Market brief 23/10/2025

VIETNAM STOCK MARKET

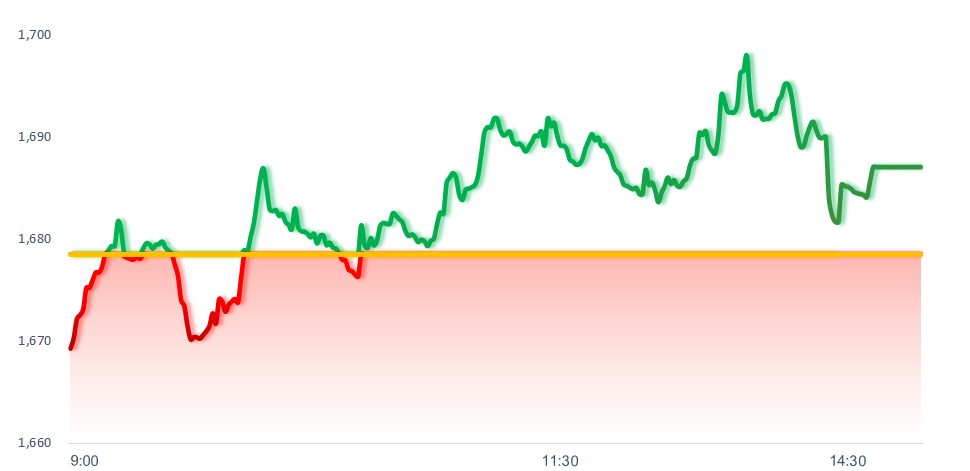

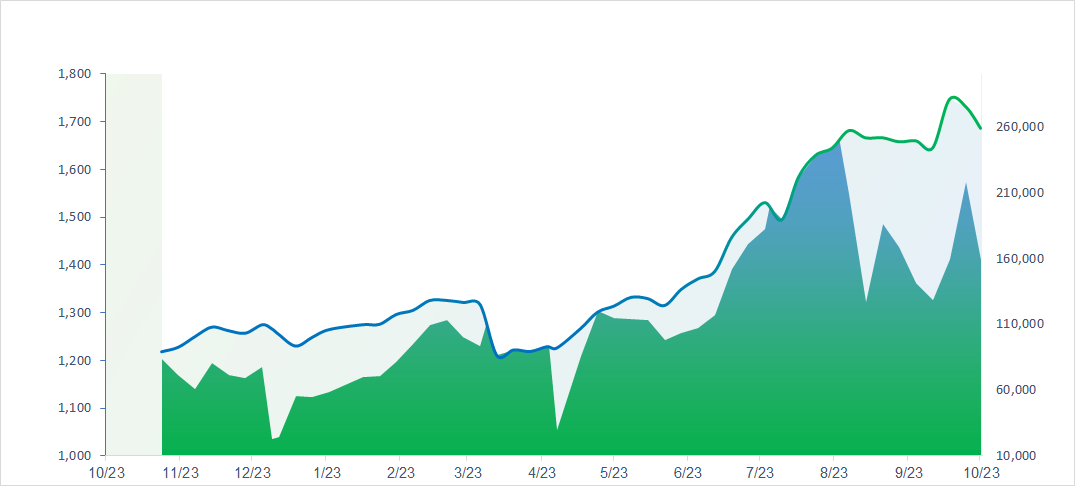

1,687.06

1D 0.51%

YTD 33.18%

266.78

1D -0.71%

YTD 17.30%

1,945.78

1D 0.77%

YTD 44.69%

111.04

1D 1.11%

YTD 16.81%

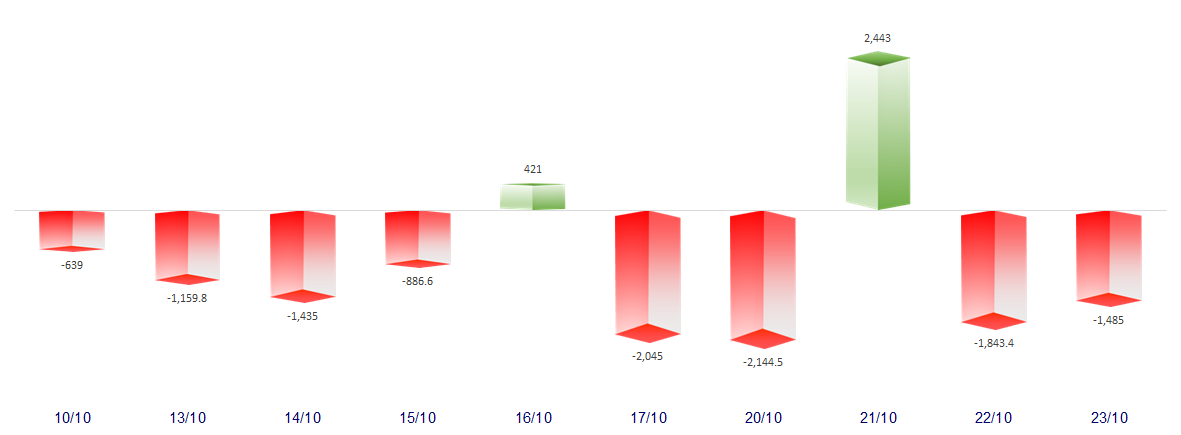

-1,485.23

1D 0.00%

YTD 0.00%

27,088.00

1D -23.69%

YTD 49.40%

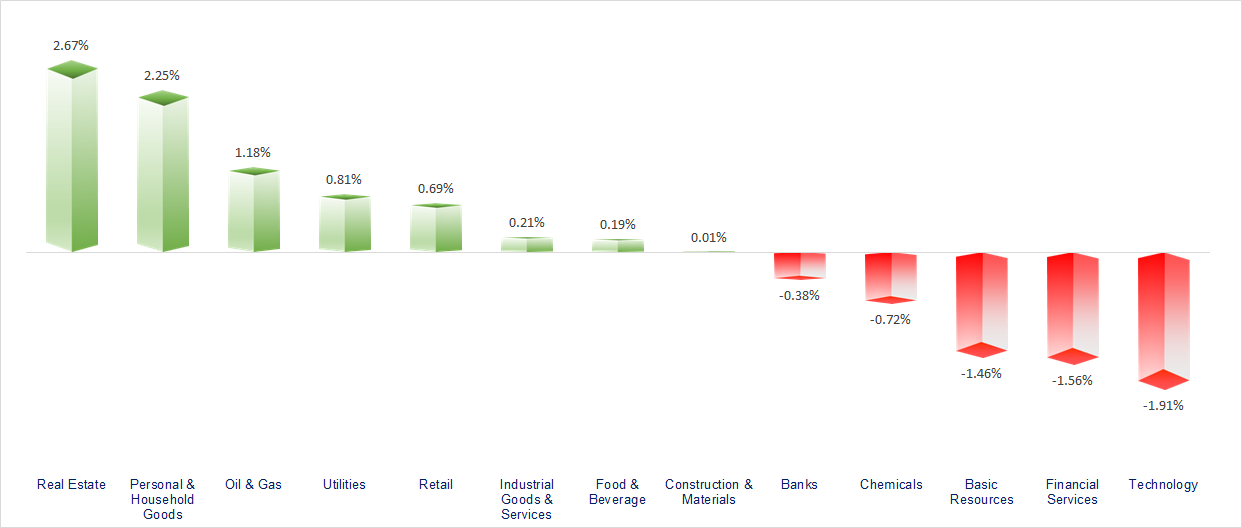

VN-Index continued its upward momentum, rising nearly 10 points as Vingroup stocks recovered, though market liquidity remained weak. The Real Estate, Oil & Gas, and Retail sectors led the gains, while Technology, Securities, and Chemicals showed lackluster performance.

ETF & DERIVATIVES

34,520

1D 1.53%

YTD 47.02%

23,600

1D 1.37%

YTD 44.96%

24,610

1D -0.57%

YTD 47.37%

29,300

1D -0.17%

YTD 45.77%

31,630

1D -0.22%

YTD 43.12%

39,200

1D 1.55%

YTD 16.95%

27,490

1D -1.82%

YTD 53.40%

1,944

1D 0.91%

YTD 0.00%

1,939

1D 3.05%

YTD 0.00%

1,924

1D 0.16%

YTD 0.00%

1,928

1D 0.94%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

48,641.61

1D -1.35%

YTD 21.93%

3,922.41

1D 0.22%

YTD 17.03%

25,967.98

1D 0.72%

YTD 29.46%

3,845.56

1D -0.98%

YTD 60.27%

84,556.40

1D 0.15%

YTD 7.61%

4,416.27

1D 0.51%

YTD 16.60%

1,302.35

1D 0.00%

YTD -6.99%

65.97

1D 5.40%

YTD -12.10%

4,117.00

1D 0.45%

YTD 56.24%

Asian stock markets traded mixed today amid escalating U.S.–China trade tensions. Specifically, Japan’s Nikkei 225 fell more than 1.3% to 48,641.61 points, while Hong Kong’s Hang Seng Index rose over 0.7% to 25,967.98 points.

VIETNAM ECONOMY

5.90%

1D (bps) -38

YTD (bps) 193

4.60%

3.16%

1D (bps) -9

YTD (bps) 69

3.68%

1D (bps) 9

YTD (bps) 83

26,352

1D (%) 0.00%

YTD (%) 3.13%

31,351

1D (%) -0.04%

YTD (%) 14.98%

3,756

1D (%) -0.07%

YTD (%) 5.49%

Domestic gold prices continued to decline broadly today. Notably, plain gold rings fell by up to 3 million VND/tael, narrowing the price gap with SJC gold bars even further.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Propose that the Government implement support policies to give businesses at risk of bankruptcy an opportunity to recover;

- Prioritize resources for legal support to help the private sector break through and grow;

- A VND 27,000 billion expressway project is behind schedule, and the Ministry of Construction has ordered urgent action;

- South Korea keeps its base interest rate unchanged at 2.5% to stabilize the economy;

- U.S. national debt continues to surge at a staggering pace;

- The European Union discusses a plan to use USD 163 billion in frozen Russian assets, while Ukraine demands the right to decide how the funds are spent.

VN30

BANK

59,800

1D 0.34%

5D -4.93%

Buy Vol. 11,368,373

Sell Vol. 6,277,549

36,900

1D -0.81%

5D -7.17%

Buy Vol. 5,161,213

Sell Vol. 4,378,258

49,700

1D -1.58%

5D -7.62%

Buy Vol. 14,253,340

Sell Vol. 13,386,845

37,250

1D -1.97%

5D -9.70%

Buy Vol. 25,364,335

Sell Vol. 23,477,991

30,000

1D -1.48%

5D -9.64%

Buy Vol. 19,493,580

Sell Vol. 26,746,387

25,200

1D -0.98%

5D -7.35%

Buy Vol. 30,786,351

Sell Vol. 33,283,636

33,000

1D 1.54%

5D -1.20%

Buy Vol. 56,375,398

Sell Vol. 70,081,920

17,800

1D -1.93%

5D -9.87%

Buy Vol. 13,608,424

Sell Vol. 15,760,465

55,600

1D 0.36%

5D -6.55%

Buy Vol. 8,943,290

Sell Vol. 10,050,112

18,500

1D -0.80%

5D -7.50%

Buy Vol. 7,679,575

Sell Vol. 7,155,586

24,950

1D -0.60%

5D -5.13%

Buy Vol. 14,286,246

Sell Vol. 15,557,759

16,700

1D 0.30%

5D -7.99%

Buy Vol. 128,193,619

Sell Vol. 137,766,005

18,150

1D -0.55%

5D -4.47%

Buy Vol. 7,521,262

Sell Vol. 7,817,329

51,300

1D 2.81%

5D 0.00%

Buy Vol. 5,628,742

Sell Vol. 4,317,354

During the October 22 trading session, the State Bank of Vietnam (SBV) significantly increased the scale of Open Market Operation (OMO) lending, while keeping the interest rate unchanged at 4.0% per year. As a result, VND 3,000 billion was successfully bid for a 7-day term, VND 22,000 billion for a 14-day term, VND 15,000 billion for a 28-day term, and another VND 15,000 billion for a 91-day term. In total, the SBV injected nearly VND 55,000 billion into the banking system through the OMO channel on October 22.

OIL & GAS

59,800

1D 1.36%

5D 1.87%

Buy Vol. 1,197,884

Sell Vol. 1,206,239

34,250

1D 0.00%

5D 1.63%

Buy Vol. 2,130,322

Sell Vol. 2,721,438

Brent crude oil prices continued to rise nearly 4% from the start of the session to 5:00 PM today.

VINGROUP

215,000

1D 5.91%

5D 0.89%

Buy Vol. 8,455,263

Sell Vol. 6,413,242

115,000

1D 1.77%

5D -5.74%

Buy Vol. 10,217,027

Sell Vol. 10,810,024

39,400

1D 1.03%

5D -9.22%

Buy Vol. 16,806,680

Sell Vol. 19,817,090

VIC: Hung Long Real Estate (VMI) is expected to transfer ownership of all 243.46 million VIC shares to VinSpeed, following VinSpeed’s merger with Hung Long Real Estate.

FOOD & BEVERAGE

56,600

1D 0.53%

5D -7.52%

Buy Vol. 4,670,471

Sell Vol. 4,391,307

78,200

1D -1.01%

5D -11.34%

Buy Vol. 13,408,290

Sell Vol. 17,630,866

45,450

1D 1.45%

5D 0.55%

Buy Vol. 1,419,326

Sell Vol. 1,511,640

VNM: Foreign investors continued to net sell VND 24 billion worth of Vinamilk shares in today’s session.

OTHERS

65,400

1D 0.62%

5D -0.15%

Buy Vol. 350,066

Sell Vol. 461,430

91,000

1D 0.00%

5D -4.21%

Buy Vol. 2,391,159

Sell Vol. 2,393,719

184,000

1D 2.11%

5D 6.05%

Buy Vol. 3,552,335

Sell Vol. 3,579,729

95,000

1D -2.06%

5D 5.79%

Buy Vol. 11,957,770

Sell Vol. 16,826,345

85,700

1D 1.42%

5D 1.42%

Buy Vol. 13,179,784

Sell Vol. 17,059,688

26,100

1D -1.51%

5D -4.04%

Buy Vol. 1,616,758

Sell Vol. 2,056,430

37,500

1D -2.47%

5D -9.31%

Buy Vol. 34,234,029

Sell Vol. 46,332,771

26,500

1D -0.75%

5D -6.19%

Buy Vol. 40,217,408

Sell Vol. 45,854,217

MWG: Mobile World Investment Corporation (MWG) recorded a cumulative after-tax profit of VND 4,989 billion for the first nine months of 2025, marking a 73% increase year over year compared to the same period in 2024, and surpassing its full-year target.

Market by numbers

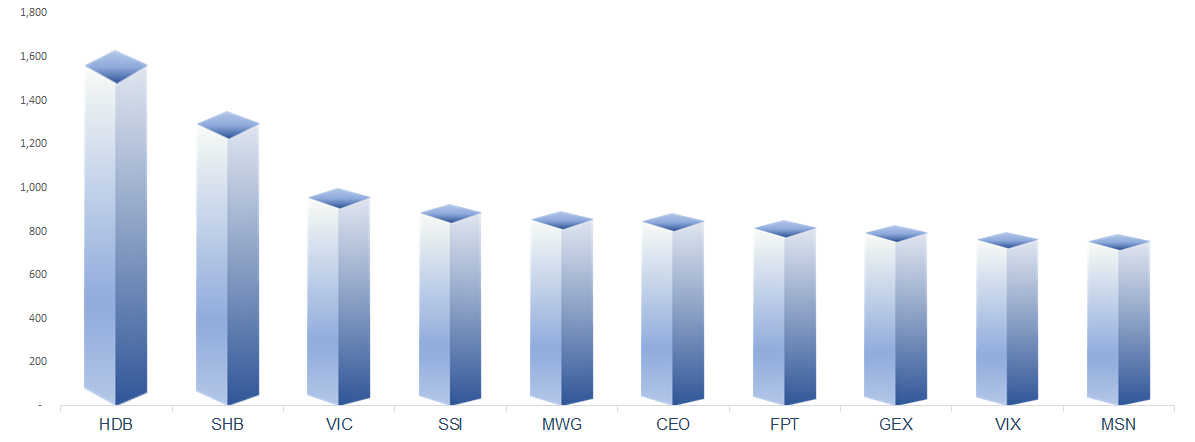

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

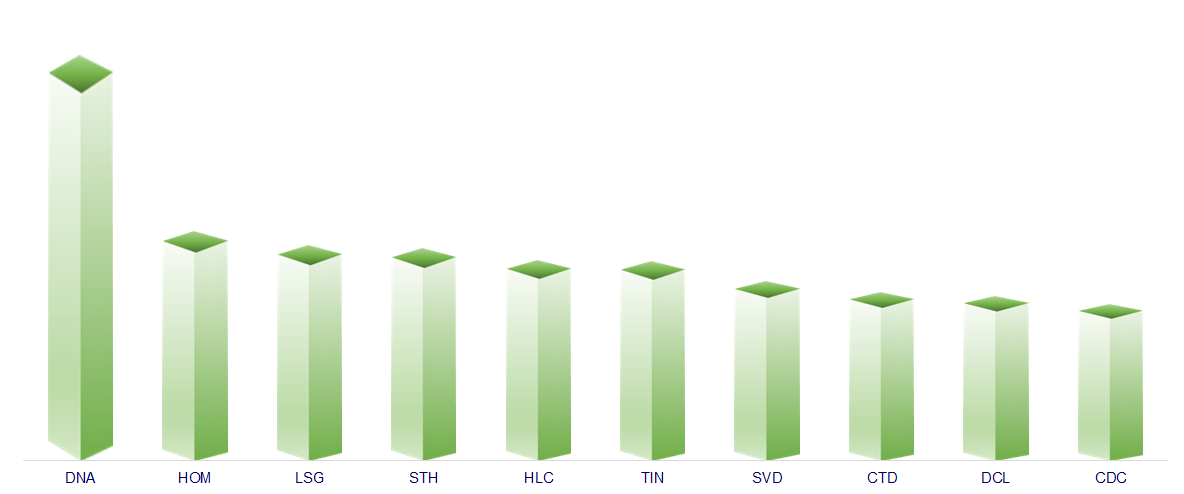

TOP INCREASES 3 CONSECUTIVE SESSIONS

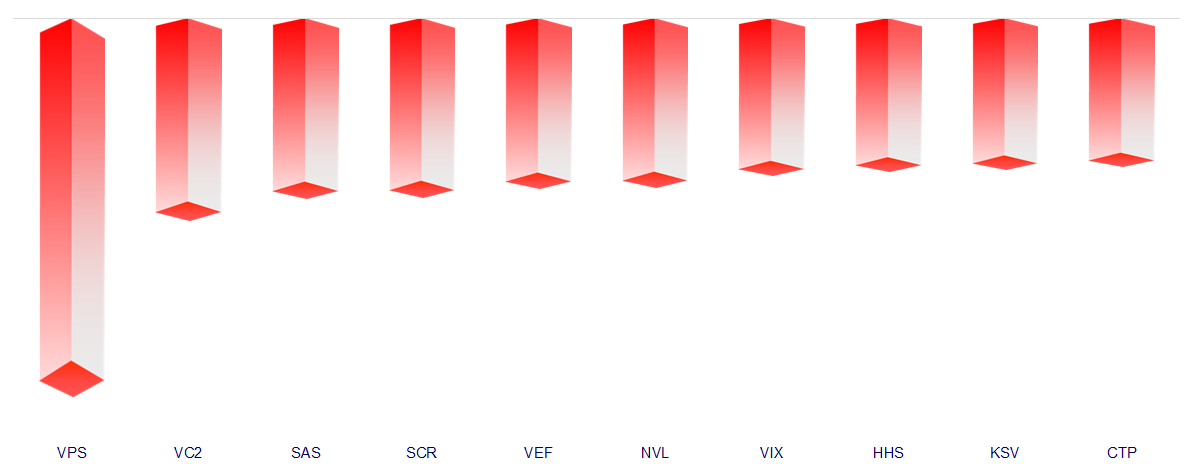

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.