Market brief 14/10/2025

VIETNAM STOCK MARKET

1,761.06

1D -0.23%

YTD 39.02%

275.33

1D -0.01%

YTD 21.06%

2,013.69

1D 0.07%

YTD 49.74%

113.15

1D 0.40%

YTD 19.03%

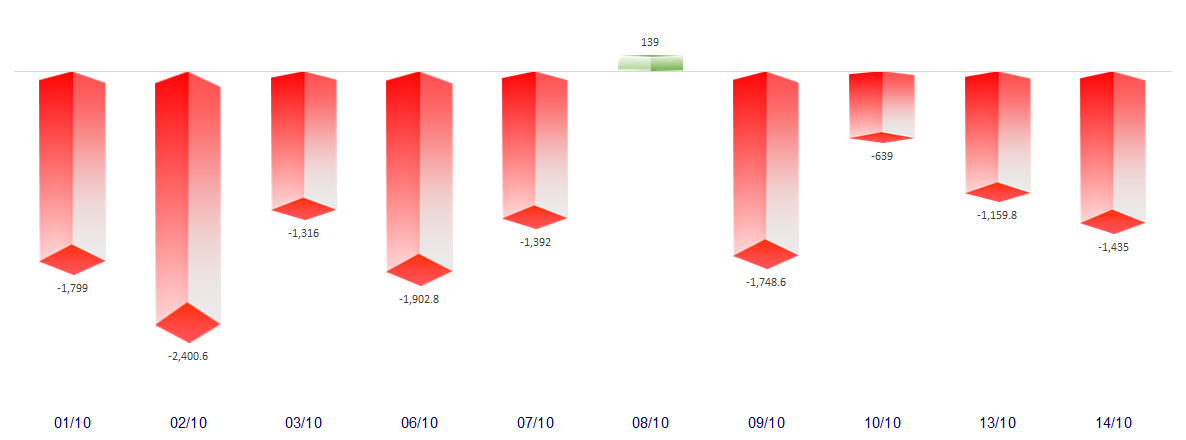

-1,435.46

1D 0.00%

YTD 0.00%

56,652.00

1D 16.38%

YTD 212.46%

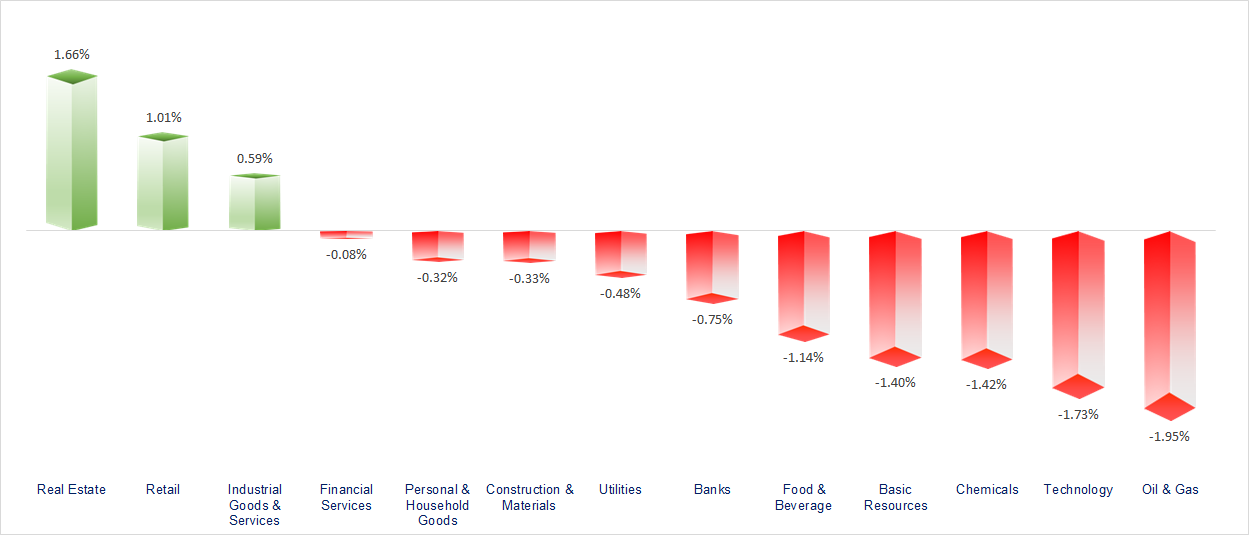

VN-Index recorded its first distribution session, with liquidity exceeding USD 2 billion. The Real Estate and Retail sectors were the strongest performers, while Oil & Gas, Technology, and Chemicals remained relatively weak.

ETF & DERIVATIVES

35,490

1D 0.40%

YTD 51.15%

24,520

1D 0.70%

YTD 50.61%

25,400

1D 0.04%

YTD 52.10%

29,500

1D 1.03%

YTD 46.77%

34,300

1D 0.03%

YTD 55.20%

39,620

1D 0.05%

YTD 18.20%

26,500

1D 1.18%

YTD 47.88%

2,014

1D 0.03%

YTD 0.00%

2,010

1D -0.05%

YTD 0.00%

2,008

1D -0.10%

YTD 0.00%

1,983

1D 0.05%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

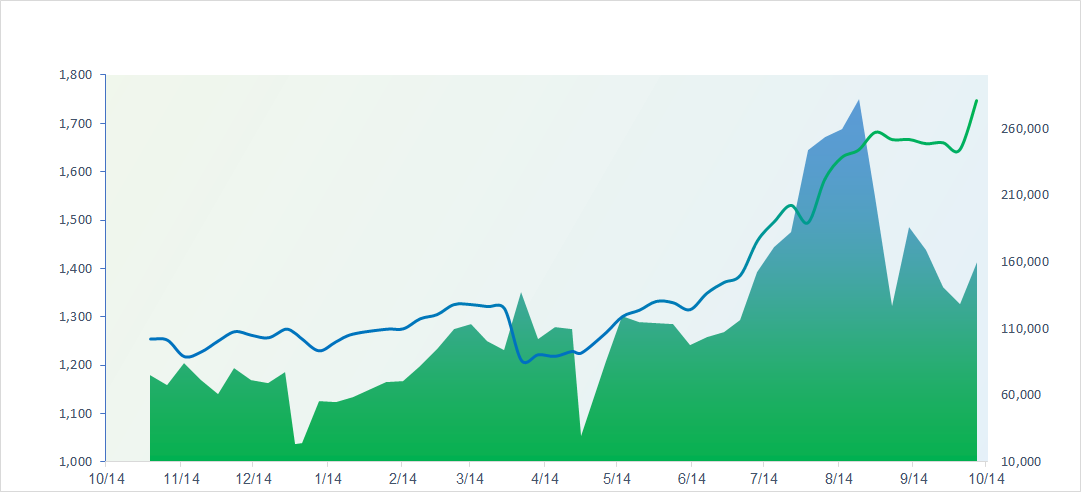

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

46,847.32

1D -2.58%

YTD 17.43%

3,865.23

1D -0.62%

YTD 15.32%

25,441.35

1D -1.73%

YTD 26.83%

3,561.81

1D -0.63%

YTD 48.44%

81,990.96

1D -0.41%

YTD 4.35%

4,354.52

1D -0.80%

YTD 14.97%

1,266.38

1D -1.60%

YTD -9.56%

62.08

1D -1.96%

YTD -17.28%

4,128.00

1D 0.42%

YTD 56.66%

Asian stock markets continued to decline today as investors remained concerned about escalating U.S.–China trade tensions, following China’s new maritime transport restrictions. Notably, Japan’s Nikkei 225 dropped more than 2.5%, closing at 46,847.32 points, while Hong Kong’s Hang Seng Index lost over 1.7%, ending at 25,441.35 points.

VIETNAM ECONOMY

4.90%

1D (bps) 15

YTD (bps) 93

4.60%

3.15%

1D (bps) -4

YTD (bps) 68

3.65%

1D (bps) 13

YTD (bps) 80

26,369

1D (%) 0.01%

YTD (%) 3.20%

31,299

1D (%) -0.19%

YTD (%) 14.79%

3,751

1D (%) -0.03%

YTD (%) 5.34%

Meanwhile, after global gold prices once again broke their all-time high, currently trading around USD 4,130/oz, domestic gold prices — including SJC gold, plain rings, and jewelry gold — also hit new records, rising by VND 1.5–2.8 million per tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- An overview of Vietnam’s economy in the first nine months and full-year 2025 forecasts;

- Vietnam’s aviation market grows strongly, with double-digit passenger growth;

- Proposal to consider applying personal income tax on gold bullion trading;

- China officially implements special port fees for U.S. vessels;

- U.S. President to visit Asia, aiming to witness the Thailand–Cambodia ceasefire signing ceremony;

- Samsung reports record-breaking profits, the highest in three years.

VN30

BANK

63,100

1D 0.00%

5D -0.94%

Buy Vol. 12,361,959

Sell Vol. 10,906,636

39,600

1D -2.10%

5D -1.13%

Buy Vol. 10,218,761

Sell Vol. 12,122,468

54,400

1D -2.07%

5D 6.28%

Buy Vol. 17,379,824

Sell Vol. 20,219,906

40,800

1D -1.21%

5D 4.62%

Buy Vol. 35,201,368

Sell Vol. 41,635,664

32,500

1D 2.52%

5D 4.67%

Buy Vol. 84,225,666

Sell Vol. 87,397,757

27,050

1D -1.10%

5D 0.74%

Buy Vol. 94,020,981

Sell Vol. 86,934,521

32,650

1D 0.00%

5D 4.31%

Buy Vol. 43,655,277

Sell Vol. 49,001,967

19,200

1D -1.29%

5D -0.78%

Buy Vol. 57,083,828

Sell Vol. 67,424,744

60,600

1D -0.66%

5D 3.59%

Buy Vol. 12,693,507

Sell Vol. 13,121,131

20,000

1D -0.74%

5D -0.99%

Buy Vol. 20,969,758

Sell Vol. 26,019,993

26,300

1D -1.68%

5D -0.57%

Buy Vol. 26,894,450

Sell Vol. 28,868,874

18,000

1D -0.55%

5D 4.35%

Buy Vol. 206,510,129

Sell Vol. 217,471,006

19,400

1D -0.26%

5D 1.04%

Buy Vol. 4,004,878

Sell Vol. 4,684,270

51,500

1D -1.90%

5D -2.09%

Buy Vol. 5,830,551

Sell Vol. 4,116,110

VPB: Consolidated pre-tax profit for the first nine months of 2025 reached VND 20,396 billion, up 47.1% year over year. Notably, credit growth exceeded 28%, driven by contributions from both the parent bank and subsidiary companies.

Oil & Gas

60,000

1D -0.99%

5D -1.48%

Buy Vol. 891,498

Sell Vol. 1,118,684

33,600

1D -1.32%

5D -0.88%

Buy Vol. 3,137,877

Sell Vol. 3,100,978

Brent crude oil prices fell nearly 2% today amid signs of escalating U.S.–China trade tensions.

VINGROUP

211,900

1D 3.16%

5D 17.72%

Buy Vol. 16,651,099

Sell Vol. 16,397,758

127,000

1D 2.25%

5D 23.18%

Buy Vol. 18,979,959

Sell Vol. 18,556,857

42,750

1D -0.58%

5D 22.14%

Buy Vol. 41,140,379

Sell Vol. 42,757,258

All three Vingroup stocks reversed more than 3% from their session highs, accompanied by higher trading volume than the previous session, indicating a likely distribution session for this trio.

Food & Beverage

63,500

1D -0.78%

5D 3.42%

Buy Vol. 7,977,322

Sell Vol. 11,409,961

82,500

1D -2.94%

5D 0.00%

Buy Vol. 17,875,842

Sell Vol. 22,588,173

45,400

1D -1.20%

5D -1.30%

Buy Vol. 1,249,377

Sell Vol. 1,373,106

VNM: Vinamilk saw strong net buying by foreign investors for the second consecutive session, with a total value of VND 81 billion.

OTHERS

64,800

1D -1.97%

5D -2.11%

Buy Vol. 646,292

Sell Vol. 725,114

96,200

1D 0.31%

5D 3.44%

Buy Vol. 5,139,691

Sell Vol. 4,285,583

152,500

1D 6.94%

5D 14.32%

Buy Vol. 9,141,799

Sell Vol. 5,812,149

92,400

1D -1.70%

5D -3.25%

Buy Vol. 17,802,539

Sell Vol. 18,672,445

84,200

1D 1.45%

5D 7.95%

Buy Vol. 15,116,077

Sell Vol. 17,271,772

27,850

1D -2.28%

5D 1.83%

Buy Vol. 4,033,216

Sell Vol. 5,621,545

41,000

1D -0.85%

5D 0.49%

Buy Vol. 85,189,190

Sell Vol. 109,197,669

28,350

1D -2.24%

5D -2.24%

Buy Vol. 114,971,899

Sell Vol. 130,072,575

VJC: Within just two trading sessions, VJC recorded a nearly 15% gain, despite foreign investors being net sellers of over VND 40 billion today.

Market by numbers

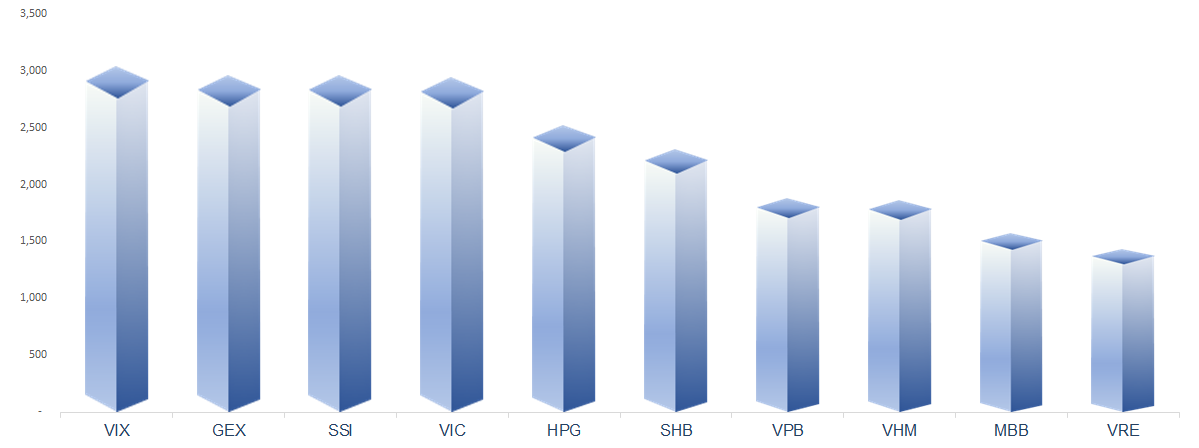

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

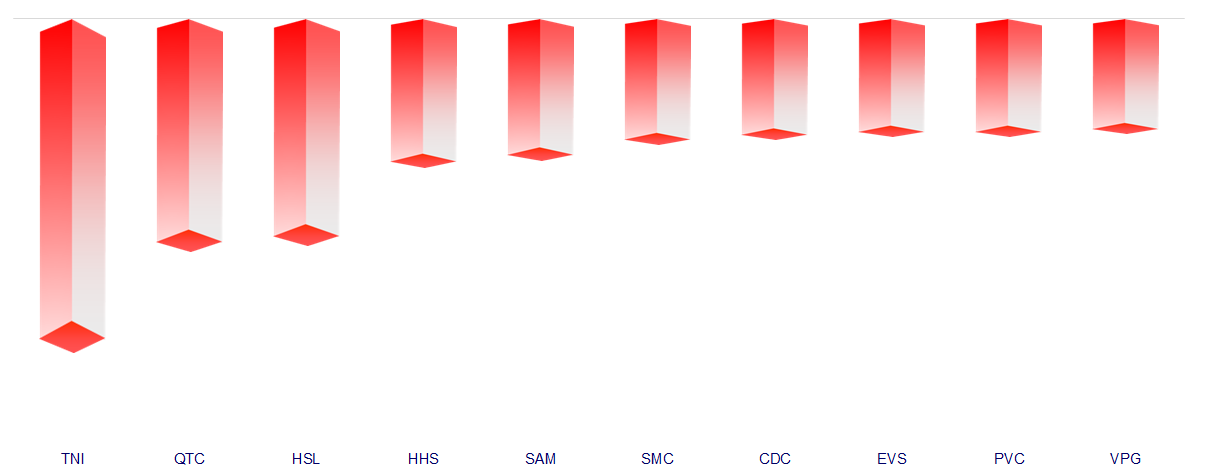

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.