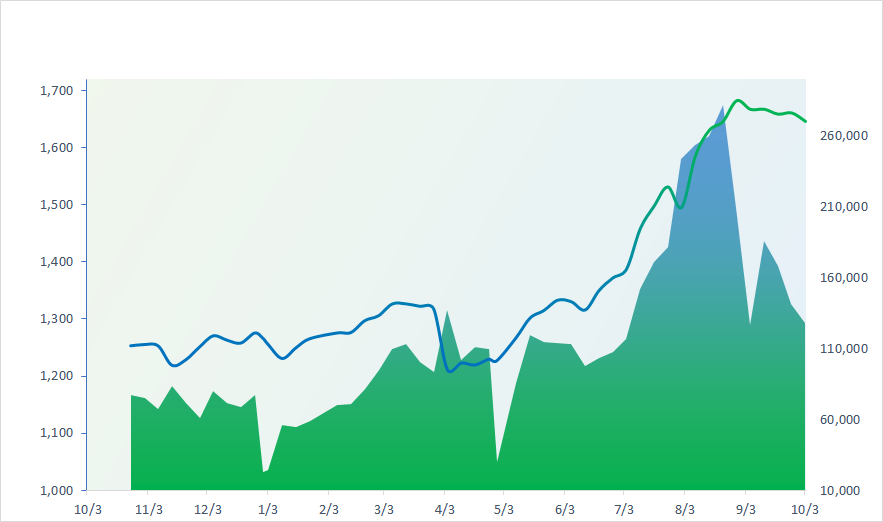

VN-Index slightly recovered during the session, supported by stocks in the Vingroup ecosystem. Vingroup and Technology stocks were the two groups with the most positive performance today. In contrast, many other sectors saw negative adjustments, notably Oil & Gas, Resources, and Chemicals.

ETF & DERIVATIVES

32,880

1D 0.24%

YTD 40.03%

22,490

1D -0.53%

YTD 38.14%

23,480

1D -0.51%

YTD 40.60%

28,240

1D 0.36%

YTD 40.50%

33,000

1D -1.35%

YTD 49.32%

38,200

1D -0.55%

YTD 13.96%

24,840

1D -0.12%

YTD 38.62%

1,857

1D 0.22%

YTD 0.00%

1,860

1D 0.49%

YTD 0.00%

1,855

1D 0.37%

YTD 0.00%

1,836

1D 0.37%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

45,769.50

1D 1.85%

YTD 14.73%

3,882.78

1D 0.00%

YTD 15.84%

27,140.92

1D -0.54%

YTD 35.31%

3,549.21

1D 0.00%

YTD 47.92%

81,207.17

1D 0.28%

YTD 3.35%

4,411.95

1D 0.38%

YTD 16.48%

1,293.61

1D 0.41%

YTD -7.61%

64.50

1D 0.22%

YTD -14.06%

3,862.64

1D 0.30%

YTD 46.59%

In Asian stock markets, investors entered the final trading day of the week with a positive sentiment, as expectations of U.S. interest rate cuts outweighed concerns about a government shutdown. Leading the gains was the Nikkei 225, driven by a surge in technology stocks.

VIETNAM ECONOMY

4.30%

1D (bps) -10

YTD (bps) 33

4.60%

3.18%

1D (bps) 1

YTD (bps) 70

3.51%

1D (bps) 2

YTD (bps) 66

26,420

1D (%) -0.06%

YTD (%) 3.40%

31,760

1D (%) 0.06%

YTD (%) 16.48%

3,765

1D (%) -0.04%

YTD (%) 5.72%

Today, the domestic gold market began to cool off in some segments. SJC gold bars edged down slightly to 137.8 million VND/tael after stabilizing in the previous session, while plain gold rings and 24K jewelry showed signs of stabilizing again after multiple consecutive sessions of gains.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Aeon has invested USD1.5 billion, considering Vietnam a key foreign market;

- Tây Ninh province has started construction on a provincial road project worth over VND1,850 billion connecting to Ho Chi Minh City;

- The Ministry of Construction submitted a report on the operational plan for Long Thành International Airport;

- The U.S. government will remain shut down at least until early next week;

- Outlook for the third round of Russia-U.S. negotiations;

- China tests twin-tower solar power plant.

VN30

BANK

61,700

1D 0.08%

5D -1.35%

Buy Vol. 5,439,333

Sell Vol. 6,214,556

39,800

1D -0.75%

5D -1.85%

Buy Vol. 3,950,073

Sell Vol. 5,755,587

50,800

1D -1.36%

5D 0.20%

Buy Vol. 12,159,741

Sell Vol. 11,843,067

38,350

1D -1.29%

5D 1.72%

Buy Vol. 14,469,761

Sell Vol. 19,192,829

29,500

1D -2.16%

5D -2.96%

Buy Vol. 48,620,556

Sell Vol. 40,648,439

26,550

1D -0.93%

5D 1.14%

Buy Vol. 44,884,448

Sell Vol. 30,148,343

30,200

1D -2.11%

5D 0.17%

Buy Vol. 13,485,502

Sell Vol. 15,282,031

18,700

1D -0.53%

5D -0.53%

Buy Vol. 19,954,118

Sell Vol. 16,118,688

57,000

1D -2.90%

5D 0.88%

Buy Vol. 15,543,701

Sell Vol. 14,743,638

19,750

1D 0.25%

5D -0.25%

Buy Vol. 13,156,495

Sell Vol. 10,908,596

25,650

1D -0.39%

5D 0.00%

Buy Vol. 17,896,423

Sell Vol. 16,654,404

16,700

1D -1.76%

5D -2.91%

Buy Vol. 93,495,099

Sell Vol. 134,460,102

19,000

1D -1.55%

5D -2.56%

Buy Vol. 5,534,596

Sell Vol. 6,205,990

52,500

1D 1.74%

5D 9.26%

Buy Vol. 4,884,617

Sell Vol. 4,060,477

According to data from the State Bank of Vietnam (SBV), as of September 29, 2025, credit to the economy had grown by 13.37% compared to the end of 2024. With the current credit growth pace, if credit institutions maintain strong, sustainable capital mobilization capabilities to support economic growth, credit growth could reach 19–20% by year-end—a notably high rate compared to previous years.

OIL & GAS

60,100

1D -0.33%

5D -2.28%

Buy Vol. 1,074,243

Sell Vol. 851,409

33,450

1D -1.62%

5D -3.88%

Buy Vol. 3,344,185

Sell Vol. 2,780,215

As of 5:00 PM today, Brent crude oil had risen over 0.5% to reach 64.5 USD/barrel.

VINGROUP

176,500

1D 3.22%

5D 7.62%

Buy Vol. 6,530,937

Sell Vol. 6,266,956

100,000

1D 1.42%

5D 1.01%

Buy Vol. 8,017,694

Sell Vol. 7,555,613

32,750

1D 3.15%

5D 11.39%

Buy Vol. 19,371,865

Sell Vol. 17,439,210

VIC: Vingroup successfully issued VND3,500 billion in bonds with an interest rate of 11% per year.

FOOD & BEVERAGE

61,300

1D 0.16%

5D 0.33%

Buy Vol. 6,580,986

Sell Vol. 6,482,657

80,000

1D -1.84%

5D -2.68%

Buy Vol. 13,916,879

Sell Vol. 13,728,286

45,550

1D 0.33%

5D -0.22%

Buy Vol. 976,039

Sell Vol. 939,720

VNM: October 17, 2025, will be the record date for Vinamilk’s cash dividend payment at a rate of 28.5%, equivalent to 2,850 VND/share.

OTHERS

66,400

1D 0.30%

5D -1.92%

Buy Vol. 332,488

Sell Vol. 500,110

91,500

1D -0.33%

5D -4.09%

Buy Vol. 1,972,842

Sell Vol. 1,856,528

129,300

1D 0.47%

5D -2.42%

Buy Vol. 2,009,577

Sell Vol. 2,119,926

93,400

1D 1.41%

5D -4.21%

Buy Vol. 13,766,201

Sell Vol. 11,256,947

77,000

1D -0.13%

5D -1.16%

Buy Vol. 13,499,212

Sell Vol. 13,615,386

26,700

1D -2.20%

5D -6.32%

Buy Vol. 4,260,344

Sell Vol. 3,914,525

37,650

1D -0.53%

5D -0.92%

Buy Vol. 41,910,344

Sell Vol. 37,732,224

27,650

1D -1.60%

5D -3.15%

Buy Vol. 87,574,481

Sell Vol. 90,975,644

HPG: On October 1, 2025, Hòa Phát delivered its first batch of containers to Touax Container Leasing Pte Ltd – one of the world’s leading container leasing companies with over 40 years of experience. This batch was manufactured according to Touax’s specific technical requirements.

Market by numbers

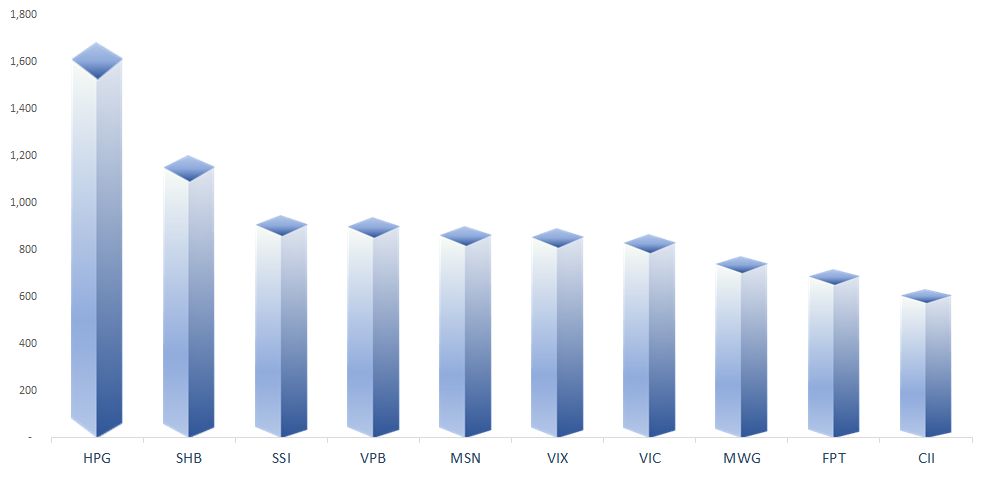

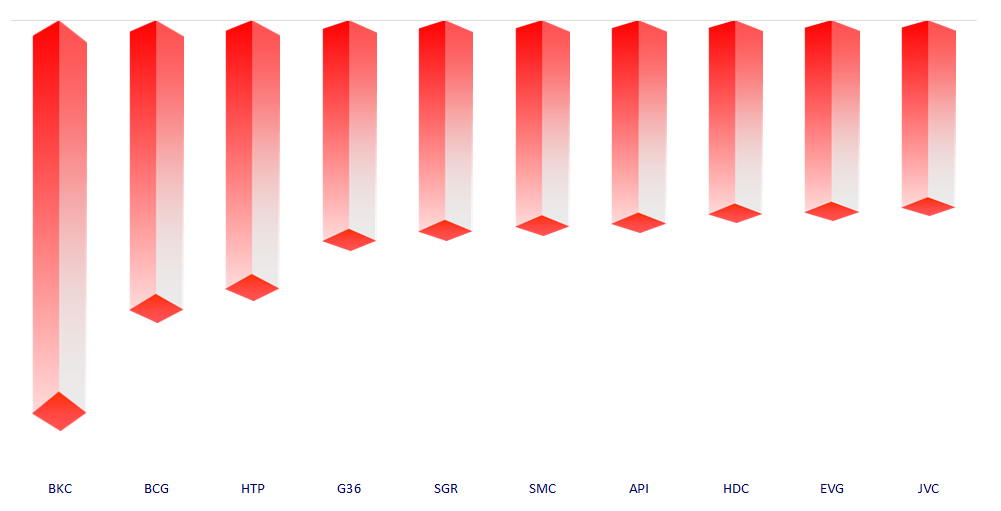

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

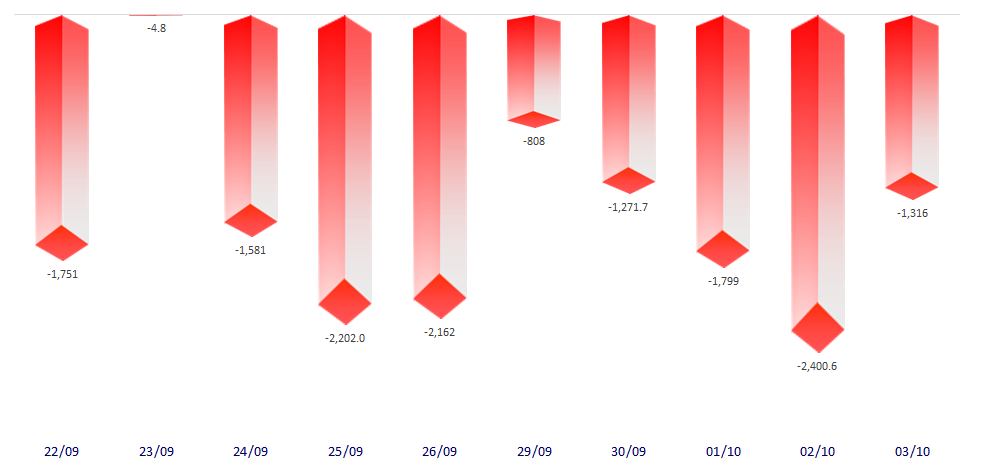

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.