Market brief 06/10/2025

VIETNAM STOCK MARKET

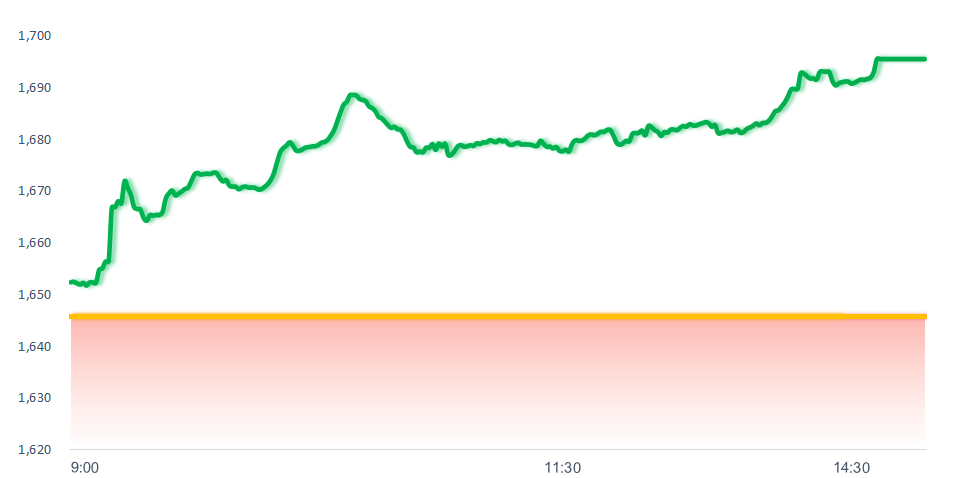

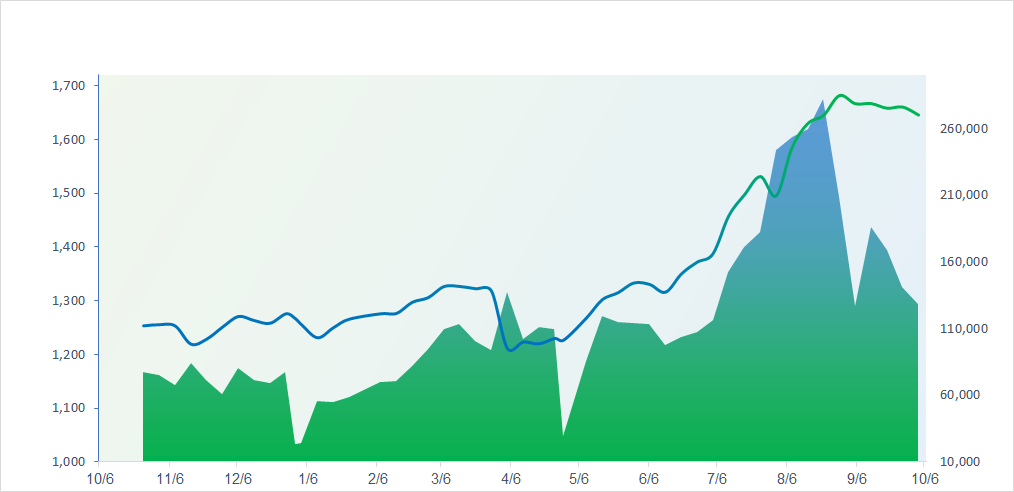

1,695.50

1D 3.02%

YTD 33.84%

274.69

1D 3.36%

YTD 20.78%

1,918.97

1D 3.20%

YTD 42.70%

109.16

1D 0.13%

YTD 14.83%

-1,902.81

1D 0.00%

YTD 0.00%

35,046.00

1D 29.26%

YTD 93.29%

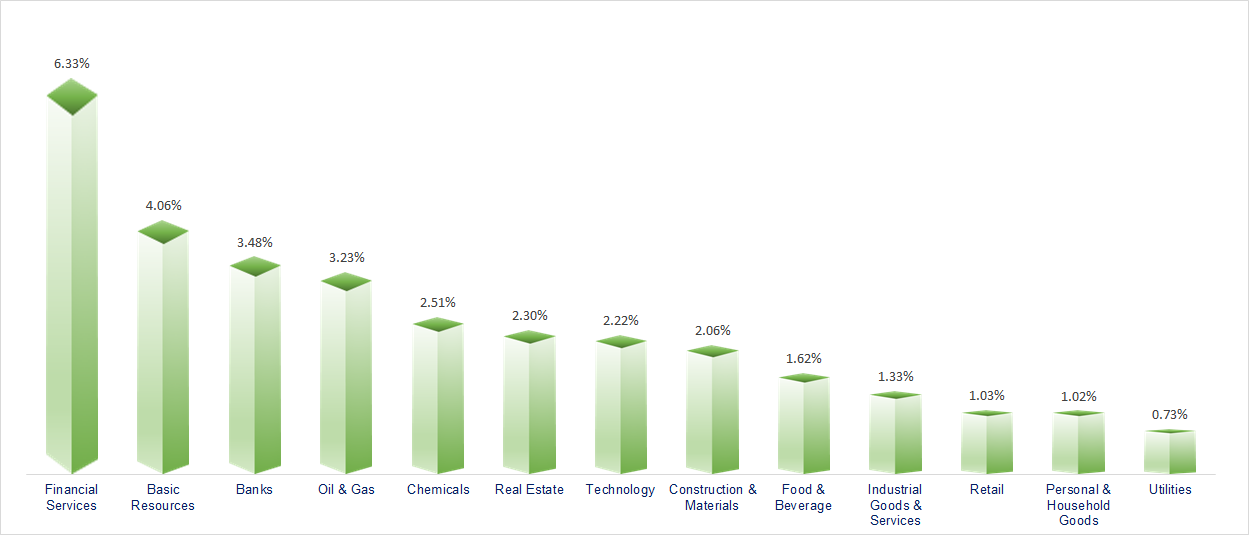

VN-Index surged nearly 60 points as capital flows returned strongly to the Securities, Banking, and Real Estate sectors. All industry groups posted positive performance today, with Securities, Resources, Banking, and Oil & Gas standing out the most.

ETF & DERIVATIVES

33,950

1D 3.25%

YTD 44.59%

23,300

1D 3.60%

YTD 43.12%

24,450

1D 4.13%

YTD 46.41%

28,400

1D 0.57%

YTD 41.29%

34,290

1D 3.91%

YTD 55.16%

39,040

1D 2.20%

YTD 16.47%

25,150

1D 1.25%

YTD 40.35%

1,919

1D 3.32%

YTD 0.00%

1,917

1D 3.07%

YTD 0.00%

1,913

1D 3.13%

YTD 0.00%

1,886

1D 2.75%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

47,944.76

1D 4.75%

YTD 20.18%

3,882.78

1D 0.00%

YTD 15.84%

26,957.77

1D -0.67%

YTD 34.39%

3,549.21

1D 0.00%

YTD 47.92%

81,798.81

1D 0.73%

YTD 4.10%

4,411.95

1D 0.00%

YTD 16.48%

1,285.64

1D -0.62%

YTD -8.18%

65.76

1D 1.91%

YTD -12.38%

3,940.00

1D 1.37%

YTD 49.52%

In Asian stock markets, performances were mixed, but Japan was the highlight. The Nikkei 225 skyrocketed nearly 5%, setting a new record high after the ruling Liberal Democratic Party elected Sanae Takaichi as its new leader on October 4. This outcome positions her to become Japan’s first-ever female Prime Minister. Her victory sparked a wave of optimism across Japanese trading floors, as she had previously voiced support for aggressive monetary easing and increased government spending.

VIETNAM ECONOMY

4.48%

1D (bps) 18

YTD (bps) 51

4.60%

3.18%

1D (bps) 1

YTD (bps) 70

3.50%

1D (bps) -1

YTD (bps) 65

26,403

1D (%) -0.06%

YTD (%) 3.33%

31,683

1D (%) -0.24%

YTD (%) 16.20%

3,763

1D (%) -0.04%

YTD (%) 5.68%

Bitcoin hit an all-time high yesterday, surpassing USD 125,000, pushing its market capitalization to USD 2.5 trillion, making it the seventh-largest asset globally.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam’s CPI in Q3 2025 rose 3.27% compared to the same period last year;

- Vietnam recorded a trade surplus of USD 16.82 billion in the first nine months of 2025;

- Realized FDI into Vietnam’s real estate sector reached nearly USD 1.4 billion in the first nine months;

- Global gold prices broke through the 3,900 USD/oz mark;

- The U.S. government shutdown is cited as a reason why the Fed should cut interest rates at the end of this month;

- The French Prime Minister resigned after just 27 days in office, marking the shortest tenure in history.

VN30

BANK

64,000

1D 3.73%

5D 2.98%

Buy Vol. 13,203,148

Sell Vol. 11,585,448

40,750

1D 2.39%

5D 1.12%

Buy Vol. 5,552,653

Sell Vol. 6,433,502

52,400

1D 3.15%

5D 2.75%

Buy Vol. 16,771,319

Sell Vol. 14,511,571

39,400

1D 2.74%

5D 4.37%

Buy Vol. 32,135,308

Sell Vol. 35,532,998

31,550

1D 6.95%

5D 1.45%

Buy Vol. 73,106,436

Sell Vol. 55,775,713

27,350

1D 3.01%

5D 4.59%

Buy Vol. 83,250,929

Sell Vol. 62,794,580

31,500

1D 4.30%

5D 1.94%

Buy Vol. 44,398,968

Sell Vol. 42,556,972

19,850

1D 6.15%

5D 5.31%

Buy Vol. 54,922,029

Sell Vol. 46,880,765

59,800

1D 4.91%

5D 5.65%

Buy Vol. 18,348,864

Sell Vol. 16,984,393

20,550

1D 4.05%

5D 4.05%

Buy Vol. 18,681,630

Sell Vol. 18,061,456

26,800

1D 4.48%

5D 4.69%

Buy Vol. 30,833,552

Sell Vol. 27,340,065

17,400

1D 4.19%

5D 3.57%

Buy Vol. 198,961,296

Sell Vol. 189,990,023

19,700

1D 3.68%

5D 1.03%

Buy Vol. 4,090,114

Sell Vol. 4,099,671

51,800

1D -1.33%

5D 8.37%

Buy Vol. 6,718,814

Sell Vol. 6,366,512

During the past week (September 29 – October 3), VND interbank lending rates for maturities of one month or less declined across all terms. As of October 3, the interbank VND lending rates were: overnight at 4.30% (-0.06 percentage points compared to the previous week), 1-week at 4.52% (-1.14 points), 2-week at 4.66% (-1.04 points), and 1-month at 5.16% (-0.40 points). On the open market, through the collateralized lending (OMO) channel, the State Bank of Vietnam offered VND 55,000 billion across maturities of 7, 14, 28, and 91 days, with interest rates held steady at 4.0%. A total of VND 48,982 billion was successfully bid across all four maturities. Meanwhile, VND 55,854 billion matured on the OMO channel last week. The central bank did not issue any SBV bills during the week.

OIL & GAS

60,800

1D 1.16%

5D -1.14%

Buy Vol. 862,207

Sell Vol. 840,439

34,150

1D 2.09%

5D -1.73%

Buy Vol. 2,221,282

Sell Vol. 1,565,756

Brent crude oil prices rose nearly 2% after OPEC+ announced a smaller-than-expected monthly production increase, easing concerns over oversupply.

VINGROUP

179,700

1D 1.81%

5D 3.99%

Buy Vol. 3,267,569

Sell Vol. 3,946,071

102,700

1D 2.70%

5D 0.79%

Buy Vol. 8,535,107

Sell Vol. 8,488,271

35,000

1D 6.87%

5D 16.67%

Buy Vol. 23,893,313

Sell Vol. 18,173,231

VIC: The group announced the establishment of VinMetal Manufacturing and Trading JSC, officially entering the metallurgical industry and expanding its existing Industry – Technology pillar.

FOOD & BEVERAGE

62,400

1D 1.79%

5D 3.48%

Buy Vol. 6,458,742

Sell Vol. 8,067,084

83,000

1D 3.75%

5D 1.47%

Buy Vol. 12,936,479

Sell Vol. 12,542,897

46,150

1D 1.32%

5D 1.43%

Buy Vol. 1,443,365

Sell Vol. 1,560,811

VNM: On October 17, the company will finalize the list of shareholders eligible to receive the remainder of the 2024 dividend and an interim 2025 dividend. The cash dividend payout ratio will be 28.5%.

OTHERS

66,900

1D 0.75%

5D -0.45%

Buy Vol. 352,926

Sell Vol. 483,848

92,800

1D 1.42%

5D -1.28%

Buy Vol. 2,153,600

Sell Vol. 1,852,464

134,300

1D 3.87%

5D 3.55%

Buy Vol. 4,087,361

Sell Vol. 4,405,603

95,500

1D 2.25%

5D 0.00%

Buy Vol. 14,493,579

Sell Vol. 15,811,208

77,600

1D 0.78%

5D 0.78%

Buy Vol. 13,046,421

Sell Vol. 12,682,050

27,550

1D 3.18%

5D -2.48%

Buy Vol. 4,966,572

Sell Vol. 2,939,042

40,250

1D 6.91%

5D 7.19%

Buy Vol. 87,279,674

Sell Vol. 61,298,593

29,200

1D 5.61%

5D 2.10%

Buy Vol. 111,968,169

Sell Vol. 109,287,387

MWG: MWG was the most heavily net-sold stock by foreign investors in today’s session, with a total net sell value of VND 311 billion.

Market by numbers

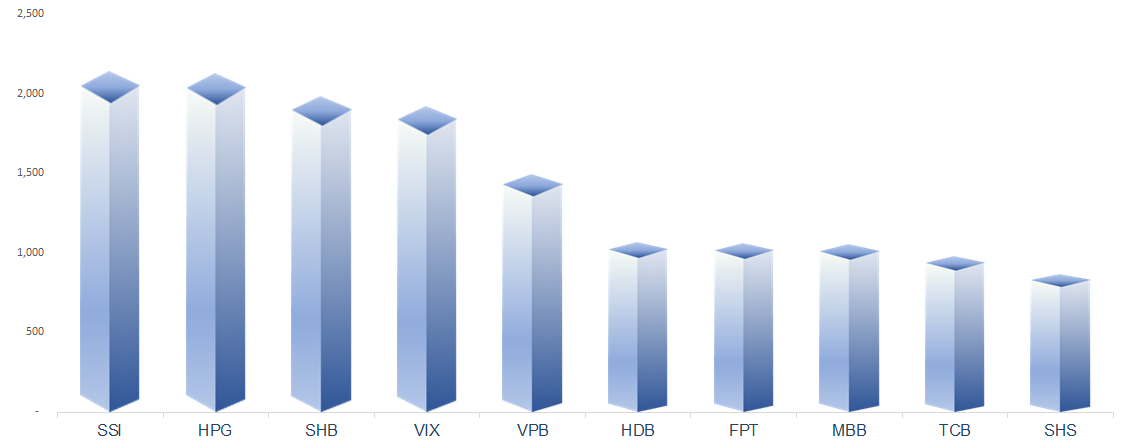

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

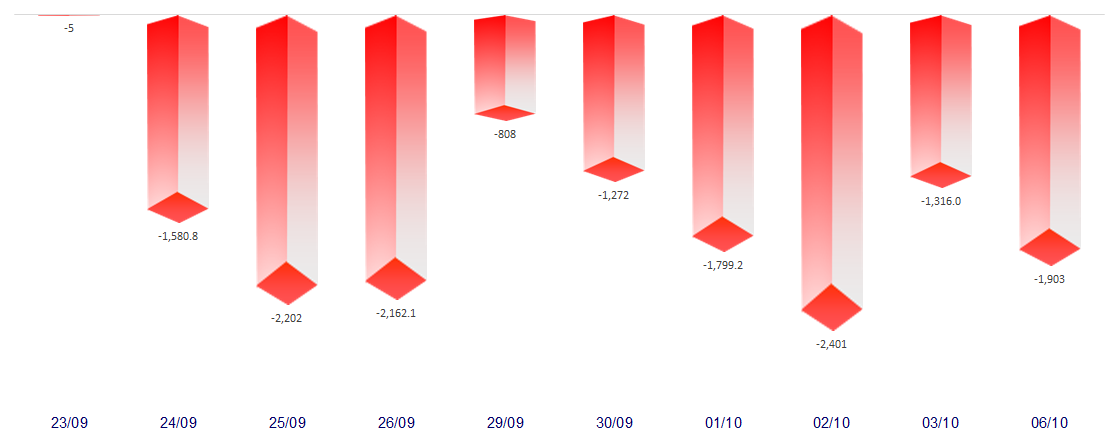

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.